Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11.

Oil has scored strong gains yesterday, and that could carry over into today's session perhaps as well. How likely is that to turn out true?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

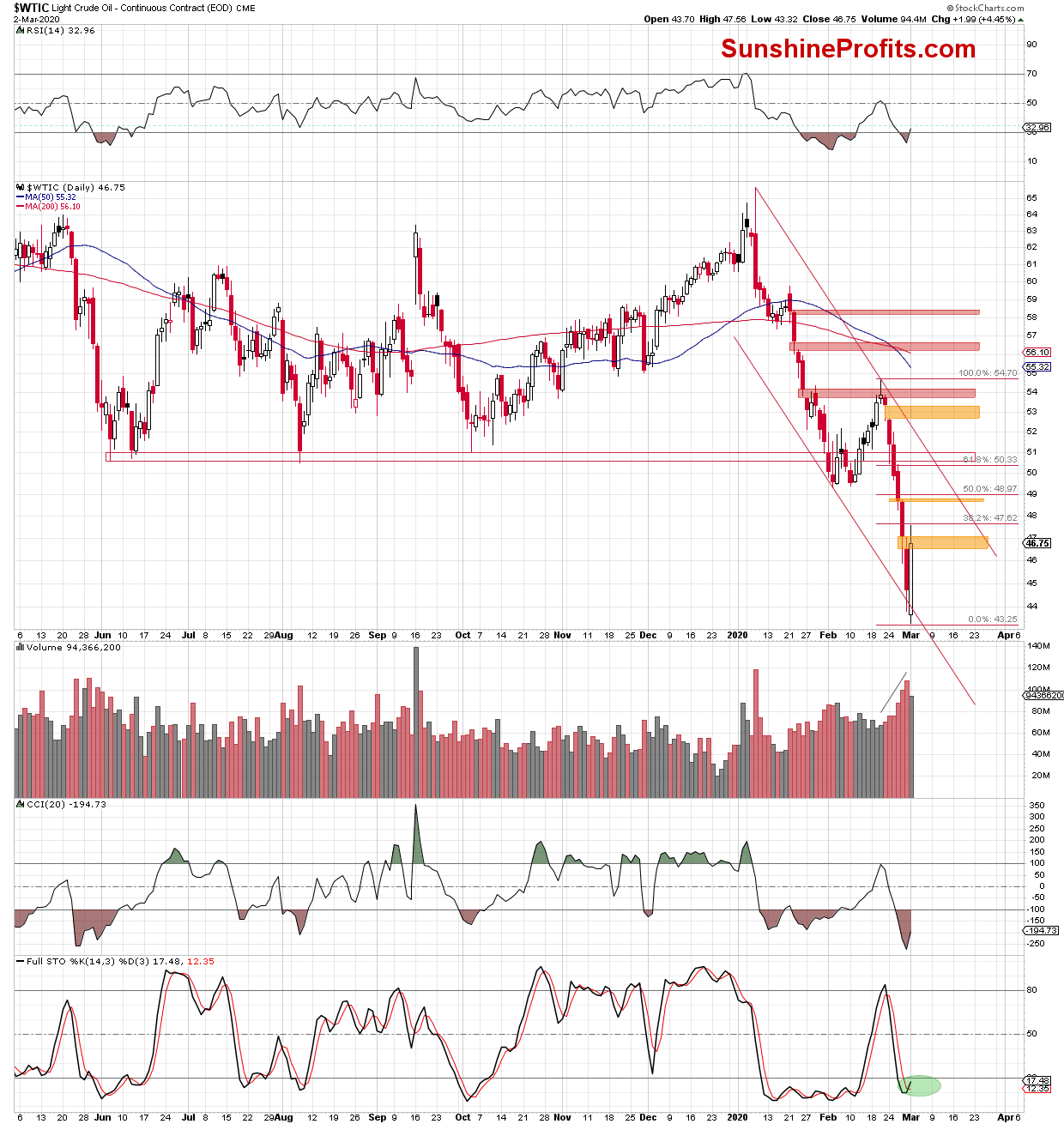

The daily chart shows that although crude oil opened Monday's session below the lower border of the declining red trend channel, the bulls stepped in. As prices moved higher, the earlier breakdown was invalidated.

This positive development triggered further improvement in the following hours, and the first orange gap was tested. Thanks to yesterday's upswing, black gold also reached the 38.2% Fibonacci retracement based on the February 20- March 2 downward move.

As you can see on the above chart, the combination of these two resistances stopped the buyers and translated into a pullback before the closing bell. In this way, the bulls failed to close the gap. Coupled with the above-mentioned retracement, the gap thus continues to serve as the nearest resistance.

Additionally, we should keep in mind that yesterday's white candlestick materialized on smaller volume than the red candles that we saw in the previous week. This suggests that the bulls may be still weaker than their opponents.

On the other hand, the Stochastic Oscillator flashed its buy signal, further supporting the bulls. How did they use this advantage before today's market open?

Let's take a look at the crude oil futures to find out.

As we can see, the futures opened with a green gap, which triggered further improvement in the following hours. Despite this upswing, prices remain below the nearest orange gap and the 50% Fibonacci retracement, which serve as the nearby resistances.

As long as they remain on the cards, the way to the upper border of the declining red trend channel is closed, and a reversal in the very near future should not surprise us.

If this is the case and the futures and black gold turn south, we could see not only a test of yesterday's low, but also a fresh 2020 low.

How low could the commodity and its futures go?

We think that the best answer lies in the quote from our yesterday's Alert:

(...) In our opinion, the commodity could move even lower and drop to around $42.20 (...) Additionally, there is also the December 2018 low slightly above this level, which increases the likelihood that we'll see a test of this support in the coming week.

Summing up, it seems that the final bottom for this short-term decline is not yet in, and that we might see even lower crude oil prices in the following days and/or hours.

Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager