Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

After the strong declines that we observed last week, the price of crude oil began to consolidate (in a narrow range so far) just above the psychological barrier of $ 50. Will such a price change transform into a bigger rebound or is it just the calm before the storm and a fresh low?

Let’s examine the charts below and try to find the answer to this question (charts courtesy of http://stockcharts.com)

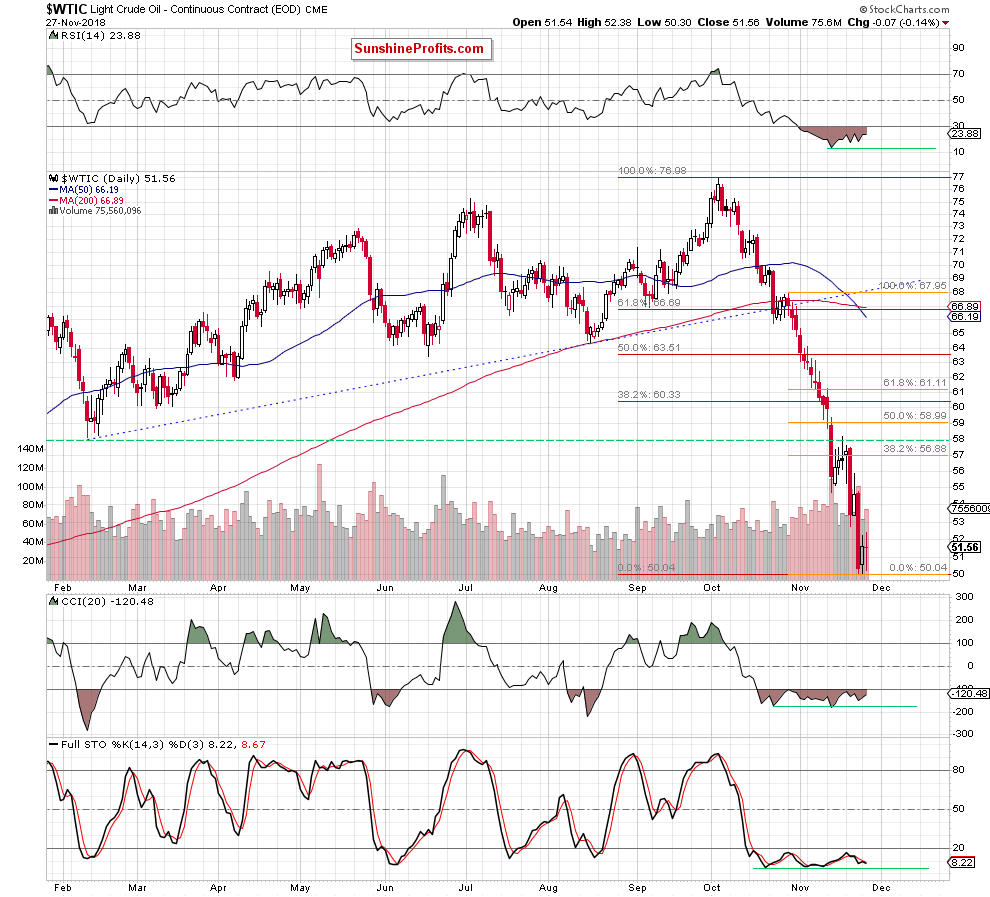

Looking at the daily chart, we see that although crude oil wavered between small gains and losses during yesterday’s session, the commodity closed the day only 7 cents below Monday’s closure, which means that the overall situation in the very short term hasn’t changed much and our last comments remain up-to-date also today:

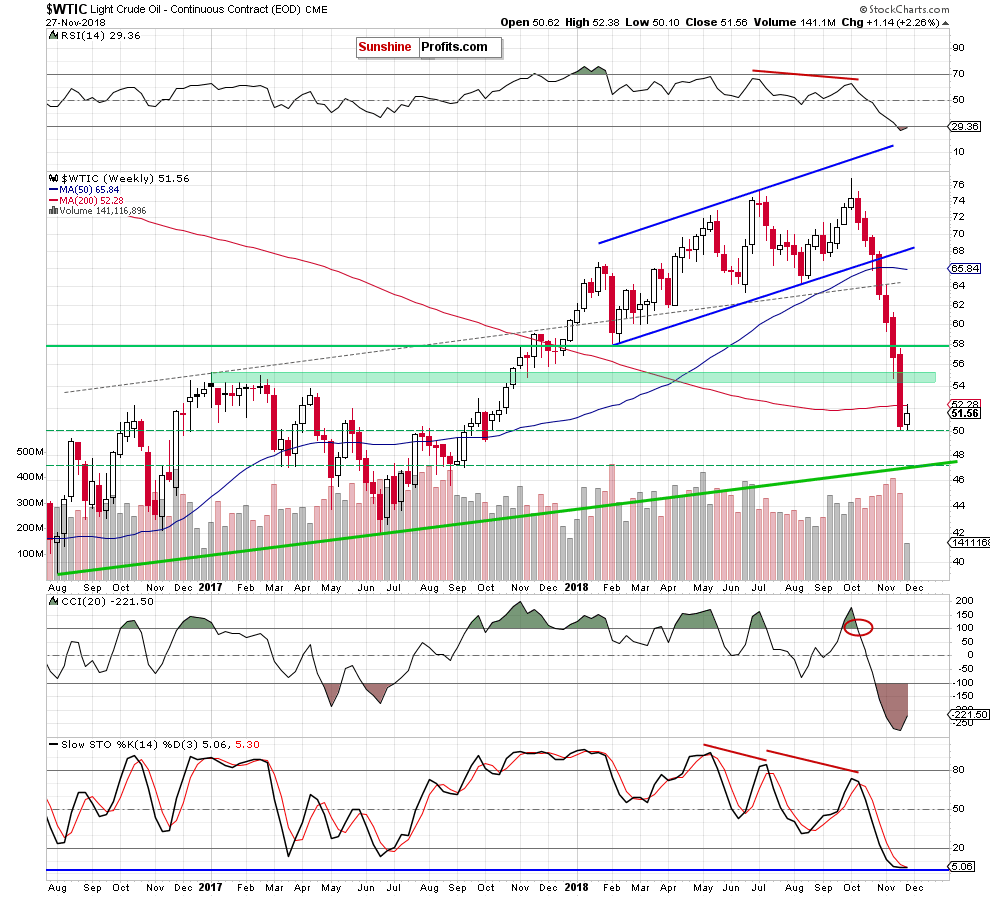

On the weekly chart, we see that crude oil bounced off the barrier of $50 during yesterday’s session and closed the day above $51. Although this may look encouraging, we should keep in mind that the price of black gold increased to the previously-broken 200-week moving average and pulled back, closing the day below it.

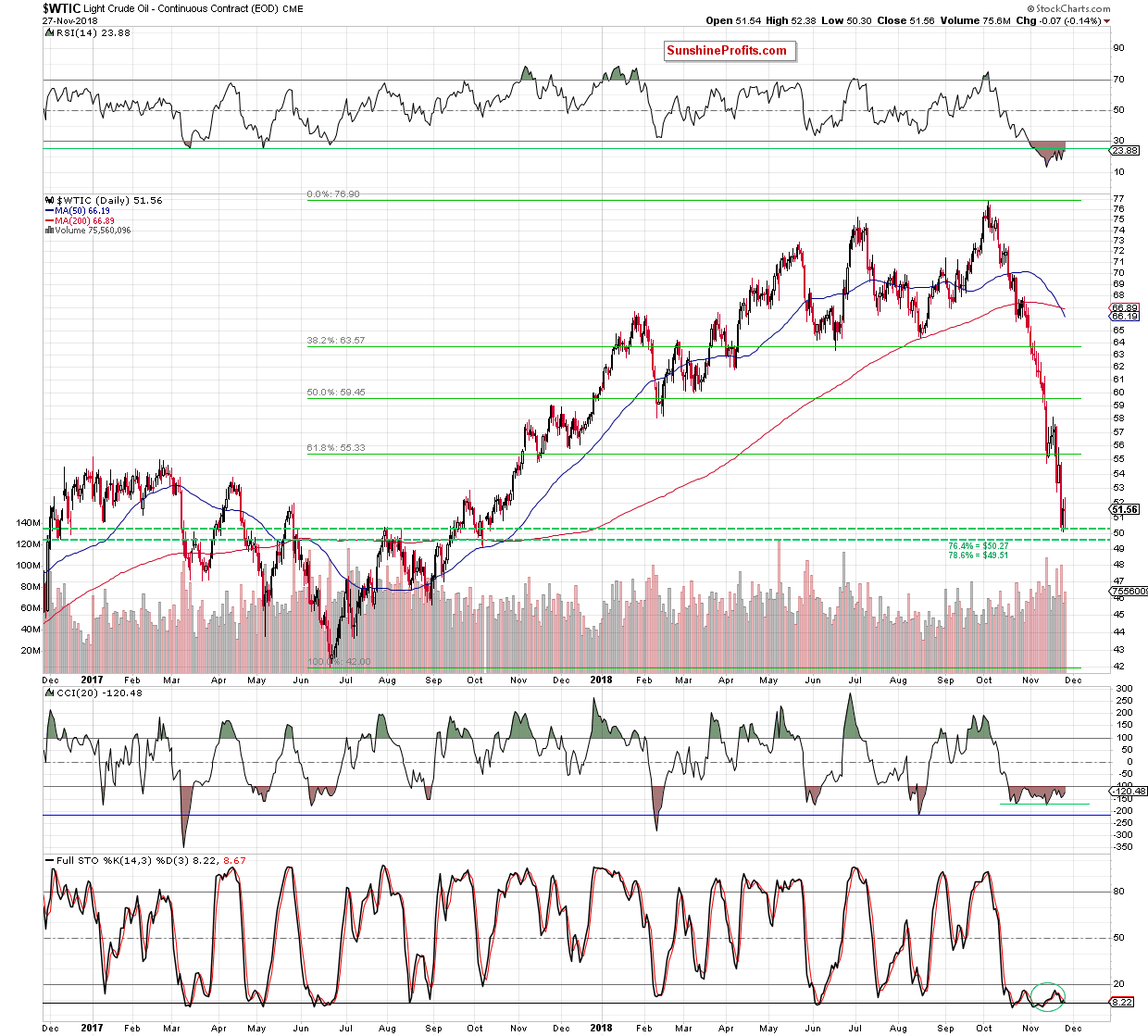

Such price action suggests that we could see nothing more than a verification of the earlier breakdown under this support. If this is the case, the price of light crude will likely move lower once again and test the recent lows, the barrier of $50 or even the support area created by the 76.4% and the 78.6% Fibonacci retracements (marked on the daily chart below with the green horizontal dashed lines) in the following days.

Finishing today’s commentary, please note that the current position of the daily indicators (there are bullish divergences between the RSI, he CCI and the Stochastic Oscillator and the price of the commodity) suggests that the space for declines may be limited – especially when we also factor in the position of the weekly indicators.

Nevertheless, as we mentioned earlier, one more downswing before a bigger rebound should not surprise us in the very near future. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts