Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.11 and the initial downside target at $62.85 are justified from the risk/reward perspective.

Yesterday’s session brought another fresh peak, but despite this positive development, it's hard for us to be optimists who see further increases. What technical factors can thwart pro-bullish plans in the coming days?

Technical Analysis of Crude Oil

Let's examine the charts below (charts courtesy of http://stockcharts.com).

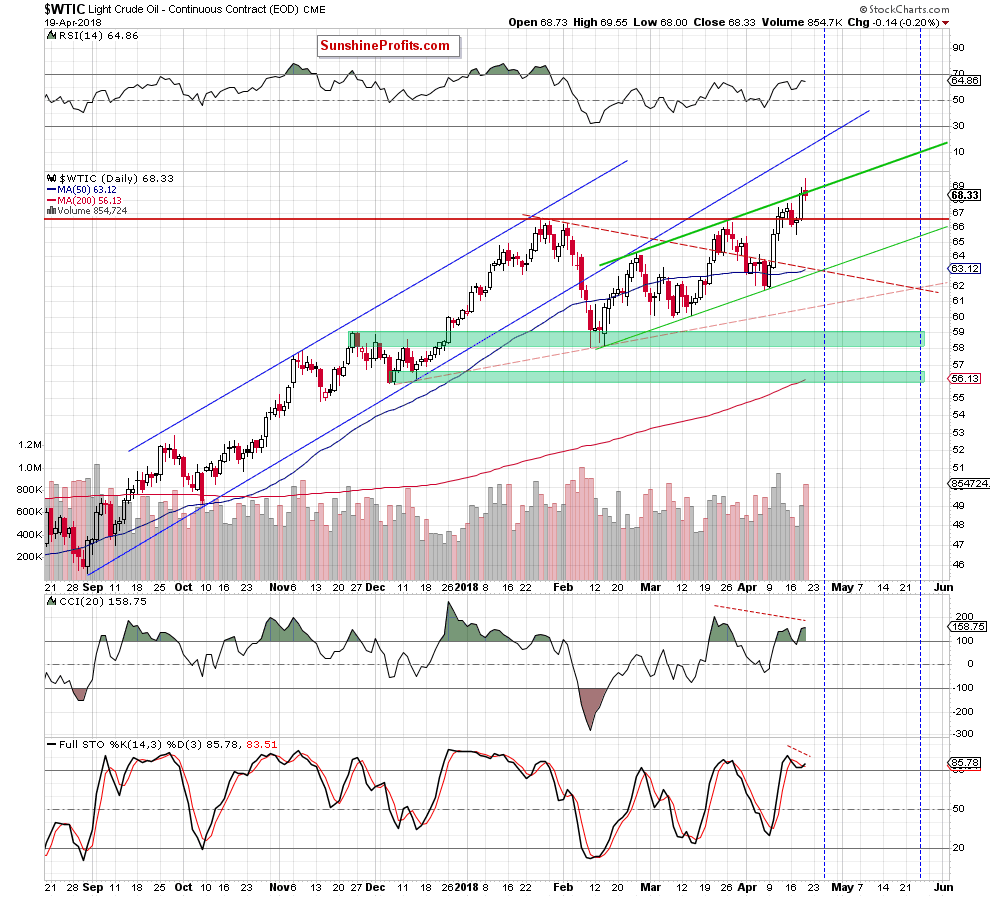

Looking at the daily chart, we see that although oil bulls pushed black gold to another fresh 2018 high, they showed weakness during the day and let their opponents to take the commodity below the previously-broken upper border of the green rising trend channel. In this way, crude oil invalidated yesterday’s small breakout and closed another session below this line, which is a bearish development.

Additionally, Thursday’s move materialized on visibly higher volume, which suggests that oil bears got stronger and will not give up this zone without a fight. When we take a closer look at the current position of the daily indicators, we can see bearish divergences not only in the CCI, but also in the Stochastic Oscillator, which increases the probability of further deterioration in the coming days.

On top of that, the pro-bearish scenario is also reinforced by the current situation in the WTIC:UDN ratio about which we wrote in our last Oil Trading Alert:

Crude Oil from Non-USD Perspective

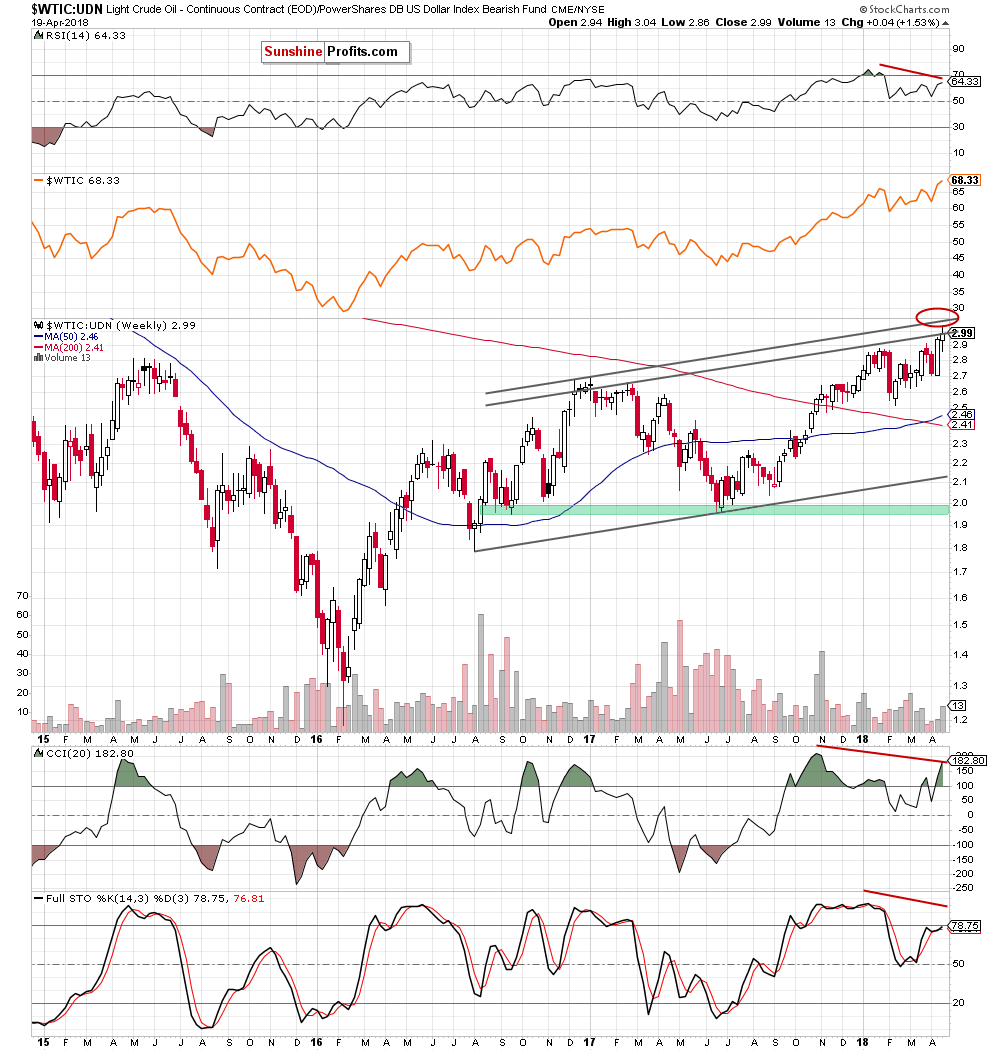

On top of that, the picture, which emerges from the non-USD (WTIC:UDN ratio) chart of crude oil also doesn’t bode well for oil bulls and higher prices. As a reminder, please note that UDN is the symbol for the PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies".

(…) the ratio extended gains and climbed to the strong resistance area created by the upper borders of the black rising trend channel (based on an intraweek highs and closing prices), which suggests that the space for gains may be limited and reversal is just around the corner.

Additionally, these are clearly visible negative divergences between the ratio and the indicators, which increases the probability of a downswing in a very near future.

Taking all the above into account, we can summarize today’s alert in the same way as we did yesterday:

Summing up, although crude oil hit a fresh 2018 peak, the commodity closed the day inside the green rising trend channel, which suggests that as long as there is no confirmed breakout above the upper line of the formation another attempt to move lower is likely – especially when we factor in the current situation in the non-USD chart of crude oil.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $70.11 and the initial downside target at $62.85) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts