Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGG22]

No new position justified on a risk/reward point of view. - RBOB Gasoline [RBH22]

No new position justified on a risk/reward point of view. - WTI Crude Oil [CLH22]

No new position justified on a risk/reward point of view. - Brent Crude Oil [BRNH22]

No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

Crude oil prices are taking a short break in the pre-open US session, even if prices remain supported by several geopolitical crises posing risks to supply from the Middle East and Russia in an already tight market.

Rebels in Yemen fired ballistic missiles in rapid succession at the United Arab Emirates today, which intercepted them and Saudi Arabia, where two people were injured.

These problems pose significant risks to oil supply given the following:

- Russia and the United Arab Emirates (UAE) are major producers in the Organization of the Petroleum Exporting Countries and its allies (OPEC+).

- The enlarged cartel has already been struggling to reach the agreed production level anyway.

I personally don’t believe the scenario of a potential Russian invasion of Ukraine. However, I think Russia appears to be maintaining some kind of pressure on the West (Europe and especially the US, which has put military troops around the Black Sea region). Thus, these military demonstrations might show publicly that they will not tolerate any provocation and, on the other hand, to ensure that the US is not violating an agreement made with Russia. It states that Ukraine wouldn’t be invited to join NATO’s military union anytime soon – Russia’s red line here.

Furthermore, in my opinion, the US might be concerned that the relationship between the EU and Russia gets better and that new energy agreements will arise between both parties (notably regarding Russian gas deliveries to Europe that constitute currently 35% of the total supply).

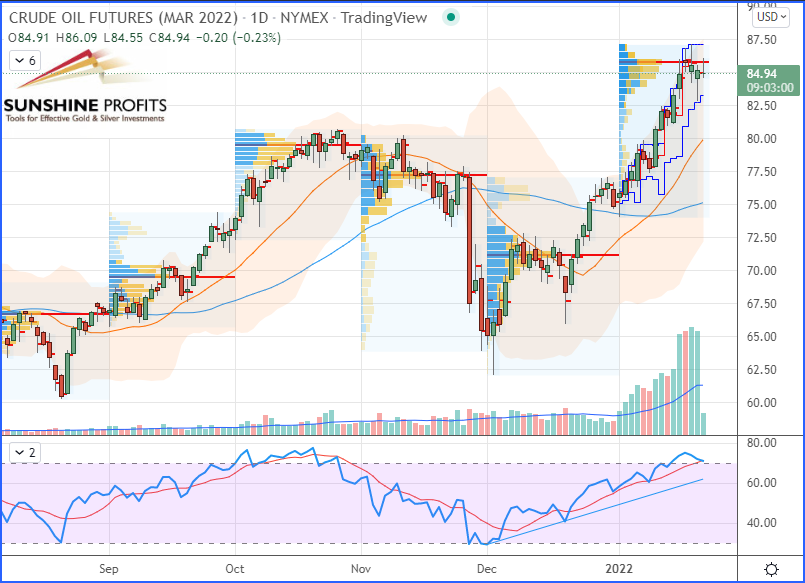

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

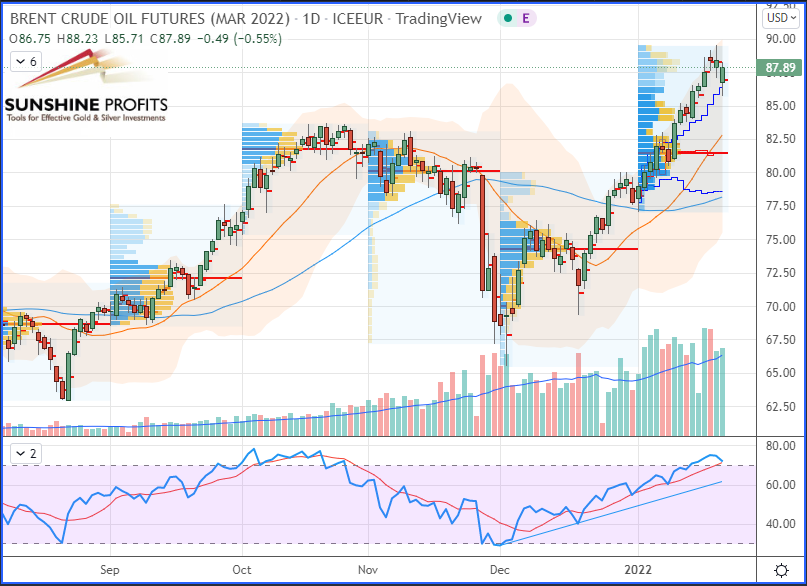

Brent Crude Oil (BRNH22) Futures (March contract, daily chart)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

In summary, there are some games of power playing between several regions, shown publicly through military demonstrations/exercises and speeches (which might be somewhat distracting). However, also some more subtle agreements and moves may be interesting to spot. If you have any comments or another interpretation of what could potentially move the markets, please let me know. I would love to hear from you.

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist