Briefly: In our opinion, full (150% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

In yesterday’s alert, we wrote that the situation could change quickly and that in such a case, we would send another alert. Six minutes after yesterday’s opening bell, we already posted the second alert. And for a very good reason. The USD Index took a deep dive and metals were not even close to reacting in a normal way. They were actually a bit lower. We know an extremely bearish signal when we see one and that was definitely the most bearish development for the PMs that we’ve seen this year.

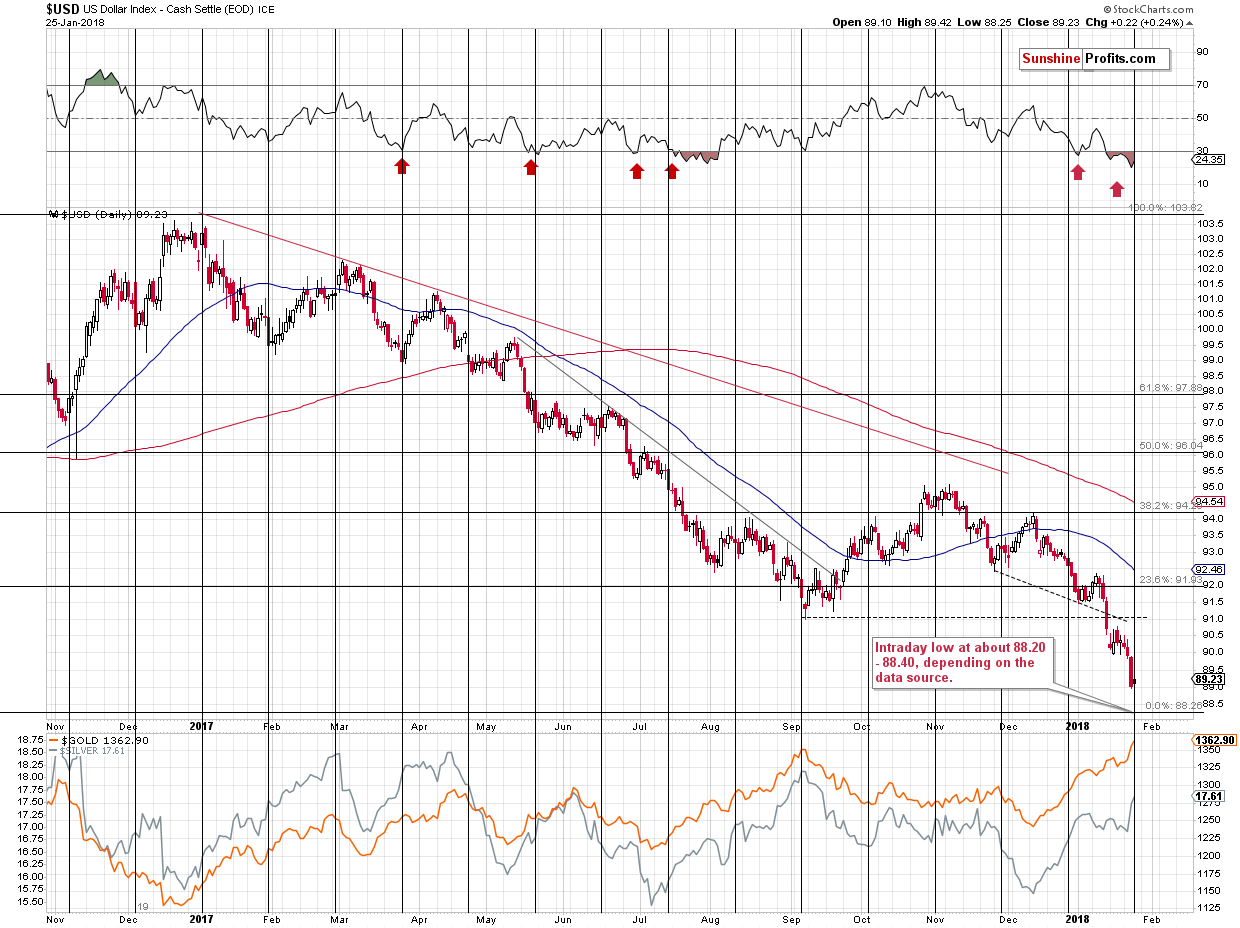

Let’s take a look at what happened. This time we’ll start with the short-term USD Index chart (chart courtesy of http://stockcharts.com) as we want to show you the action of yesterday’s session.

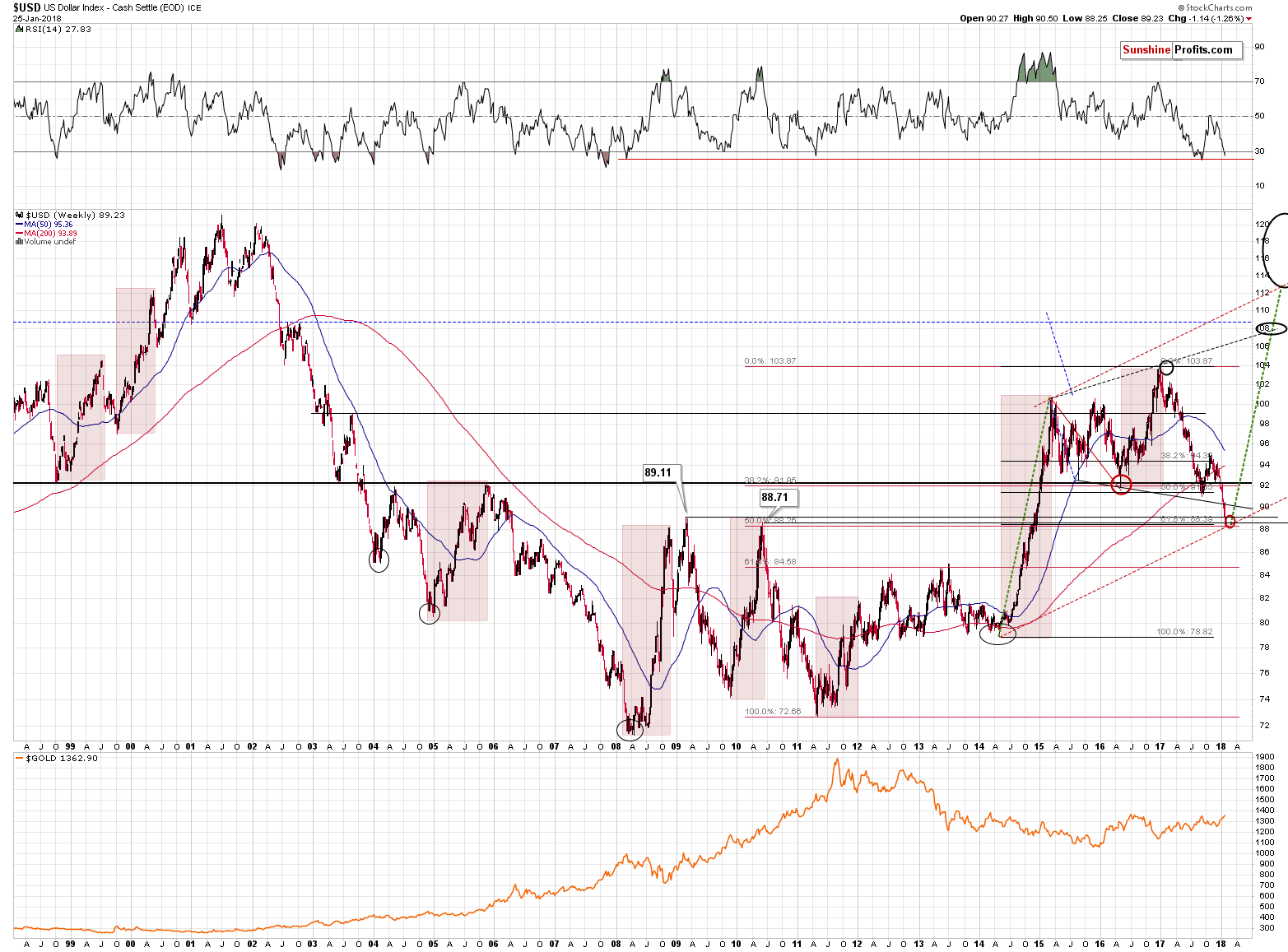

We previously wrote about 3 very strong support levels based on the previous highs (2009 and 2010) and the 50% Fibonacci retracement level based on the 2011 – 2017 rally. These levels are: 89.11, 88.71 and 88.26.

The USD Index opened yesterday’s session at 89.10, moved almost a full index point lower (Stockcharts shows 88.25 as the intraday low, while Bloomberg points to 88.438 as the low) and then rallied back up, closing the session at 89.23 (Stockcharts) / 89.391 (Bloomberg).

Please recall what we wrote about breakdowns/breakouts and their invalidations. While the former need to be confirmed / verified to be important, an invalidation is an immediate and strong signal. Now, please go through the previous paragraph again. That’s right – the USD Index broke below the key support levels on an intraday basis and immediately invalidated the breakdown, closing the session higher and above all of them. That’s a perfectly bullish combination.

The only thing that could make it more bullish is if the USD reversed under oversold conditions and close to the cyclical turning point.

Oh wait. It did.

Based on the daily RSI indicator, the USD Index was most oversold in more than a year and it reversed exactly at the turning point.

The strength of the bullish factors and the amount of them is almost breathtaking.

And there’s also one more. The 50% Fibonacci retracement level based on the 2011 – 2017 rally was not the only one that was reached. There is also another useful way to create the retracement and that is by basing it on the 2014 bottom. It’s definitely important as that’s when the biggest rally of the past two decades started. Consequently, retracements based on it are important as well. The 61.8% Fibonacci retracement level is at about 88.40.

In other words, the USD Index has an incredibly bullish set-up that’s strengthened by yet another important bullish factor.

The situation in the precious metals market seems even more critical, but before moving to it, let’s stay with the currencies for a while.

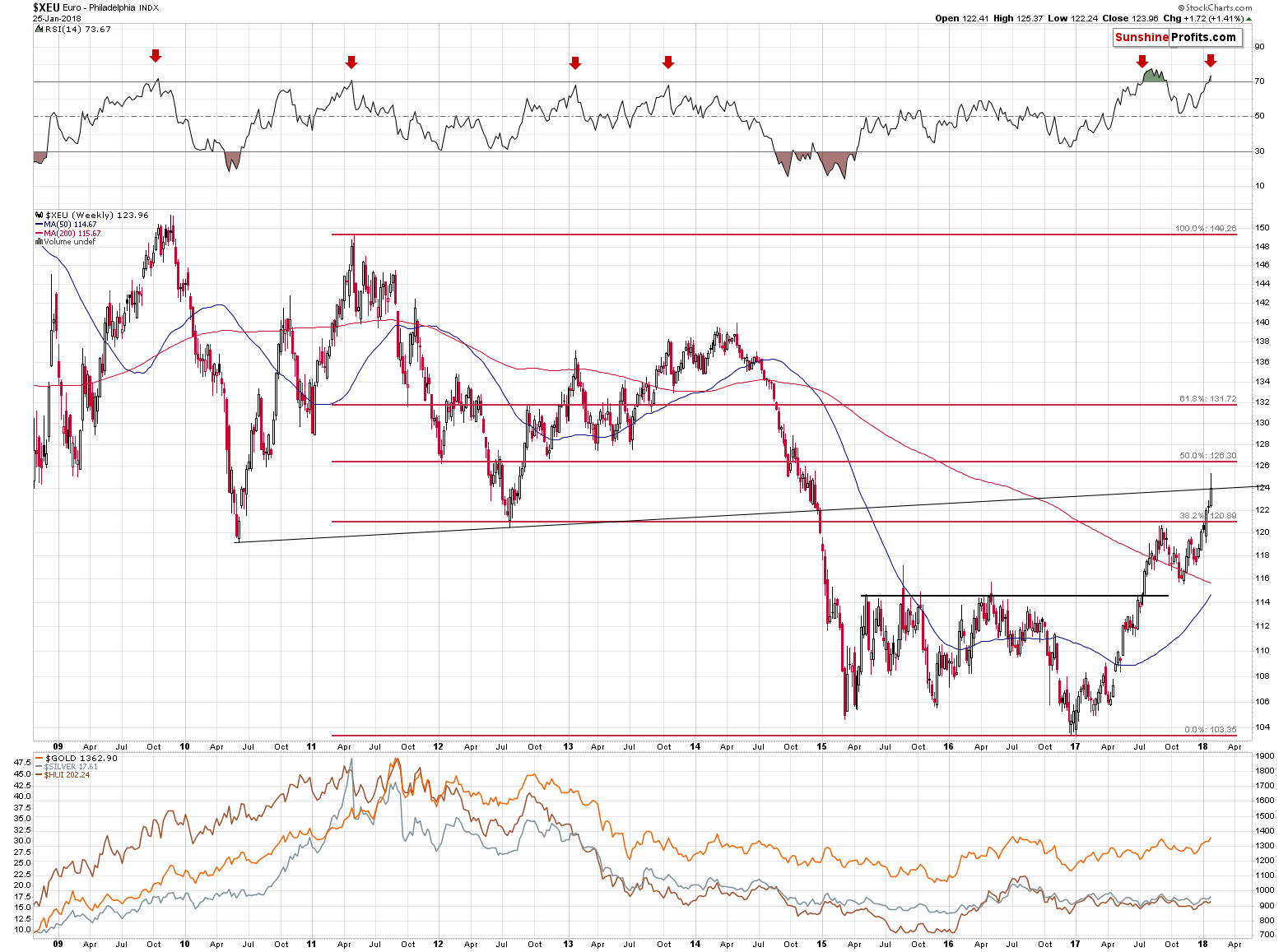

In yesterday’s alert, we wrote the following about the Euro Index:

The Euro Index broke above the 38.2% Fibonacci retracement level and it just reached another resistance level. This one is created based on the 2010 and 2012 bottoms. It seems important, because its proximity stopped the decline in late 2014. It stopped it for just a while, but still, it showed that this line is indeed important.

Let’s not forget that the RSI is above the 70 level and the proximity of this level triggered bearish reversals several times in the past.

The above resistance line confirmed its usefulness once again. The Euro Index rallied above it, but it didn’t manage to hold the gains and declined before the end of the session, closing it a little below the previous day’s closing price. We saw a major reversal after a major rally, while the RSI was overbought. The above serves as a perfect confirmation of the USD Index’s bullish combination of signals.

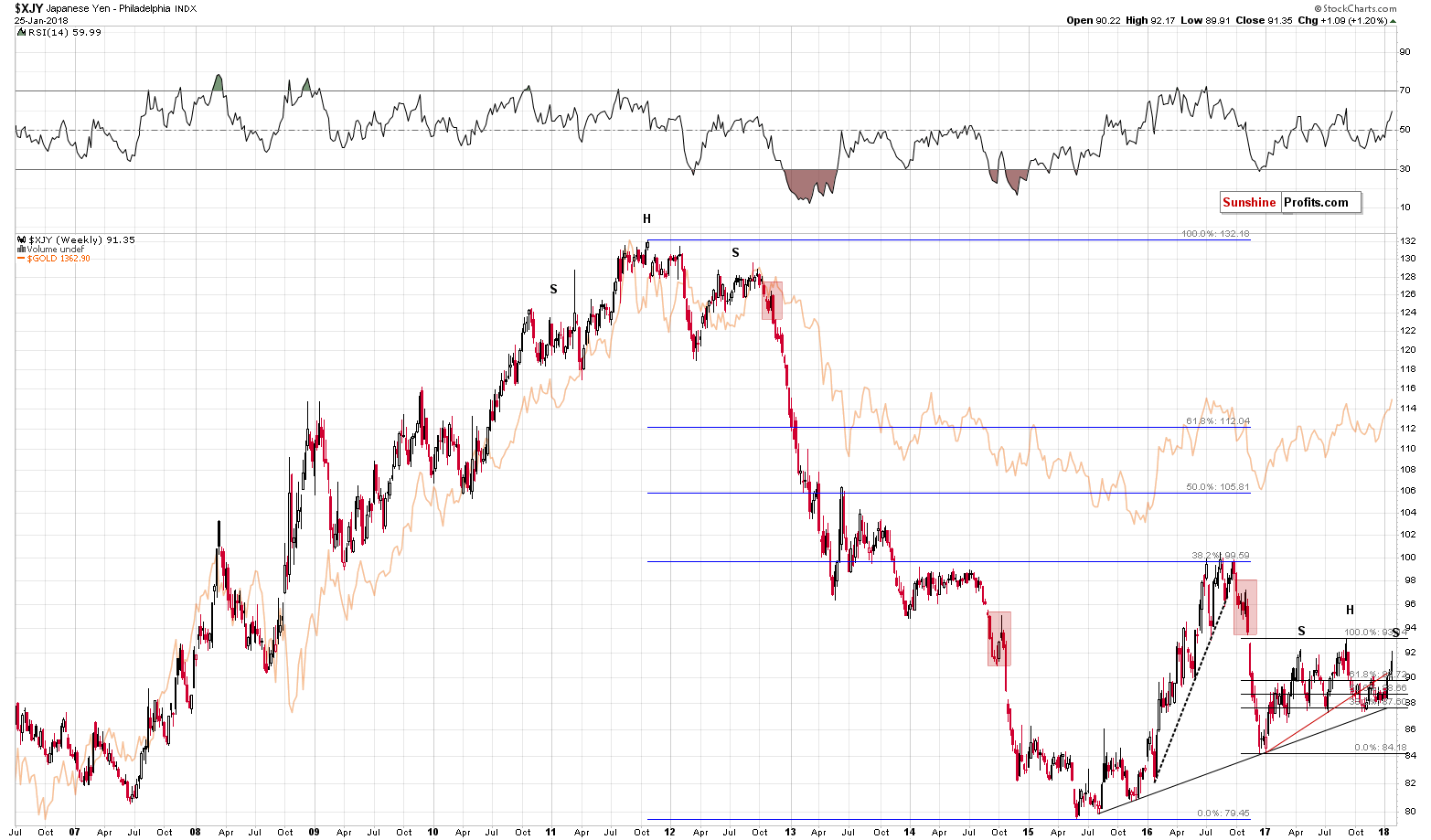

As far as the Japanese currency is concerned, we wrote the following:

The Japanese yen moved above the rising red support / resistance line. This move could still be invalidated, but it’s not that clear anymore – the yen is too much above the line for the reversal to be imminent.

So, while the short-term situation for the yen is unclear based on the long-term picture (you’ll find more short-term details in our Forex Trading Alerts), there is a – potentially – interesting development that we would like to mention. The formation is far from being complete, but it’s possible that a decline from here would result in a quite clear head-and-shoulders pattern.

What’s so interesting about it? The 2011 tops in the yen and gold as well as the 2016 tops in yen and gold all took shape of this pattern. Again, that’s just a possibility at this time, but something that’s worth keeping in mind.

Today, we would like to add that in the case of the mentioned tops, the shoulders of the formations – tops – were formed at very similar price levels. The early 2011 top and the late 2012 top formed at very similar prices and we can say the same thing about the shoulder tops from late 2016.

Why is this significant?

Because yesterday’s intraday top was very close to the early 2017 tops – the first shoulder of the possible head-and-shoulders formation. This observation makes it more likely that the final top for the yen is already in or about to be in. This, in turn, makes the same more likely for the precious metals market.

Let’s move right to the latter. We will use ETFs today as it seems that the data for metals from Stockcharts is not close to being correct (for instance showing a price increase in silver while there clearly was a decrease).

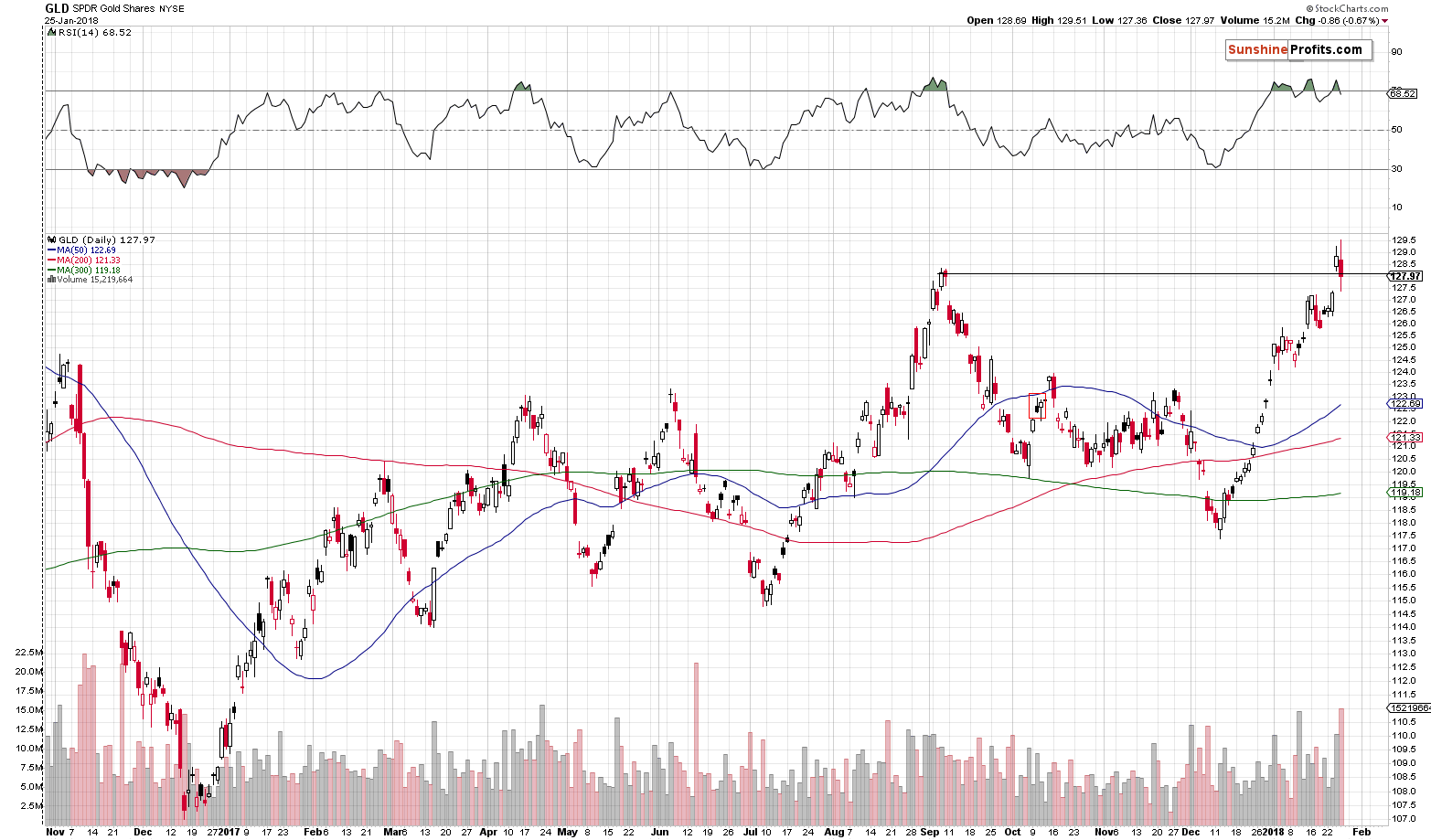

The key development is gold’s decline and close back below the highest close of September. In other word, it’s the invalidation of gold’s breakout. It took place on huge volume, which validates and strengthens the impact of the invalidation. It’s also bearish on a stand-alone basis.

The most important thing is that gold didn’t even manage to rally above $1,370 despite the USD’s volatile decline during yesterday’s session. In the previous alerts we thoroughly described the likely strength of reaction in light of the possible decline in the USD and while gold moved in precise tune with it, yesterday, it didn’t even manage to do just that. Gold’s lack of strength was astonishing and that (along with the levels that the USD reached) was the factor that made us strongly increase the size of our short positions once again. The implications of the above remain bearish and today’s small pre-market upswing (to $1,353) doesn’t change it.

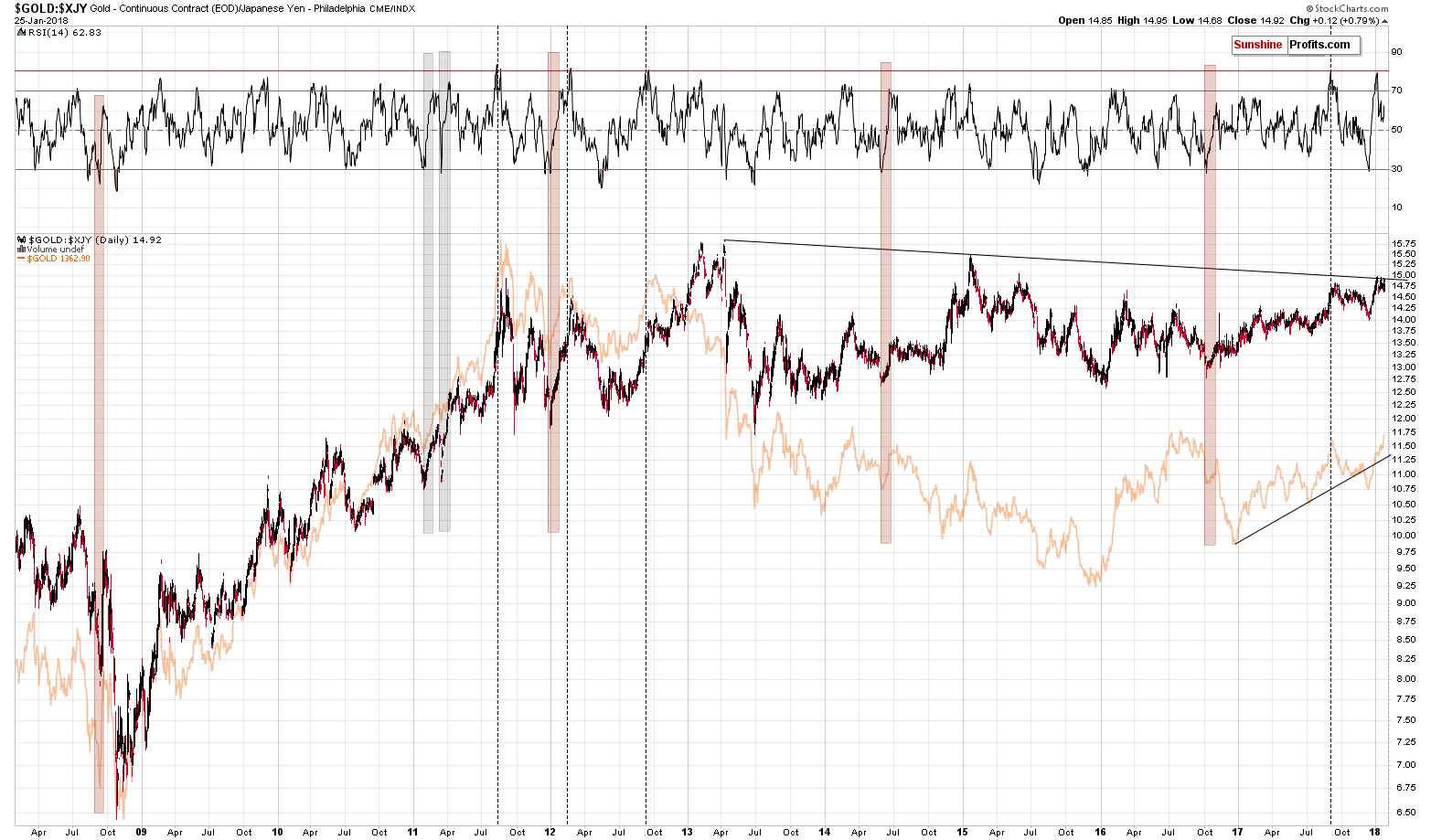

Looking at gold’s performance in terms of the Japanese yen from the big perspective, we see that there was recently no breakout at all – only another move to the declining, long-term resistance line. Since the latter was not broken, the bearish implications of its proximity remain in place.

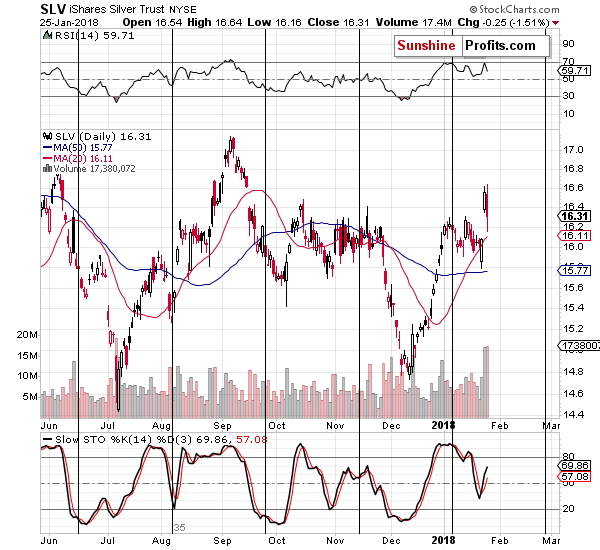

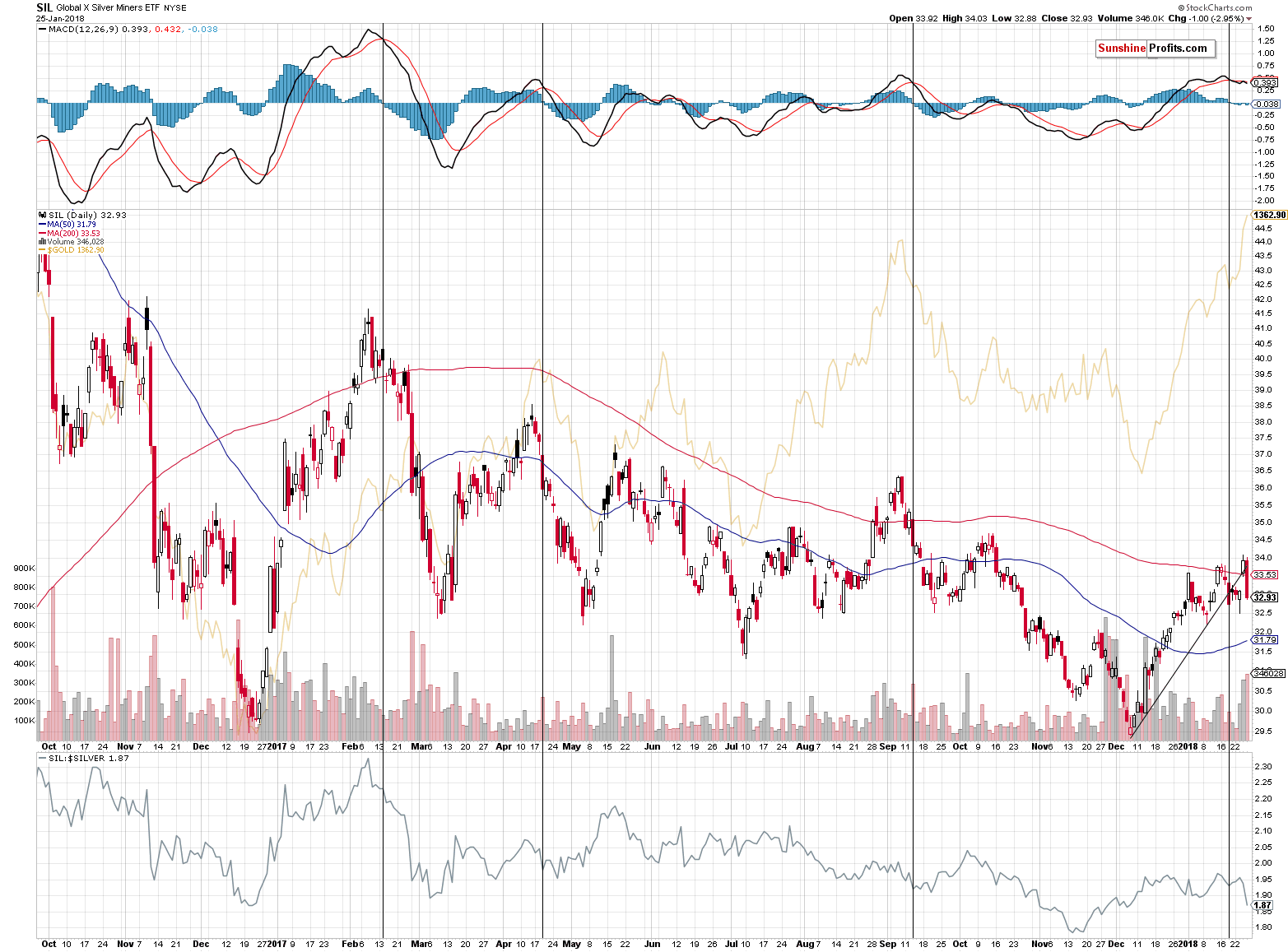

Silver was not close to the September high, but it also invalidated a breakout. Namely, the white metal invalidated the breakout above the October 2017 high.

The chart is already bearish because of the above, but we would also like to discuss something else. We saw a two-session reversal that was confirmed by huge volume during both sessions. There are very few cases like that, so it requires more attention.

There are numerous names for multiple-session candlestick patterns (the bullish engulfing pattern, dark cloud pattern, tri star top pattern etc.) and it might appear overwhelming for one to keep all the above in mind and know when to apply which one. The good rule of thumb is to check for the entire pattern’s opening and closing prices and it’s low as well as high and then to create a single candlestick out of the entire pattern. Then, compare it with the volume level and the price trend that preceded it and interpret it as if it was just this one single candlestick. The majority of complicated formations turn out to be either strong rallies, strong declines or big-volume reversals.

In the case of silver, we get a big-volume long-legged doji, which is not necessarily bearish by itself, but when compared to the previous similar cases, it becomes such. You will find details on the chart below.

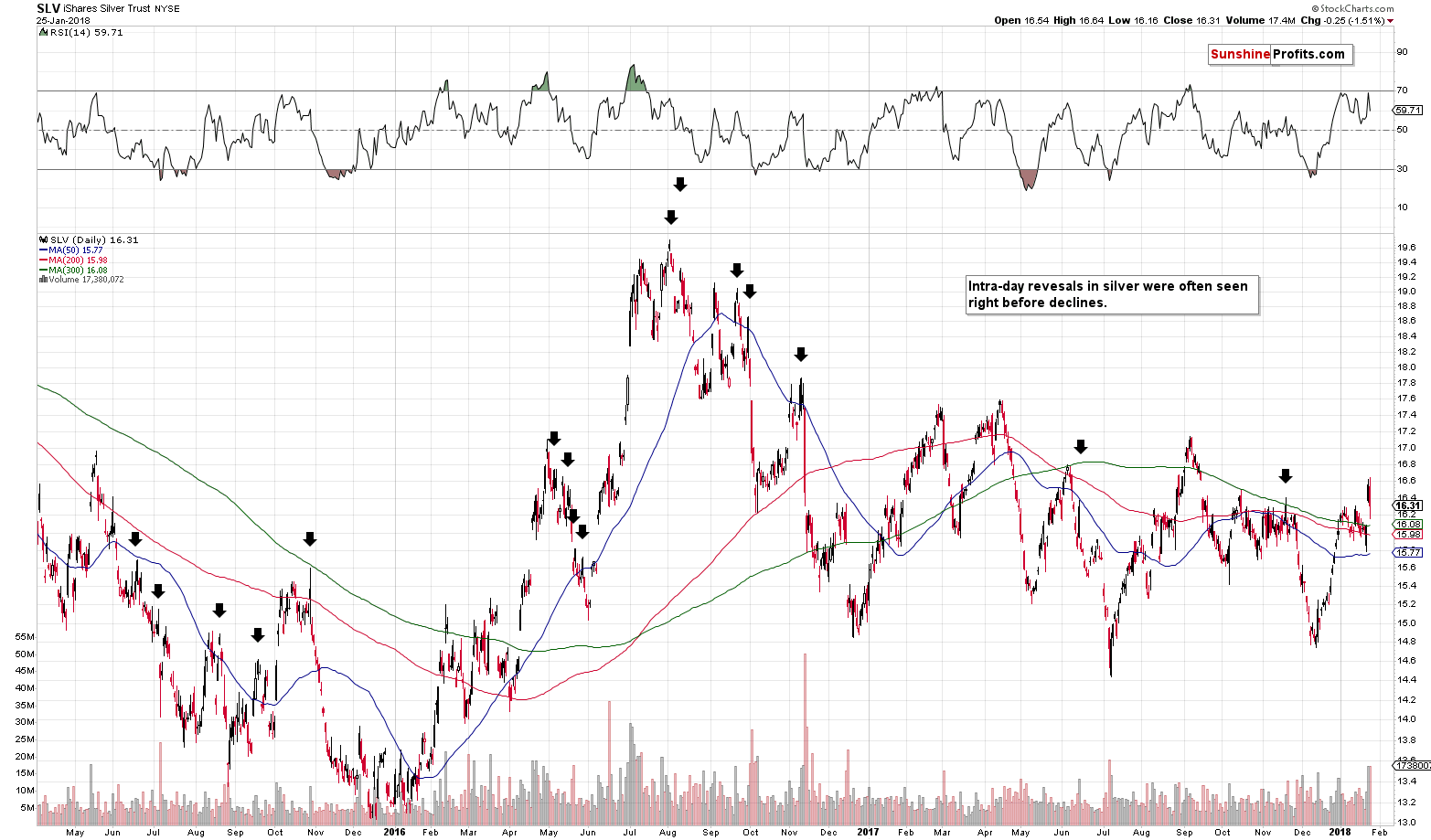

We marked analogous sessions with black arrows. Even if the reversal was not complete and SLV didn’t end the session very close or below the previous closing price, the big volume and the fact that it was preceded by a big rally made the picture very bearish. In fact, declines followed in practically all marked cases. Naturally, the implications here are bearish.

Interestingly, silver stocks invalidated even more than that. In just one session, SIL invalidated an entire week of gains – it closed below Monday’s opening price.

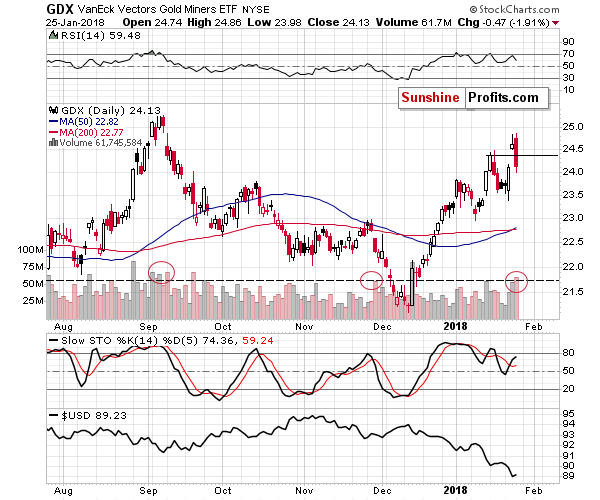

The entire mining stock sector moved lower on huge volume (biggest daily volume of 2018) and it invalidated the breakout above the previous 2018 high. The volume is very important with regard to the invalidation, but also by itself.

There were only two cases in the recent past when GDX declined on similarly big volume after a rally. We marked these situations with red ellipses. Sizable downswings followed in both cases, so the implications here are bearish as well.

Summing up, the USD’s epic turnaround along with gold’s extraordinary weakness relative to the USD’s intraday decline along with multiple bearish confirmations paint a very bearish picture for the precious metals market for the following weeks.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,218; stop-loss: $1,382; initial target price for the DGLD ETN: $53.98; stop-loss for the DGLD ETN $37.68

- Silver: initial target price: $14.63; stop-loss: $17.82; initial target price for the DSLV ETN: $33.88; stop-loss for the DSLV ETN $20.88

- Mining stocks (price levels for the GDX ETF): initial target price: $19.22; stop-loss: $26.14; initial target price for the DUST ETF: $39.88; stop-loss for the DUST ETF $15.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $27.82; stop-loss: $38.22

- JDST ETF: initial target price: $94.88 stop-loss: $37.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold heads for weekly gain on weaker dollar

Freeport profit pops higher; miner makes progress in Indonesia

=====

In other news:

U.S. Dollar Bounces as Trump Goes Back on Treasury Secretary Mnuchin's Comments

This whole US dollar debacle is a perfect example of what the Trump administration does best

Draghi Clears Path for Euro-Area Economy as Momentum Builds

World stocks set for 10th straight week of gains, euro jumps

Biggest Stock Sell Signal Since 2013 Sparked by Record Inflows

Currency war is last thing world needs: ECB's Coeure

Cryptocurrencies Drop After Japanese Exchange Halts Withdrawals

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts