Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil extended rally and hit a fresh 2015 high, the commodity reversed and declined, invalidating earlier breakout above key resistance line. Will this negative sign encourage oil bears to act in the coming days?

Yesterday, the ADP report showed that non-farm private employment increased only by 169,000 in April, missing expectations for an increase of 200,000 and fuelling worries over the strength of the U.S. labor market. Thanks to these disappointing numbers the USD Index extended declines, making crude oil more attractive for buyers holding other currencies.

On top of that, the U.S. Energy Information Administration reported that U.S. crude oil inventories fell by 3.9 million barrels in the week ended May 1, significantly below expectations of a 1.5 million build. The report also showed that supplies at Cushing, Oklahoma, declined by 12,000 barrels last week, easing concerns that stockpiles could reach full storage capacity by the start of the summer. In these circumstances, light crude extended gains and climbed above $62. Despite this improvement, the commodity reversed and declined, erasing almost all earlier gains. Will we see further deterioration in the coming days? (charts courtesy of http://stockcharts.com).

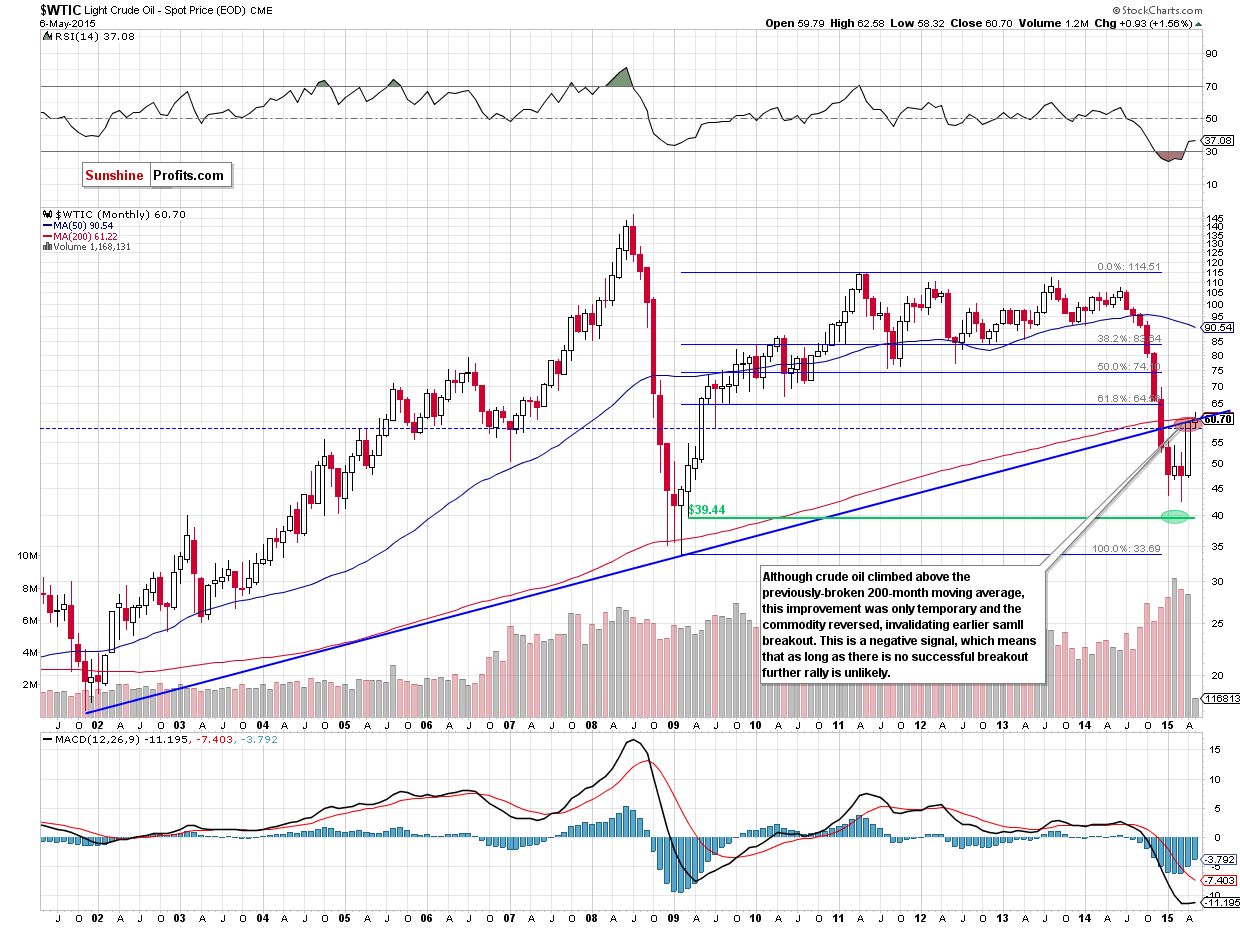

On the long-term chart we see that although crude oil climbed above the 200-month moving average, this improvement was only temporary and the commodity reversed, invalidating earlier small breakout. This s a negative signal which means that as long as there is no successful breakout above this key resistance further rally is unlikely.

How yesterday’s downswing affect the very short-term picture? Let’s examine the daily chart and find out.

Quoting our previous Oil Trading Alert:

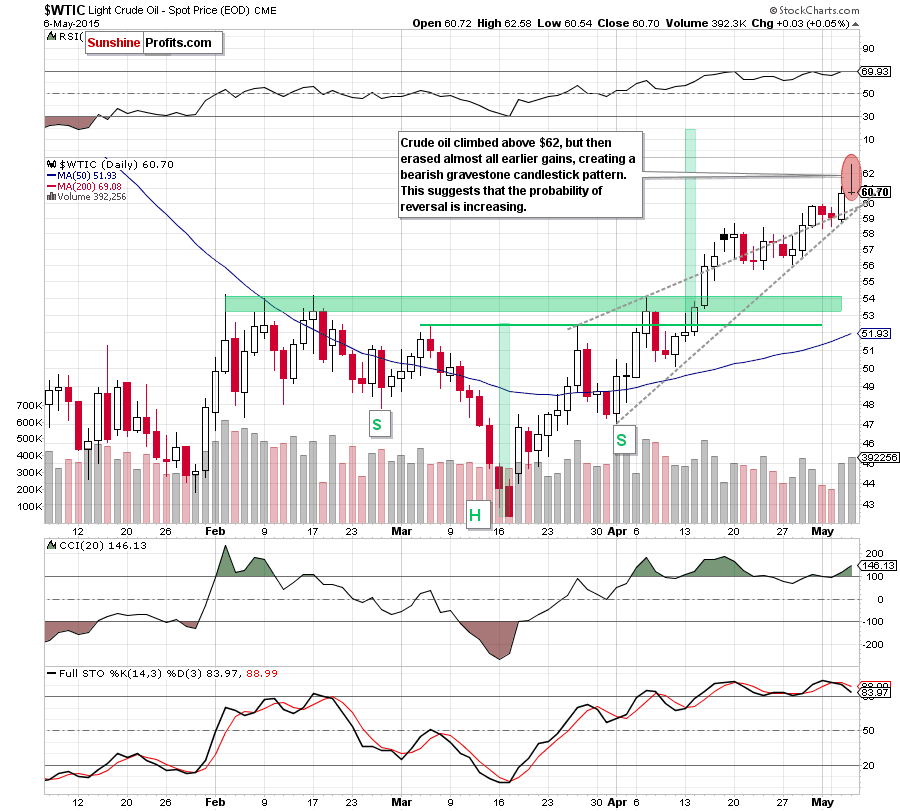

(…) crude oil bounced off grey support lines, which (…) resulted in a breakout above the previous high and the barrier of $60. This positive event triggered further rally and pushed light crude to a fresh 2015 high of $61.10, which suggests a test of the strength of the 200-month moving average marked on the long-term chart.

(…) please note that the RSI climbed to the level of 70, while Stochastic Oscillator generated a sell signal (there are also negative divergences between indicators and light crude). Additionally, the size of volume that accompanied yesterday’s increase wasn’t huge (compared to what we saw in mid-Apr), which suggests that even if crude oil moves little higher from here, correction of the recent rally is just around the corner.

Looking at the charts, we see that the situation developed in line with the above scenario and crude oil extended rally, climbing to an intraday high of $62.58. Despite this improvement, the commodity reversed and erased almost all earlier gains creating a gravestone candlestick pattern on the daily chart (please note that this is a common reversal pattern, which suggests that a bullish rally or trend is about to reverse). Taking this fact into account, and combining it with the size of volume (only slightly higher than the day before), position of the indicators and the long-term picture, we believe that the probability of reversal is increasing.

If this is the case, and the commodity moves lower, the initial downside target would be around $60, where the previously-broken grey support lines are.

Summing up, crude oil extended gains and hit a fresh 2015 high. Although this is a positive signal, the current position of the indicators in combination with the size of volume that accompanied yesterday’s upswing and the invalidation of small breakout above the 200-month moving average suggests that correction of the recent rally is just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts