Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11.

Despite the surprise Fed rate cut announcement, crude oil sold off later on. Yet it's rallying as we speak. What's in store for black gold in the days ahead?

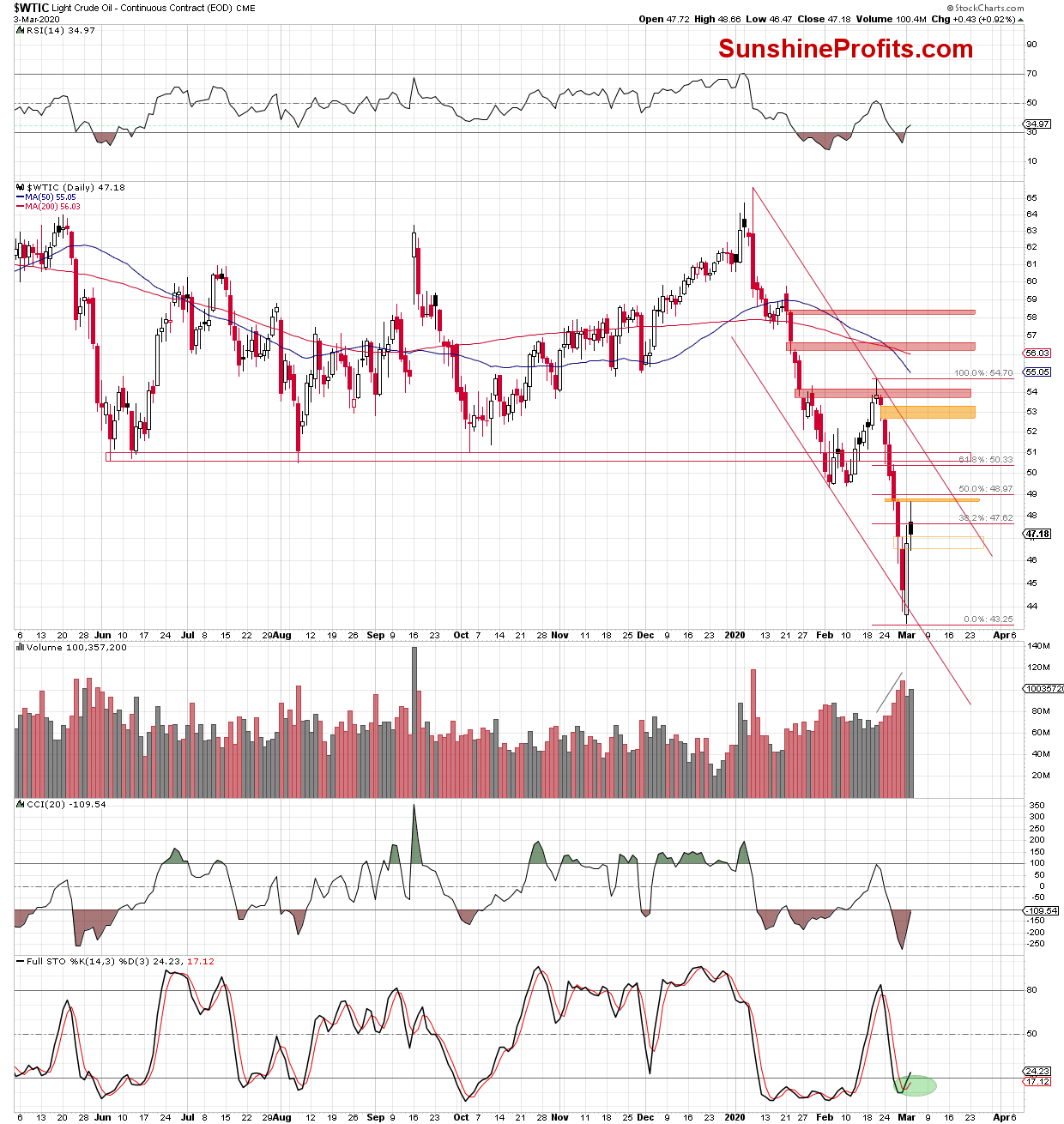

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

Both the above charts reveal that the overall situation in either the short or very short term hasn't changed much as crude oil and its futures keep trading below both the orange gap created on February 27 and the 50% Fibonacci retracement.

Therefore, our yesterday's Oil Trading Alert is up-to-date also today.

Summing up, it seems that the final bottom for this short-term decline is not yet in, and that we might see even lower crude oil prices in the following days and/or hours.

Due to your Analyst's business travel ahead, the Service will resume on Tuesday March 10. We'll keep you updated of breaking developments should there be any though. Thank you for your patience.

Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager