Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective.

The very short-term changes have thrown the price of crude oil up and down in the last days, causing some doubts as to who is in charge. However, when we expand the picture of the commodity a bit and look at it from the medium- and long-term perspectives, we can easily point those who have an advantage over their rivals.

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

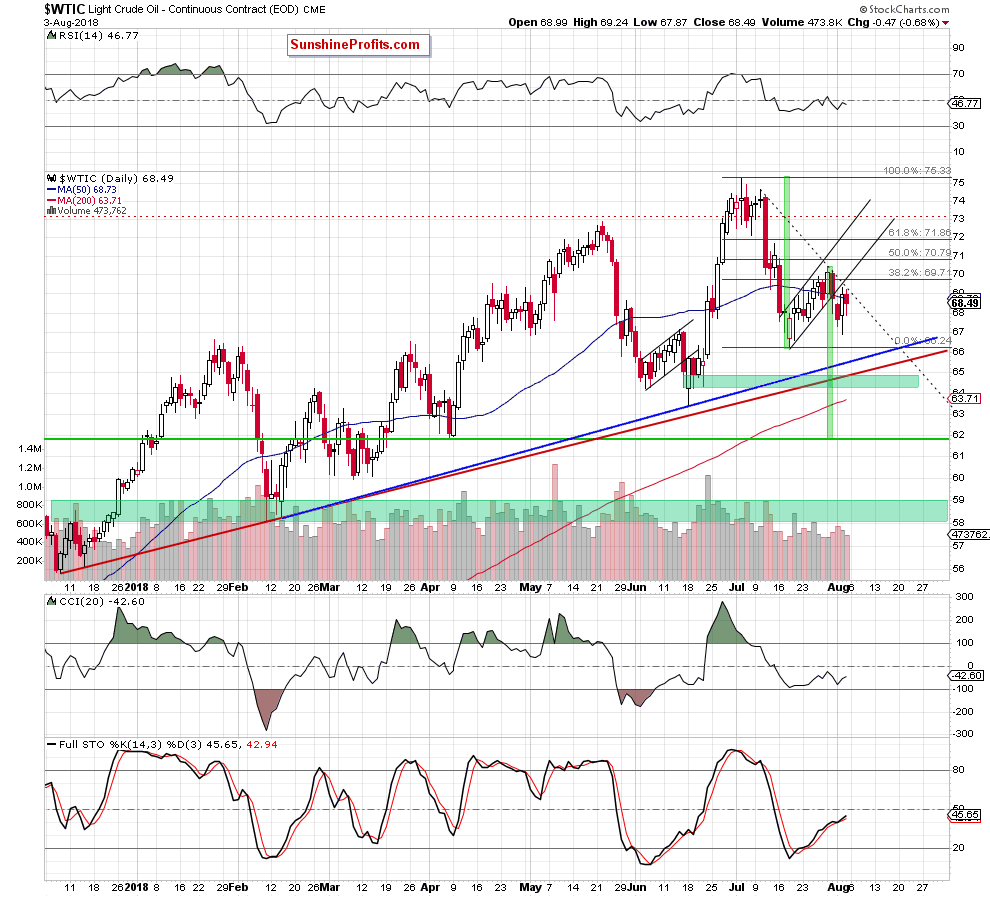

Looking at the daily chart, we see that although crude oil moved higher on Thursday, the proximity to the previously-broken lower border of the very short-term black rising trend channel encouraged oil bears to act on the following day.

As a result, light crude pulled back, which looks like a verification of the earlier breakdown under this line. If this is the case, the sellers will likely trigger another move to the south in the coming week.

At this point it is also worth noting that black gold is also trading under the black doted resistance line based on recent peaks, which means that as long as there is no successful breakout above it, higher prices of the commodity are not likely to be seen and further deterioration should not surprise us.

Where will oil bears head next?

In our opinion, if the above-mentioned resistances withstand the buying pressure in the near future, we’ll likely see (at least) a test of the blue and red support lines based on 2018 lows later this week (currently around $65.60).

Are there any other technical factors that can encourage the sellers to take action? Let’s zoom out our picture a bit and examine the weekly chart.

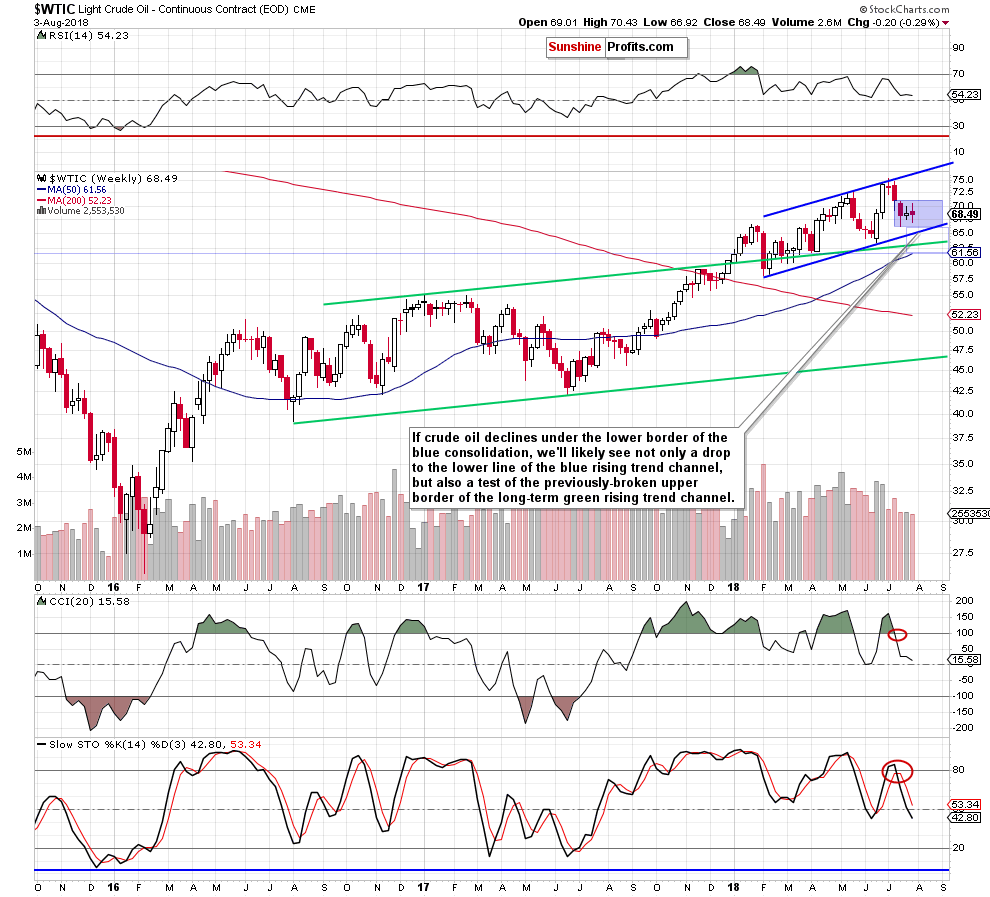

From this perspective, we see that black gold stuck in the blue consolidation slightly above the lower border of the blue rising trend channel, which makes the broader perspective a bit unclear.

Nevertheless, taking into account the short-term picture and the medium-term sell signals generated by the CCI and the Stochastic Oscillator, we think that light crude will extend losses and we’ll see not only a drop to the lower line of the blue rising trend channel, but also a test of the previously-broken upper border of the green rising trend channel in the following week(s).

This scenario is also reinforced by the long-term picture of the commodity. Let’s take a look at the chart below.

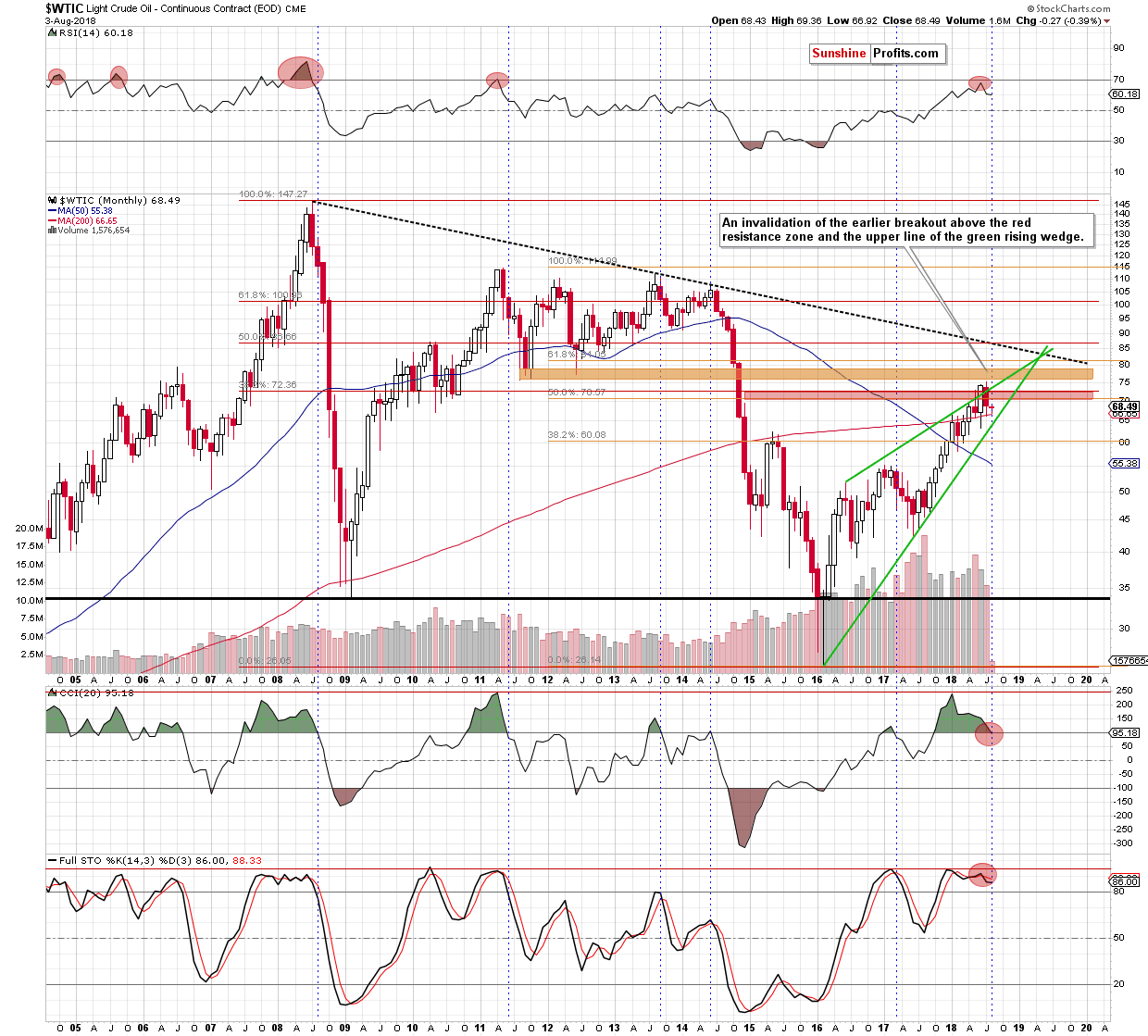

As you see on the monthly chart, black gold remains under the upper border of the green rising wedge and the red zone, which means that an invalidation of the earlier breakouts above these resistances and its negative impact on the price are still in effect, suggesting lower values of the commodity in the coming month(s).

Finishing today’s commentary, we would like to add that the CCI joined the Stochastic Oscillator and generated the sell signal. When we compare this situation to what we already saw in the past, we noticed that in all similar cases (since 2008) the behavior of the indicator preceded smaller or bigger declines (we marked them with blue dotted vertical lines), which increases the probability that the history will repeat itself once again and we’ll see black gold at lower levels.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish (an invalidation of the earlier breakouts above the long-term resistances, a verification of the breakdown under the lower line of the very short-term rising trend channel, the flag/pennant formations underway), favoring the sellers and lower prices of crude oil in the coming week(s).

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts