Briefly: in our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

In the previous alerts, we wrote that the precious metals market was likely to reverse on Wednesday and Thursday based on the triangle apex turning points and thus a rally was possible. The possible upside target area was between $1,303 and $1,309. Gold just topped at $1,306 – right in the middle of the above estimate. Was this really the final top? Mining stocks showed great strength indicating bigger rallies on the horizon. Will we see them shortly? Context is king in any market situation, so in order to answer this question, we’ll have to consider it first.

The answer is: probably not. In yesterday’s alert, we described the current situation in the PM sector as crazy, and we explained that the signals shouldn’t necessarily be trusted:

As we had pointed out previously, yesterday was one of this week’s apex-based reversals and weird things often happen right at the tops. Tops are formed when emotions reach zenith, and this is when what should make sense, no longer does. In most cases, we see silver’s daily outperformance, but at times the emotional reaction of market participants could take a different form. This simply might have been the case yesterday.

If it wasn’t for the two apex-based reversals, the interpretation of mining stocks strong daily performance would have been bullish, but in light of the former, it really isn’t.

The above is also the filter through which we’ll interpret what happened yesterday.

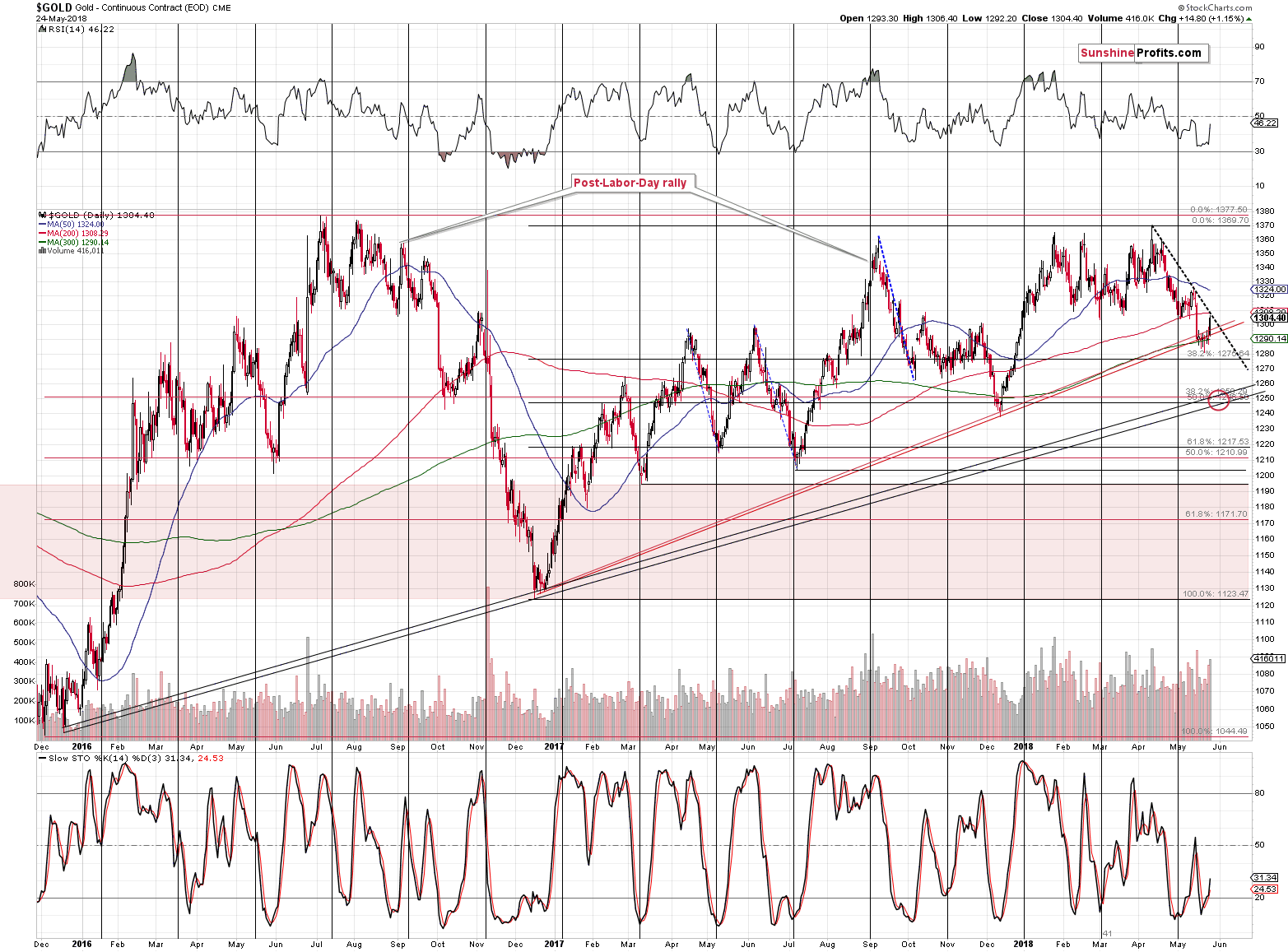

Gold at the Target

Gold rallied on volume that was the strongest (taking daily upswings into account) since the first half of April. This may seem bullish, but please note that back then the big-volume session marked the final top that preceded an almost $100 downswing. The strength of the resistance that was reached back then was bigger as it was based on more and more long-term tops, but the current resistance line is not weak either. Therefore, we may have just seen the final top this time as well. After all, the history tends to repeat itself to a certain extent.

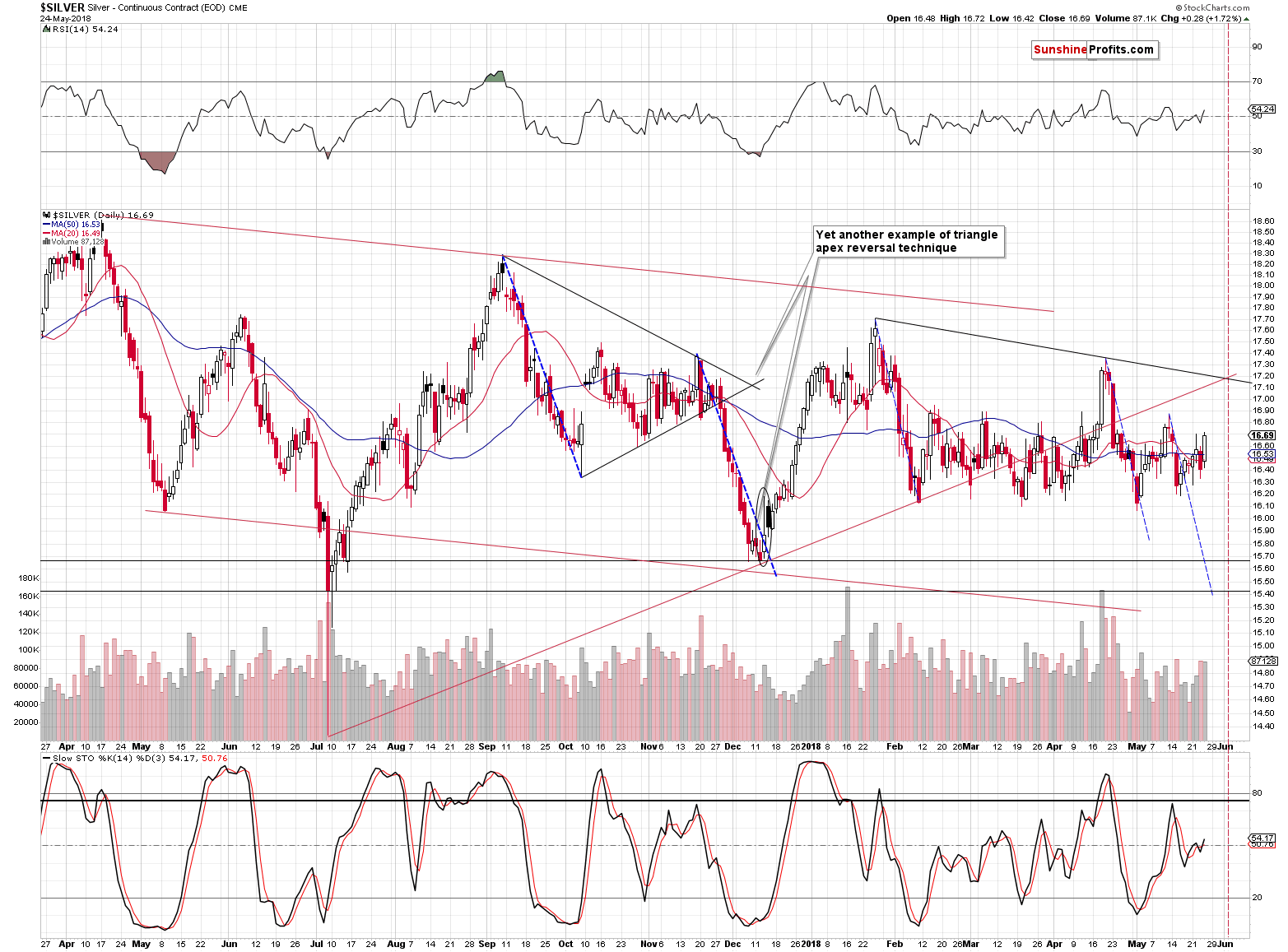

Silver’s Topping Pattern

In yesterday’s alert, we wrote the following:

Silver declined after having outperformed gold for a few days, which usually means that the top is already in. The rising volume during the decline confirmed the bearish implications of the recent performance of the white metal.

(…)

Before moving to mining stocks, we would like to point out the fact that there is a medium-term apex-based reversal close to the end of the month, so if the decline starts shortly (today or tomorrow), then we can expect to see another turnaround in a week’s time.

The rally still seems to have really ended earlier this week and yesterday’s upswing appears to be somewhat “forced”. All regular topping signals were in place and yet, the rally was prolonged. Why? There is no way to say with a 100% certainty, but it might have been the case that the time was simply not right. The apex-based turning point for gold was yesterday and with gold moving strongly higher, silver practically had to move higher as well. There was also a news-based factor as the meeting between USA and North Korea was cancelled. As a reminder, geopolitical events' impact on the price of gold is likely to be limited.

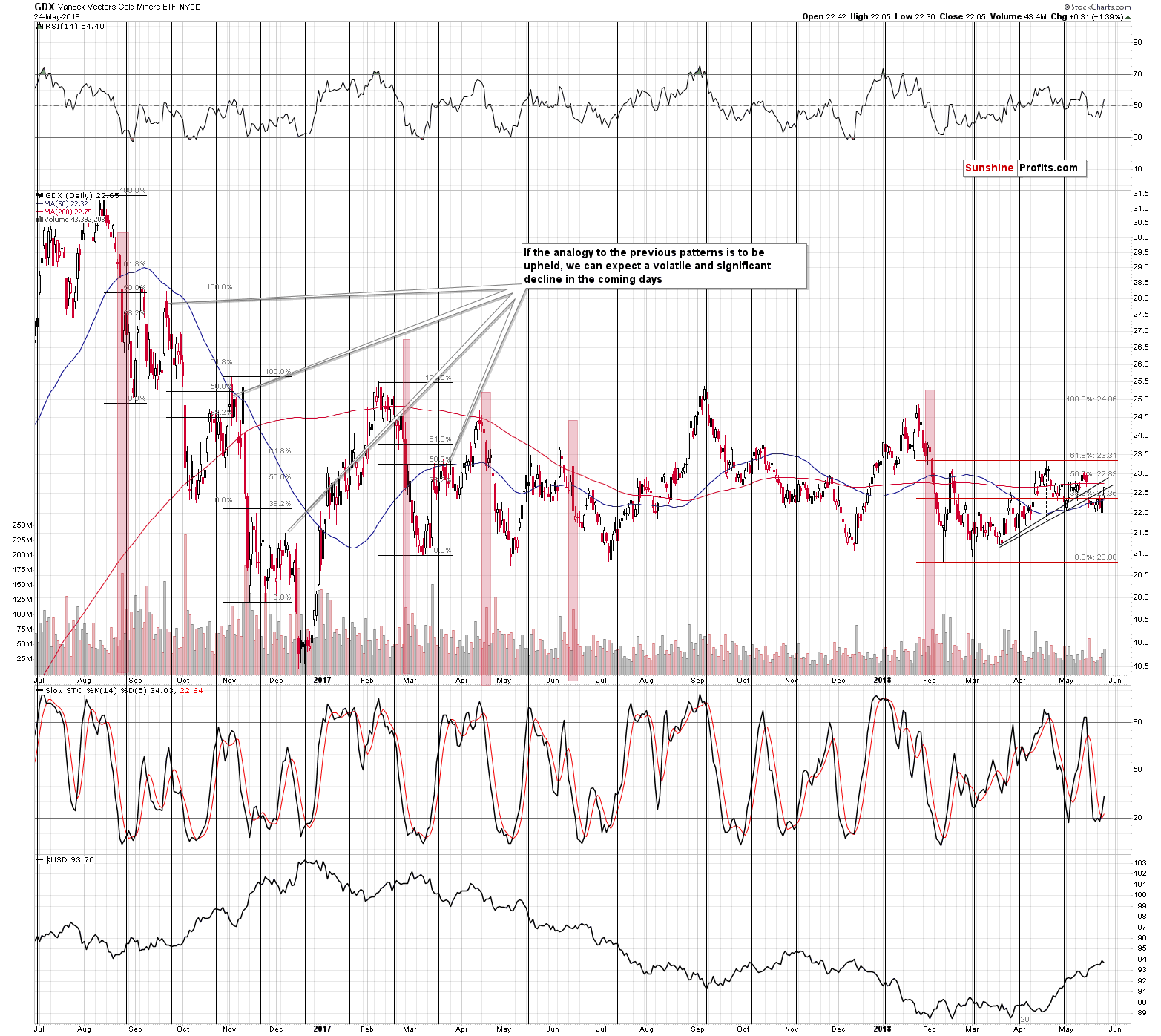

Mining Stocks Bullish Rally

In just two days’ time the very short-term implications of the above chart have turned around from being bearish to bullish. At least at the first sight. Mining stocks moved higher on big and increasing volume. Unlike what had happened on Wednesday, when gold had declined and miners had rallied, yesterday’s upswing in miners took place along with a move higher in gold. So, while Wednesday’s performance had been exceptional, yesterday’s one was simply normal.

If the mining stocks’ performance yesterday was exceptional once again, we would say that something’s up and that the outlook may be becoming bullish, but that wasn’t the case.

Miners’ were not weak, so we don’t have the bearish confirmation on this front, but as we emphasized earlier, we are in the situation, in which odd things could happen because of the apex-based turning points.

The mining stocks moved back above the 38.2% Fibonacci retracement and the rising neck level of the bearish head-and-shoulders pattern based on the intraday lows. They didn’t move back above the neck level based on the daily closing prices, though.

Overall, the outlook in the mining stocks – taken alone and without the context – improved based on yesterday’s session, but the strength of the implications was not as big as it seems at the first sight.

Summary

Summing up, gold’s and silver’s apex-based turning points provide context for the recent strength in the precious metals market and from this perspective, it appears that the implications still remain bearish. The rally was quite possible and new bearish signal (reaching target on big volume in analogy to the previous high) from the gold market seems to cancel out the bullish improvement in mining stocks. Based on the current medium-term trend and the strength of the signals that confirm it, along with the doubtful strength of the possible upswing before the decline, it seems that it’s justified to keep the current speculative short positions intact.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,251; stop-loss: $1,382; initial target price for the DGLD ETN: $48.88; stop-loss for the DGLD ETN $37.48

- Silver: initial target price: $15.73; stop-loss: $18.06; initial target price for the DSLV ETN: $27.58; stop-loss for the DSLV ETN $19.17

- Mining stocks (price levels for the GDX ETF): initial target price: $21.03; stop-loss: $23.54; initial target price for the DUST ETF: $28.88; stop-loss for the DUST ETF $21.16

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $30.62; stop-loss: $36.14

- JDST ETF: initial target price: $59.68 stop-loss: $40.86

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The three most important factors in the gold market are the real interest rates, the U.S. dollar, and the risk aversion. Fair enough. But we need to dig deeper to solve the gold’s puzzle. We invite you to take a second look at the bullion’s fundamental drivers to develop a more sophisticated model of the gold prices.

Three Drivers of Gold, Second Look

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold slips, but safe-haven demand keeps prices above $1,300

Ray Dalio said last year gold was good protection because of Trump and North Korea 'playing chicken'

LME Plans To Launch Yuan-Denominated Metals Futures Markets

Platinum market could see another surplus in 2018; Prices may average $993 an ounce

=====

In other news:

Stocks Rebound as Korea Concerns Cool; Oil Falls: Markets Wrap

Trump Cancels Summit With North Korea’s Kim, Citing ‘Hostility’

North Korea says it's still open to talks after Trump cancels summit

OPEC, Russia discuss raising oil output by about 1 million barrels per day: Sources

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts