Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Fresh 2018 peak, the Fibonacci retracement and one more technical formation. What does the mix of these three ingredients mean for black gold in the coming days?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com).

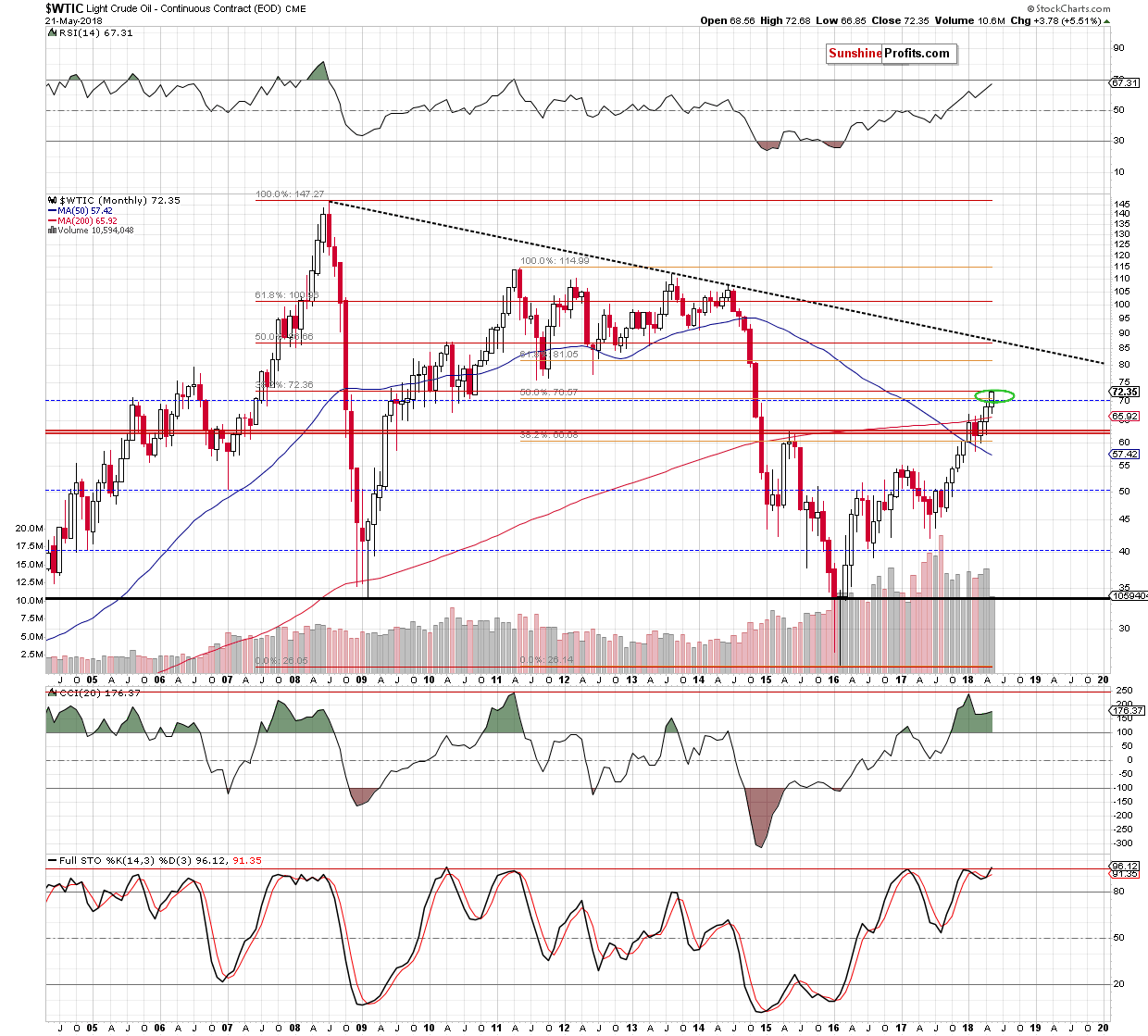

From today’s point of view, we see that crude oil extended gains and climbed to the upper border of the major resistance zone created by the 50% Fibonacci retracement based on the 2011-2016 downward move and the 38.2% Fibonacci retracement based on the entire 2008-2016 decline (we marked it with the green ellipse on the long-term chart below).

As you see, this area continues to keep gains in check since the beginning of the month, which significantly increases the probability of reversal – especially when we factor in the short-term picture of black gold.

Let’s take a look at the daily chart below.

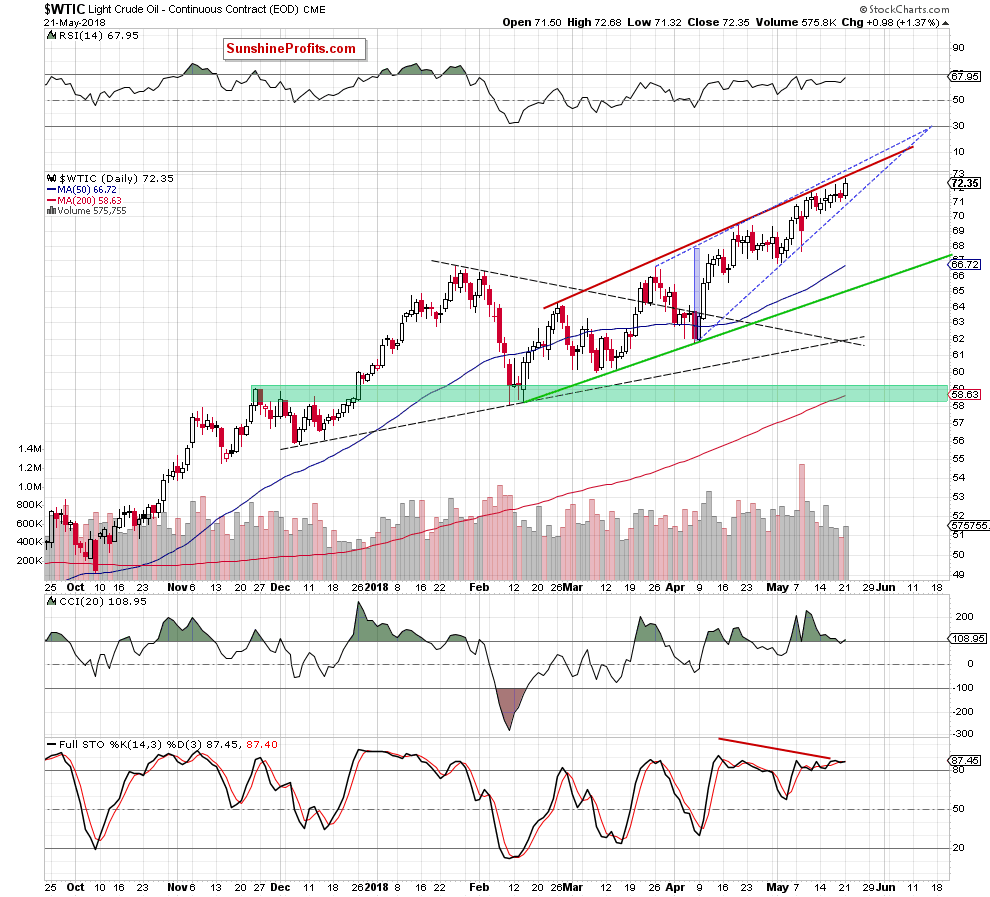

From this perspective, we see that although crude oil moved higher yesterday, the commodity is still trading under the upper border of the blue rising wedge and the red rising resistance line based on the previous highs.

Therefore, despite yesterday’s improvement, we continue to believe that as long as there is no breakout above the upper border of the formation or a breakdown below the line of the wedge, another bigger move is not likely to be seen.

In other words, until this time we will likely not decide to open any positions. Nevertheless, we should keep in mind that the space for moves in both directions decreased significantly, because the lines of the rising wedge approached each other in recent days. This means that the breakthrough is only a matter of time (hopefully a short time).

Summing up, the overall situation in the very short term remains too unclear to justify opening any positions now. However, if we see a breakout above the 38.2% Fibonacci retracement and the upper line of the blue rising wedge, we’ll consider opening long positions. On the other hand, if we see a confirmed breakdown under the lower border of the formation, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts