Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Yesterday we had a question mark over the resumption of bullish momentum. Thereafter, crude oil dipped below $52.00 and looks to be somewhat recovering now. Does the market action translate into a call to action on our part?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

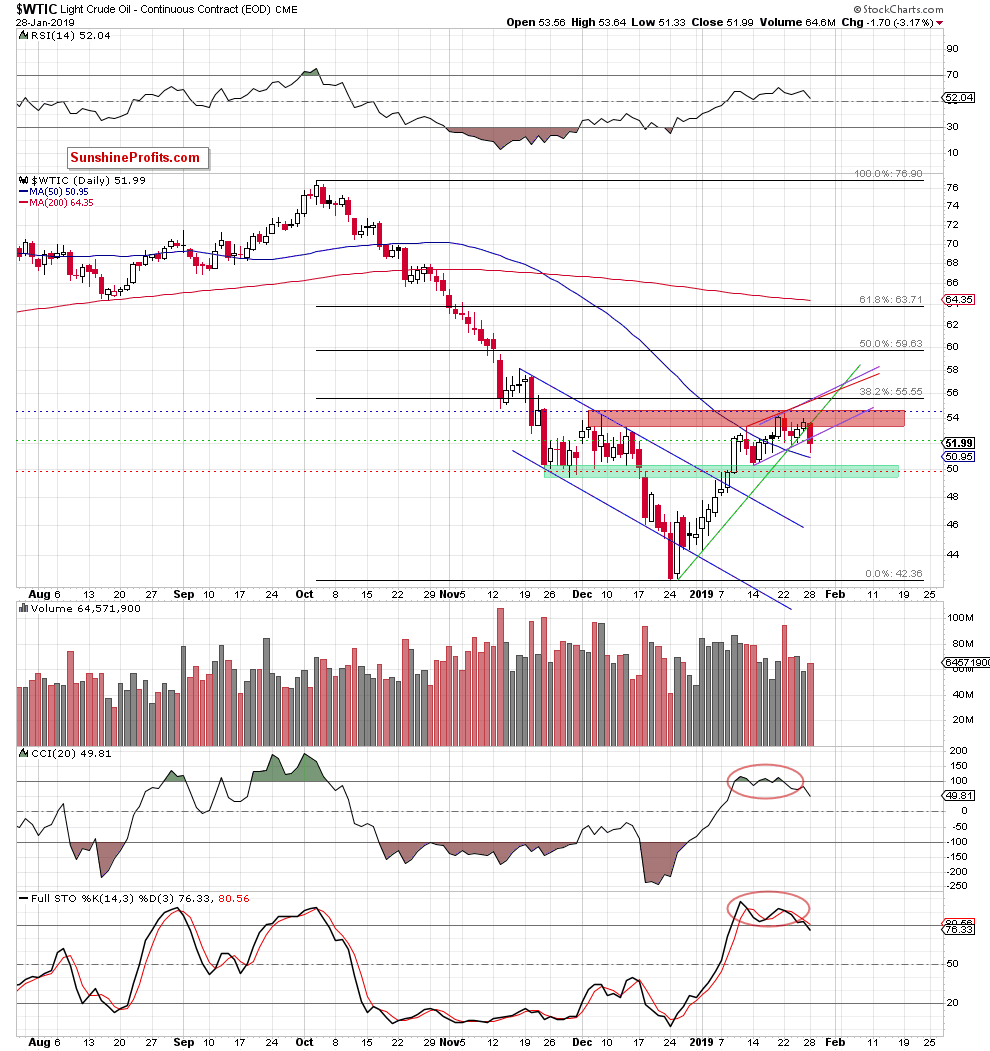

Starting with the daily, crude oil closed yesterday below two important levels: the short-term green support line and the lower border of the purple rising trend channel. The volume on the decline was greater than the volume on the upswing, which has bearish implications. The red resistance zone proved to be a tough nut to crack for the buyers this time and the breakdown has a high likelihood of getting confirmed by successive closures below the green support line in the coming days. Indicators' position deteriorated as CCI shows decreasing trend strength and Stochastics' overbought position is slowly but surely crumbling – we are on the lookout for a strong sell signal emerging under more favourable price conditions.

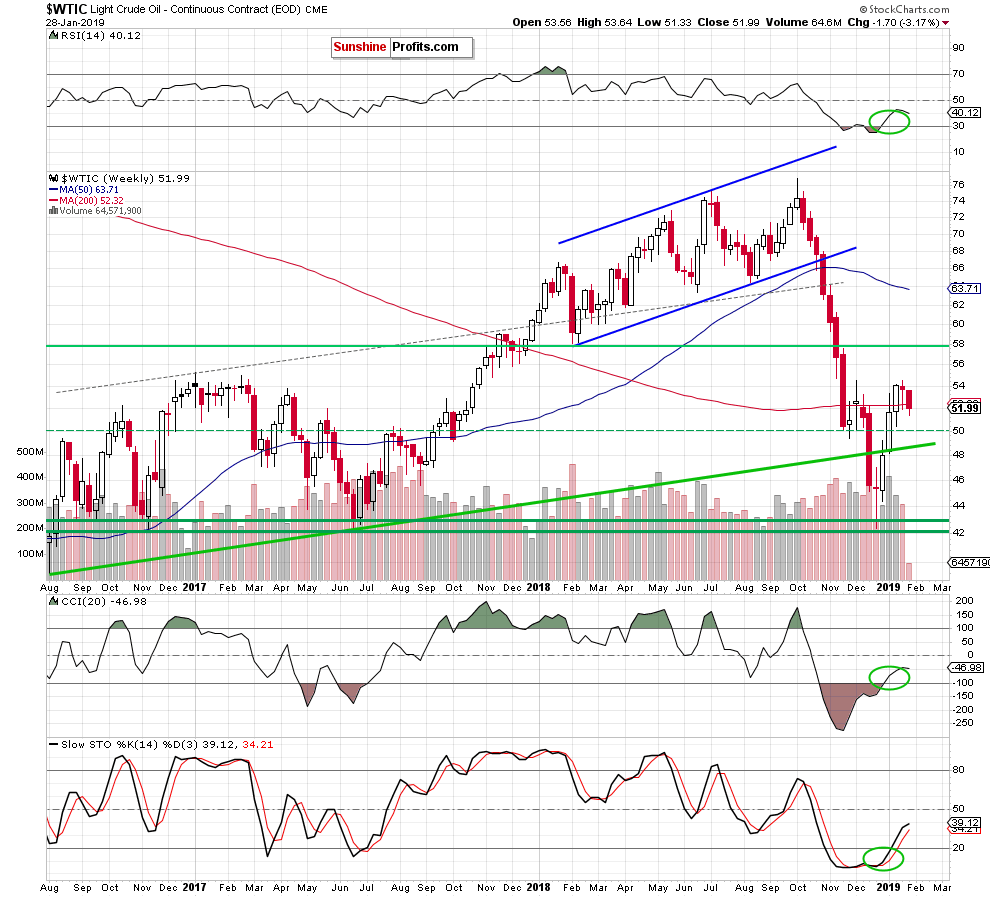

Additionally, the 200-week moving average was broken yesterday as the higher timeframe below shows. All in all, it was prudent that we closed our long position before this deterioration and ringed the bell with a decent profit. As they say, offense wins matches but defence wins championships. Oh, so true.

Nevertheless, this 200-week moving average signal is the least important for us currently because until we see a weekly close below its level, the situation is still subject to change. At the moment of writing these words, crude oil is meandering slightly above it at around $52.50.

Remember that yesterday’s downswing materialized on bigger volume than Friday’s increase. The sell signals remain in the cards.

In our last alert, we wrote:

(….) If we see any reliable signs of the bulls’ or the bears’ strength (for example, a (…) daily closure under the lower border of the purple rising trend channel) we’ll consider opening next position.

However, Monday’s rebound before session closure (which created the lower shadow of yesterday’s candlestick) suggests that the bears didn’t win the whole day and a verification of yesterday’s breakdown should not surprise us before we see another move into the downside. That could present us with a clearer take on the indicators' position and a possible entry point.

Therefore, we’ll wait at the sidelines for the result of today's session. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager