Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11. Please note that we might decide to close the position even before it reaches these levels.

Not only has crude oil opened with a profound bearish gap, it did slide during most of the session. As part of the intraday losses were reversed before the closing bell, does it offer a glimmer of hope for the bulls?

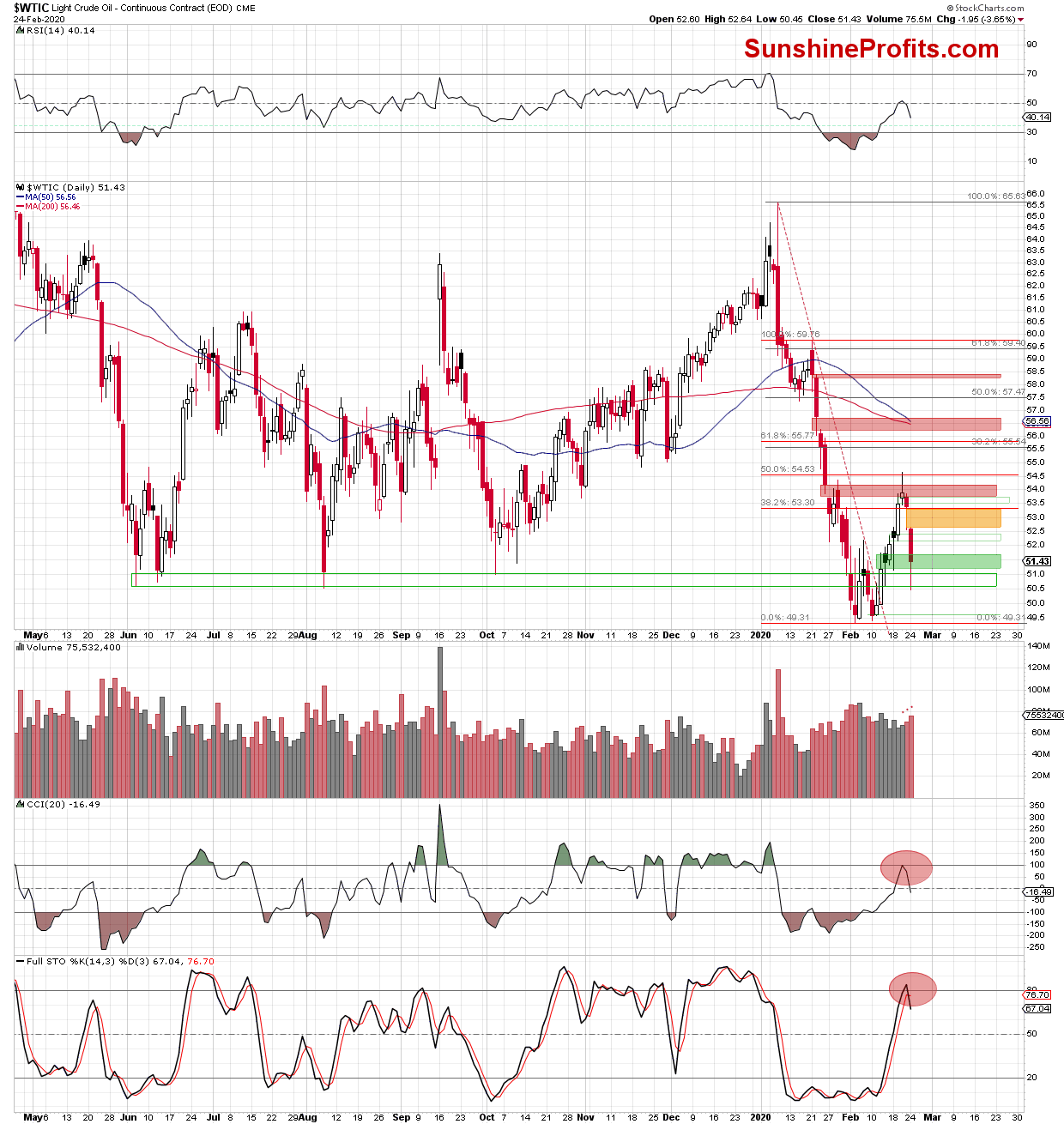

Let's start with the daily chart examination (charts courtesy of http://stockcharts.com and http://stooq.com ).

The first thing that catches the eye, is yesterday's notable orange bearish gap. Such a sizable setback for the bulls encouraged the sellers to follow through in the coming hours. As a result of that deterioration, the bullish gap created on January 18 was closed.

Additionally, the CCI and the Stochastic Oscillator generated their sell signals, giving the bears even more reasons to act. The volume of yesterday's decline increased, confirming the sellers' commitment to yesterday's downswing.

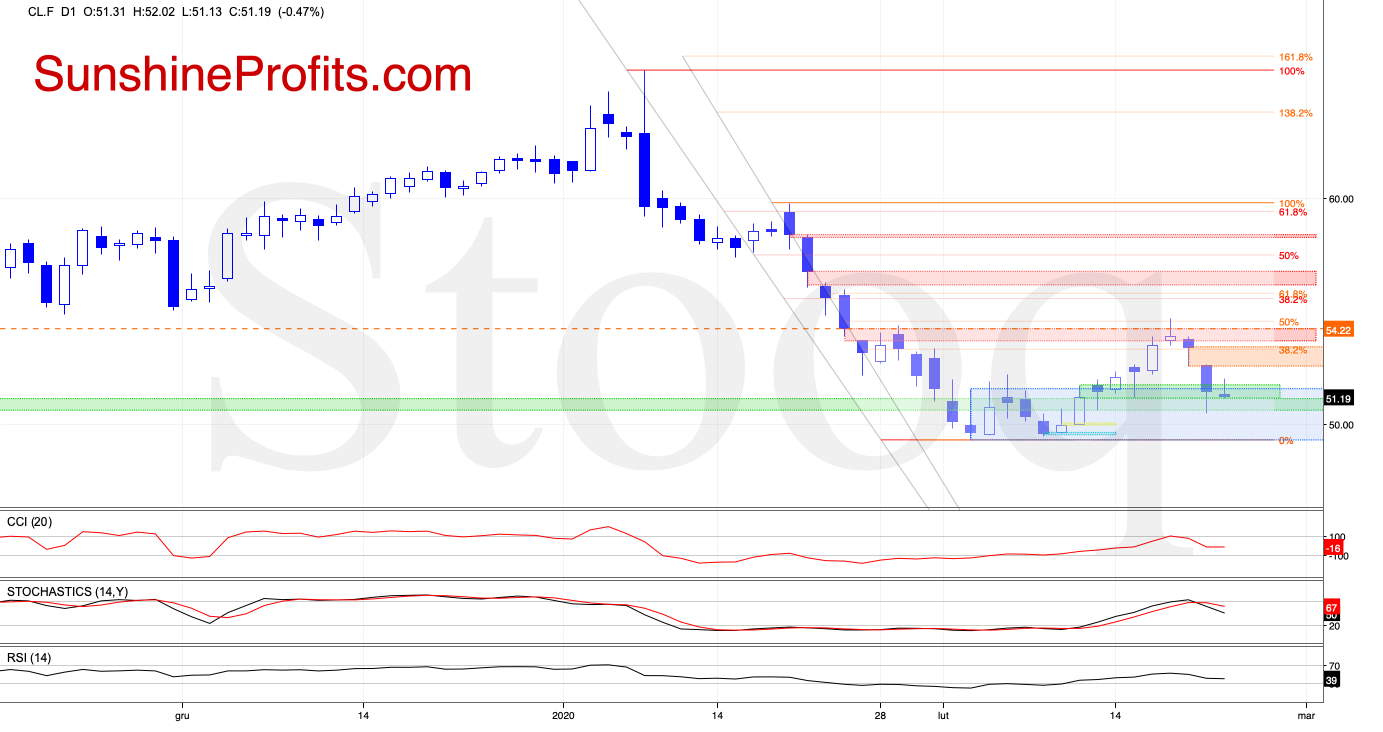

How did yesterday's slide affect investors' moods before today's open? The chart below answers that.

Crude oil opened Tuesday with another bearish gap. Coupled with the sell signals generated by the indicators, it means that our yesterday's observations are up-to-date also today:

(...) Will we see further deterioration?

Taking all the above into account and combining it with the sell signals generated by the CCI and the Stochastic Oscillator (in the case of crude oil futures), we think that lower values of the futures and the black gold are just a question of time.

How low could they go?

In our opinion, the first downside target for the sellers will be around $51.39-$51.56. This is where the nearest support area created by the mid-February lows and the 61.8% Fibonacci retracement based on the entire February rebound, is.

However, if this zone is broken, the way to the February lows or even the realization of the bearish scenario about which we wrote in our February 12 Oil Trading Alert, will be likely open:

(...) Additionally, another move to the downside and a fresh 2020 low would be in line with the Elliott Wave Theory.

Summing up, the outlook for crude oil remains bearish and the corrective upswing definitely appears to be over.

The bearish gaps and volume examination support more downside to come. The short position remains justified from the risk-reward perspective.

Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11. Please note that we might decide to close the position even before it reaches these levels.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager