Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective.

Although yesterday's session approached black gold to the barrier of $70, the combination of several important technical factors stopped the buyers, which allowed oil bears to re-enter the trading floor. We observed a similar situation by analyzing the relation of oil with gold and silver. Does this positive relationship correctly bode the price of oil in the coming days?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

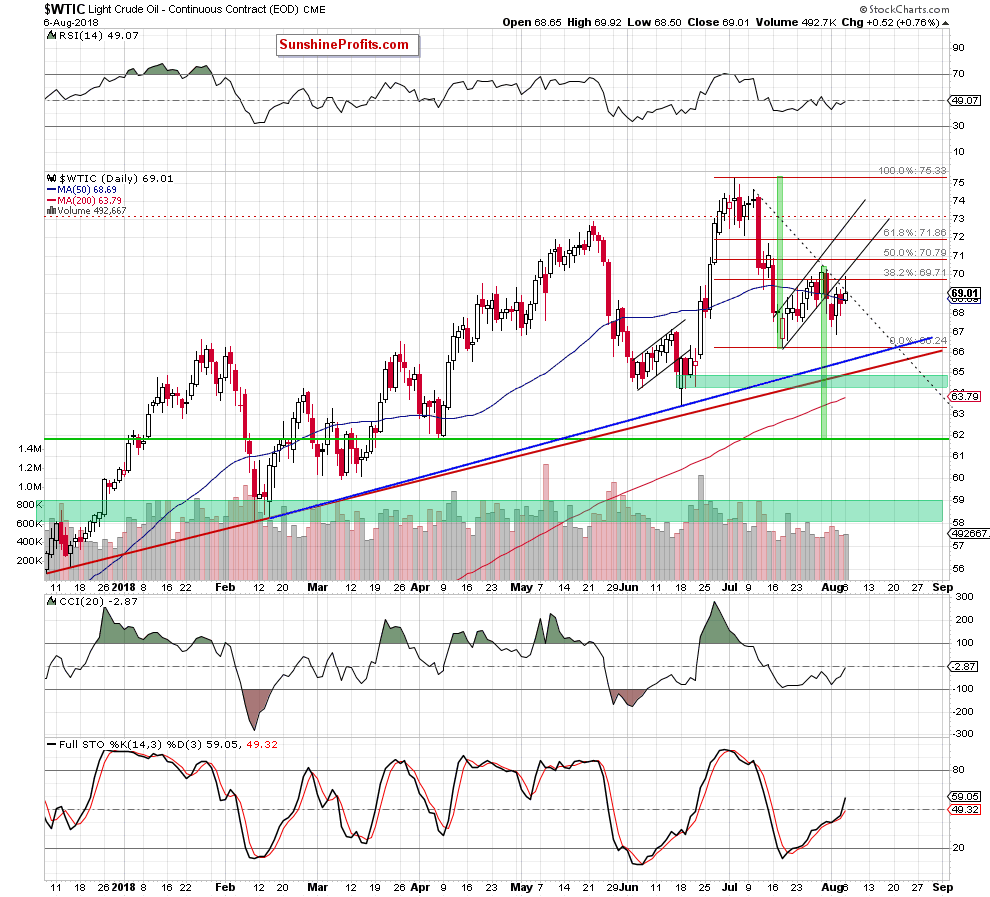

Technical Picture of Crude Oil

From today’s point of view, we see that although crude oil increased once again during yesterday’s session, the previously-broken 38.2% Fibonacci retracement in combination with the proximity to the lower border of the very short-term black rising trend channel encouraged oil bears to act for the second time in a row.

Thanks to their attack, black gold pulled back, which looks like another verification of the earlier breakdown under the trend channel. Additionally, the commodity closed the day under the black dotted resistance line based on recent peaks, invalidating the earlier small breakout, which doesn’t bode well for oil bulls in the coming week.

Taking all the above (and the broader perspective about which we wrote more in our yesterday’s Oil Trading Alert) into account, we believe that as long as there is no successful breakout above the 38.2% retracement, the black dotted line and a comeback to the very short-term black rising trend channel, higher prices of crude oil are quite doubtful – especially when we factor in the current situation in the oil-to-gold and oil-to-silver ratios.

Crude Oil – Precious Metals Link

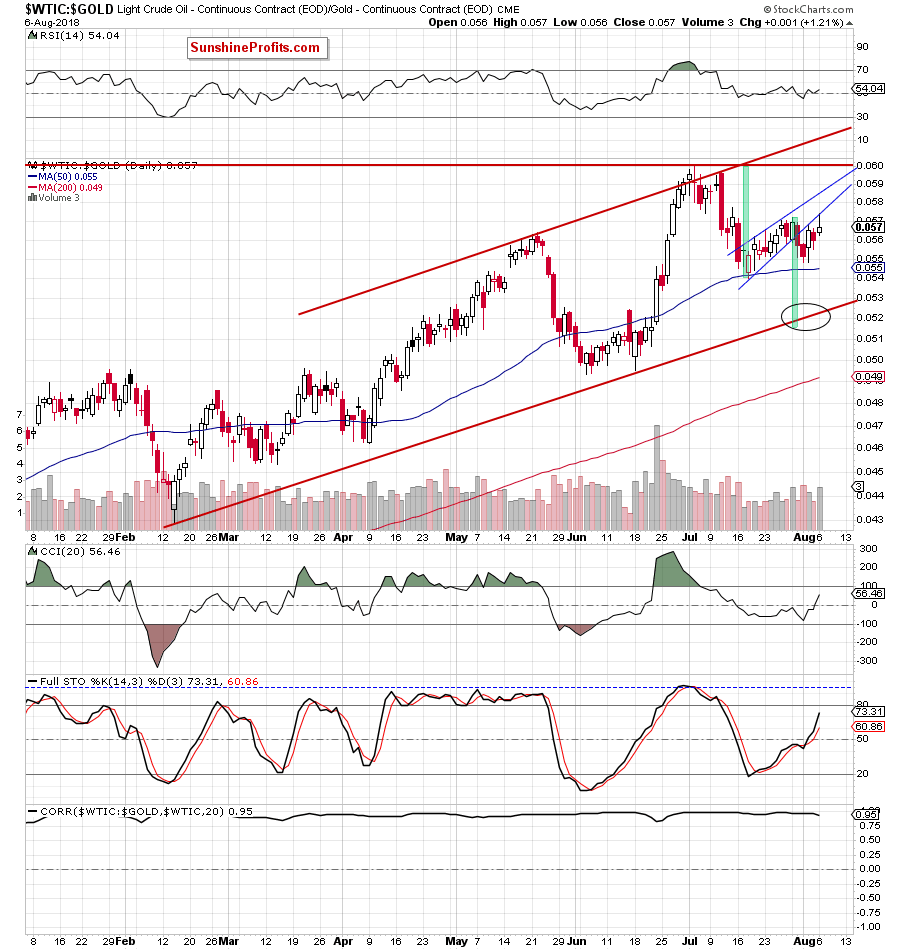

Let’s start with the oil-to-gold ratio.

On Thursday, the ratio moved quite sharply higher, which resulted in a climb to the lower line of the blue rising wedge. Although the sellers triggered a pullback, their opponents managed to trigger one more upswing, which (similarly to what we wrote in the case of crude oil) looks like another verification of the earlier breakdown.

Despite yesterday’s price action, the ratio is still trading under this important very short-term resistance, suggesting that reversal is just around the corner.

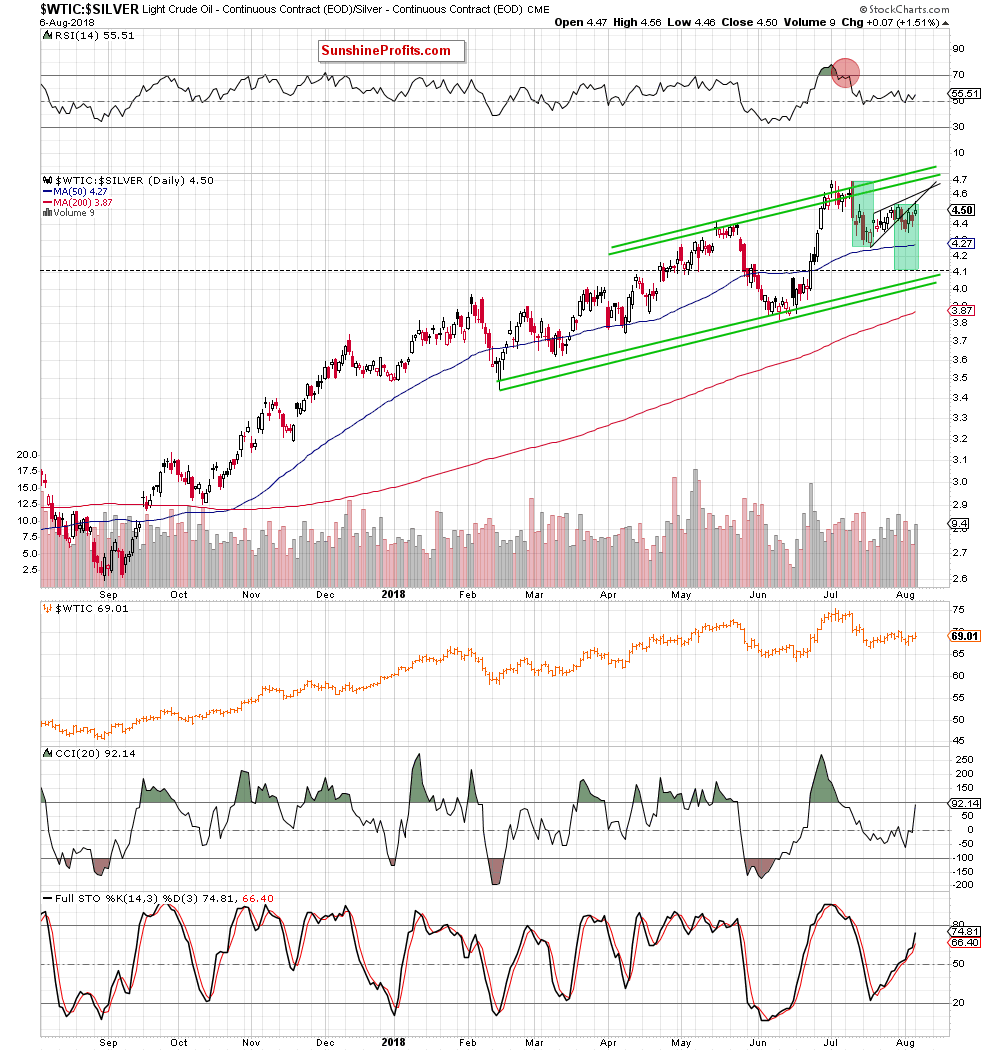

Something similar we could also observe in the oil-to-silver ratio.

What does it mean for black gold?

Considering a strong positive correlation between these ratios and the price of light crude, we believe that if they reverse and move lower from current levels, we’ll also see a decline in crude oil in the very near future.

How low could light crude go if the situation develops in line with our assumptions?

In our opinion, if the above-mentioned resistances withstand the buying pressure, we’ll likely see (at least) a test of the blue and red support lines based on 2018 lows later this week (currently around $65.60).

Connecting the dots, we believe that we can summarize today’s Oil Trading Alert in exactly the same way as we did yesterday:

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish (an invalidation of the earlier breakouts above the long-term resistances, a verification of the breakdown under the lower line of the very short-term rising trend channel, the flag/pennant formations underway), favoring the sellers and lower prices of crude oil in the coming week(s).

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts