Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with $59.62 as stop-loss and $68.25 as initial price target.

Important Note: As you’ve likely noticed – most of our Oil Trading Alert subscribers are also subscribers to our Gold & Silver Trading Alerts – I’ve been putting much more energy into the latter due to the simple reason that this is my passion and specialty, and I’ve been providing you with the crude oil analyses to ensure this service’s continuity (our promise to subscribers is to keep you updated) after our much-valued previous author left to pursue other opportunities. Since that time, I’ve been on the lookout for a person that could provide crude oil analyses of the highest quality. Simultaneously, I was writing Oil Trading Alerts that were much shorter than I would like to provide you with, but was unable to do so, due to the finite resources of energy I have each day (please keep in mind that not only was I writing the detailed Gold & Silver Trading Alerts, but also managing the entire company and reviewing new crude oil author candidates).

I’m happy to announce that the above-mentioned search is over, and it’s a great pleasure for me to welcome Nishant Jain, MBA, CPSM, as the new author of our Oil Trading Alerts. Nishant’s expertise is a rare combination of experience in the energy industry (primarily in crude oil), technology, and business. Combining the above with technical experience and a great determination to provide you with quality content, makes me confident that I’m passing the baton to the right person. You can read Nishant's bio using this link

Nishant has been bullish on the crude oil market in the previous several weeks, and I wasn’t, and the former approach turned out to be more appropriate than the latter. As you can see, today’s first analysis from Nishant also has bullish implications, so it’s up to you what to do with the current trade. Since I’m not going to provide additional follow-ups for crude oil, I suggest taking into account Nishant’s approach and follow-up messages, or to close the current position and remain on the sidelines for a week or two to see what kind of price action does indeed prevail, and then based on this information, decide what position you’re going to take.

Thank you for your patience.

Best regards,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Hi, I’m Nishant Jain, and I’m excited to welcome you to explore my views on crude oil markets. For the past eight years I have been involved in deep-dive analysis of downstream energy commodities, including crude oil. It will be a true pleasure for me to use that knowledge in helping you make the best decisions for your oil investments. I have big shoes to fill and it will be my humble attempt to retain the high standard you all have been receiving from PR’s writing so far. As well, please don’t hesitate to reach out with an inquiring mind. If you’ve got questions, I’m here to answer them, and I look forward to it.

So, let’s get right into it, starting with a short overview of where prices are likely to be headed.

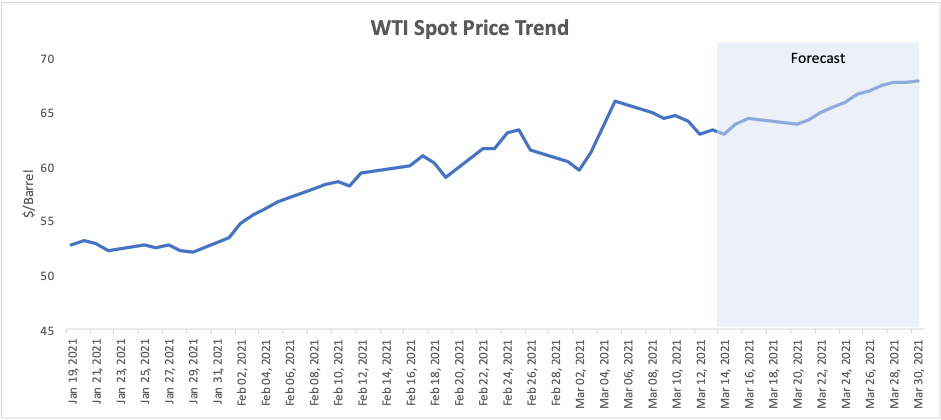

Supply constraints due to cuts in OPEC+ production have led to a rally in oil prices, with an almost 35% increase in the last three months . In fairly typical fashion, the market has over-reacted to the supply-demand deficit, thus leading to higher prices. However, during the last ten days, we can see a flatline with resistance at the $65 per barrel price point. Although drillers are sufficiently incentivised at this price point to ramp up production, I do not see production increases happening for at least one more quarter. From the second half of 2021 onwards, and as the supply from the U.S. increases, we can expect production to catch up with rising demand.

On the demand side, while the re-opening of the economy has brought the situation to near pre-pandemic levels, the higher prices themselves are acting as a deterrent in increasing demand, leading us closer to market equilibrium. This means that while I am optimistic on prices further increasing by 5-7% in the next 45 days, the suggestion made by some analysts that oil can go beyond $100 is quite unlikely.

While oil producers are making up for the losses of last year at this price point, oil tankers are still facing the challenge of an oversupply of oil tankers on the Saudi Arabia-China route. As a result, the U.S., Brazil and North sea tankers will benefit from long cargo routes, resulting in an increased price for the end user.

With the distribution of a $1.9 trillion coronavirus relief package to U.S. citizens, there will be a significant positive impact both for the economy and financial markets. The Biden administration is keen to move quickly on renewable energy and has urged the fossil fuel industry to adapt and innovate. The actual extent of policies towards the oil sector needs to be closely followed in the coming weeks.

In some ways, oil finds itself in a similar position to how it was in October, going for a fall before resuming a long rally. The only difference is that during this second movement towards normalcy, the volatility could be higher with a much lower level of higher upside.

For the next three to four weeks, we can see an approximate 5% uptick in price from the current levels, with a medium level of volatility. Short sellers should not consider the current decline as a sign of a further fall in the upcoming weeks, and at this point it would be prudent not to short oil.

To summarize, higher prices are acting as a deterrent to increasing demand. Prices can increase by another 5-7% in the next 45 days. I estimate a target price of $68-69 for WTI crude by the first week of April. For the long-term, production is likely to catch up with rising demand in the second half of 2021.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Long positions with $59.62 as stop-loss and $68.25 as initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist