Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Monday, crude oil extended losses as supply concerns continued to weigh. Thanks to these circumstances, light crude lost 2.04% and hit a fresh multi-month low. Where will oil bears take the commodity in the coming days?

Probably lower, but since the crude oil market is already oversold on a short-term basis, we can’t rule out a corrective upswing. Such upswing would likely only temporarily decrease our massive profits from this trade (we entered the short position on May 8 when crude oil was trading at about $59 – over $11 or over 20% higher than crude oil is trading at right now). Let’s take a look at the details (charts courtesy of http://stockcharts.com).

Yesterday, we wrote:

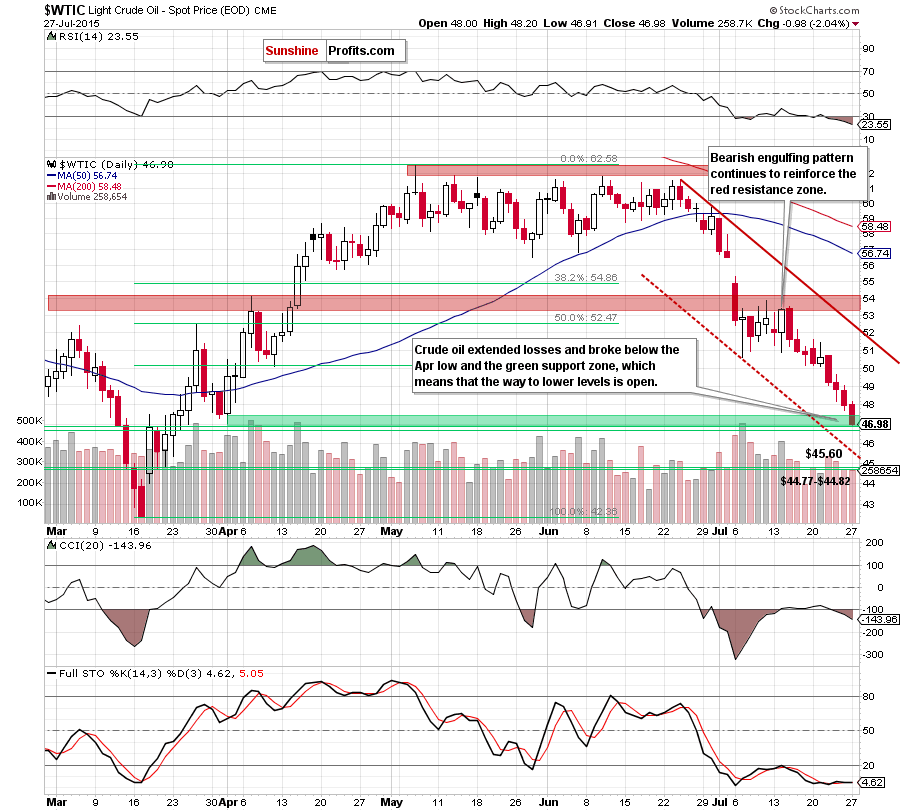

(…) the commodity closed the day below $48, which means that the way to lower prices is open. How low could the commodity go in the coming days (…) the next downside target for oil bears would be around $47.05-$47.55, where the Apr 10 low (in terms of an intraday and opening prices) is.

Looking at the daily chart we see that oil bears pushed light crude lower as we had expected. With yesterday’s downswing crude oil not only reached our downside target, but also closed the day below it, which is a bearish signal that suggests further deterioration.

If the commodity extends declines and moves lower from here, we’ll see (at least) a test of the 78.6% Fibonacci retracement level (around $46.72). What could happen if this support is broken? In our opinion, the next target for oil bears would be the lower border of the declining trend channel (currently around $45.60) or even the green support zone created by the Mar 19 and Mar 20 lows ($44.77-$44.82). Would this mark THE bottom for the crude oil price? At this time, it seems unlikely. Given the current momentum and only moderate (or low) amount of bearish comments on crude oil in mainstream media, it seems that the black gold will have to move even lower before everyone who were willing to sell or short the market are already doing so (which would imply a major reversal). In other words, it seems that the big profits from the current short trade are quite likely to become even bigger before the trade is over.

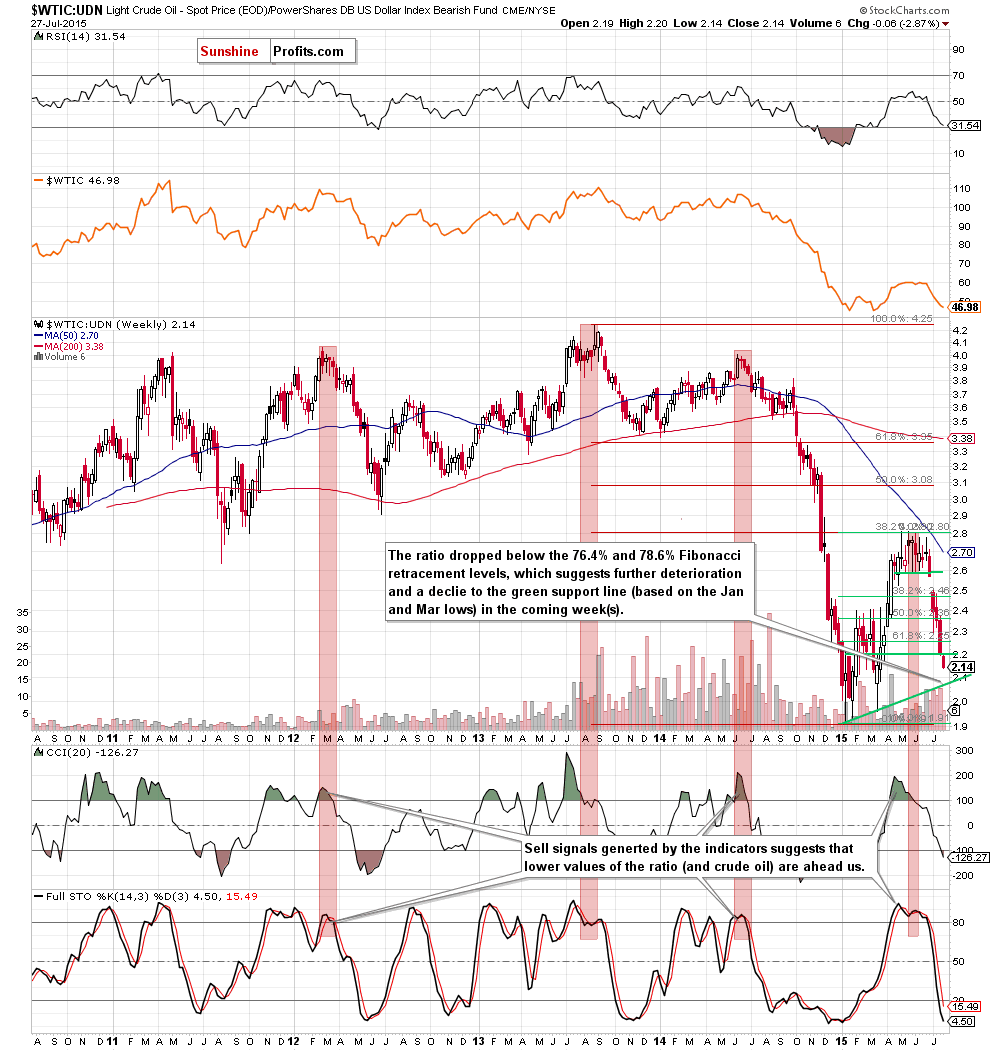

Finishing today’s Oil Trading Alert we would like to draw your attention to the WTIC:UDN ratio. As a reminder, UDN is the symbol for the PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies".

From this perspective, we see that the ratio declined sharply in the previous week and reached the green support zone based on the 76.4% and 78.6% Fibonacci retracement levels. As it turned out, this support area didn’t manage to stop oil bulls, which resulted in a breakdown. This is a negative signal, which suggests that we may see a decline even to the green support line (based on the Jan and Mar lows) in the coming week (especially when we factor in sell signals generated by the indicators). Taking the above into account, it seems that the ratio is one step ahead of the commodity, which confirms that lower values of light crude are still ahead us.

Summing up, crude oil moved lower once again, hitting a fresh multi-month low (and making our short positions even more profitable), which confirms that the downtrend remains in place and suggests that lower values of the commodity are ahead us (especially when we factor in sell signals generated by the weekly indicators and the current picture of the WTIC:UDN ratio). Even though there is a possibility of a corrective upswing in the coming days, it seems that the big profits from the current short trade are quite likely to become even bigger before the trade is over.

On an administrative note, due to travel plans there will be no regular Oil Trading Alerts on Thursday and Friday, but it doesn’t seem that it will change much as we don’t expect to see the final low being reached this week. However, if anything major happens and (!) we believe that adjustments to the current speculative positions should be made, we will send an alert anyway.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts