Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective.

Wednesday’s session showed how bears can fight if they get the right motivation. What can this lead to in the next days?

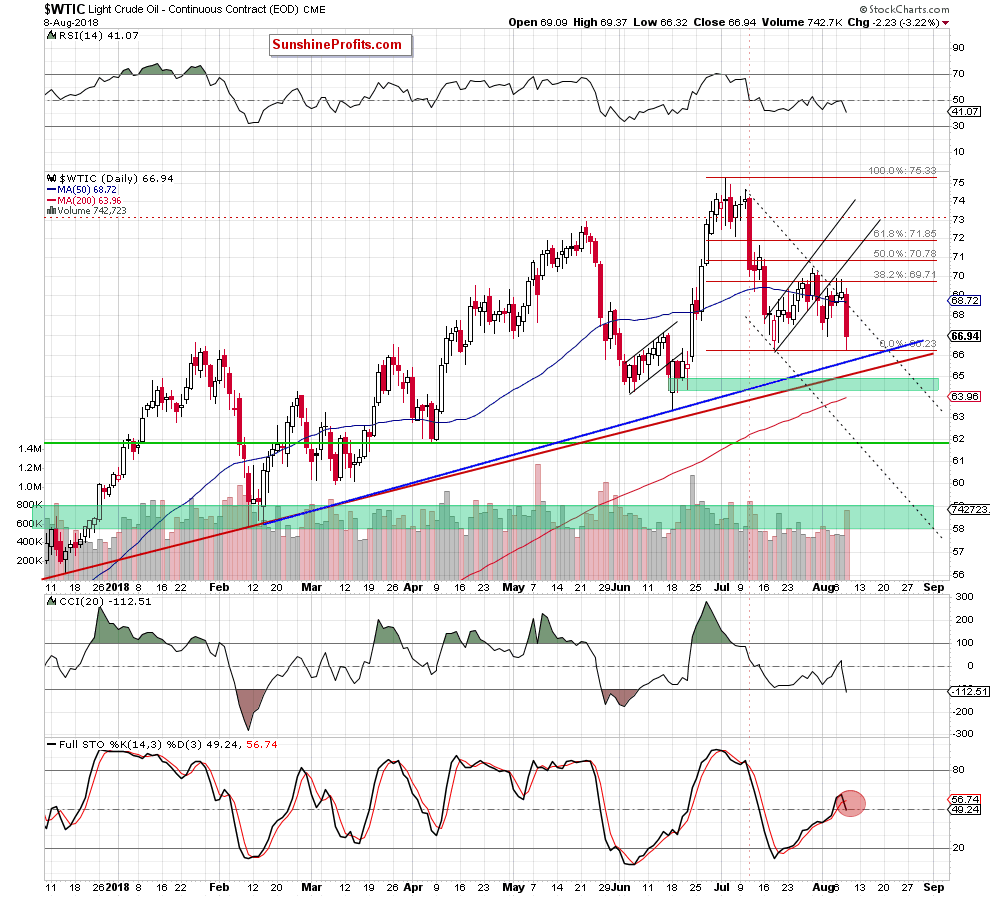

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

In our last alert, we wrote the following:

(…) we should keep in mind that oil bulls didn’t manage to overcome the 38.2% Fibonacci retracement for the second time in a row. (…) they didn’t even reach the previously-broken lower border of the very short-term black rising trend channel, which suggests that the buyers’ strength could be exhausted, and we will see a return to the south in the very near future.

From today’s point of view, we see that the situation developed in line with our assumptions and black gold declined sharply during yesterday’s session, making our short positions even more profitable.

Thanks to yesterday’s move, crude oil almost touched July low, but then rebounded slightly. Does it mean that we’ll see a post double-bottom rally in the following days?

In our opinion such scenario is quite doubtful. Why?

Firstly, light crude verified the earlier breakdown under the 38.2% Fibonacci retracement in previous days, which encouraged the sellers to act yesterday.

Secondly, thanks to their attack, the commodity invalidated the earlier small breakout above the black dotted resistance line based on previous highs.

Thirdly, Wednesday’s decline materialized on significant volume (the biggest since July 11), which raises the credibility of the direction in which the price has moved.

Fourthly, the Stochastic Oscillator generated the sell signal once again, increasing the probability of another attempt to move lower.

On top of that, the long- and the medium-term picture of the commodity continues to support the sellers and lower prices of black gold in the coming days or even weeks (more about this issue you could read in our Oil Trading Alert posted on Monday).

How low could black gold go if oil bears show their claws once again?

We believe that the best answer to this question will be the quote from our Monday’s alert:

In our opinion, if the (…) resistances withstand the buying pressure in the near future, we’ll likely see (at least) a test of the blue and red support lines based on 2018 lows later this week (currently around $65.60).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil moved sharply lower, making the very short-term outlook even more bearish (another invalidation of the earlier breakout above the black dotted line, a verification of the breakdown under the lower line of the very short-term rising trend channel and the 38.2% Fibonacci retracement), which increases the likelihood of another downswing in the coming days.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts