Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Not much happened in the precious metals market yesterday. This was an important "nothing", though.

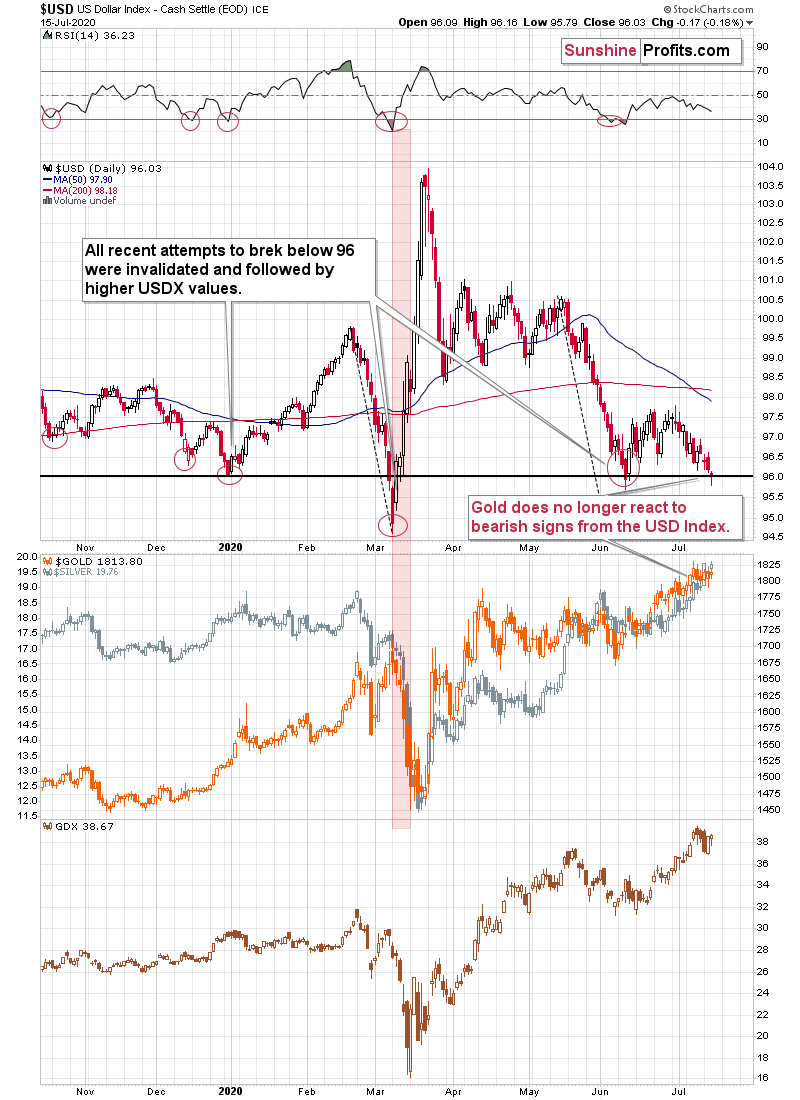

The USD Index moved visibly lower this week - also yesterday - and gold has barely reacted. As you can see on the lower chart, gold miners have also simply moved somewhat up, but not to - let alone above - their recent highs.

This "nothing" means that the precious metals market doesn't want to move higher without a decline first. And based on the multiple factors that we covered previously, especially in Monday's flagship Gold & Silver Trading Alert, it's likely that this decline is going to be major.

The lack of reaction to bullish indications from the USD Index also suggest that PMs might be vulnerable to strong reaction given a bearish lead from the USDX. And since the USDX just moved below 96, it seems that we're likely to see another USD upswing shortly. In fact, it might already be underway. After all, all recent attempts to break below the 96 level were followed by invalidations and rallies. That's how the huge March rally in the USDX and the huge downswing in the PMs started.

There's also a more short-term-oriented indication pointing to the same outcome.

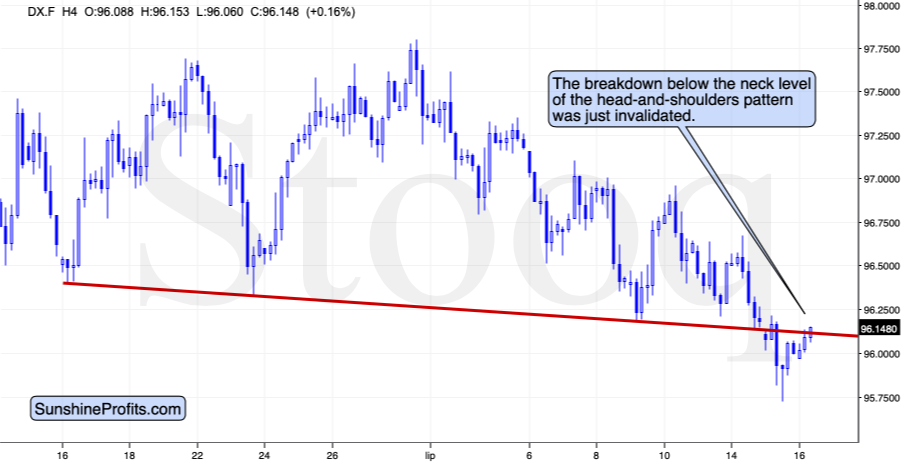

The neck level of the head and shoulders pattern that we've been commenting on in the previous days, was broken and then the breakdown invalidated just several minutes ago (I'm writing it well before the markets open in the U.S

On Monday, we wrote the following:

The USD Index did move lower and right now it's in the situation where it could still move slightly lower before soaring. The reason is the incomplete head-and-shoulders formation. Theoretically, this formation is bearish once its completed, but based on what we wrote with regard to USD's long-term picture, it seems more likely that the USD Index will attempt to break lower and then invalidate this breakdown. We saw this kind of performance multiple times and invalidated H&S pattern is a very bullish phenomenon. In fact, all invalidations are strong signs to the opposite direction, but the signals coming from invalidated H&S patterns appear particularly strong.

That's exactly what happened. The implications are bullish for the USD Index and bearish for the precious metals market.

Gold is trading below the upper of the rising support lines and given USD's invalidation, it seems that the yellow metal will attempt to break below the lower support line shortly. This line is currently at about $1,790, so a decisive move below this level is likely to lead to increased selling and decline's acceleration.

Please note that we might also see a verification of the upcoming breakdown below the lower one of the rising support lines, but it's not certain that we see it.

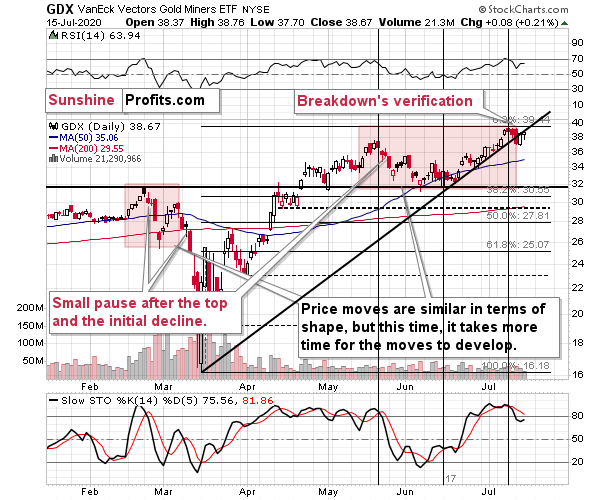

Meanwhile, mining stocks didn't do much yesterday, which was not neutral, but bearish. The reason is that the lack of action meant that GDX stayed below the rising support line and this means that the breakdown below it is now more confirmed. Ideally, we want to see three consecutive closes below a certain level, but yesterday's pause is notable despite the daily upswing in the S&P 500. Just like gold doesn't want to move higher despite lower USDX, miners didn't want to move higher despite higher stock market. That's a bearish combination.

Summary

Summing up, given the specific situation in the USD Index and its tendency to reverse mid-year, gold's relative weakness, and miners' short-term breakdown as well as many other long-term factors, it seems that the precious metals market is on the verge of a big move lower.

Naturally, everyone's trading is their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager