Briefly: in our opinion, full speculative long position (150% of the regular position size) in silver is justified from the risk/reward point of view at the moment of publishing this Alert.

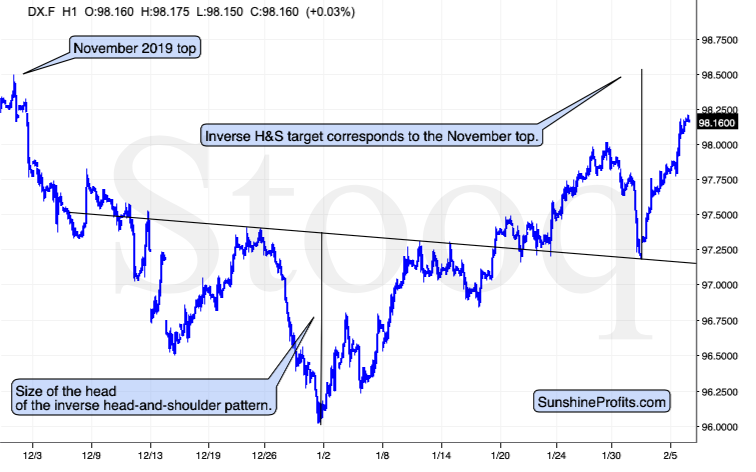

In yesterday's analysis, we emphasized the importance of the USD Index as one of the key drivers for the precious metals market. We wrote about the inverse head and shoulders formation in the USD Index and its implications.

The target based on the above chart was about 98.5.

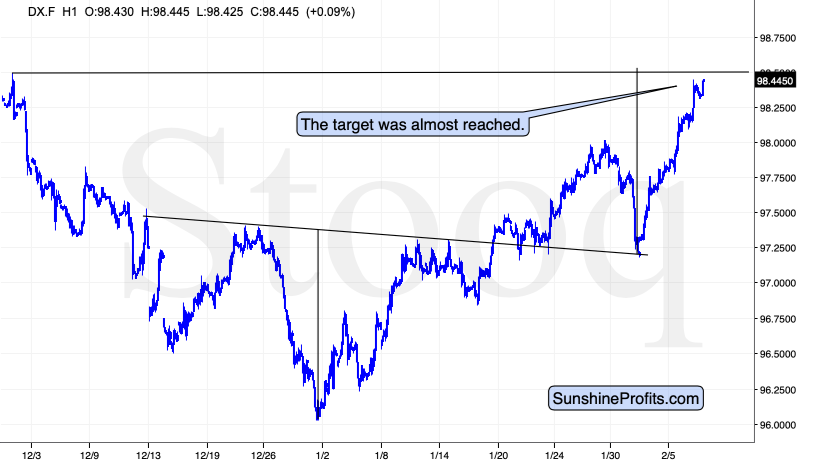

And here's how the situation looks like at the moment of writing these words:

The USD Index has almost reached the inverse-H&S-based target that corresponds to the November 2019 high. This means that the greenback is likely to reverse its course shortly.

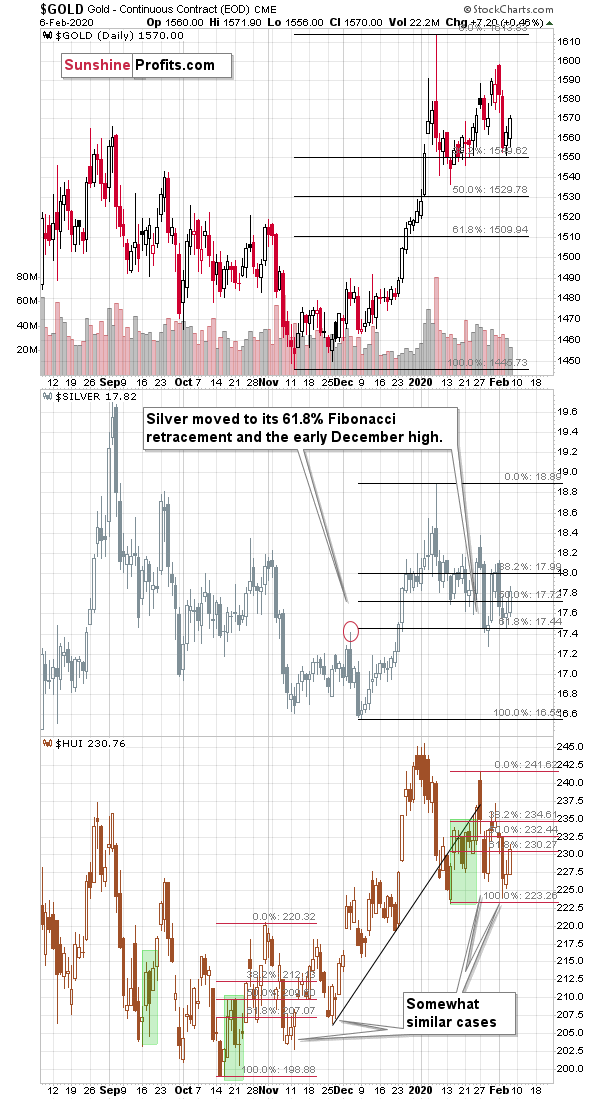

Now, the particularly interesting thing is how gold and silver reacted to the last few days of higher prices.

Meanwhile in the Metals

In the first days of February, the precious metals sector declined sharply, only to bounce back up in the following days. We wrote that choppy trading is to be expected, especially given the short-term coronavirus-scare-based bullish potential and the conflicting medium-term bearish factors. That's what we see.

The PMs moved higher yesterday, and in today's pre-market trading, they didn't decline even though the USD Index rose, which confirms what we wrote previously. Gold and silver are likely to move higher in the very short term.

As the USD Index declines, gold and silver are likely to rally, and since they managed to show resilience to the most recent daily rallies in the USDX (those of yesterday and today), they are quite likely to magnify USD's move to the downside.

Consequently, the outlook for the very short term remains bullish, while the outlook for the medium term is bearish.

At what level could the USD Index bottom, triggering a top in the PMs?

Targets of the Upcoming Metals' Move

The previous top of 98 seems to be a good candidate. A retest of the previous lows (approximately 97.2) is also not out of the question, but - unless situation regarding coronavirus gets much worse shortly - we don't expect the slide to be as big.

Gold, silver, and mining stocks are likely to respond to the above with a rally, but we wouldn't bet the farm on a re-test of the previous 2020 highs. In fact, if the USD Index declines only to 98 (that is by just 0.5), the rally in PMs might not be that significant, even if they magnify USD's upswing.

Gold could rally to $1,580 - $1590 or so, while silver could move to $18.30 approximately. The key word here is "could". These seem more like maximum than optimum targets from the risk to reward point of view. $1,580 and $18 are more conservative and likely targets.

Summary

Summing up, the USD Index is likely to correct shortly as it just moved very close to 98.5 (the November 2019 high), which is likely to make gold and silver rally, especially given their yesterday's and today's (so far) resilience. The short-term top in gold and silver is quite likely to be formed today, or early next week.

The medium-term outlook is very bearish and once the short-term correction is over, the declines are likely to resume.

The profit-take level for silver is likely to be reached shortly. Please note that reaching this level in silver futures, will automatically close the current position even without a separate confirmation from us.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long position (150% of the full position) in silver is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Silver futures: profit-take exit price: $17.89; stop-loss: $17.24; initial target price for the USLV ETN: $90.47; stop-loss for the USLV ETN: $82.95

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager