Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

On Wednesday, bear's determination showed the buyer that the way to the north is not as open as it would appear after the first sessions of this week. Thanks to yesterday's price action, the oil dived over 2% and reached the first support, encouraging bulls to fight for a few points. Is the worst already behind the buyers or is it just an illusion?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

On Tuesday, we commented the situation in crude oil in the following way:

(…) the price returned to the interior of the formation, invalidating the earlier breakout.

(…) similar price action took place in July and preceded a decline, which took the black gold to the 200-month moving average.

Taking this fact into account (and other short-term factors (…)), we think that another bigger move to the downside is just around the corner.

Yesterday, we added:

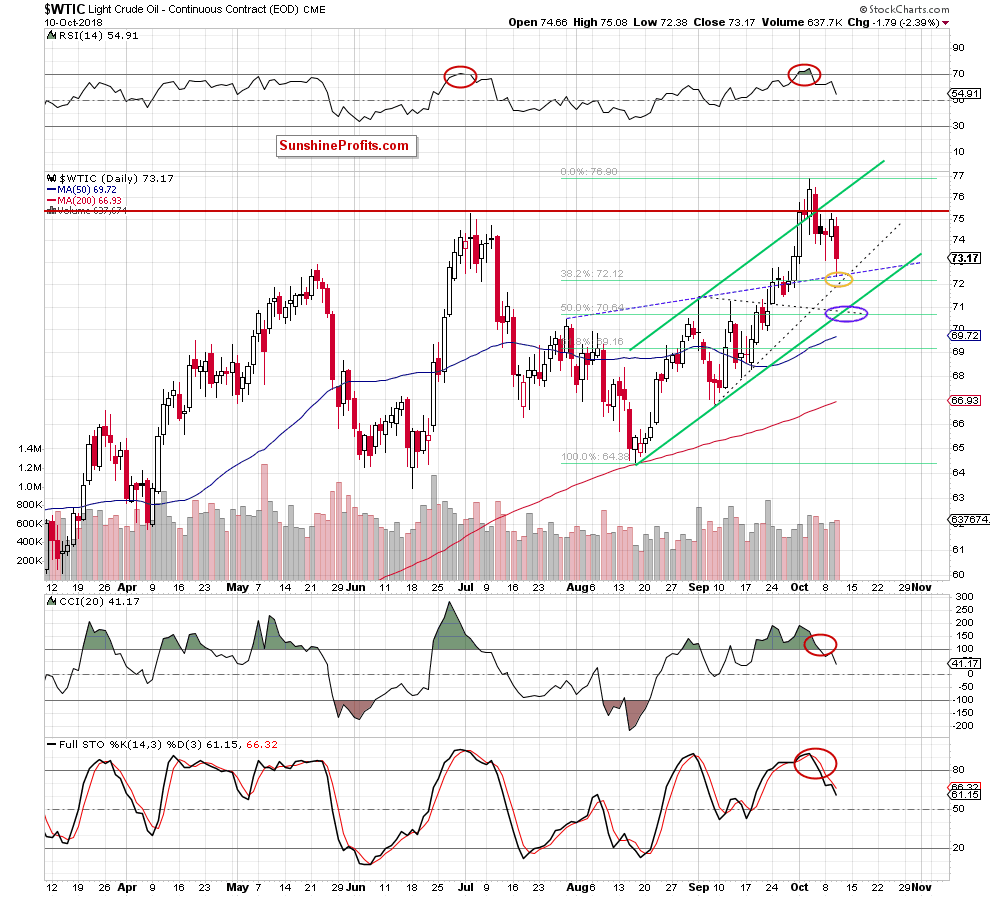

(…) this week’s move to the upside approached black gold to the upper line of the green wedge, which also looks like a verification of the earlier breakdown and can be read as a negative sign.

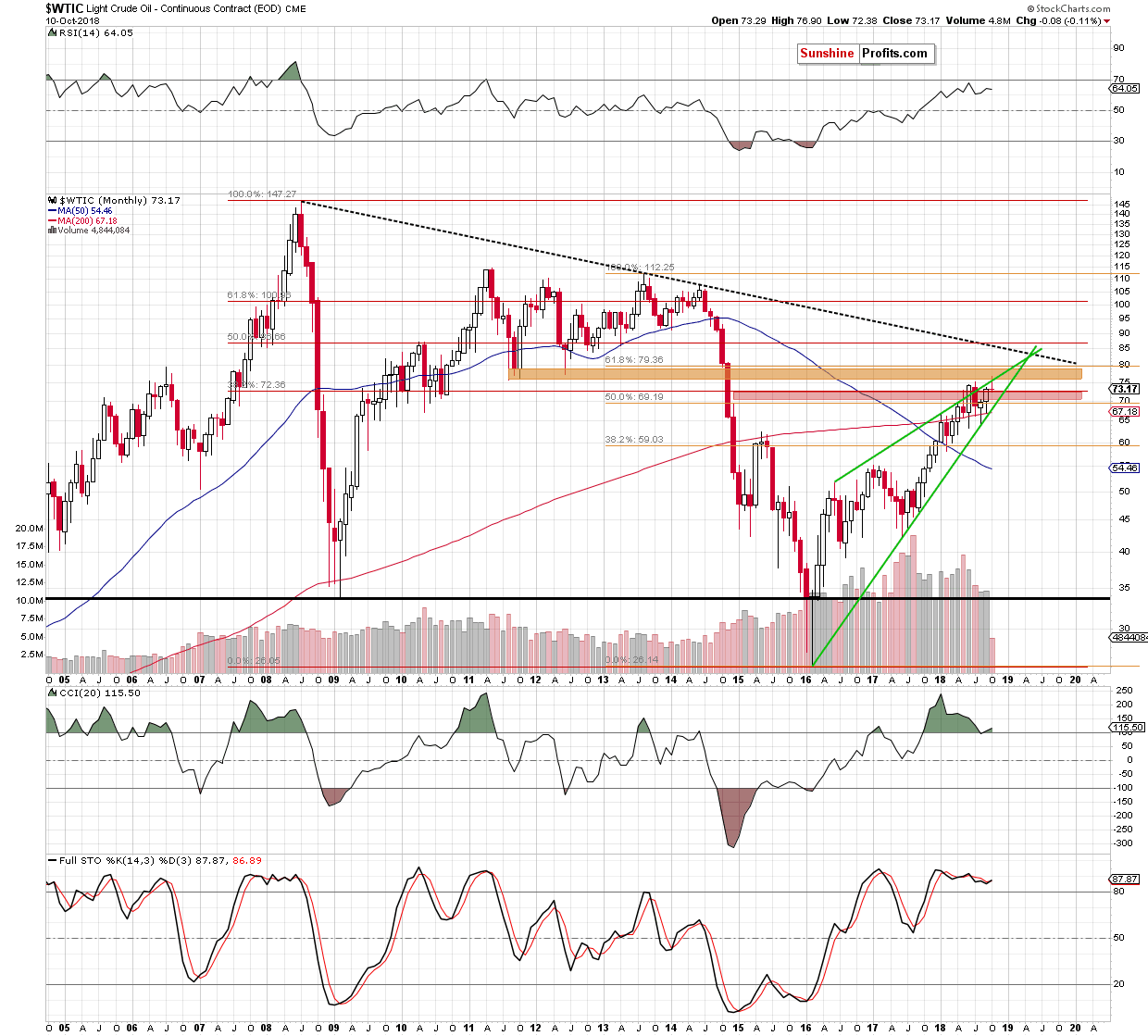

Looking at the long-term chart, we see that oil bears also read all the above-mentioned factors and treated them as an invitation to fight for prices of black gold. Thanks to their attack, the commodity approached the upper border of the red zone, which suggests that we can see an invalidation of the earlier breakout above the it in the coming days (or weeks).

Will the situation develop in line with the above assumptions? Or maybe there are some important supports seen from the short-term perspective that can thwart pro-declining plans?

Before we answer this question, let's recall the quotes from yesterday's alert

(…) crude oil approached the red horizontal resistance line based on the July high during Tuesday’s session.

(…) such price action looks like a verification of the earlier breakdown and increases the probability of another downswing in the very near future – especially when we factor in the sell signals generated by the indicators and the pro-bearish situation in the long term.

From this perspective, we see that the commodity moved sharply lower on Wednesday, making our short positions even more profitable. Thanks to yesterday’s decline, crude oil slipped to the first support area (marked with a yellow ellipse) created by the previously-broken neck line of the reverse head and shoulders formation, the 38.2% Fibonacci retracement and the lower border of the black dotted triangle.

As you see this zone triggered a rebound before the session closure but taking into account the above-mentioned long-term picture of light crude, the sell signals generated by the daily indicators and yesterday’s volume (it was bigger than day earlier during Tuesday’s rebound), we think that further deterioration is just around the corner.

How low can the price of crude oil go in the coming days?

In our opinion, if the bears manage to extend Wednesday decline, we’ll see a drop to the next support area (marked with the purple ellipse) in the following days. At this point it is worth noting that this area is created by the upper line of the black dotted triangle, the 50% Fibonacci retracement and the lower border of the green rising trend channel. Therefore, if it is broken the way to lower levels will be open.

Summing up, profitable short positions are justified from the risk/reward perspective as crude oil extended losses, reaching the first support area. Nevertheless, all the pro-bearish technical factors remain in the cards, supporting the sellers and lower prices of black gold in the coming days.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts