Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGJ22]

Long around the $4.490-4.550 support area (yellow band) with a stop at $4.340 and targets at $4.745 & $4.860 – More details in previous Oil Trading Alert. - RBOB Gasoline [RBJ22]

No new position justified on a risk/reward point of view. - WTI Crude Oil [CLJ22]

No new position justified on a risk/reward point of view. - Brent Crude Oil [BRNK22]

No new position justified on a risk/reward point of view.

Henry Hub Natural Gas (NGJ22) Futures (April contract, daily chart)

Henry Hub Natural Gas (NGJ22) Futures (April contract, daily chart)

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

The threat of sanctions caused a stir in the markets: WTI spiked above $130 and Brent is nearing the $140 mark. Where is crude oil going next?

A possible Western embargo on Russian oil caused oil prices to soar again on Monday, as stock markets feared persistent inflation and a consequent economic slowdown.

On the US dollar side, the continued rally of the greenback has propelled the dollar index (DXY) towards higher levels, as it is now approaching the three-figure mark ($100), even though it has not had a huge impact on crude oil, other petroleum products, or any other commodities in general. What we rather witness here is the greenback’s safe haven effect attracting investors, much like gold would tend to act in a “store of value” role.

US Dollar Index (DXY) CFD (daily chart)

On the geopolitical scene, Russia-Ukraine peace talks will be resumed today in Brest (Belarus) at 14:00 GMT, while another meeting is already scheduled at the Antalya Diplomacy Forum on Thursday in Turkey. Russian Foreign Minister Sergei Lavrov and his Ukrainian counterpart Dmytro Kuleba will talk there in the presence of the Turkish foreign minister. We might therefore expect some de-escalation in the Black Sea basin this week if the two parties involved were able to reach an agreement after further negotiations.

WTI Crude Oil (CLJ22) Futures (April contract, daily chart)

Brent Crude Oil (BRNK22) Futures (May contract, daily chart)

RBOB Gasoline (RBJ22) Futures (April contract, daily chart)

Henry Hub Natural Gas (NGJ22) Futures (April contract, daily chart)

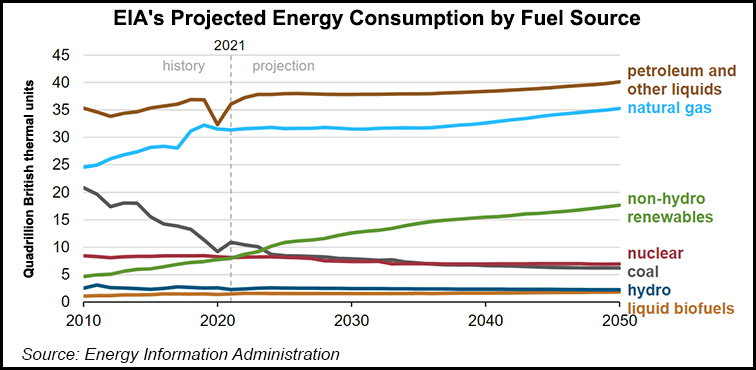

Regarding natural gas, the U.S. Energy Information Administration (EIA) published its Annual Energy Outlook (AEO) 2022 report, suggesting that even with non-hydro renewable sources set to rapidly grow through 2050, oil and gas-derived sources should still remain the top energy sources to fuel most of the United States. The agency is forecasting a rise in the production of Liquefied Natural Gas (LNG) – which mainly comes from shale gas – by at least 35%!

In summary, the threat of sanctions has already wiped out almost all Russian oil – at least 7% of global supply – from the world oil market. In the weeks or months to come, we can see sanctions on Russian oil exports create a boomerang effect on European economies, decreasing world market supply, increasing prices for industry, as well as even more rising expenses, and thus cost of living through a ripple effect.

The next OTA will be published on Thursday.

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist