Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

It looks like just another daily reversal from the lows. It seems to turn the tide in favor of the bulls. But the week is still in progress. We invite you to take a look at our observations – and their implications.

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

The week until now has been an eventful one – Monday's attempt to move lower was erased before Tuesday was over. Today is not an exception – the shallow attempts at moving lower have been rejected and the black gold currently changes hands at $53.60.

Quoting our most recent take:

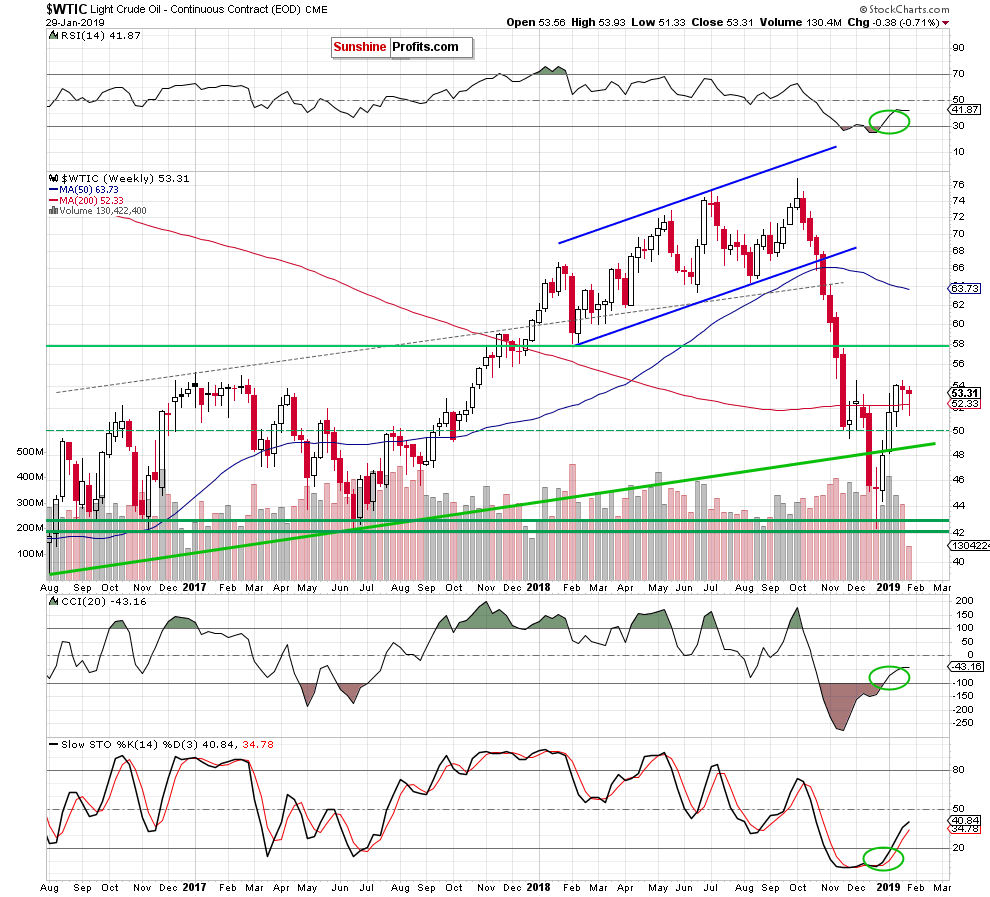

(…) crude oil closed the day under three important levels: the short-term green support line, the lower border of the purple rising trend channel and the 200-week moving average.

(…) Nevertheless, this signal is the least important for us because until we see a weekly close below its level, the situation may still change.

From today’s point of view, we see that crude oil came back above the 200-day moving average on the weekly chart. It looks prudent to wait until the end of the week to let the technical picture clarify itself instead of acting in haste and under uncertain circumstances.

Does this mean that we can treat yesterday's price action as invalidation of the earlier breakdown? Let's examine the weekly chart again to see how it tunes out the daily noise.

Yesterday, we also wrote:

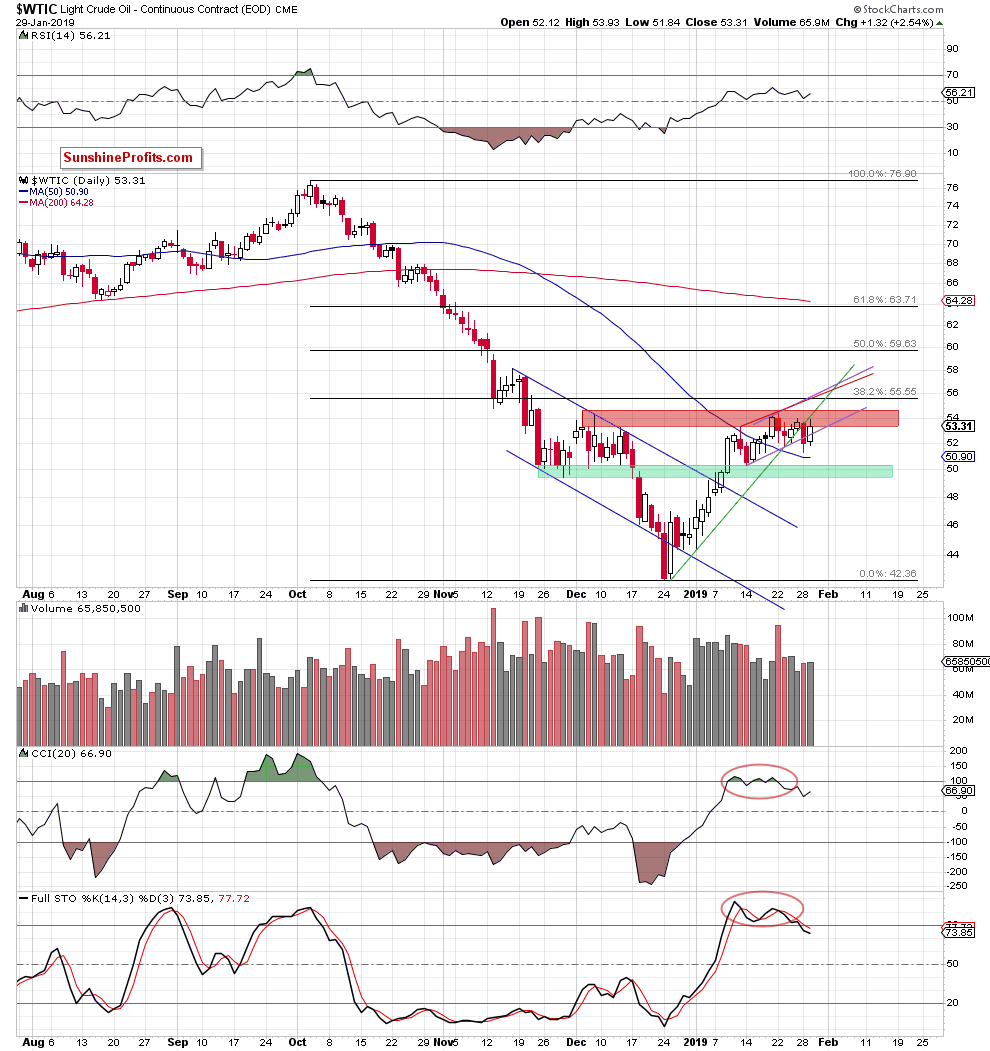

(…) However, Monday’s rebound before session closure (which created the lower shadow of yesterday’s candlestick) suggests that the bears didn’t win the whole day and a verification of yesterday’s breakdown should not surprise us before we see another move into the downside.

Yesterday, crude oil rebounded and closed the day above the lower border of the purple rising trend channel. This invalidation of the earlier breakdown happened on approximately the same volume as the preceding breakdown. When in doubt, stay out was a sentence we used in the Monday's alert - and it remains applicable today, too.

Therefore, close attention is warranted. Despite the purple channel breakdown invalidation, the price of the commodity is still trading under the red resistance zone and the previously broken green trend line. The direction of the next very short-term move remains uncertain.

We’ll wait on the sidelines for the result of Wednesday session before we make any decisions about opening next positions. We will keep you up to date with developments.

Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager