Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective.

Although Saudi Crown Prince Mohammed bin Salman said that his country and Russia began working on extending the January 2017 deal to a 10-to-20-year agreement, the price of crude oil declined yesterday. Is it time to refocus on the west?

Technical Analysis of Crude Oil

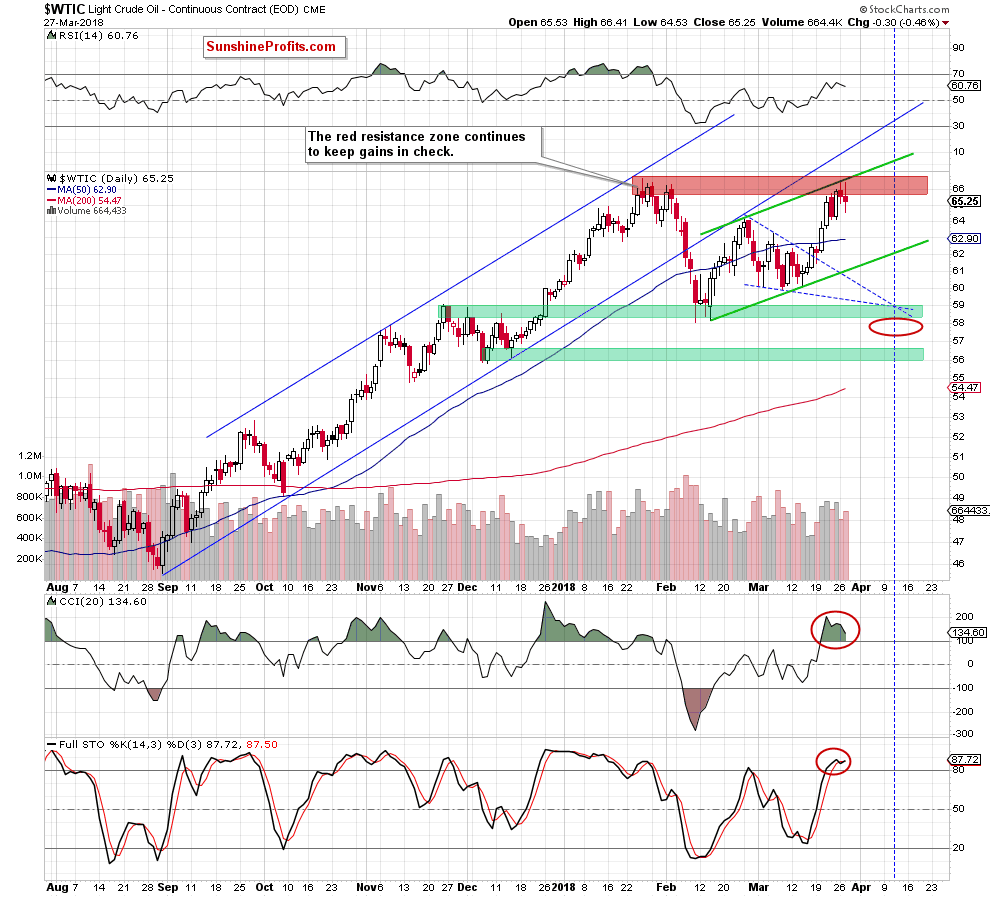

Let's examine the well-known daily chart (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that although oil bulls pushed the price of crude oil higher after the Tuesday market open, the red resistance zone created by the previous 2018 peaks in combination with the upper border of the green rising trend channel stopped them once again, triggering a pullback.

As a result, black gold closed the day under the red zone, which suggests lower prices in the coming days. Taking this fact into account, we believe that the comments that we made yesterday remain up-to-date also today and if you haven’t had the chance to read our Tuesday’s alert, we encourage you to do so today:

Crude Oil – Hello Elliott, My Old Friend…

Finishing today’s alert, please note that although the American Petroleum Institute showed after yesterday’s market closure that gasoline stocks and distillate stockpiles declined more than expected, the report also showed that crude oil inventories increased surprisingly by 5.3 million barrels in the week to March 23, missing analysts’ expectations for a decrease of 287,000 barrels. Additionally, crude oil stockpiles at the Cushing, Oklahoma, delivery hub rose by 1.7 million barrels. If today’s government data confirms such big increase in crude oil inventories, oil bears will receive one more reason to act in the coming days.

Summing up, on Tuesday, oil bulls failed to break above the major resistances once again, which together with the picture of black gold that emerged from yesterday’s alert increases the probability of another bigger move to the downside. This means that the situation is not just bearish. It’s extremely bearish and we will act accordingly. For the first time EVER, we are increasing the size of the speculative short position to 150% of the regular size. Of course, it doesn’t mean using your entire capital and then borrowing to use it for trading. It simply means that the amount that it seems justified to increase the amount that one usually dedicates to a single trade.

You can read more about the importance of proper position sizes in the second half of our tips for beginning investors.

Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts