Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

While it doesn’t look extreme at the first sight, yesterday’s session was something that we haven’t seen in almost 2 months. Namely, it was the first time since late March 2018 when we saw the black gold decline for two days in a row. It’s also declining in today’s pre-market trading. Have we just seen the May top in crude oil?

In short, it’s quite possible as another development added to the credibility of bears’ favorite outlook, but the situation still seems to be too unclear to risk opening short positions.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com).

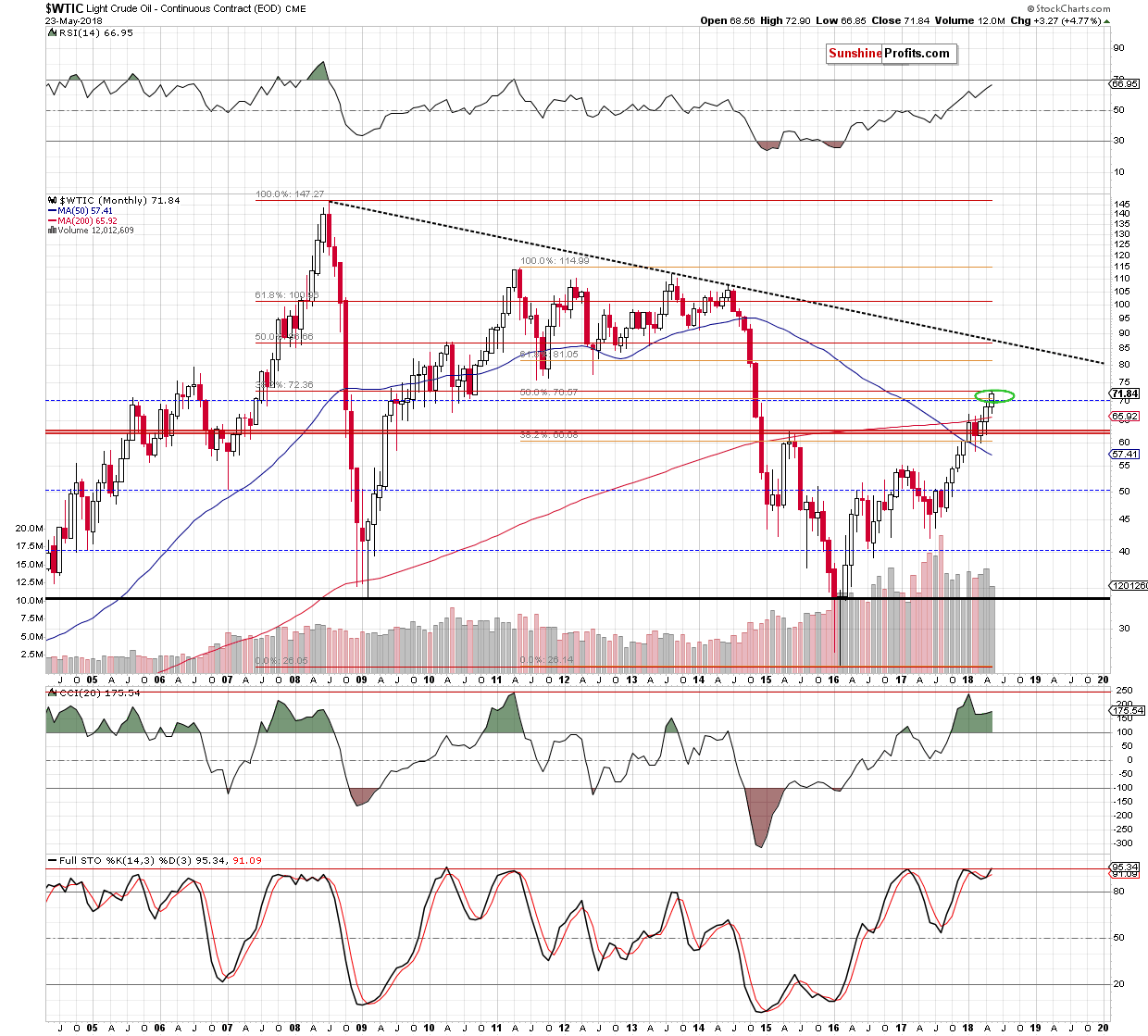

Looking at the above chart, we see that the overall situation in the long term remains unchanged, which means that what we wrote previously is up-to-date:

(…) crude oil extended gains and climbed to the upper border of the major resistance zone created by the 50% Fibonacci retracement based on the 2011-2016 downward move and the 38.2% Fibonacci retracement based on the entire 2008-2016 decline (we marked it with the green ellipse on the long-term chart below).

As you see, this area continues to keep gains in check since the beginning of the month, which significantly increases the probability of reversal – especially when we factor in the short-term picture of black gold.

What do we mean by that? Let’s take a look at the daily chart below.

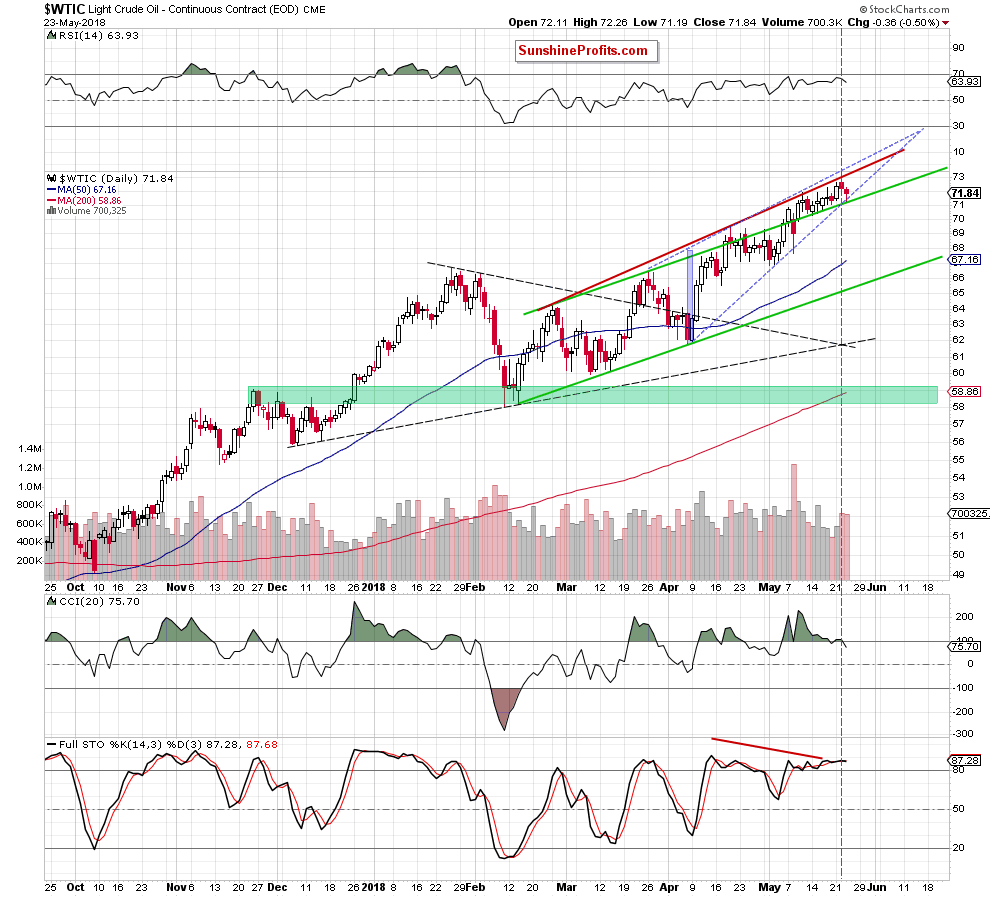

Crude oil is still trading under the upper border of the blue rising wedge and the red rising resistance line based on the previous highs. Without a major breakout above them, the outlook will not improve significantly.

On the other, without a breakdown below the lower border of the blue rising wedge and the upper border of the green channel, the outlook will not deteriorate significantly.

We saw neither during yesterday’s trading and none of them is taking place so far today, so the situation remains tense, but without clear direction in the short term.

The volume that accompanied yesterday’s and Tuesday’s downswings was quite significant, which adds credibility to the bearish scenario and the same goes for the fact that crude oil moved lower for two subsequent days, but it’s still not enough to justify opening a short position just yet.

The apex-based reversal (we marked the triangle and the reversal date with grey dashed lines) adds to the tension and makes the bearish outlook more likely as it suggests that we have just seen a major reversal and since the most recent move was up, the reversal is a bearish development.

Nevertheless, as we mentioned earlier, as long as we don’t see a breakout/breakdown no positions are justified from the risk/reward perspective. If we see bearish confirmations we’ll likely open another speculative bearish position, but it seems too early to do so today. As always, we will keep you – our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts