Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for natural gas’s October futures contract): long positions with entry at $3.848-3.897, with a stop-loss below August’s swing low (3.751) and $4.016 (TP1) / $4.156 (TP2) / $4.251 (TP3) as price targets.

The long rally on natural gas prices may lose some fuel as it started ranging on the top!

Fundamental Analysis

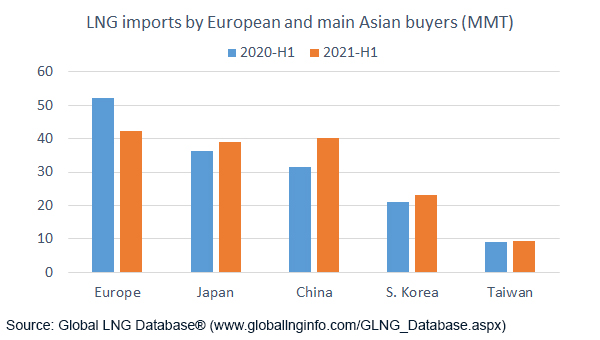

- LNG imports by the European buyers in the first half of 2021 decreased by 19% compared to 2020, while they increased by 16.8% for Chinese buyers over the same period:

- The UP-World LNG Shipping Index gained 9% last week, reducing its spread with the S&P500:

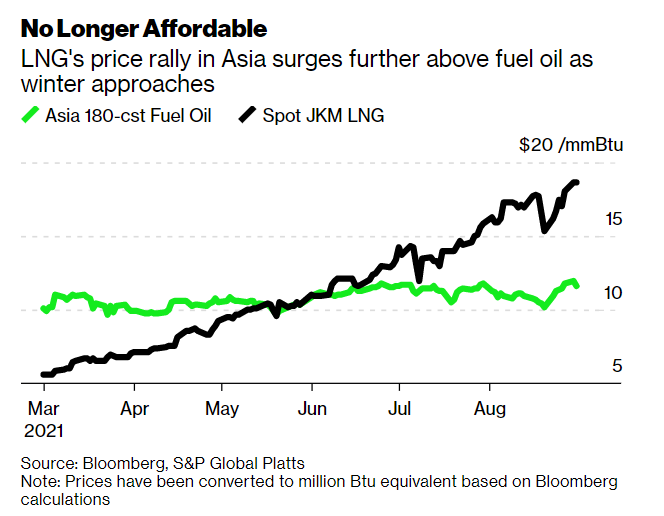

- A Bloomberg article explains that LNG prices in Asia are so high that some countries like Pakistan and Bangladesh can no longer afford to buy spot cargoes, raising the risk of blackouts or shifting to (more) polluting fuel-oil:

Technical Analysis

The Henry Hub Natural Gas futures (Oct’21) contract, currently ranging around its top levels between $4.200 and $4.550, could be set for a correction back onto its $3.848-3.897 support.

- On the daily chart (Fig.1), we show what we believe to be the optimal levels to enter and exit for a good risk to reward ratio if a corrective wave were going to happen.

- The weekly chart (Fig.2) displays a loosening in strength this week with a doji which could be interpreted as a lack of fuel on the buy side, since a number of bulls were taking their benefits at the end of month, while prices being now located in overbought territory.

Figure 1 – Henry Hub Natural Gas (NGV21) Futures (October contract, daily)

Figure 2 – Henry Hub Natural Gas (NGV21) Futures (October contract, weekly)

In summary, if natural gas futures were set to take a correction back onto support anytime soon, we would like to anticipate and be ready to enter at the best risk-optimised levels.

Tomorrow, we will take a look at some ETF relatives…

As always, we’ll keep you, our subscribers well informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for natural gas’s October futures contract): long positions with entry at $3.848-3.897, with a stop-loss below August’s swing low (3.751) and $4.016 (TP1) / $4.156 (TP2) / $4.251 (TP3) as price targets…

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist