Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

What a week! Gold plunged on Wednesday only to soar back up (and more) on Thursday! Why did it rally? How come? And what did this rally change? In today's Alert, we're going to address these questions.

Let's start with the first one. The most likely (and credible) reason for the rally in gold and the move lower in the USD Index is Donald Trump's newest tweet regarding the trade war with China. In short, it's about an "additional tariff of 10% on the remaining 300 billion dollars of goods and products coming from China into the U.S., which does not include the 250 billion dollars already tariffed at 25%".

Trump also tweeted that "Powell let us down" after the interest rates were cut. It was just yesterday when we wrote that Trump will start blaming everyone else for soaring dollar and its consequences (and ultimately declining stock market). Powell cut rates just like Trump wanted and Trump is still not happy. Most likely, if the interest rates had made the USD decline profoundly, Powell would be praised.

Anyway, Trump decided to give the Fed another reason for another rate cut and more dovish rhetoric at the next press conference. We have one more tariff threat and another risk to the economy that the Fed will need to mitigate with its interest rate policy. Let's keep in mind that Trump likely assumes that the threats and tweets cost him nothing until they are implemented. And he probably never wants to implement them as they are too costly. However, this assumption of getting market reactions for free is not correct. Trump does so at the cost of his credibility, just as the Fed's credibility is already severely damaged for bowing to his demands. Trump is known to change his mind very quickly (North Korea, anyone?) and as he does, the market reverses the previous actions.

To be clear, if the market enters a technical trend, then the short-term trend will run out until it burns itself out, until it reaches support/resistance, or both. Then after the situation changes, a new short-term trend will form that will unwind what the previous trend created.

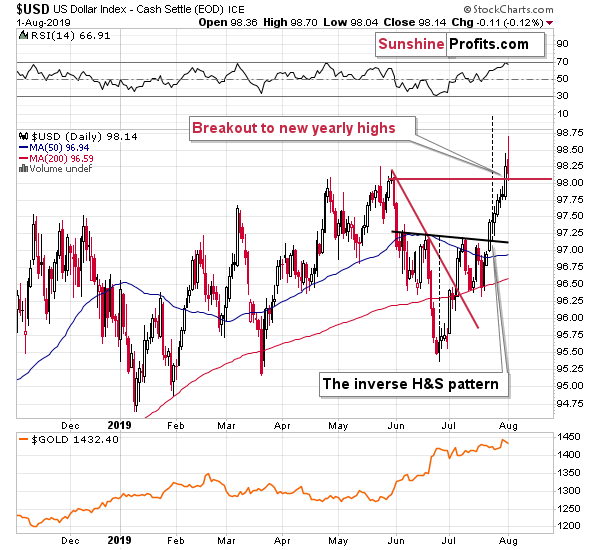

While the situation in the USD Index seems to be rather clear as the currency just soared to new highs, gold's reaction can be described by the previous paragraph. To a large extent, the USD has already stopped caring about the Fed and Trump. Not entirely, but the fact that the rates were cut, and USD broke above the previous highs and yesterday's trade-war shocker was only able to generate a pullback to the previously broken high, does confirm that.

The Tariff Shocker Aftermath

The horizontal red line clearly shows that the breakout above the May high was not invalidated.

Gold and gold stock investors still seem to care as they have fresh memory of the recent uptrend and those who sold yesterday seems to have bought back in hopes of seeing further gains. But these gains are unlikely to be seen. Despite the intraday strength, the precious metals market flashed myriads of bearish signs suggesting that the buying power has almost dried up and that it doesn't want to move higher.

How did gold move higher yesterday? Rapidly, yet - likely - temporarily.

Let's move back to Trump's credibility for a while. As it's being lost, the market reactions to words or tweets will change as investors learn not to pay attention to them and focus on facts instead. The currency market seems to have mostly adopted this stance and the precious metals market is likely to adopt it as well.

What is the current reaction to both: rate cut and Trump's trade-war shocker?

Gold is more or less where it was before they both happened, and silver is about 30 cents lower.

This is really profound. There was almost no bullish reaction to two theoretically bullish events. Mining stocks moved back up by more or less as much as they had declined on Wednesday, which means that they too didn't react almost at all to both bullish developments.

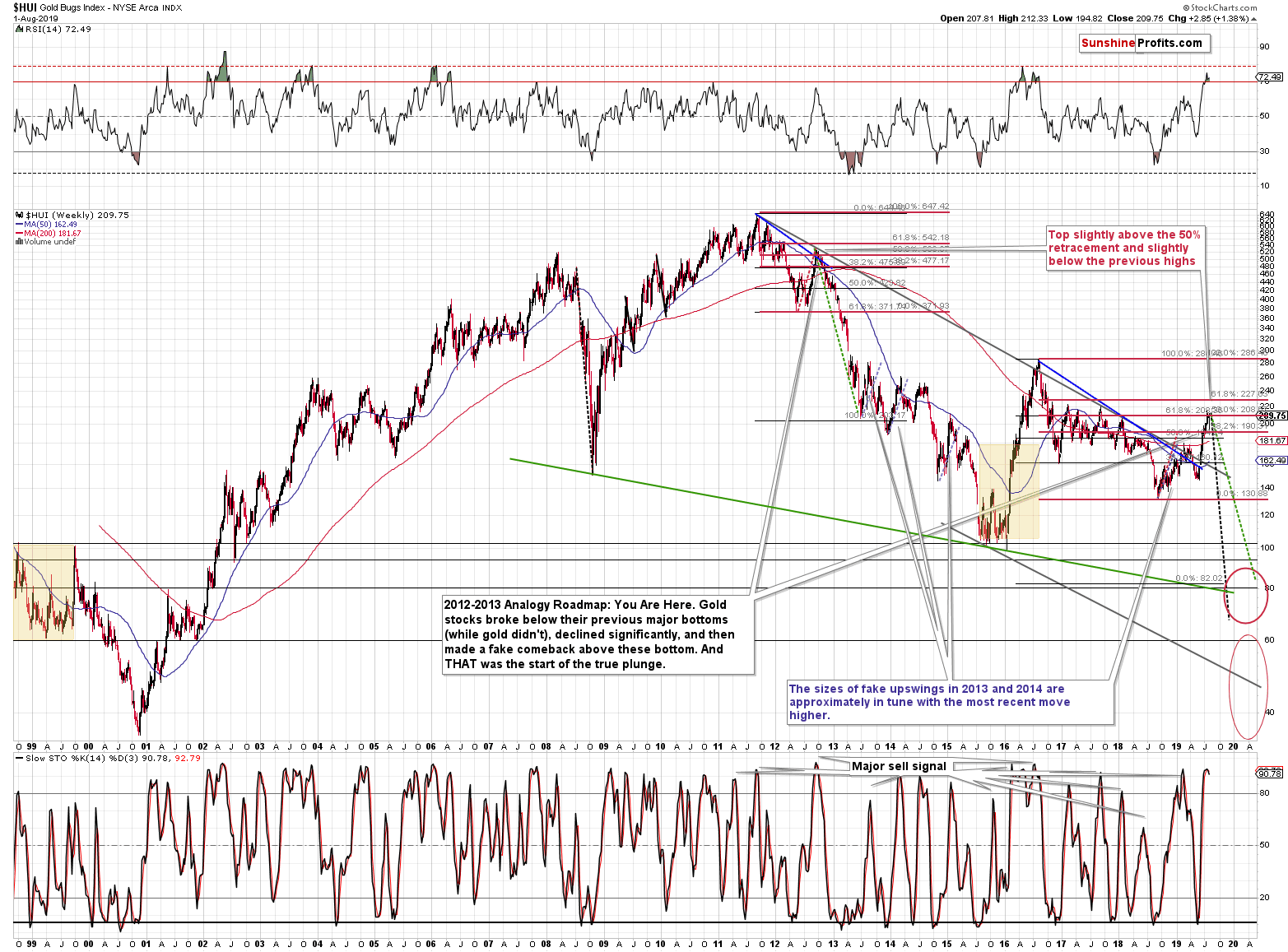

Speaking of mining stocks, let's take a look at the way they started their decline from the top that is analogous to the current one (as we had explained in the previous days)

The Path of Miners Decline

In late 2012, gold stocks declined significantly, but the decline was not a vertical drop - at least not immediately. Let's zoom in.

The above chart shows the weekly candlesticks. Please see how the decline started. It started with a quick slide and then a comeback before the end of the week. That's exactly what we see this week. If the situation is playing out practically exactly as it had played out at the top that was followed by the biggest decline in the past few decades, then how can it be bullish? Yesterday's rally is not a break from the 2012-now similarity - it's its confirmation.

Summary

Summing up, the currency market is already mostly ignoring the - likely temporary - changes in Twitter politics and it seems only a matter of time before the precious metals market is able to do the same. There are multiple long-, medium-, and short-term signs that are pointing to much lower precious metals prices and given the USD's breakout to new yearly highs, it seems that we won't have to wait for long before the downtrend in gold and miners resumes.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,468; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $30.27

- Silver: profit-take exit price: $13.81; stop-loss: $16.73; initial target price for the DSLV ETN: $39.08; stop-loss for the DSLV ETN $22.87

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $29.27; initial target price for the DUST ETF: $32.28; stop-loss for the DUST ETF $6.88

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $23.71; stop-loss: $43.47

- JDST ETF: profit-take exit price: $73.32 stop-loss: $13.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

So far, so good! After the first half of the year, gold gained more than 10 percent, rising from $1,279 at the end of December 2018 to $1,409 at the end of June 2019. We invite you to read our today's article about the gold market in the first half of the year, and learn important implications for the second half of 2019.

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager