Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

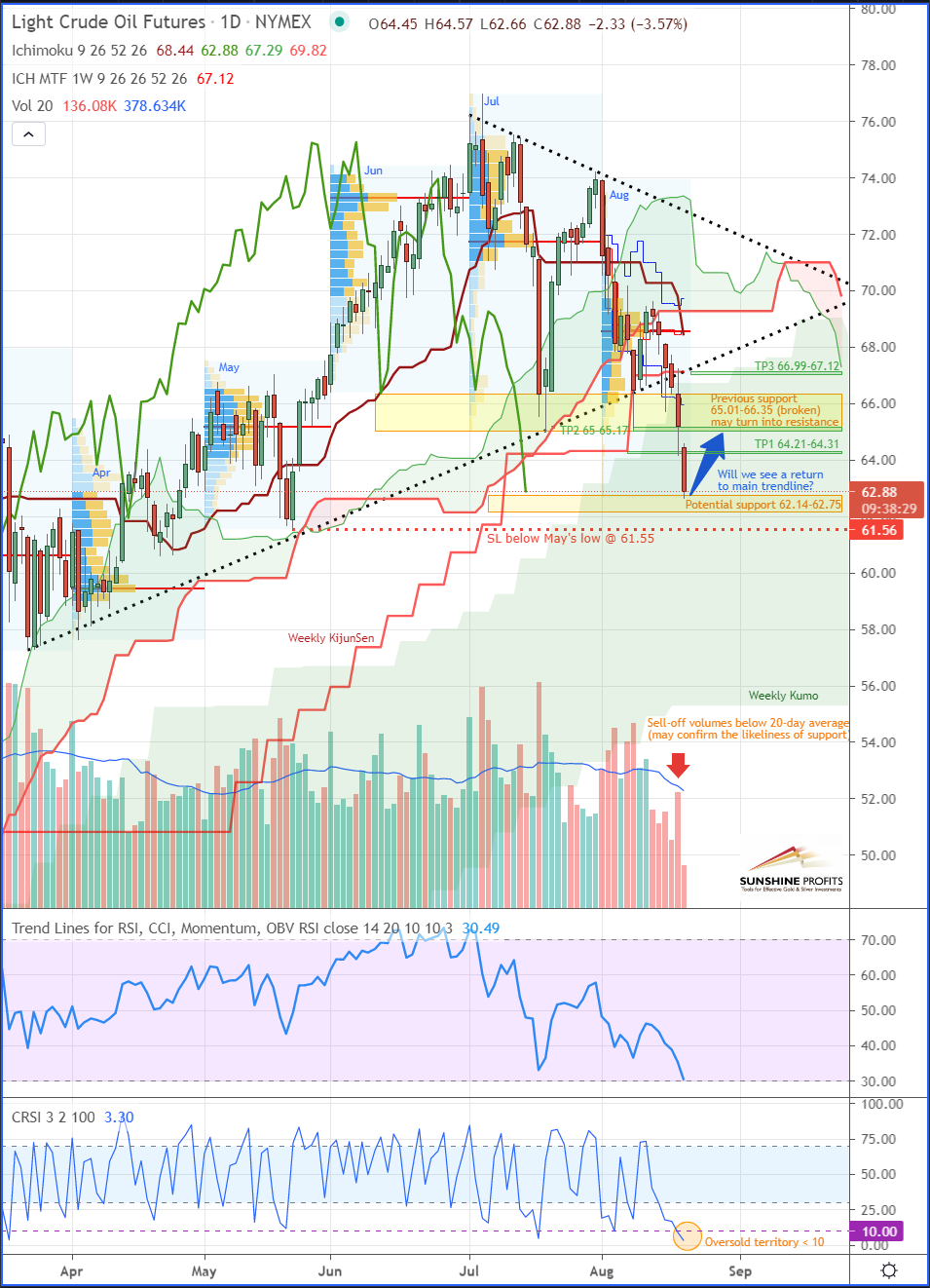

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): long positions with entry at $62.14-62.75, with a stop-loss below May’s swing low at $61.55 and $64.21-64.31 (TP1) / $65-65.17 (TP2) / $66.99-67.12 (TP3) as price targets.

With oil falling so much, the question arises about a possible correction. Are we seeing a big opportunity to fill our pockets with black gold?

2 main factors have pushed Crude Oil down to its lowest since May:

- Concerns on global demand recovery

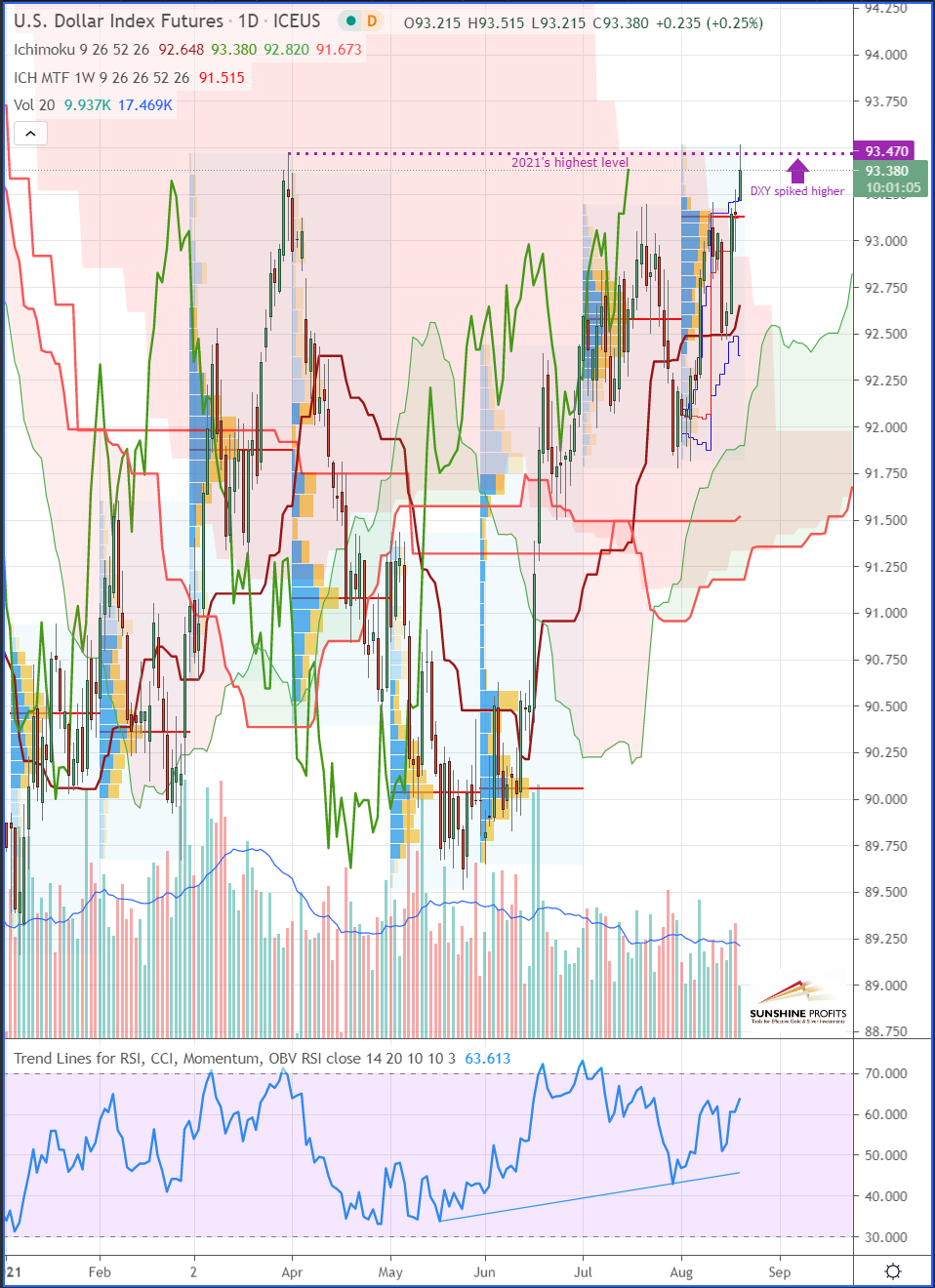

- The USD spiking above its 2021’s highest (Fig.2)

Trading Analysis

CL (Fig.3) has been pushed lower by the bears, breaking through its previous sturdy support. Moreover, we have seen in the past days the US dollar getting stronger – it pierced through its 2021 high today, right after the minutes from the FED's last meeting showed increasing prospect of reduced monetary stimulus this year! Due to some global uncertainties, it appears that investors are getting back into the greenback these days. Despite the massive increase of the dollar’s weight (+450% over the past year), it is still being considered a “King”.

But is this going to be sustained in the long term? Well, I’m not so sure. If we step further back by looking at the DXY monthly chart (Fig.1), we will notice that it is about to find rejection from multi-year resistance trend levels, which – if confirmed – may signal a resume of the greenback’s devaluation, sustaining the commodities’ long-run uptrend.

Figure 1 – U.S. Dollar Currency Index (DXY) CFD (monthly)

Figure 2 – U.S. Dollar Index (DXY) Futures (Continuous, daily)

As a reminder, the International Energy Agency last week trimmed its oil demand outlook due to the spread of the Delta variant. OPEC, however, left its demand forecasts unchanged.

Figure 2 – Brent (CL) Crude Oil Futures (Continuous contract, daily)

To sum up, the plan that was anticipated at the beginning of the week for crude oil has been invalidated due to recent market developments – most importantly, breaking the 2-month support.

For the time being, the crude looks well-positioned to find new support just above May’s lows.

As always, we’ll keep you, our subscribers well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): long positions with entry at $62.14-62.75, with a stop-loss below May’s swing low at $61.55 and $64.21-64.31 (TP1) / $65-65.17 (TP2) / $66.99-67.12 (TP3) as price targets.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist