Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

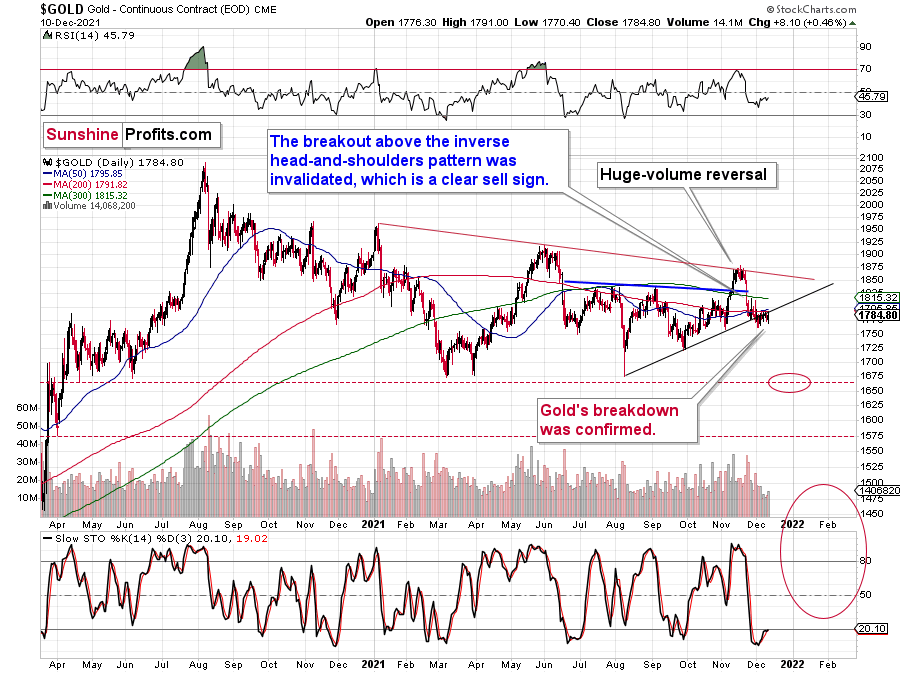

There’s very little that I can add to Friday’s flagship Gold & Silver Trading Alert today, especially since I covered the intraday-moves in Friday’s Intraday Alert. I’d still like to emphasize that gold closed the week below its rising resistance line, which means that the breakdown was clearly verified.

Despite the $8.10 rally on Friday, gold closed below the rising support line, and that’s very bearish.

The consolidation is taking place below the support line, not above it, which greatly increases the odds that the next big short-term move will be to the downside.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Fed’s Time to Shine

While Fed Chairman Jerome Powell had been preaching his “transitory” doctrine for months, the thesis was obliterated once again after the headline Consumer Price Index (CPI) surged by 6.8% year-over-year (YoY) on Dec. 10. Additionally, while the Commodity Producer Price Index (PPI) – which will be released on Dec. 14 – is likely provide a roadmap for inflation’s next move, signs of deceleration are already upon us.

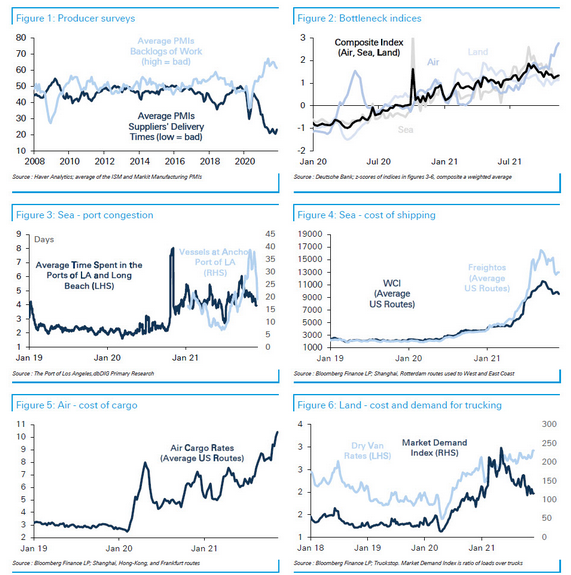

For example, supply bottlenecks, port congestion, and rapidly rising commodity prices helped underwrite inflation’s ascent. However, with those factors now stagnant or reversing, inflationary pressures should decelerate in 2022.

To explain, Deutsche Bank presented several charts that highlight 2021’s inflationary problems. However, whether it’s suppliers’ delivery times, backlogs of work, port congestion, bottleneck indices, or the cost of shipping and trucking, several inflationary indicators (excluding air cargo rates) have already peaked and rolled over.

Please see below:

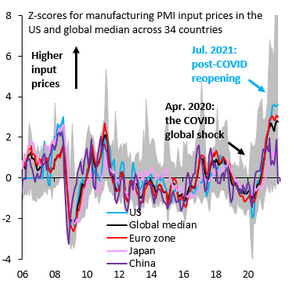

To that point, global manufacturing PMIs also signal a deceleration in input price pressures. With input prices leading output prices (like the headline CPI), the latter will likely showcase a similar slowdown if the former’s downtrend holds.

Please see below:

To explain, the colored lines above track the z-scores for prices paid within global manufacturing PMI reports. In a nutshell: regions were experiencing input inflation that was ~2 and ~4 standard deviations above their historical averages. However, if you analyze the right side of the chart, you can see that all of them have consolidated or come down (the U.S. is in light blue). As a result, it’s another sign that peak input inflation could elicit peak output inflation.

As mentioned, though, the commodity PPI is the most important indicator and if the data comes in hot on Dec. 14, all bets are off. However, the monthly weakness should be present since the S&P Goldman Sachs Commodity Index (S&P GSCI) declined by 11.2% in November.

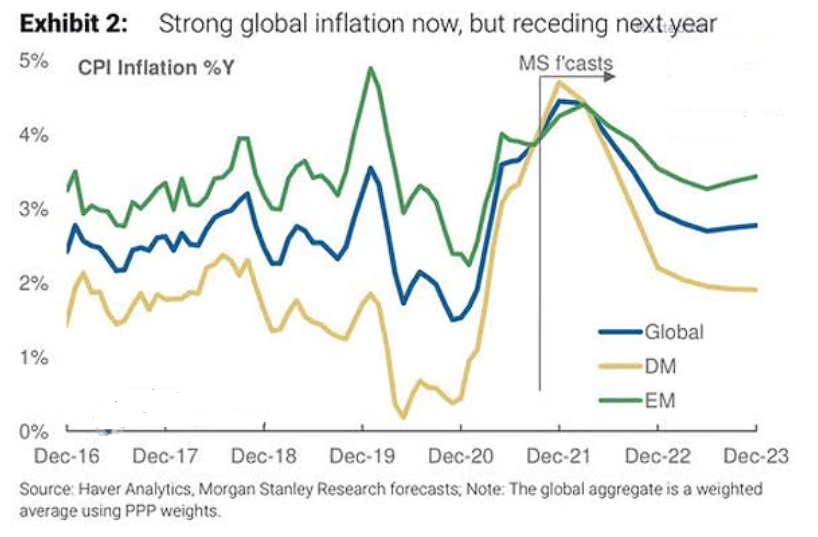

Also noteworthy, Morgan Stanley’s Chief U.S. Economist, Ellen Zentner, also sees signs of a deceleration. She wrote:

“We are seeing nascent signs that pipeline inflation pressures are easing – based on evidence from company earnings transcripts, ISM comments, Korea trade data, China's inflation data, the Fed's Beige Book, a department huddle with our equity analysts, and our own survey.”

To explain, the green, gold, and blue lines above track Morgan Stanley’s core inflation estimates for emerging markets, developed markets, and global markets. If the predictions prove prescient, the 2022 inflation narrative could look a lot different than in 2021.

However, please remember that inflation doesn’t abate without direct action from the Fed, and with a hawkish Fed known to upend the PMs (at least in the short- or medium run), the fundamental environment has turned against them. For example, when the Fed turns hawkish, commodities retreat, and with U.S. President Joe Biden showcasing heightened anxiety over inflation, more of the same should materialize over the medium term.

To explain, Morgan Stanley initially projected no rate hikes in 2022. Now, Zentner expects “2 hikes in 2022, followed by 3 hikes plus a halt in reinvestments in 2023.”

She wrote:

“Before investors close out the year, we need to get past the FOMC's final meeting next week, and it comes with every opportunity for surprise. On Wednesday, we expect the Fed to move to a hawkish stance by announcing that it is doubling the pace of taper, highlighting continued inflation risks and no longer labeling high inflation as transitory, and showing a hawkish shift in the dot plot. We think this shift will shake out in a 2-hike median in 2022, followed by 3.5 hikes in 2023 and 3 hikes in 2024.”

Furthermore, upping the hawkish ante, Goldman Sachs initially projected no rate hikes in 2022. Then, the team moved to three rate hikes in 2022 (June, September, and December 2022). Now, Goldman Sachs expects the FOMC to hike rates in May, July, and November 2022 – with another four hikes per year in 2023 and 2024.

“The FOMC is very likely to double the pace of tapering to $30bn per month at its December meeting next week, putting it on track to announce the last two tapers at the January FOMC meeting and to implement the last taper in March,” wrote Chief Economist Jan Hatzius.

“We expect the Summary of Economic Projections to show somewhat higher inflation and lower unemployment. Our best guess is that the dots will show 2 hikes in 2022, 3 in 2023, and 4 in 2024, for a total of 9 (vs. 0.5 / 3 / 3 and a total of 6.5 in September). We think the leadership will prefer to show only 2 hikes in 2022 for now to avoid making a more dramatic change in one step, especially at a meeting when the FOMC is already doubling the taper pace. But if Powell is comfortable showing 3 hikes next year, then we would expect others to join him in a decisive shift in the dots in that direction.”

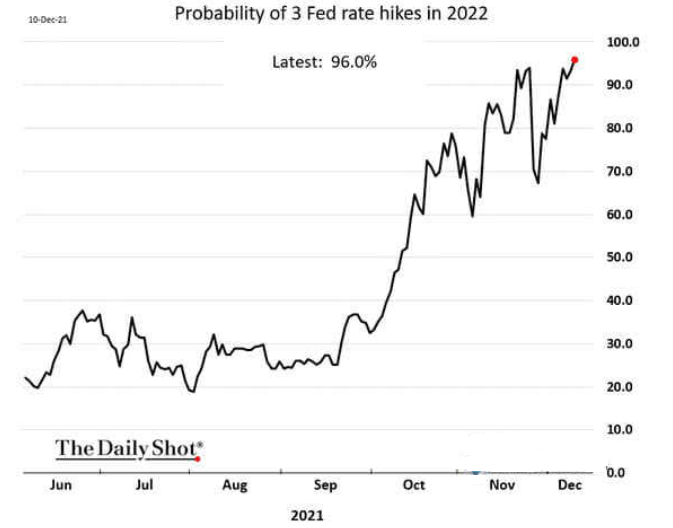

Speaking of three hikes, the market-implied probability of three FOMC rate hikes in 2022 has risen to 96%.

Please see below:

For context, I’ve been warning for months that surging inflation would force the Fed’s hand. I wrote on Oct. 26:

Originally, the Fed forecasted that it wouldn’t have to taper its asset purchases until well into 2022. However, surging inflation pulled that forecast forward. Now, the Fed forecasts that it won’t have to raise interest rates until well into 2023. However, surging inflation will likely pull that forecast forward as well.

More importantly, though, while the PMs have remained upbeat in recent weeks, the forthcoming liquidity drain will likely shift the narrative over the medium term.

The bottom line? While inflation shows signs of peaking, there is a vast difference between peak inflation and the Fed’s 2% annual target. As a result, even if a 6.8% YoY headline CPI was the precipice, it’s nothing to celebrate. Thus, the Fed needs to tighten monetary policy to control inflation, and anything less will likely re-accelerate the cost-push inflationary spiral.

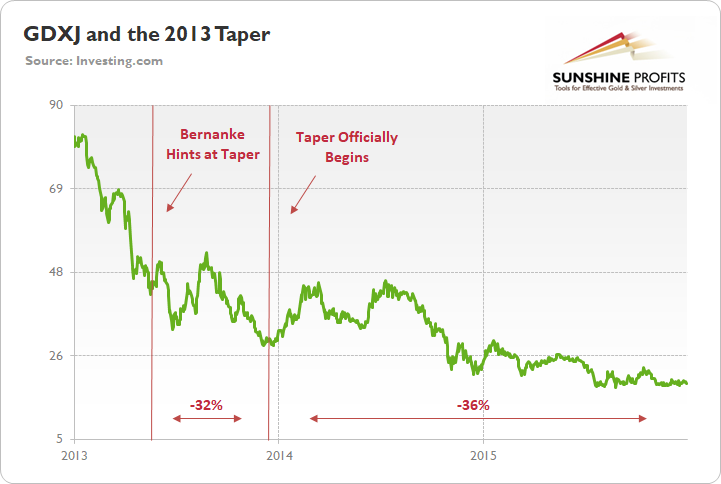

To that point, with the precious metals extremely allergic to a hawkish Fed, I’ve highlighted on numerous occasions how the GDXJ ETF suffered following the 2013 taper. With 2022 Fed policy looking even more hawkish than in mid-2014, the latter’s downtrend should have plenty of room to run.

In conclusion, the PMs were mixed on Nov. 10, and the scorching inflation print was largely ignored by investors. However, with the Fed poised to provide another dose of reality on Dec. 15, the recent volatility should persist. To that point, it’s important to remember that the S&P 500’s volatility increased materially after the Fed tapered in 2013. With stock market drawdowns bullish for the USD Index and bearish for the PMs, there are plenty of technical, fundamental, and sentiment factors brewing that favor the theme of ‘USD Index up, PMs down’ over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the current corrective upswing in gold is about to be over soon, and the next short-term move lower is about to begin. Since it appears to be another short-term move more than a continuation of the bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

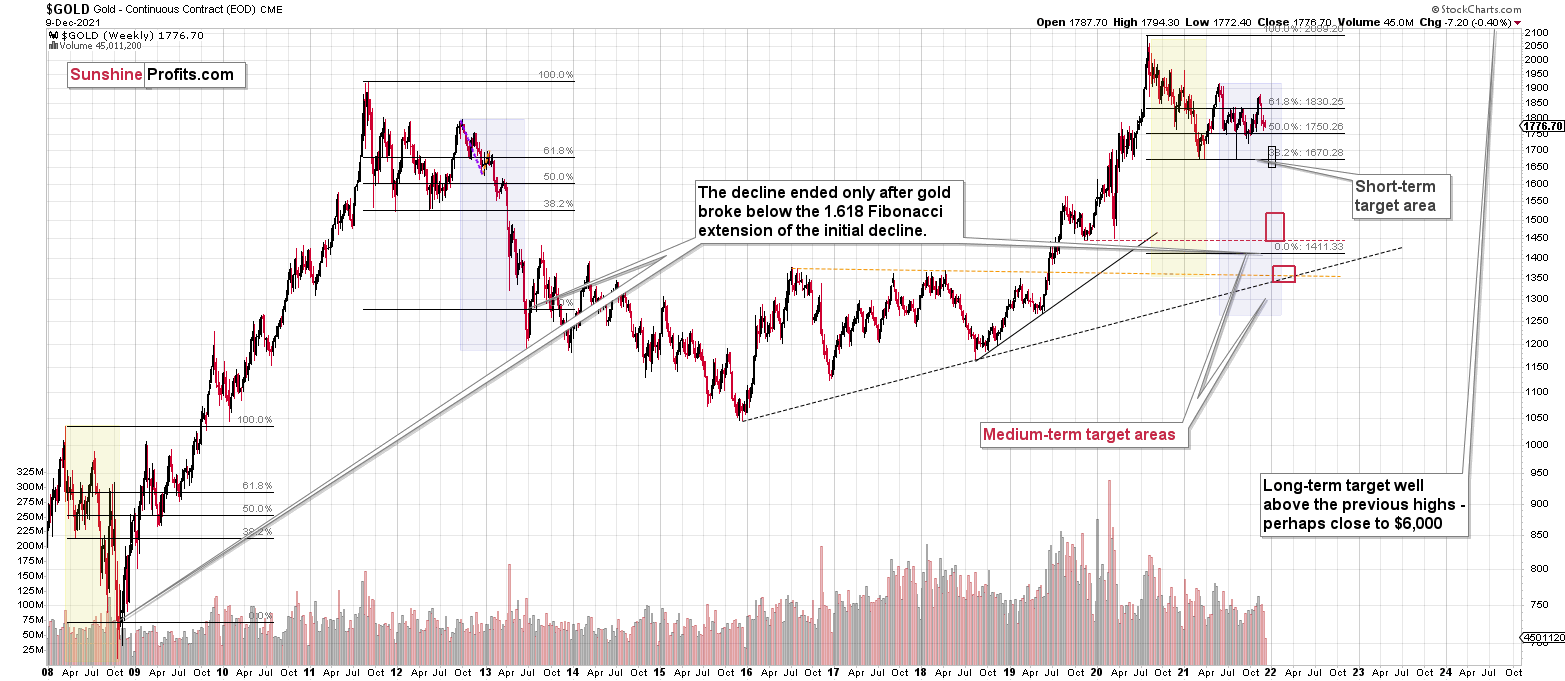

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty. I expect the final bottom to take place near the end of the year, perhaps in mid-December. It is not set in stone that PMs have to bottom at that time. If not then, then early 2022 would become a likely time target.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops. The additional confirmation will come from the tapering schedule, as markets are likely to move on the rumor and reverse on the fact as they tend to do in general.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: Greetings, PR! Well done and a great call on gold’s most recent short-term decline. My question is: will all this war talk in the news in recent days – i.e., will Russia go into Ukraine – change your medium-term outlook for gold? Also, with China talking about taking Taiwan as well. Any thoughts? Keep up the FANTASTIC analyses!

A: Thank you for the positive feedback, I greatly appreciate it.

If Russia invades Ukraine, I expect gold to rally in the short term and then to move back down in the medium term. Based on rumors, not facts, I would expect the majority of the upswing to happen before the actual invasion,. I don’t think that the above is likely to happen, though.

If there are already “talks” about Russia going into Ukraine and China taking over Taiwan, and gold is not soaring despite those talks, the implications for gold are actually bearish, as it “should be” moving higher on those rumors in indications. Instead, gold has been trading back and forth below its rising support/resistance line. This shows that the precious metals market is currently weak, not strong.

Q: Thanks for the great analysis. I would appreciate it if you could mention invalidation area to manage the risk. For instance, gold shorts – it could be closing prices above a certain level, say 1920. In such a case, the bearish case could be scrapped. It will help us manage the risk.

A: I don’t have an invalidation area or stop-loss for the current trade. I understand the benefits of providing such levels in many trades, but I’m primarily looking at dynamics of price move relative to each other (gold vs. silver vs. USDX vs. miners), and for the gold price itself (without any other detail). To invalidate the bearish outlook, it would need to move so significantly high (say to $2,151) that having a stop-loss level there would be useless. Of course, I would be likely to close the trade well before gold reached $2,151 if it rallied at all, that is. However, that would likely be based on mining stocks outperforming gold, while gold itself would be reacting strongly to the USD’s weakness. Right now, we have the opposite, by the way.

Q: What is the probability there will be a relief rally at the Dec 14/15 Fed meeting? Today, on the economic inflation data, gold rallied pretty significantly from the early market premarket value and declined, but reversed some and still finished up. Today, I would have thought gold would have declined with the high inflation numbers and the equity markets advance and S&P set a new high. Is gold already starting to move on the inflation number? The market has already priced in accelerated tapering. 10yrTB yield seems too careless and the USD basically did nothing and even declined again.

A: If gold declines right before the Fed meeting (before the results are announced), then a relief rally would be quite likely (say 60%-70%), but if gold does nothing beforehand, and just continues to trade sideways below the rising resistance line, it would be more likely to decline on any piece of news than to rally on it. In this case, I would see the chances of a relief rally at about 30% or less.

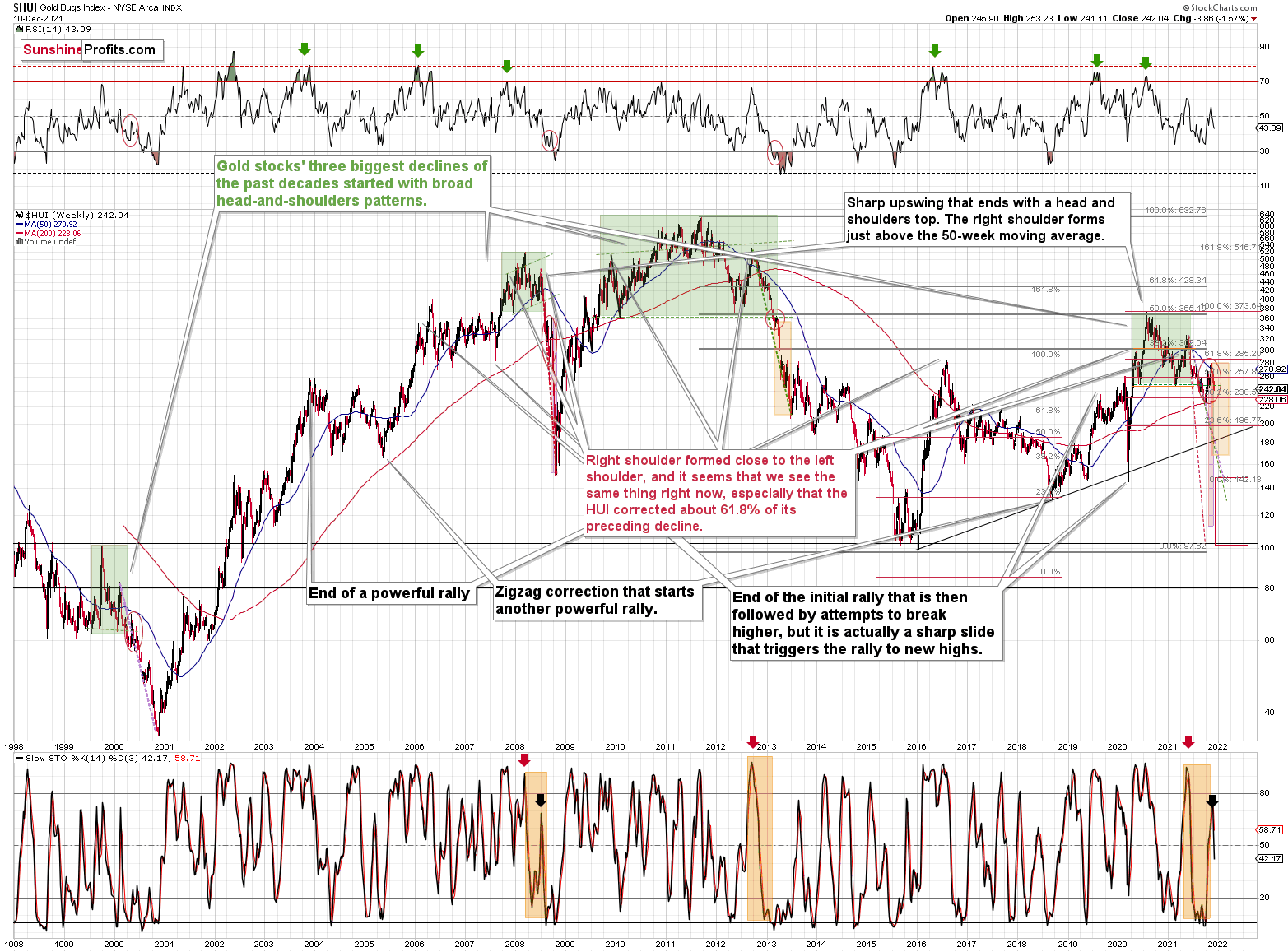

Q: Could you explain how, using HUI, the 2016 slide, the Fib retracements and use that to show and map the degree in which the HUI could potentially sink… this time?

Very best.

A: Sure.

After the 2016 top, the HUI Index kept declining until it corrected the 76.4% Fibonacci retracement (it’s visible on the chart as 23.6% as Stockcharts doesn’t provide a symmetrical price level to the above, but 100% - 23.6% = 76.4%). It’s one of the less famous Fib levels, but sometimes it also stops price moves. That’s what happened in 2018 and the HUI Index rallied.

If the HUI Index declined to its 23.6% Fibonacci retracement based on its recent sharp upswing (the 2020 one), then it would move slightly below the 200 level.

While this might be one of the targets that stops the decline, it doesn’t seem to me that this would be the final bottom for the current decline.

Please note that after the 2016 top, there was no major decline in the prices of the major stock indices, and we might see one in the not-too-distant future. Also, back then, the USD Index didn’t soar throughout the HUI’s bottoming process in 2016-2018. Consequently, to me, the current situation seems more similar to what happened in 2020, 2013, and 2008. Therefore, it seems to me that the HUI Index might bottom lower than at the above-mentioned 200 level.

Summary

Summing up, gold declined in tune with my long-term-based indications, and the medium-term downtrend appears to have resumed. Based on the analogy to 2013 and other factors, a bigger decline in gold appears to be just around the corner (regardless of what happens in the very near term).

If the new Covid-19 variant makes the vaccine rather useless, we might be in for very wild price moves in most markets. In the case of the precious metals sector, the initial move should be to the downside, but at the same time, it makes the long-term outlook even more bullish.

It seems that we might see a short-term bottom close to the middle of December, and perhaps that’s when gold will move to its previous 2021 lows. However, I don’t think that it would be the final bottom. Conversely, it seems that the final bottom would form lower after a short-term correction (from the above-mentioned December lows).

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief