Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective.

Wednesday’s session belonged to oil bears. Thanks to their yesterday's attack, black gold lost 1.6%, the price fell below $68 and the likelihood of a pro-declining scenario significantly increased. Where will the commodity head next?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Today’s alert is going to be very brief, because crude oil didn’t do anything that would change the outlook on Wednesday and the same applies to today’s session so far.

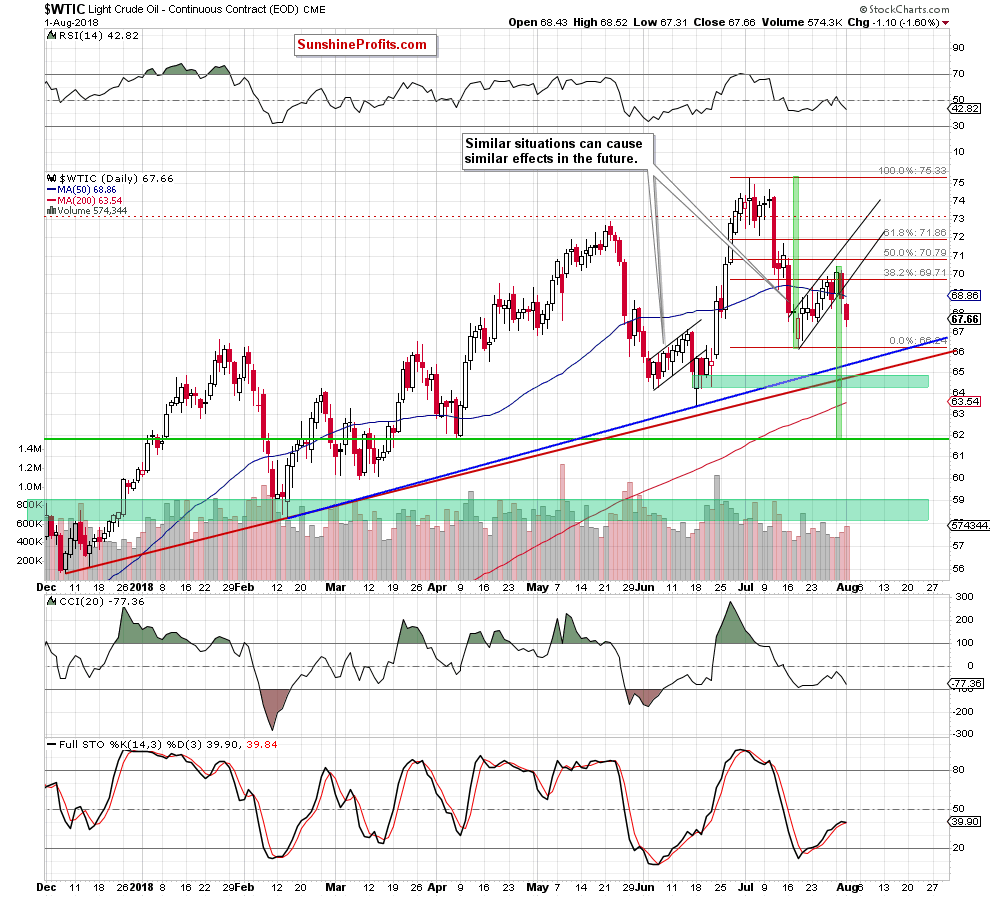

The only thing that crude oil did yesterday is that the commodity extended losses and moved away from the previously-broken lower border of the very short-term black rising trend channel and the 50-day moving average (please note that black gold invalidated the earlier breakout on Tuesday), making our short positions more profitable.

Such price action in combination with rising volume shows that oil bears gained the appetite for lower prices, which increases the probability that we’ll see further deterioration in the very near future – especially if the Stochastic Oscillator generates the sell signal once again.

Earlier today, we haven’t seen any important breakout/breakdown, which could change the overall situation. Therefore, if you haven’t had the chance to read yesterday’s alert, we encourage you to do so today - it’s up-to-date:

Crude Oil – Breakdowns and Their Consequences

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish (invalidation of the earlier breakouts above the long-term resistances, the breakdown and the daily closure under the lower line of the very short-term rising trend channel, the flag/pennant formations underway), favoring the sellers and lower prices of crude oil in the coming week(s).

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to your editor travel plans, there will be no Oil Trading Alert on Friday (Aug. 3, 2018). The next Oil Trading Alert is scheduled for Monday, Aug. 6, 2018. Thank you for your understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts