Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Despite successful Monday’s breakout above the line of the neck of the pro-growth formation and Tuesday closure above this resistance, oil bulls capitulated during yesterday's session. Lack of forces to maintain gained levels resulted in a very negative signal.

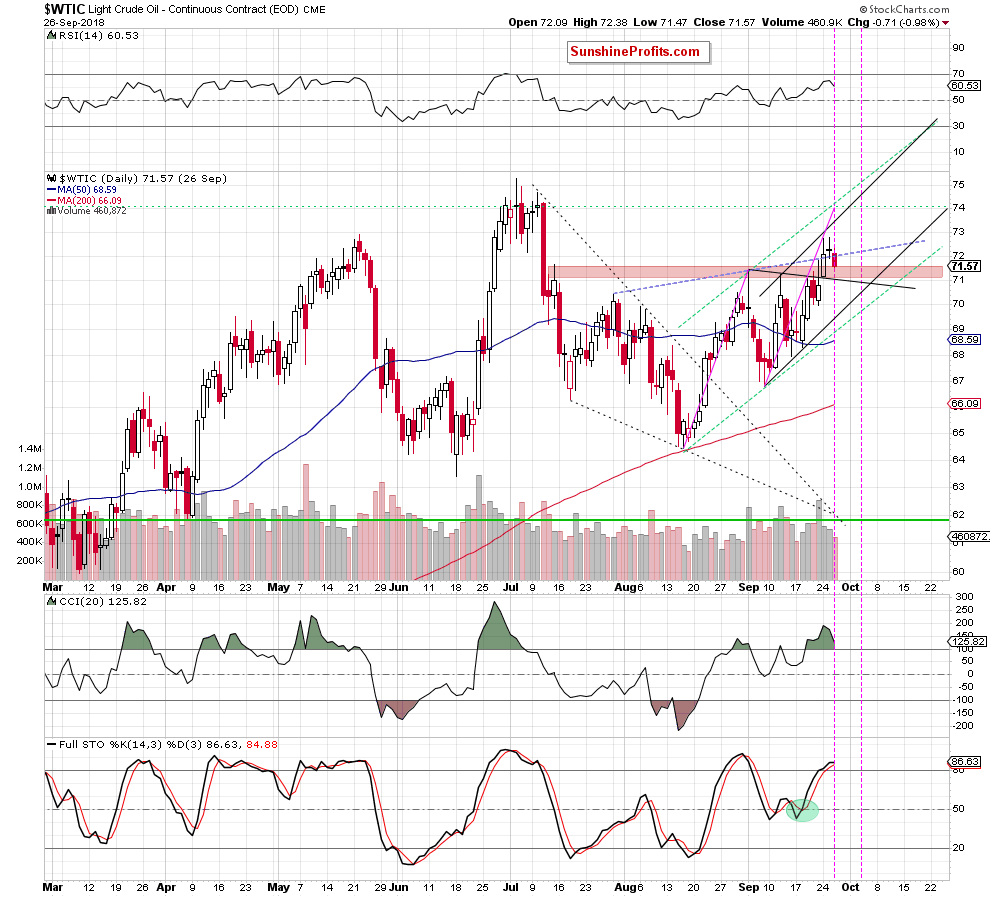

Let’s take a look at the daily chart below (charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on September 12, 2018, we wrote the following:

(…) you can see two pink lines that we draw: the first one corresponds to the time in which crude oil formed the first wave (between the mid-August low and the September 4 peak); the second one is its shift in time and we based it on the last week's low. Based on this simple dependency (assuming that the upcoming increases will last approximately as long as the previous ones), we can see that black gold can still grow for about 2 weeks (until around September 24/25).

What’s interesting, around these dates, we also see a vertical pink line, which shows the place where the arms of the above-mentioned triangle (marked with time dotted lines) will intersect in the future.

What does it mean for cure oil? We think that the best answer to this question will be reading this interesting concept: Triangle Apex Reversal Pattern (for those who do not have time to delve into technical details… please note that in the place where the triangle’s arms are crossed, we can often see reversal).

In our last commentary, we added:

(…) thanks to yesterday’s price action, the opening price was almost the same as the closing price (the difference was just 3 cents), which resulted in a doji candlestick. The appearance of this candle indicates the lack of decisiveness on the market. Neither the bulls nor the bears show an advantage now. (…) if it appears on the chart after an upward move (just like in the current situation), there is a high probability that we will see a correction or a trend reversal in the very near future.

From today’s point of view, we see that the situation developed in line with our assumptions and crude oil turned to the south during yesterday’s session. Thanks to this downswing, the commodity dropped under the previously-broken neck line of the reverse head and shoulders formation and closed the day below it, invalidating the earlier breakout.

This is a bearish development, which suggests further deterioration in the following days. Nevertheless, looking at yesterday’s volume, we do not see its significant increase (in fact, yesterday's downswing materialized on an even lower volume than Tuesday's increase), which doesn’t confirm that oil bears are determined enough to trigger a sizable move to the downside at the moment.

In our opinion, their attack will be more likely and reliable if the sellers break below the red zone and the previously-broken upper line of the black triangle and invalidate these breakouts.

An additional support they could also receive from the daily indicators, which are quite close to generating sale signals (maybe even later in the day).

Taking all the above into account, we believe that the right time to open short positions is just around the corner. However, in our opinion, it's worth to be patient for a moment and wait for additional confirmations. As always, we will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts