Trading position (short-term; our opinion): Long positions (with a stop-loss order at $41.88 and the upside target around $50)

Although the black gold moved higher on bullish EIA weekly report, the commodity reversed and declined in the following hours after news from Washington. Will we see further deterioration in the coming week?

Yesterday, the government data showed that crude oil inventories fell by around 6.3 million barrels in the week ended June 30, easily beating analysts’ forecasts of draw of 2.3 million barrels. Additionally, gasoline supplies fell by almost 3.7 million barrels, beating expectations of a rise of 1.067 million barrels. On top of that, distillate inventories fell by 1.85 million barrels, compared to expectations of a rise of 217,000 barrels. Thanks to these bullish numbers crude oil moved higher and hit an intraday high of $46.53. Despite these encouraging circumstances, the black gold gave up some gains after news that U.S. Interior Secretary signed an order, which will make easier to drill and mine on federal land. Will we see further deterioration in the coming week?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

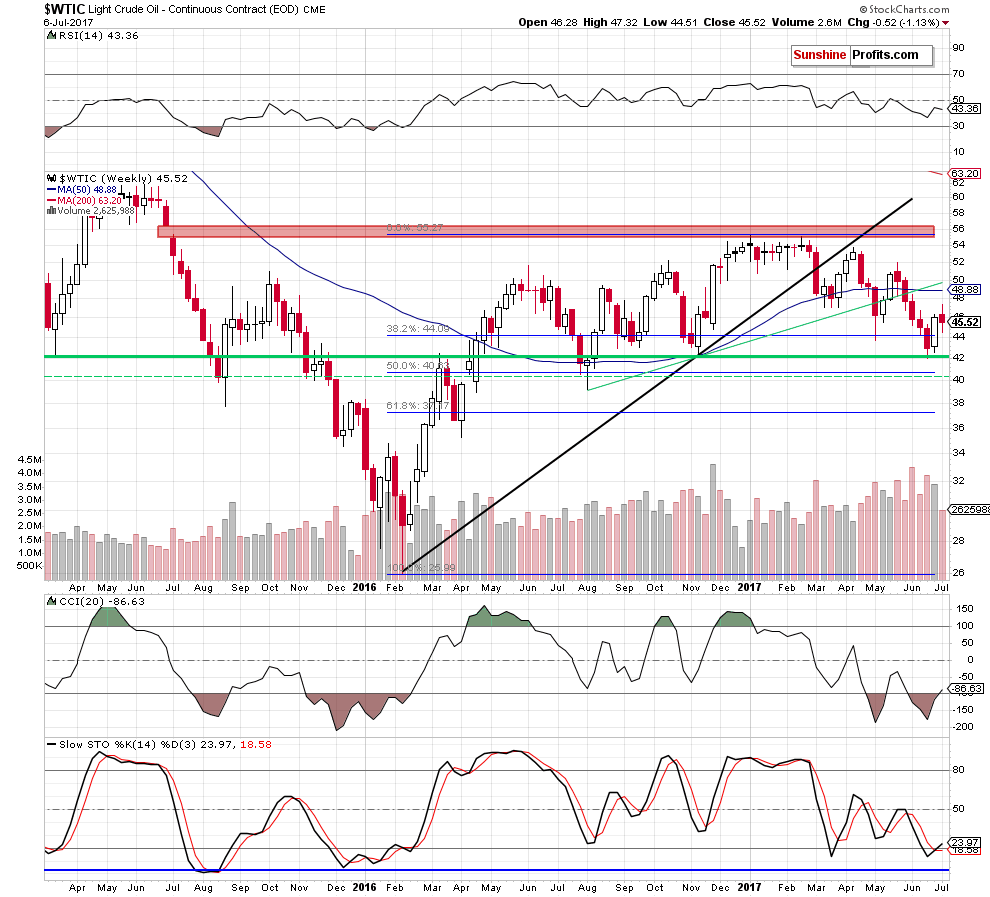

From the medium-term perspective, we see that the situation hasn’t changed much, which means that what we wrote yesterday remains up-to-date:

(…) the buy signals generated by the CCI and the Stochastic Oscillator remain in play, supporting oil bulls and another attempt to move higher. Additionally, (…), light crude is still trading above the previously-broken 38.2% Fibonacci retraceent, which means that an invalidation of the breakdown below this support and its positive impact on the price are still in effect.

Having said the above, let’s take a closer look at the daily chart.

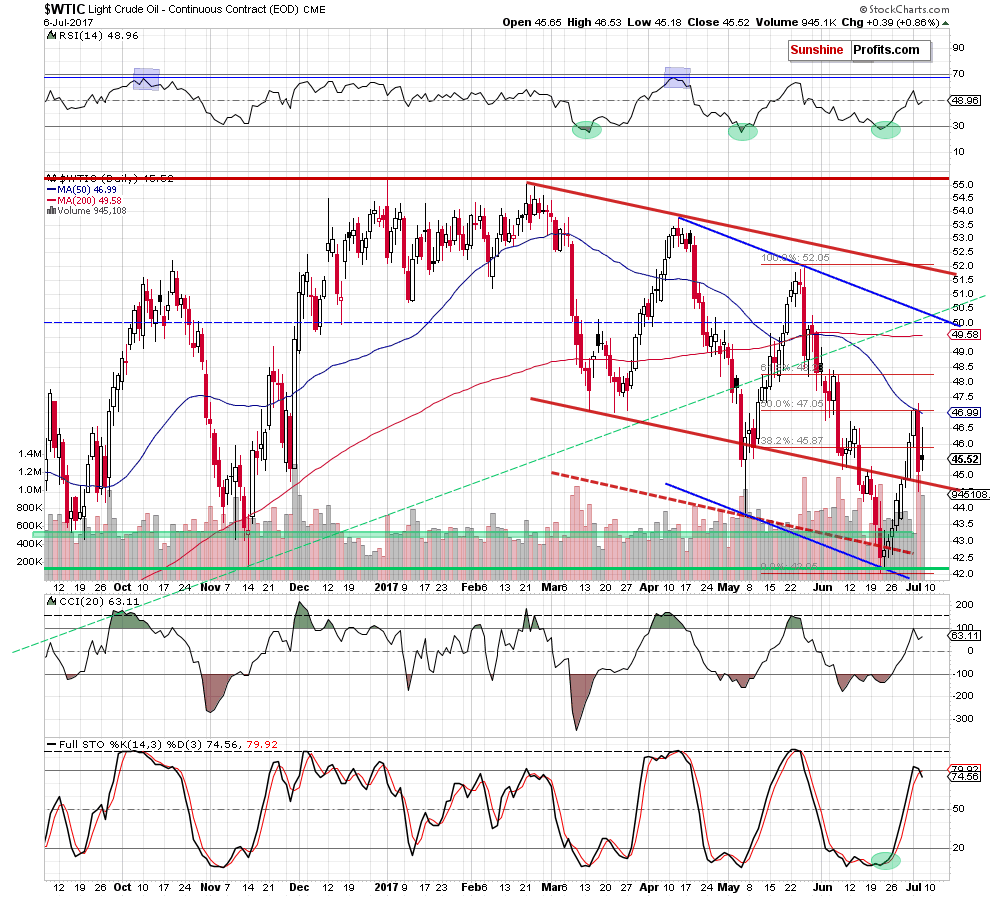

Looking at the very short-term chart, we see that although crude oil moved higher after the market’s open, oil bulls didn’t manage to hold gained levels, which resulted in a pullback.

Despite this drop, light crude closed yesterday’s session above the previously-broken lower border of the red declining trend channel, which suggests that as long as there is no invalidation of the breakout above this line (confirmed by a daily closure under $44.75) another attempt to move higher is likely.

How High Could Crude Oil Go?

We believe that the best answer to this question will be the quote from our yesterday’s Oil Trading Alert:

(…) In our opinion, the first upside target will be around $47.07-$47.32, where the 50-day moving average and this week’s high are. If this resistance area is broken, the next resistance levels and likely targets are created by the 61.8% Fibonacci retracement (at $48.23) and (approximately) the $50 level.

At this point it is worth keeping in mind that the $50 level is a very round number, so it’s important from the psychological point of view and it has indeed stopped both rallies and declines in the previous months (we marked it with a blue, dashed line). Moreover, the rising green resistance line and the declining blue resistance line also coincide close to the $50 level.

Summing up, long positions continue to be justified from the risk/reward perspective as it seems that crude oil will move even higher before the next local top is seen.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at $41.88 and the upside target around $50) We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts