Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- WTI Crude Oil [CLF22] No position currently justified on a risk-to-reward point of view.

- Natural Gas [NGF21] No position currently justified on a risk-to-reward point of view.

By the way, have you read my last article about commodity currencies? Let me know what you would like to learn more about regarding that hybrid (commodities/FX) topic, so I will do my best to emphasise on some of your suggestions in my future posts!

Apparently, some markets didn’t find the Thanksgiving turkey very tasty this year.

CBOE Volatility S&P 500 Index (VIX) Futures (daily chart)

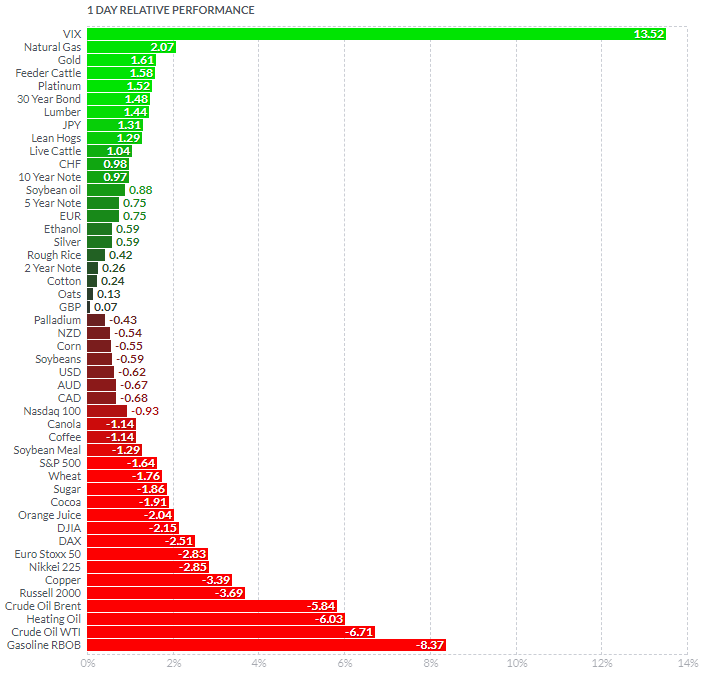

With the “indicator of fear” (also known as the VIX or Volatility Index) spiking over 13.5 % in the European session, propelling some precious metals (Gold and Platinum) and natural gas to the roof, while sending the crude and petroleum products to the lower ground, the volatility has just clearly reached a higher level.

(Source: FINVIZ)

WTI Crude Oil (CLF22) Futures (January contract, daily chart)

The main fears on the oil market come from the possibility of a demand slowdown starting from Q1 2022. Additionally, that timing happens when the United States, along with a larger group of countries (including China, India, Japan, Republic of Korea, and the UK) have made the decision to release some of their strategic oil reserves on the market, aiming at artificially increasing the supply, and thus lowering oil prices. Well, this may represent one driver of prices indeed, although a more general economic slowdown associated with a non-sustained demand as we are getting into the winter may be the main concern now.

On the other hand, the winter – expected to be colder in certain regions – is also supporting the gas prices, hence the recent surge on the Henry Hub futures, along with sustained US exports of Liquefied Natural Gas (LNG) that are also supporting natural gas prices.

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart)

In conclusion, we could be entering a new volatile period on the global markets, associated with various fears maintained through headlines by media (Covid variants, restrictions, etc.). For now, I would suggest staying away from the noisy headlines and just relax and enjoy some new pieces of turkey leftovers, or whatever else if you don’t eat meat. Ignore the noise and trade what you see (not what you think). Stay tuned and enjoy your weekend!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist