Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

A drop, a rebound and a pullback – this is how we can summarize Thursday session. If we add to the above a glance at the volume, the question arises: what has really changed?

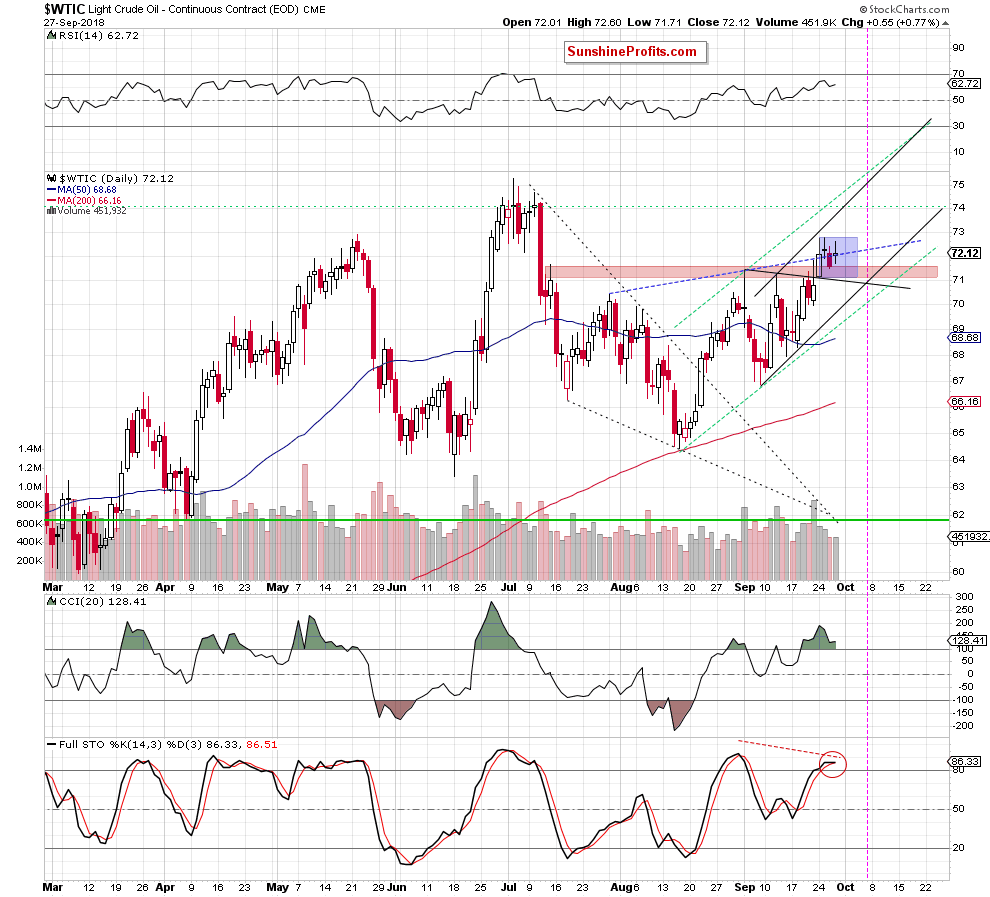

Let’s take a look at the daily chart below (charts courtesy of http://stockcharts.com).

Today’s Oil Trading Alert will be quite short, as basically not much changed on the market since we commented on it yesterday. Although crude oil dropped after the market’s open, the proximity to the previously-broken highs encouraged oil bulls to fight, which resulted in a rebound that approached the commodity to the recent peaks.

Despite this “improvement”, black gold pulled back and finally finished the day slightly above the neck line of the reverse head and shoulders formation. In this way, the buyers invalidated Wednesday’s breakdown, but taking into account the volume, which accompanied yesterday’s battle it’s hard to believe in their strength at the moment.

Additionally, the Stochastic Oscillator generated a sell signal, increasing the probability of another move to the downside. Nevertheless, in our opinion, as long as light crude is trading in the blue consolidation a bigger decline is not likely to be seen, which remains in line with our yesterday’s comments:

(…) looking at yesterday’s volume, we do not see its significant increase (in fact, yesterday's downswing materialized on an even lower volume than Tuesday's increase), which doesn’t confirm that oil bears are determined enough to trigger a sizable move to the downside at the moment.

In our opinion, their attack will be more likely and reliable if the sellers break below the red zone and the previously-broken upper line of the black triangle and invalidate these breakouts.

An additional support they could also receive from the daily indicators, which are quite close to generating sale signals (maybe even later in the day).

Taking all the above into account, we believe that the right time to open short positions is just around the corner. However, in our opinion, it's worth to be patient for a moment and wait for additional confirmations. As always, we will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts