Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 2.80% as situation in Libya and a weaker greenback supported the price. As a result, light crude hit a fresh 2015 high and reached the long-term resistance. Will it stop oil bulls in the coming days?

In recent days, the output at the Elephant oil field in Libya was slashed, which in combination with the closure of the Zueitina oil port and several oilfields in Eastern Libya lowered the nation's oil production and supported the price of the commodity. Additionally, a weaker U.S. dollar made crude oil more attractive for buyers holding other currencies. As a result, light crude extended rally and broke above $60. How high could the commodity go in the coming days? (charts courtesy of http://stockcharts.com).

Quoting our last commentary:

(…) if the commodity moves higher from here, we’ll see another test of the resistance zone (marked on the monthly chart) and the barrier of $60 in the coming day(s).

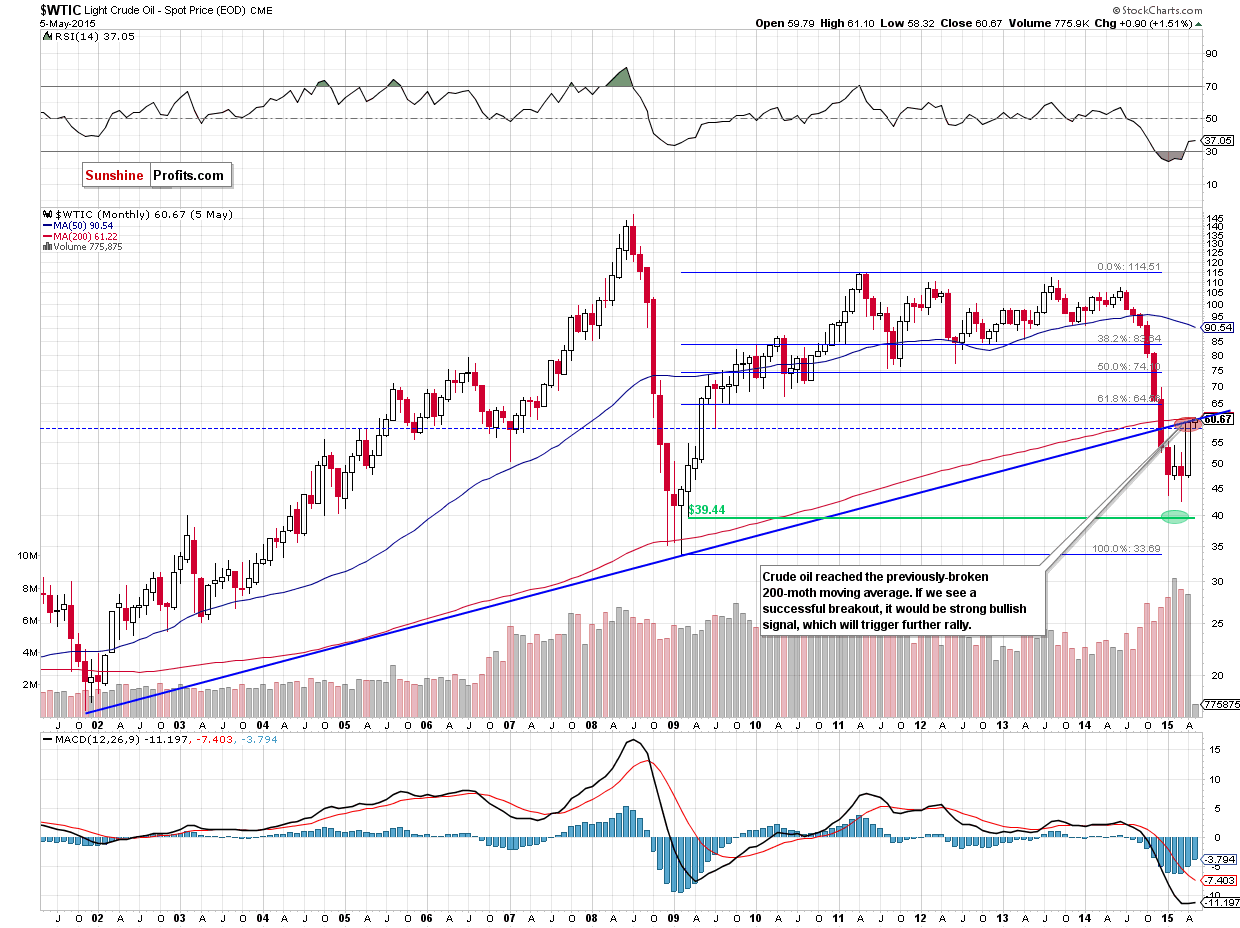

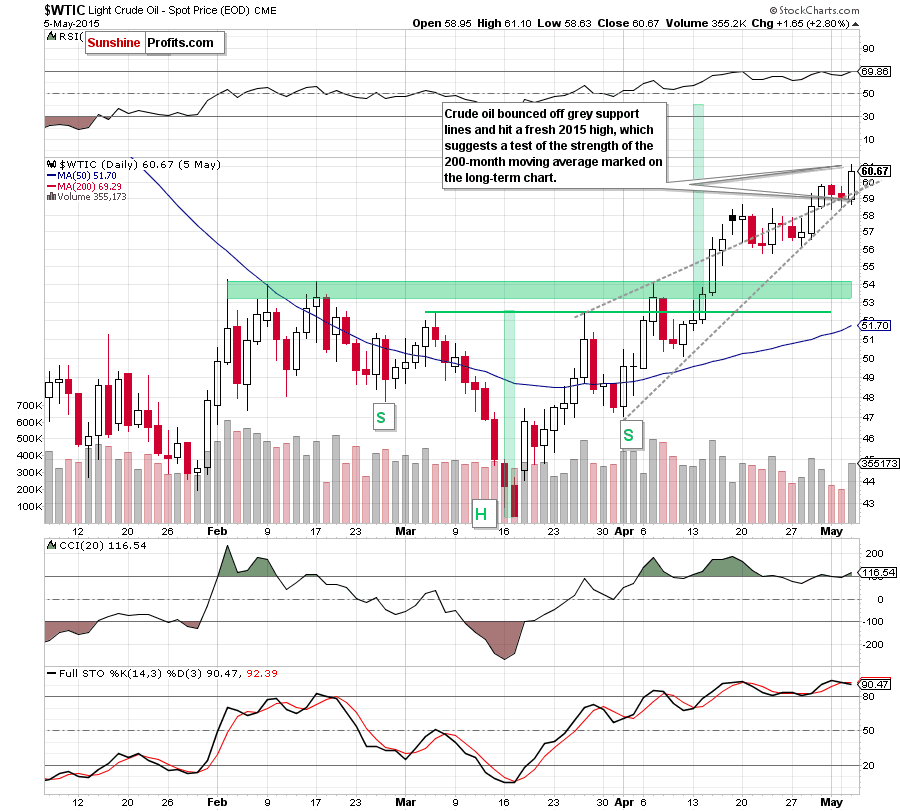

Looking at the daily chart, we see that crude oil bounced off grey support lines, which encouraged oil bulls to act and resulted in a breakout above the previous high and the barrier of $60. This positive event triggered further rally and pushed light crude to a fresh 2015 high of $61.10, which suggests a test of the strength of the 200-month moving average marked on the long-term chart.

If this solid resistance is broken, it would be a solid bullish signal, which will trigger further improvement and an increase to around $67, where the 38.2% Fibonacci retracement based on the Jun-Mar declines is. On the other hand, if oil bulls do not manage to close the day above this key resistance (yesterday, the 200-month moving average was at $61.22), we’ll see a correction of the recent rally in the coming days. In this case, the initial downside target would be around $58.32, where the bottom of the last pullback is.

Finishing today’s alert please note that the RSI climbed to the level of 70, while Stochastic Oscillator generated a sell signal (there are also negative divergences between indicators and light crude). Additionally, the size of volume that accompanied yesterday’s increase wasn’t huge (compared to what we saw in mid-Apr), which suggests that even if crude oil moves little higher from here, correction of the recent rally is just around the corner.

Summing up, crude oil extended gains and hit a fresh 2015 high. Although this is a positive signal, the current position of the indicators in combination with the size of volume that accompanied yesterday’s upswing and the 200-month moving average suggests that even if crude oil moves little higher from here, correction of the recent rally is just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts