Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

The Crude Oil rebounding scenario described last week successfully happened! CL indeed bounced from the May 2021 low, reaching our targets!

Trading Analysis

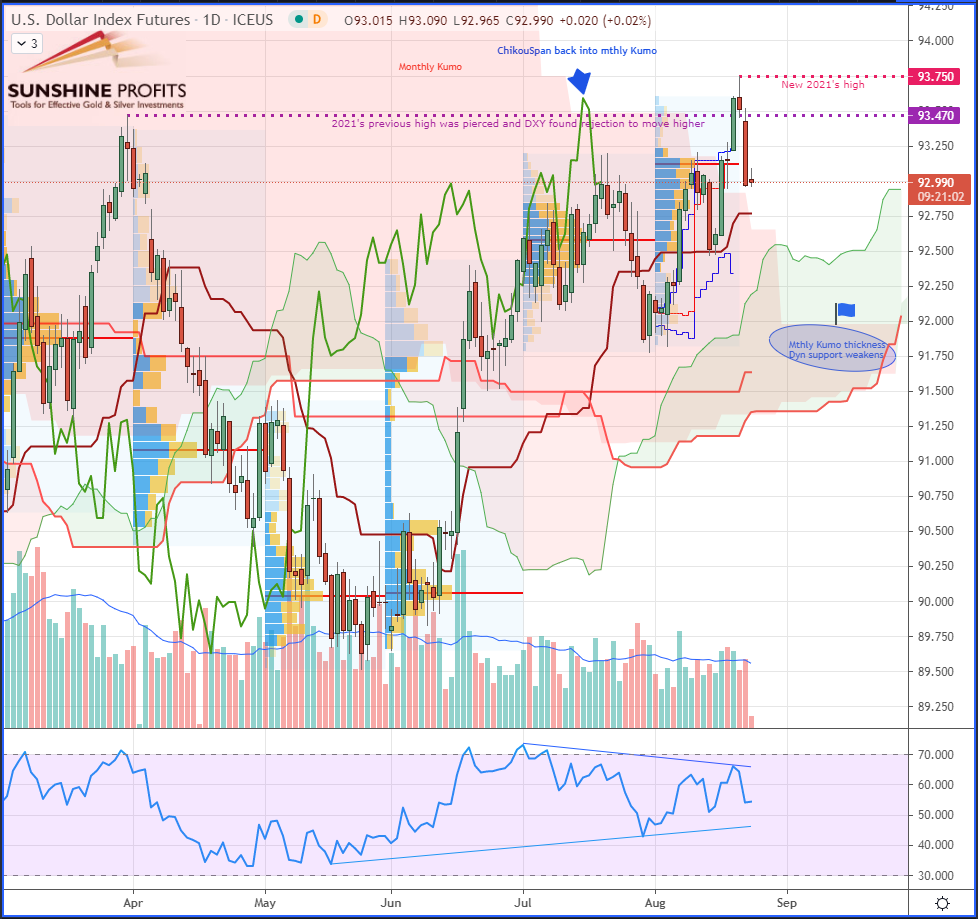

- As a reminder, in last week’s oil trading alert (published on Thursday, Aug. 19), I said that CL (NYMEX Light Crude Oil Futures) prices were showing a great opportunity to buy at the lows of May 2021 while the US dollar index (DXY) was getting stronger (Fig.1). The greenback was piercing above its previous 2021 high, where it found rejection to climb higher — reaching a new 2021 high at 93.750. The ChikouSpan (lagging line) immediately got back into the monthly Kumo (cloud), announcing a rejection of the DXY’s sustained uptrend.. Therefore, the US dollar index is set for a correction. Moreover, a warning may arise from the decreasing thickness of the monthly Kumo, which may reduce the strength of the long-term dynamic support (relative to previous months).

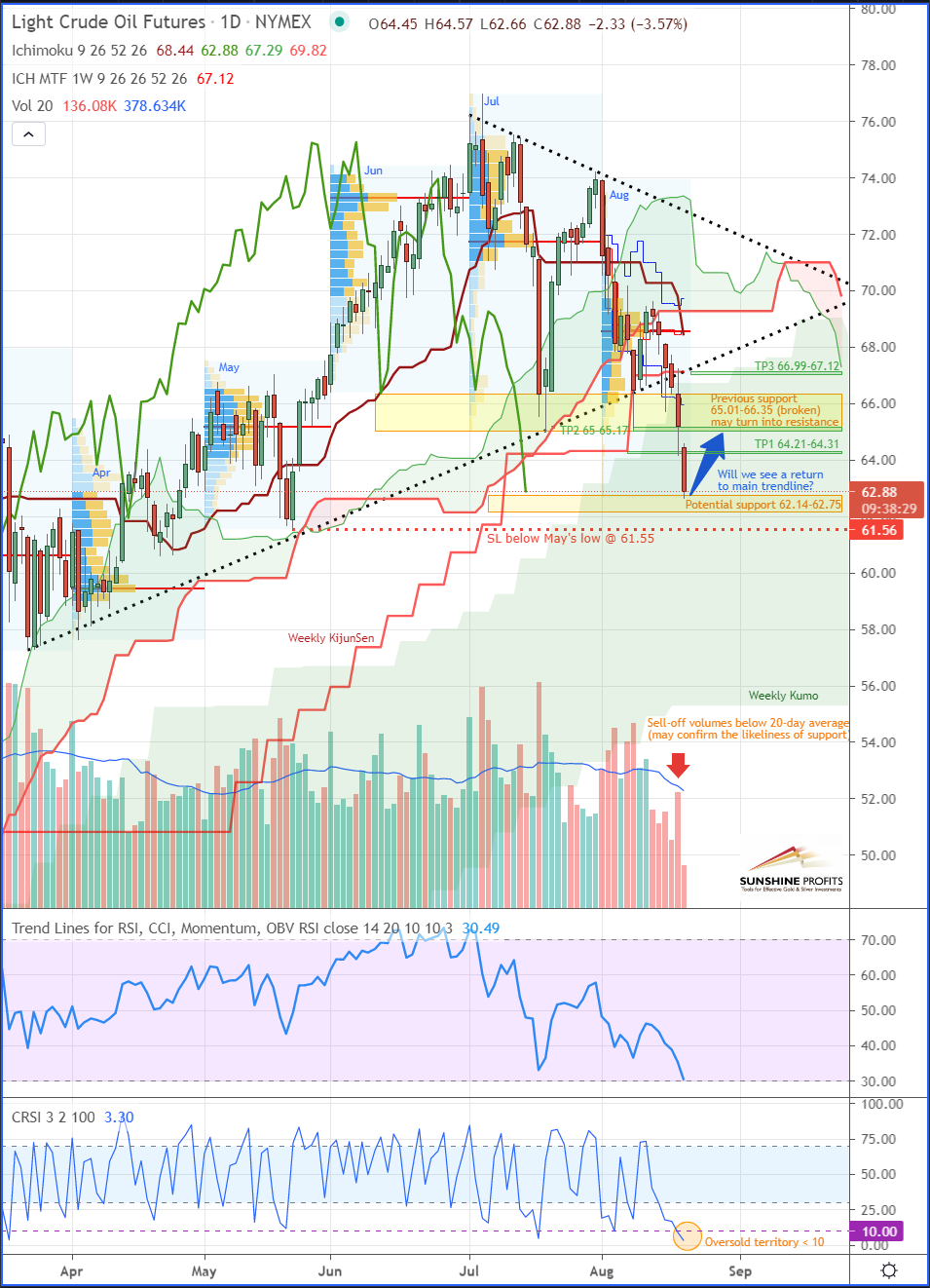

- In Fig.2, you can see how we draw our trading plan for the crude, paying attention to both fundamental analysis and technical levels to determine stops, entries and exits.

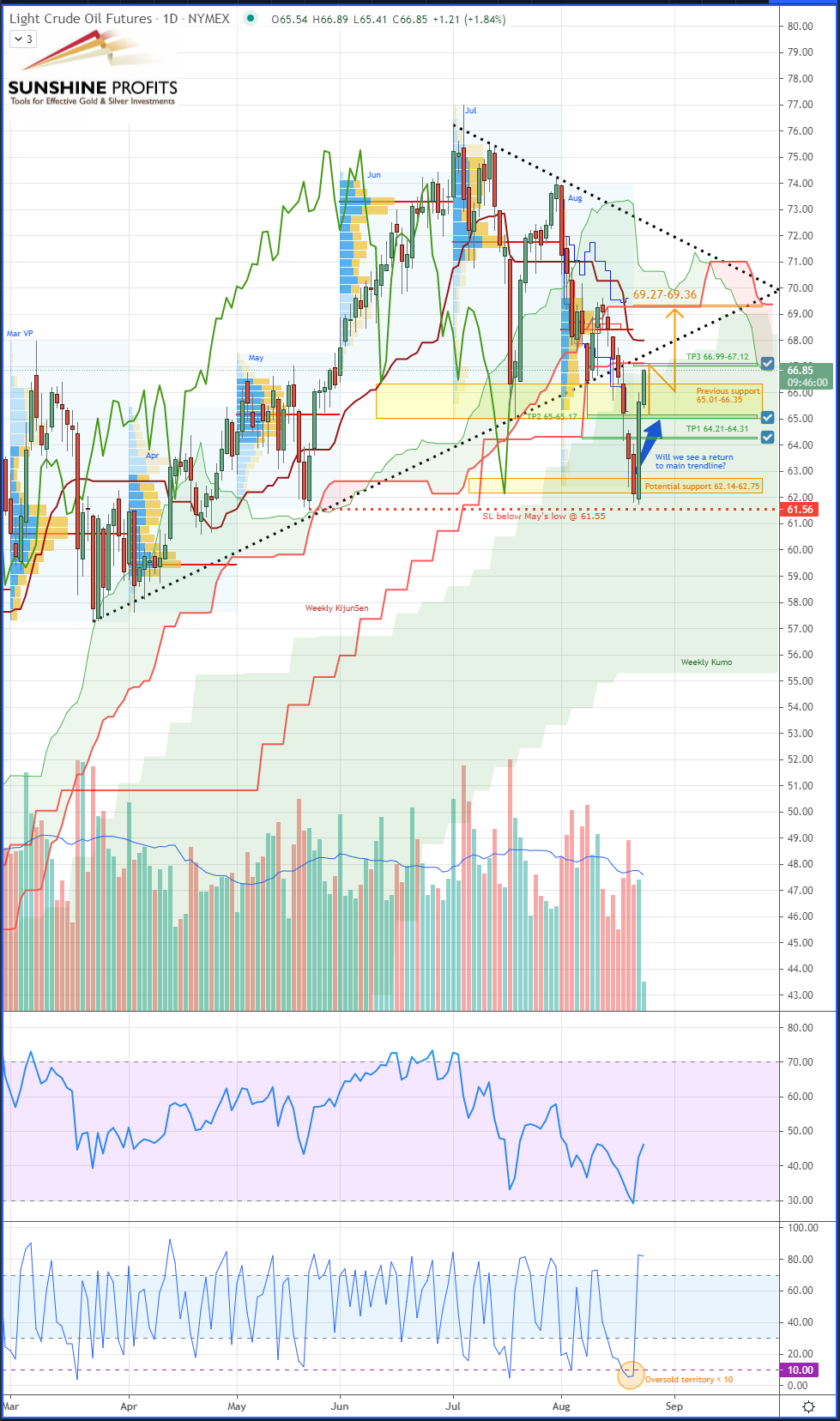

- At the moment of writing this market review, CL prices have already hit our two first targets (labeled as TP1/TP2) with a risk/reward ratio of 2.15 (TP1) and 3+ (TP2). The TP3 target (set on a risk/reward ratio higher than 5) is just about to be reached, as prices are now moving pretty close towards it, already getting near $66.89; so, just 10 cents below the final exit that was initially determined in the $66.99-67.12 area.

Figure 1 – Dollar Index (DXY) Futures (Continuous contract, daily)

Figure 2 – Last week’s suggested trade plan on Brent (CL) Crude Oil Futures (Continuous contract, daily)

Figure 3 – Today’s trade plan status on Brent (CL) Crude Oil Futures (Continuous contract, daily)

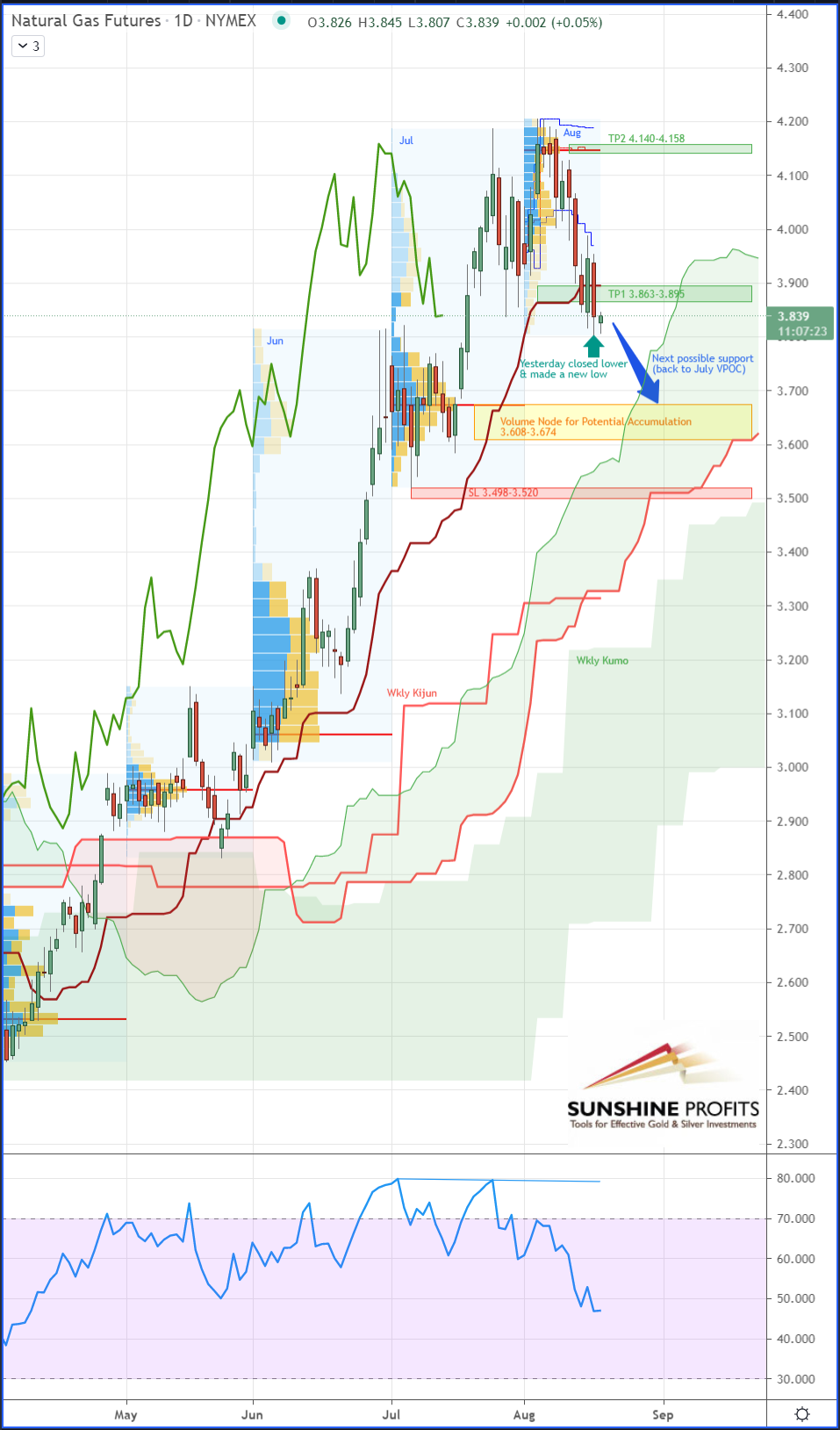

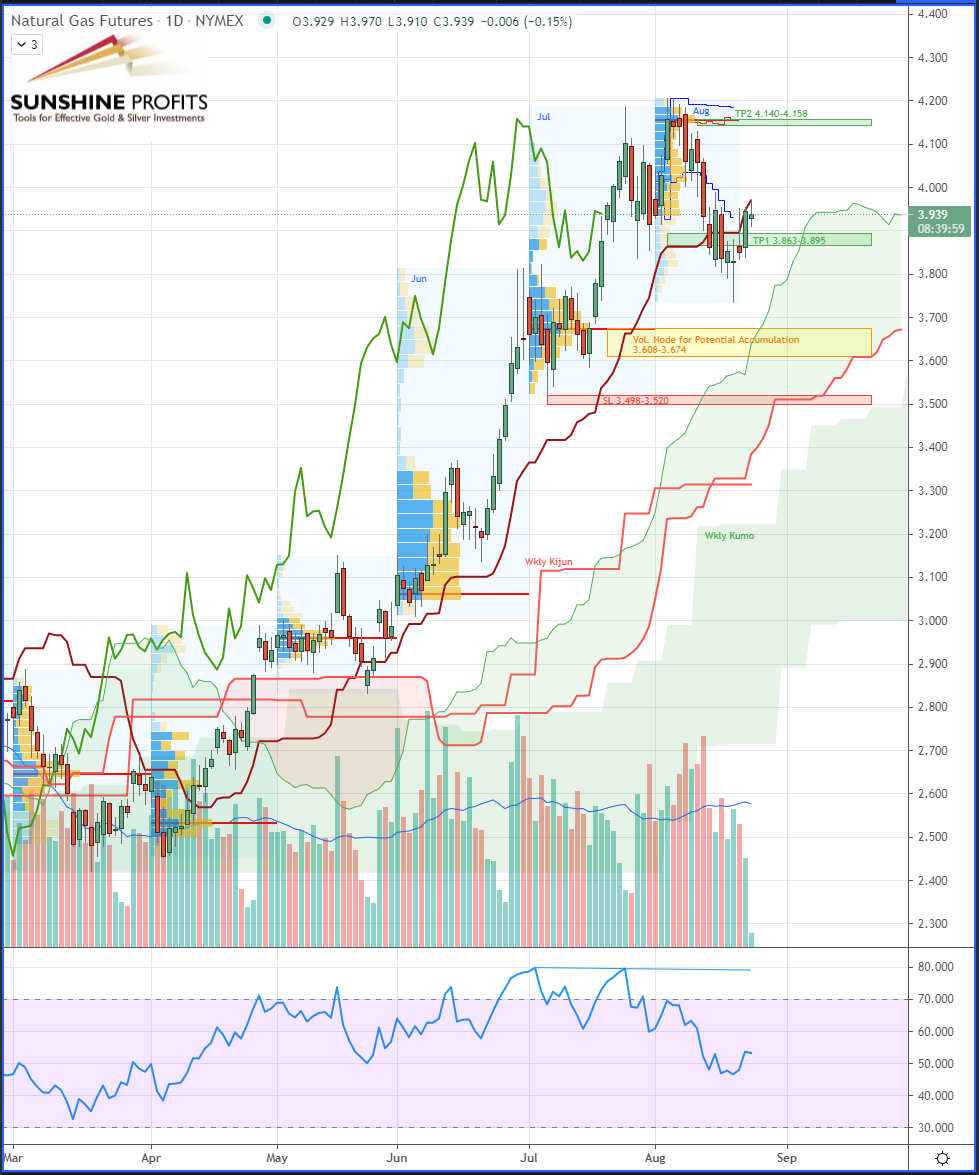

- Regarding NG (NYMEX Natural Gas Futures), we expected a correction down to July’s VPOC before entering in the best conditions (Fig.4) to get a fairly good risk-to-reward ratio. As we can see in the Fig.5, the correction indeed happened although it did not retrace to our pre-defined entry level. Therefore, we preferred sticking to our trade plan and not entering until NG prices retrace sufficiently.

Figure 4 – Last week’s suggested trade plan on Henry Hub (NG) Natural Gas Futures (Continuous contract, daily)

Figure 5 – Today’s trade plan status on Henry Hub (NG) Natural Gas Futures (Continuous contract, daily)

In summary, the scenarios drawn last Thursday for both energy products have been partially validated so far by the recent market developments, with a successful trade on crude that met most of our expectations. In order to maintain a good risk/reward ratio, we did not enter the gas trade since all of our conditions weren’t met.

As always, we’ll keep you, our subscribers well informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist