Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Everyone and their brother seem to think that gold mining stocks can only go up. In reality, the opposite is most likely for the next few days - weeks.

This is probably the final warning that you read about the decline before it happens. The very bearish indications for the mining stocks became near crystal-clear based on yesterday's price action. And what action was that?

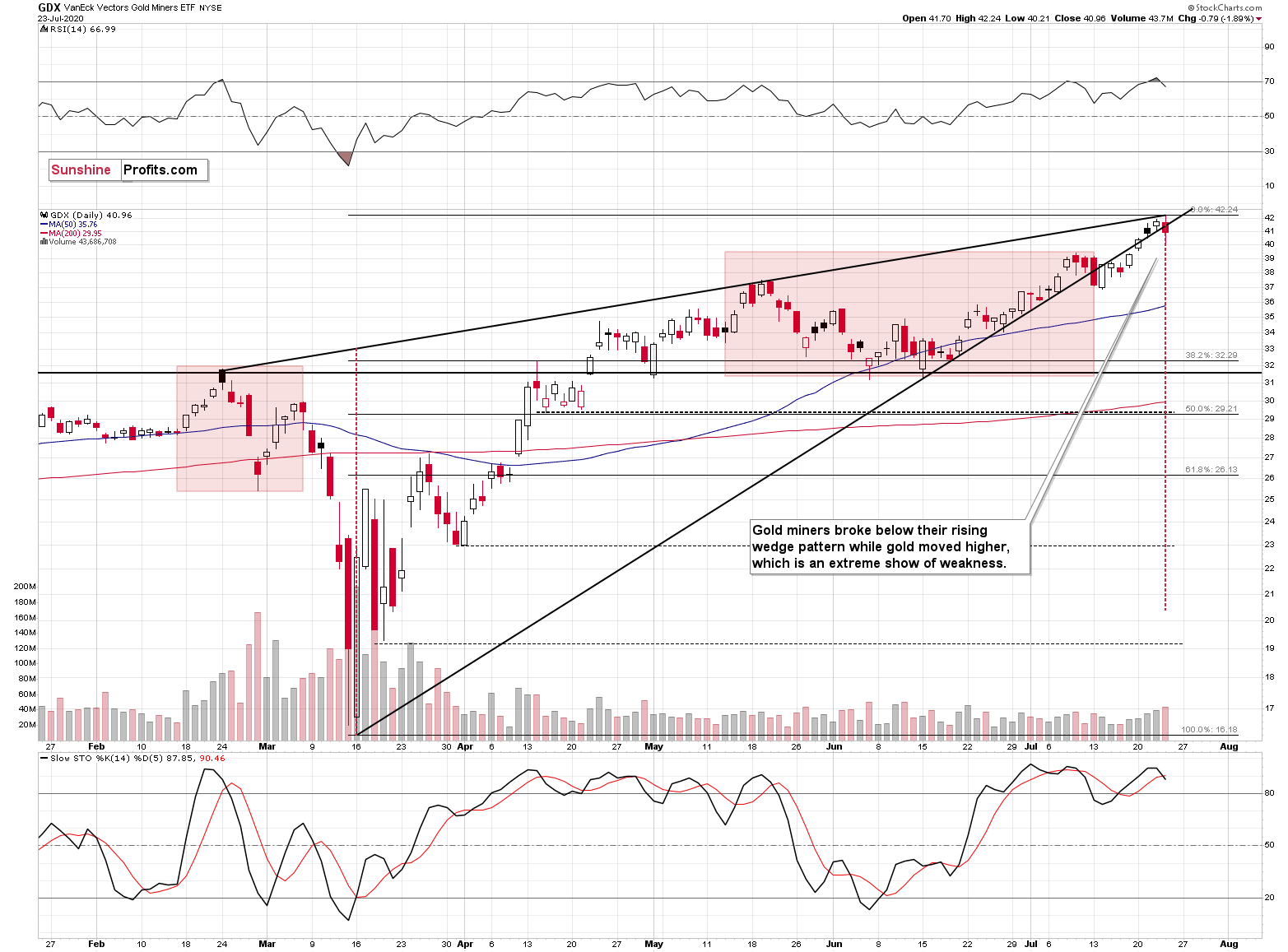

It was a breakdown! Breakdown below the rising, medium-term support line which was also the lower border of the rising wedge pattern.

Gold miners broke below the rising support line on relatively strong volume.

Despite gold's daily upswing.

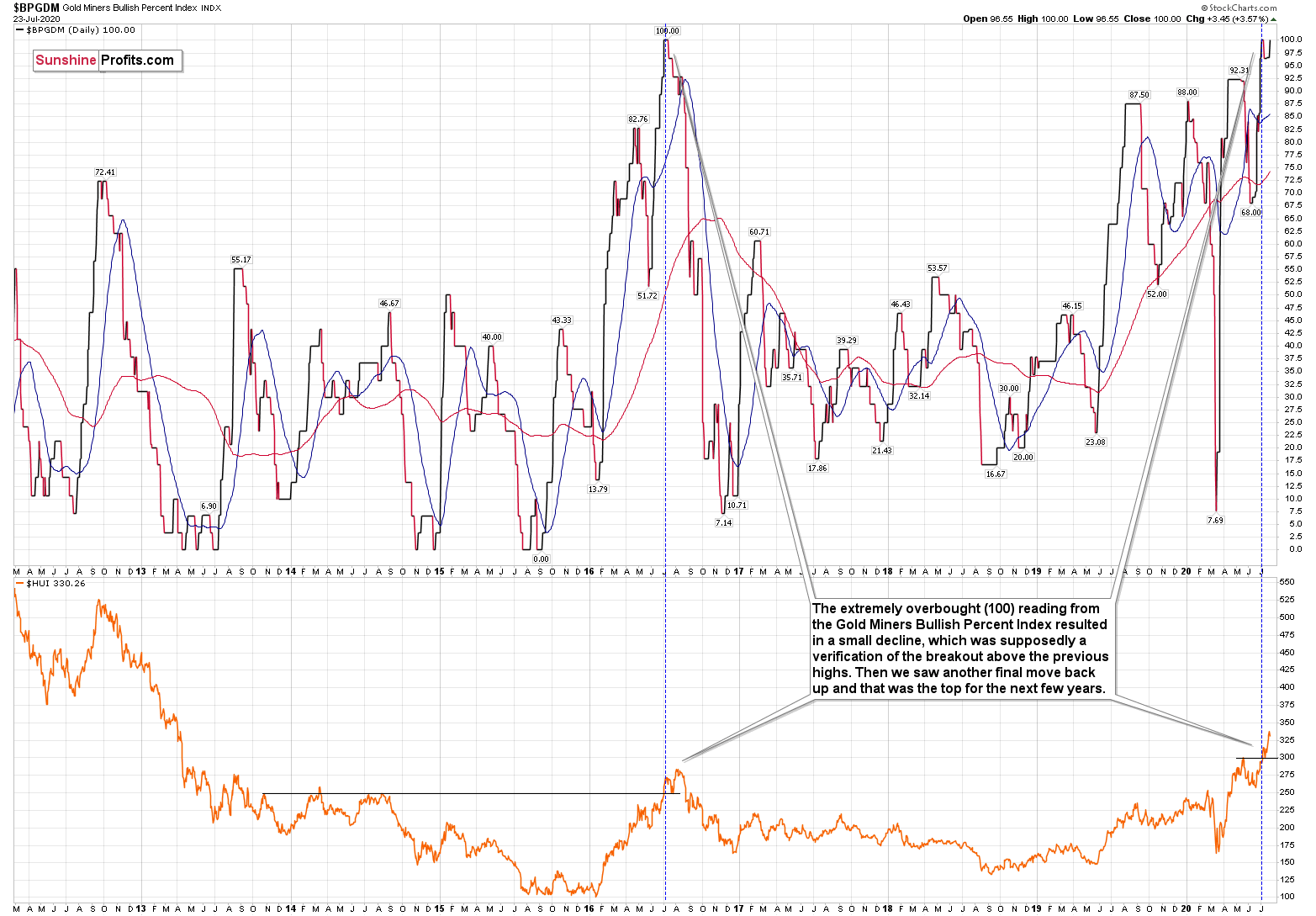

And shortly after, the Gold Miners Bullish Percent Index flashed the most extremely overbought reading - 100.

Gold miners also declined right after rallying once again - just like they have done in 2016, during the only other time when Gold Miners Bullish Percent Index got as overbought.

The RSI just moved back below 70, flashing a sell signal, and the Stochastic indicator flashed a sell signal of its own.

It's really hard to imagine a more bearish combination for the mining stocks.

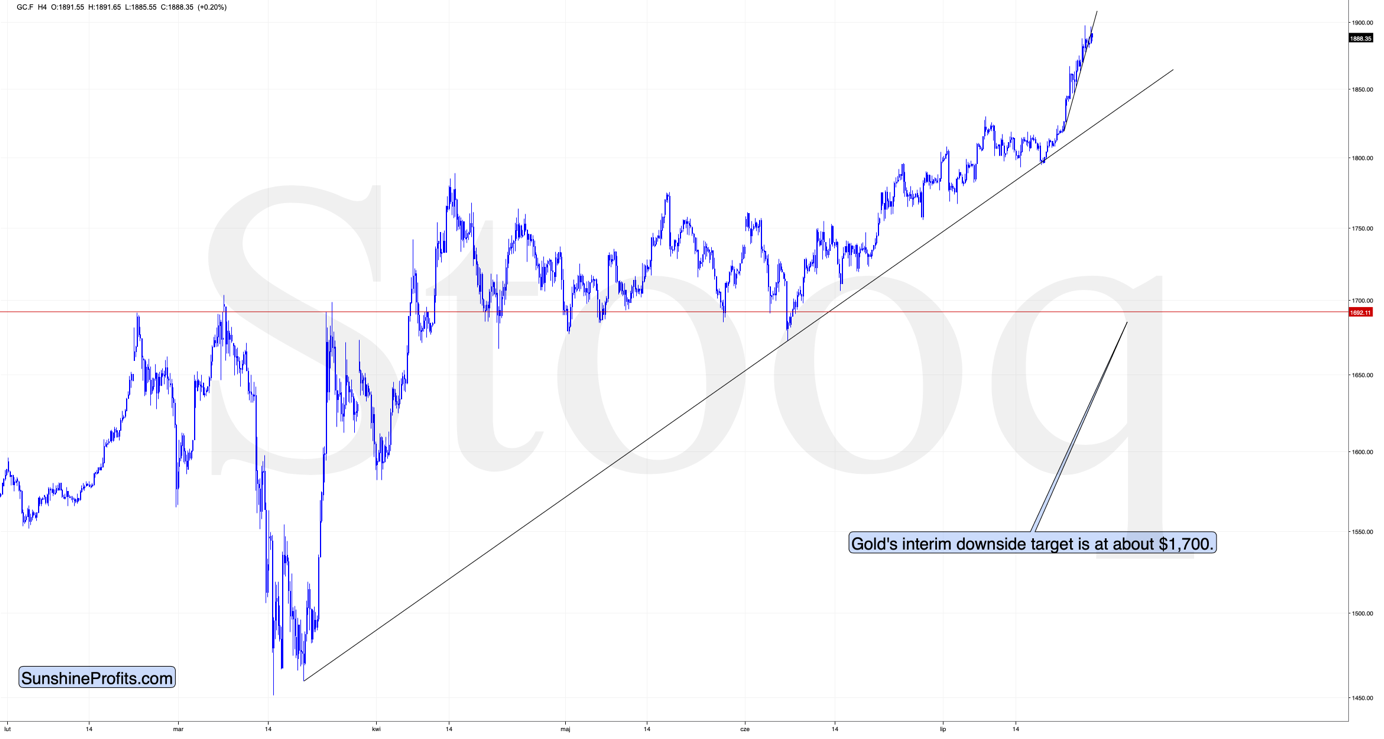

If there only was any indication that gold is about to decline as well... Of course, there is one. Actually, more than one, but let's focus on the obvious. Namely, gold just moved to its 2011 highs. It didn't move above the $1,900 level, but it closed above $1,883.25 yesterday. And why would this level be important?

Because in the entire recorded history, there were only two other cases when gold closed above $1,883.25 and in both cases, gold then moved initially higher only to decline significantly in the following hours and days.

Gold futures closed at $1,890 yesterday, and moved a bit higher in today's pre-market trading before giving up their gains. At the same time, gold broke below the very short-term rising support line.

Miners just can't wait to slide, and it seems that gold is about to provide them with a major trigger.

But wait, there's more.

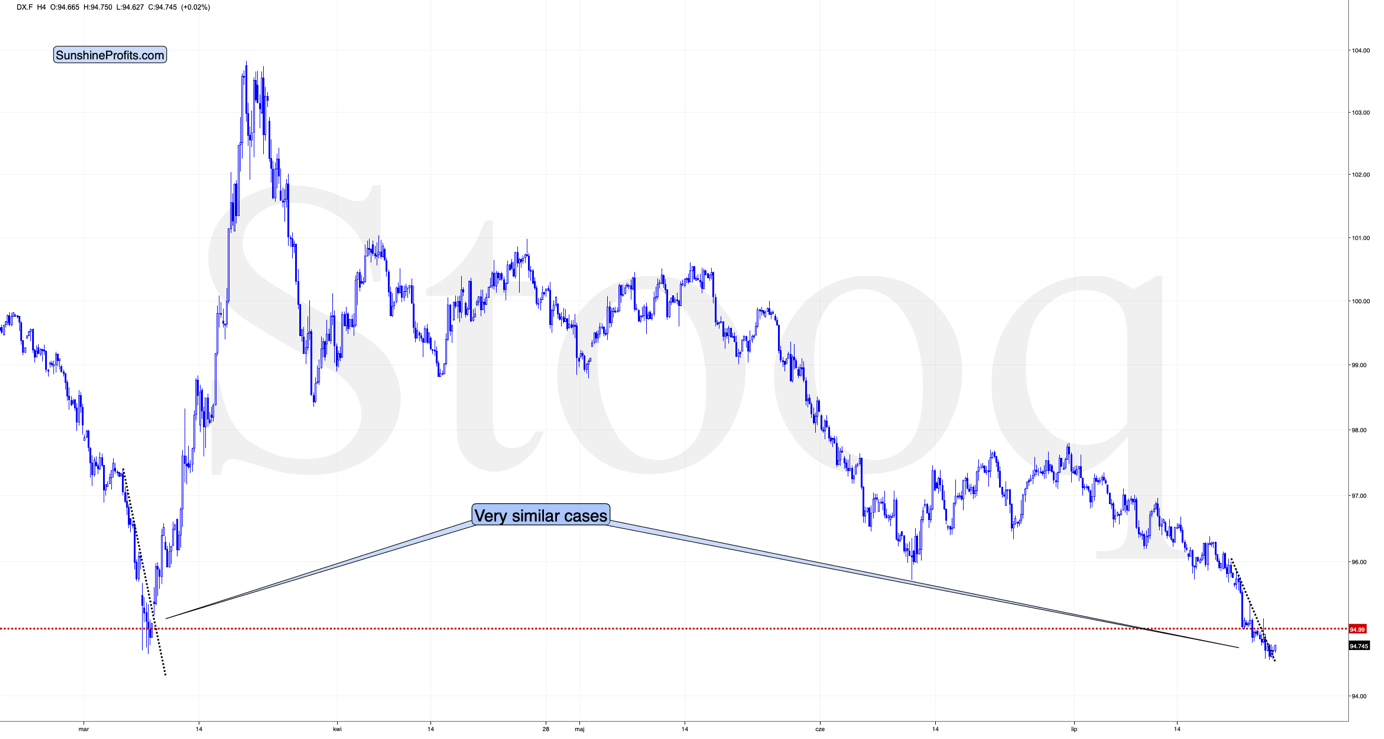

It is very often the case that gold takes signals from the USD Index. That was definitely the case in the first half of March, when USD's major bottom corresponded to gold's major top. And right now...

Right now, the USD Index appears to be repeating its early-March performance. It broke below the 95 level, just like it did back then. It's been trading below this level for longer, but it's not that surprising given the overall lower volatility this time.

Accounting for the lower volatility this time, it still seems that the time is up for the USD Index's decline, and today's small breakout above the very short-term declining resistance line (dashed line on the above chart) appears to confirm it.

So, we not only have a very powerful combination of bearish factors in case of the mining stocks, bearish confirmation from gold, but also an indication that gold is about to get a major bearish trigger that already caused its price to slide in March.

The only piece of the perfectly bearish puzzle for the short term (and short term only!) that seems to be missing, is the bearish outlook for the general stock market. But is it really missing?

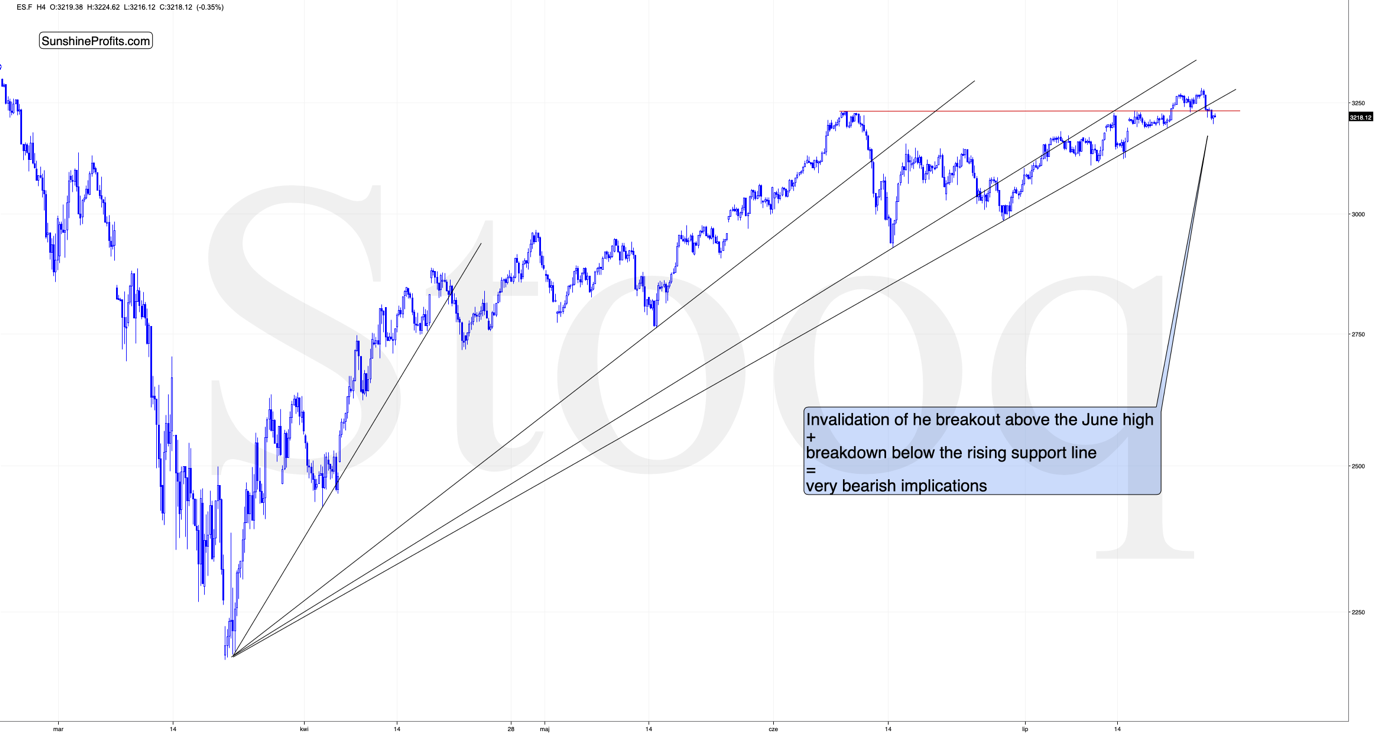

The S&P 500 futures have just invalidated the previous breakout above the June high, and at the same time they broke below the rising support line - just like the GDX ETF did yesterday. This is a bearish combination in the short run.

This is especially the case given that this rising, medium-term support line already worked two times in recent weeks. The previous support lines that were broken (also visible on the above chart) and none of these breakdowns triggered a major decline. However, they were previously not proven as support lines that already worked. This time, we saw a breakdown below the line that already held twice. This means that the current breakdown is important.

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think that after bottoming temporarily at about $1,700, gold, silver and miners will bounce back - perhaps $30-$50 or so in gold, and then we will probably see another move lower, with silver declining more than miners. That would be in tune with how the markets initially reacted to the Covid-19 threat.

However, we are not married to this outlook. Gold moved to almost $1,900 and starting from this level instead of $1,700 or so and moving to $1,400 would imply a decline almost twice as big now. Consequently, there is a chance that the decline to $1,700 is all there we'll see, before the PMs move higher.

How will we tell, which scenario is more likely? Based on the way different parts of the precious metals sector react to the decline and to the initial rebound. If silver catches up with the decline when gold moves to $1,700, but miners lead on the way back up (strongly so), it will be more likely that the bullish scenario prevails. If we see the opposite - miners are weak during the rebound and silver doesn't catch up with the decline once gold approaches $1,700, the bearish case will prevail. Anything in between will require additional confirmations and we will keep our subscribers updated in any case.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is very positive in the long run, but it doesn't make the short-term decline unlikely. In the very near term, markets can and do get ahead of themselves and then need to decline - sometimes very profoundly - before continuing their upward march.

Summary

Summing up, the extremely overbought reading from the Gold Miners Bullish Percent Index and the individual price moves (including silver's powerful upswing) make the current case very similar to the 2016 topping pattern, and other important indications (especially gold's and USD's long-term cycles) point to likely - sizable - decline in the following several weeks. Miners' relatively weak performance relative to gold and (especially) silver suggest that miners are about to move visibly lower.

Naturally, everyone's trading is their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

Also, since we plan to adjust our positions when gold moves to $1,700 or so, we are moving the exit levels for the current trading positions in miners closer to the current price.

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $32.02; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $28.73; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $21.22; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager