Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGG22]

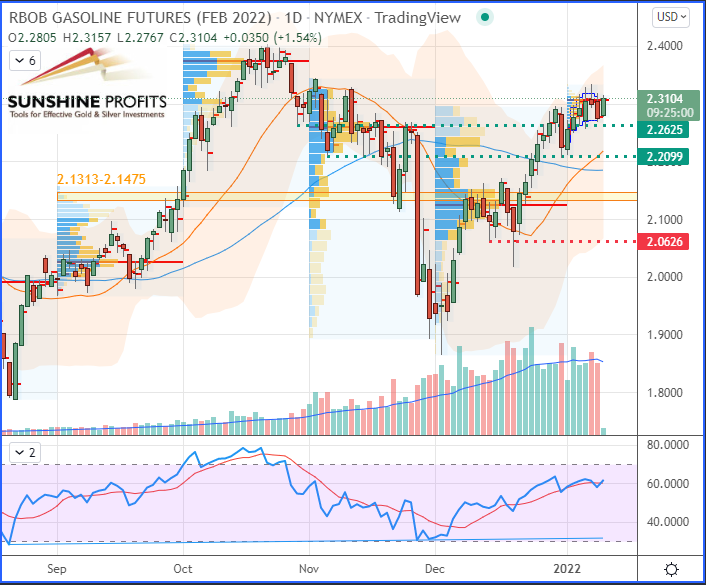

Short around 4.876-5.079 / Stop just above 5.400 / Targets at 4.568 & 4.213 - RBOB Gasoline [RBG22]

Long around 2.1313-2.1475 / Stop just below 2.0626 / Targets at 2.2099 & 2.2625 - WTI Crude Oil [CLG22]

Long around 72.00-73.15 / Stop just below 69.21 / Targets at 76.20 & 78.01 - Brent Crude Oil [BRNH22]

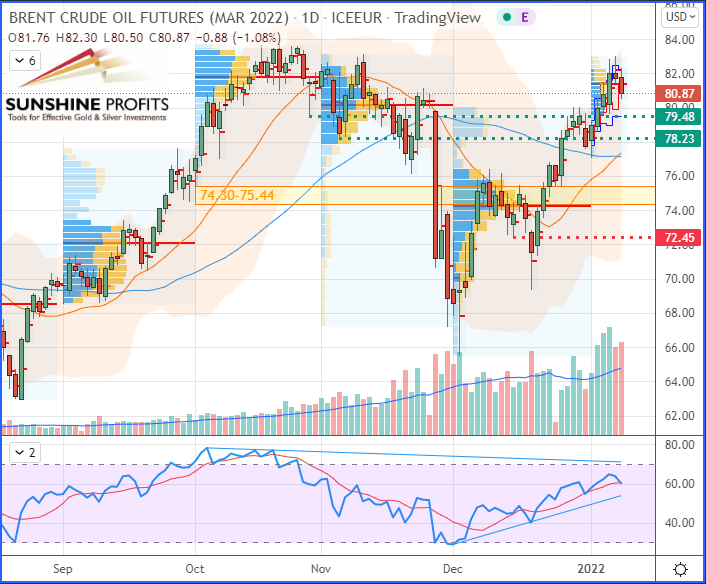

Long around 74.30-75.44 / Stop just below 72.45 / Targets at 78.23 & 79.48

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

Oil prices edged higher in the European session by maintaining most of their recent gains.

Both the North Sea Brent barrel and the West Texas Intermediate (WTI) barrel resumed their forward march after the stabilisation of the situation in Kazakhstan and an increase in Libyan production. Black gold is thus on the rise again today, after two sessions down, stimulated by investor confidence in sustained demand.

If crude oil does not break its previous highs from the second half of 2021, the next pullback could happen around the $72.00-73.15 support area (highlighted by the yellow band) for the WTI and 74.30-75.44 for the Brent:

WTI Crude Oil (CLG22) Futures (February contract, daily chart)

Brent Crude Oil (BRNH22) Futures (March contract, daily chart)

RBOB Gasoline (RBG22) Futures (February contract, daily chart)

Regarding RBOB Gasoline, we have a similar configuration with potential support around $2.1313-2.1475.

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

On Henry Hub natural gas, the market is set by an overall downward trend. Therefore, we might see some short-selling happening around the $4.876-5.079 resistance area (again, highlighted by the yellow band). To take advantage of this bearish market behavior, some aggressive traders could potentially enter short following the next extension and then target a return to current prices.

Since warmer temperatures are more likely to be forecasted in the near future, domestic demand should be gradually falling, and US Liquefied Natural Gas (LNG) exports may slow down just before springtime. Consequently, this abovementioned resistance could act as an engine-braking system to slow down the next upward move. Once gas demand is assumed to have reached its seasonal peak, the market could be set for its next correction.

In summary, those are some scenarios that we could see in the coming days/weeks. As always, we prefer anticipating before the market fully develops towards one direction. Given that a sudden surge in volatility may turn those markets into choppy ones, we will also keep an eye on both geopolitical events and health concerns.

The next oil trading alert will be published on Friday. Stay tuned!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist