Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective.

Analyzing crude oil’s chart from the long-term perspective, we noticed something interesting, which happened once again in March. Curious?

Technical Analysis of Crude Oil

Let's take a look at the charts (charts courtesy of http://stockcharts.com).

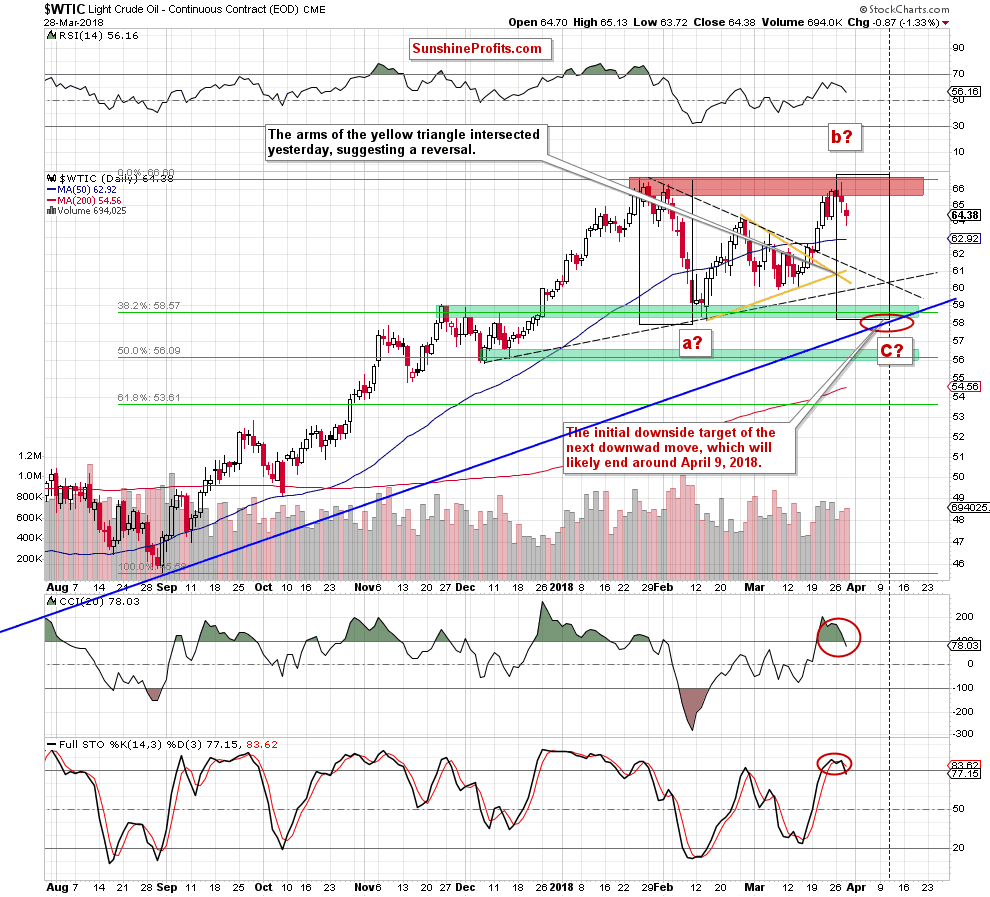

From today’s point of view, we see that crude oil moved a bit higher after yesterday’s market open – similarly to what we saw in the previous days. Despite this “increase” it turned out quite quickly that oil bulls do not have enough strength even to re-test the red resistance zone. This show of weakness encouraged their opponents to act and resulted in another move to the downside.

Thanks to yesterday’s move, black gold slipped under $65 and the CCI joined the Stochastic Oscillator by generating a sell signal. Additionally, when we take a closer look at the above chart, we notice that recent declines materialized on increasing volume, which suggests that currency bears didn’t say the last word and further deterioration is still ahead of us.

How low will light crude go in the coming days? When we can expect another reversal? If you want to know the answers to these questions, we invite you to read our Tuesday Oil Trading Alert – it’s up-to-date also today:

Crude Oil – Hello Elliott, My Old Friend…

Before we summarize today’s alert, we also decided to take a look at the broader picture of crude oil as the last session of the week and the month is just ahead of us and bigger changes are not likely to be seen.

Crude Oil from Broader Perspective

Let’s start this section with the medium-term chart.

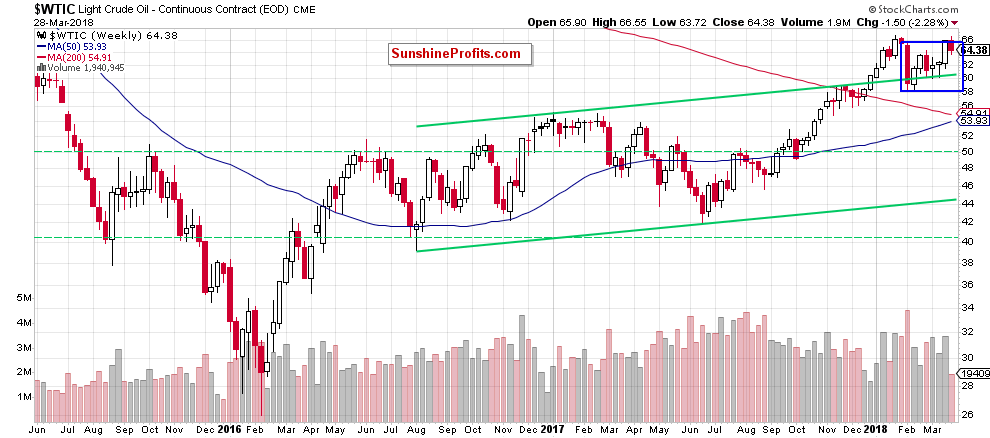

The first thing that catches the eye on the weekly cart is an invalidation of the earlier tiny breakout above the upper border of the blue consolidation. This is a negative development, which suggests further deterioration and a test of the lower line of the formation in the coming week(s).

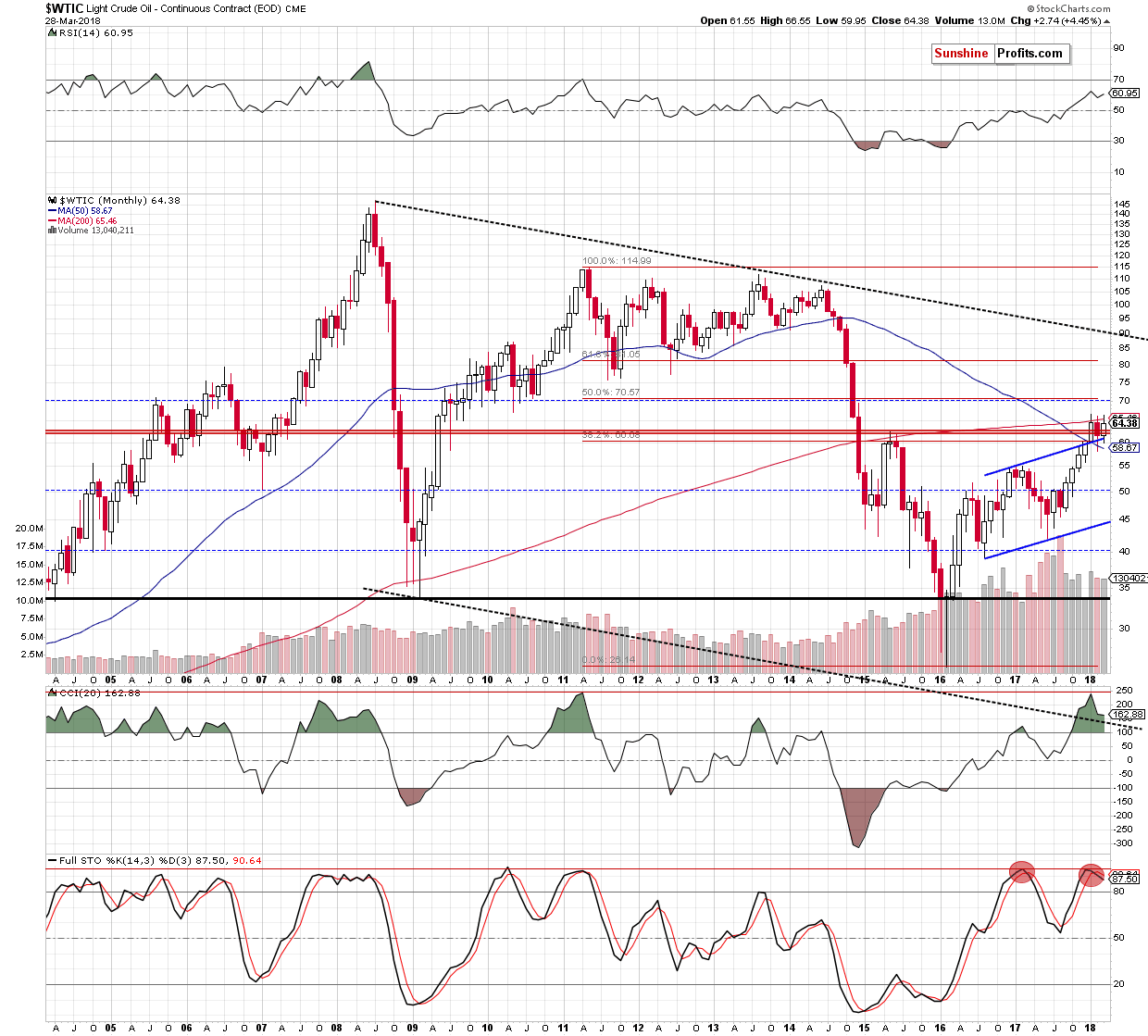

When we zoom out our picture, we’ll see one re bearish factor, which could be use in the coming week. What do we mean?

Another unsuccessful attempt to break above the major resistance – the 200-month moving average, which continues to keep gains in check since the beginning of the year. Additionally, the sell signal generated by the Stochastic Oscillator remains in play, supporting oil bears and lower prices of black gold in the coming month.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil extended losses, invalidating the earlier breakout above the upper border of the blue consolidation (seen on the medium-term chart) and failed to break above the major resistance – the 200-month moving average (marked on the long-term chart) for the third time in a row. These bearish developments increase the probability of further declines and a test of the green support zone, where our initial downside target is.

Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Oil Trading Alert tomorrow and on Monday due to your Editor’s holiday travel schedule. Consequently, the next regular alert is scheduled for Tuesday, April 3rd. However, if anything major happens, we’ll keep you updated through short intraday alerts anyway.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts