Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective.

On Tuesday, crude oil gained 0.23% and oil bulls managed to close the day above the very short-term declining resistance line. Positive development? Only the first sight. Why? All details you will find in today’s alert.

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

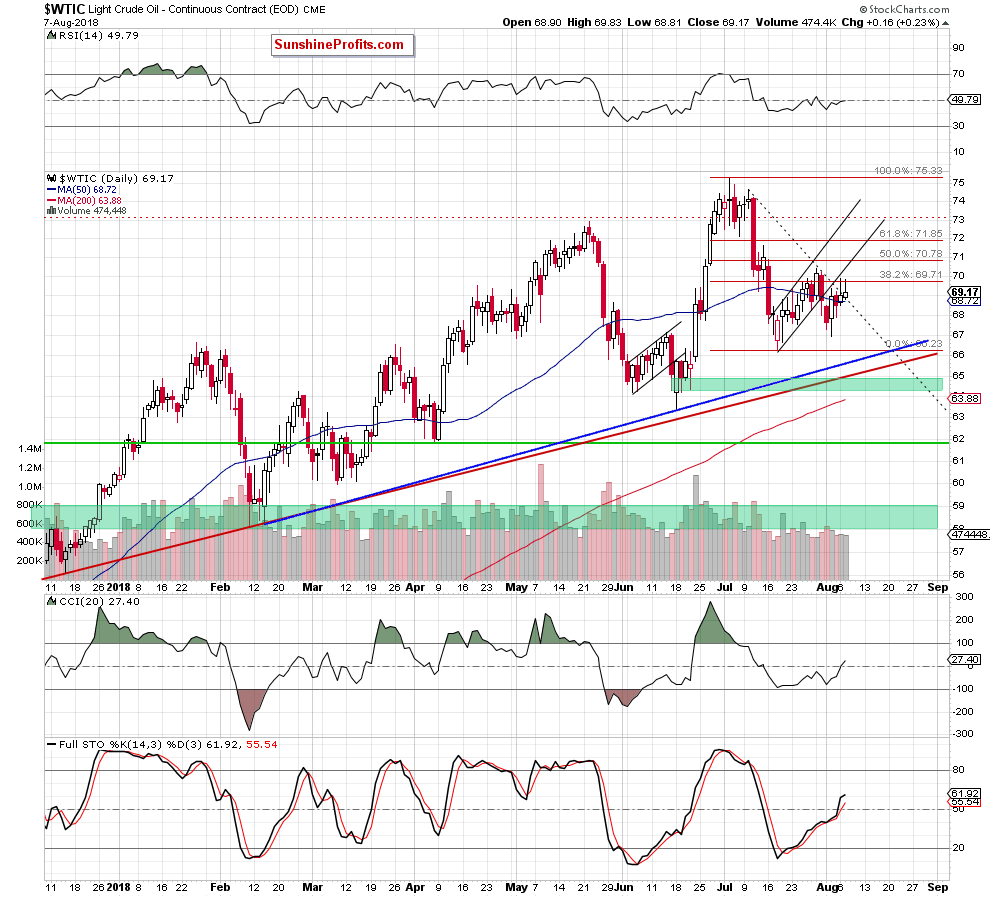

The first thing that catches the eye on the daily chart is the above-mentioned breakout above the black dotted resistance line based on recent peaks.

Although this is a positive event, we should keep in mind that oil bulls didn’t manage to overcome the 38.2% Fibonacci retracement for the second time in a row. As you see, their opponents have activated their forces in this area, which triggered a pullback and resulted in a daily closure under this resistance level.

At this point, it is also worth noting that despite the fact that oil bulls pushed the price of light crude higher yesterday, they didn’t even reach the previously-broken lower border of the very short-term black rising trend channel, which suggests that the buyers’ strength could be exhausted, and we will see a return to the south in the very near future.

On top of that, the long- and the medium-term picture of the commodity continues to support the sellers and lower prices of black gold in the coming days or even weeks (more about this issue you could read in our Oil Trading Alert posted on Monday).

Additionally, the picture that emerges after analyzing the relationship between crude oil and precious metals also favors oil bears (if you haven’t had the chance to read about this link in our yesterday’s alert, we encourage you to do so today - it’s up-to-date).

Connecting the dots, we believe that as long as there is no successful breakout above the 38.2% retracement and a comeback to the very short-term black rising trend channel, higher prices of crude oil are doubtful and anther reversal should not surprise us.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish (an invalidation of the earlier breakouts above the long-term resistances, a verification of the breakdown under the lower line of the very short-term rising trend channel and the 38.2% Fibonacci retracement),favoring the sellers and lower prices of crude oil in the coming week(s).

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $73.10 and the initial downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts