Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Let’s start today’s analysis with a question that I just received:

Now that gold, silver and the miners are oversold, what kind of a bounce do you expect? Why not take profits and re-short at a higher level?

Well, I’m fine with everyone using my opinions on the market in any way they see fit (as long as they are not viewed as “investment advice”, that is). This means that one is free to take profits now and re-open the short positions at higher levels after a rebound… that is, if a rebound does indeed take place and one is realistically able to get back in their short positions at higher prices.

The question starts with an assumption that gold, silver, and miners are oversold, and that I expect a bounce.

But are they indeed oversold?

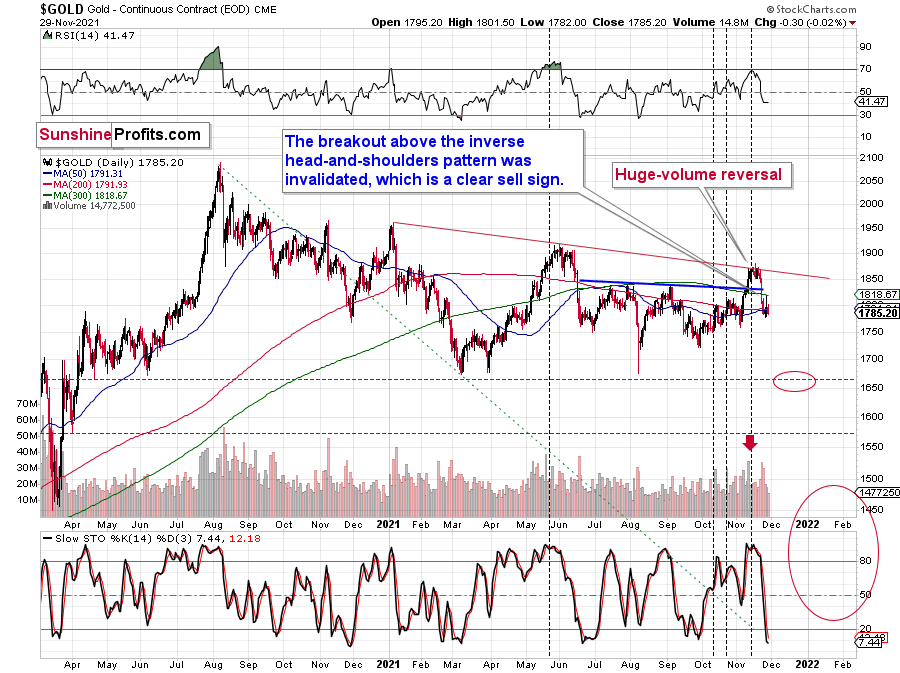

The Stochastic Indicator based on gold (lower part of the above chart) moved below 20, so it is in the oversold territory, but the RSI (upper part of the chart) is slightly above 40, and only levels below 30 are viewed as oversold.

Is the Stochastic Indicator reliable enough to trigger a rebound on its own? Well, it might or might not be the case. In January 2021, the move below 20 in Stochastic triggered a small rally, and the same happened in late February, but the corrections were not very significant. In early March, when the indicator moved below 20, the decline still continued.

Gold’s price is slightly above the previous highs, and it’s trading close to its 50- and 200-day moving averages. That’s quite a normal performance.

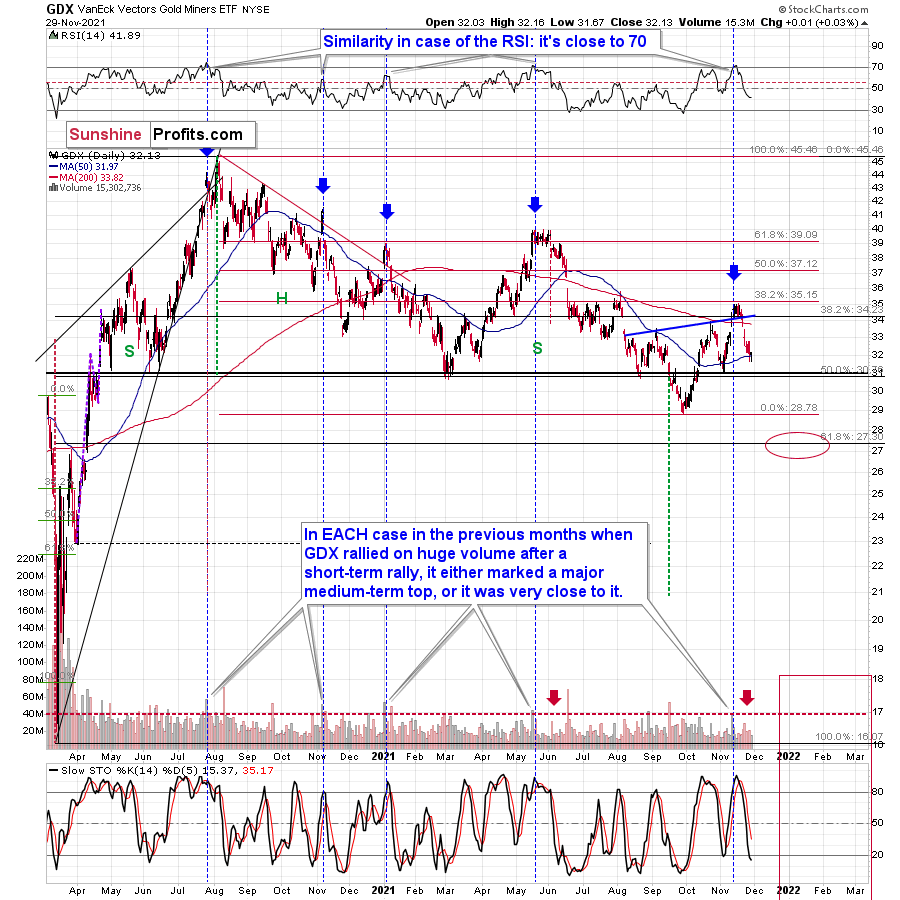

Given that gold-based RSI recently touched the 70 level and then gold declined sharply, the current situation is similar to what we saw in January 2021. Gold was also trading close to its 50- and 200-day moving averages at that time. The pullbacks were relatively small in the case of gold, and… they were even smaller in the case of mining stocks.

The very short-term back and forth movement that we saw in January wasn’t really worth trading – the risk of not being able to get back in at higher prices was too big. It seems to be quite high also at this time, especially when we consider what’s going on in the stock markets. And yes, I mean stock markets, not just one. Let’s take a look at “world stocks”.

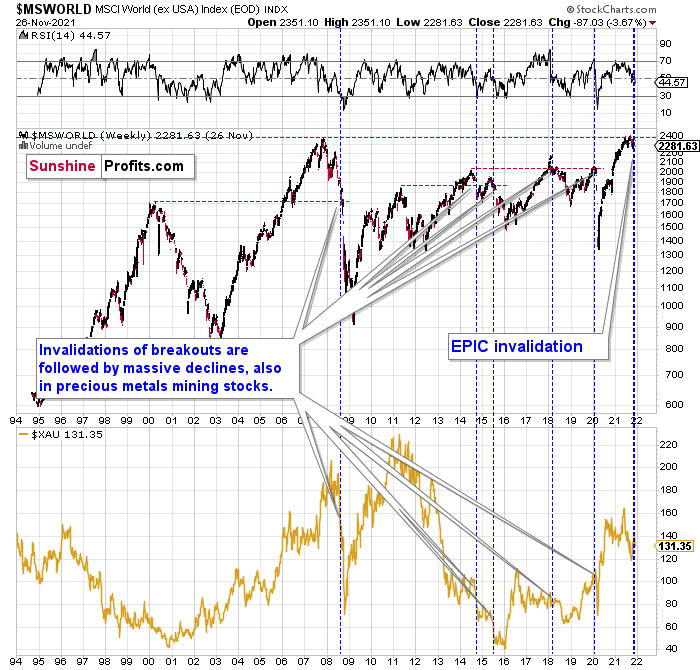

In the chart below, you’ll find the Morgan Stanley Investment International (MSCI) index on world markets, excluding the USA.

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium- and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in the mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not “logarithmic” scale. You probably still remember how significant and painful (if you were long that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

What does it mean? It means that it is time when being out of the short position in mining stocks to get a few extra dollars from immediate-term trades might be risky. The possibility that the omicron variant of Covid makes vaccination ineffective is too big to be ignored as well. If that happens, we might see 2020 all over again – to some extent. In this environment, it looks like the situation is “pennies to the upside and dollars to the downside” for mining stocks. Perhaps tens of dollars to the downside… You have been warned.

Having said that, let’s take a look at the situation from a more fundamental angle.

The Monetary Fork in the Road

With the EUR/USD accounting for nearly 58% of the movement of the USD Index, the currency pair’s influence on the dollar basket is material. However, with the dove-hawk gap between the ECB and the Fed continuing to widen, the USD Index should shine well into 2022.

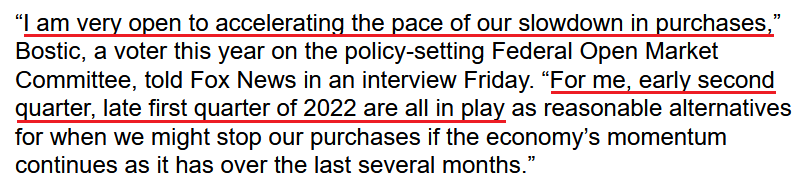

To explain, while the latest coronavirus strain spooked investors on Nov. 26, Atlanta Fed President Raphael Bostic (a voting FOMC member) reiterated his call for an accelerated taper.

“We have a lot of momentum in the economy right now,” he said. “That momentum, I’m hopeful, will be able to carry us through this next [COVID-19] wave.” And while he added that his preference “is predicated on the idea and the notion that the new variant is similar to Delta,” he concluded:

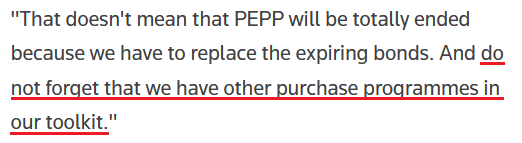

On the flip side, ECB President Christine Lagarde said on Nov. 26 that PEPP purchases would likely end “early next year.” However, this was expected as the purchase program will reach its already disclosed limit. Despite that, though, Lagarde still isn’t ready to wean the Eurozone off of QE, and she said that the revolving door of stimulus should continue to turn:

As a result, what a difference a month makes.

Per Bloomberg on Oct. 19:

Per Reuters on Nov. 25:

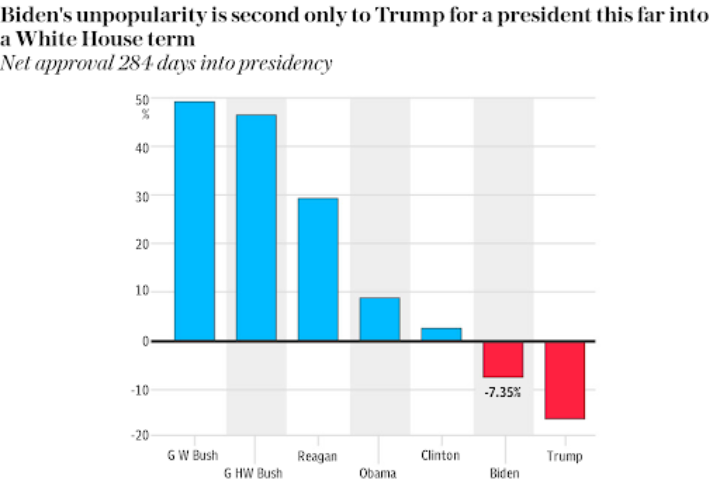

To that point, the Fed’s hawkish rhetoric/policy has more room to run. For example, I’ve highlighted the inflationary conundrum that’s confronting U.S. President Joe Biden. In a nutshell: surging inflation has pushed U.S. consumer confidence to a 10-year low. In turn, Biden’s net approval rating is the second-lowest ever 284 days into a presidency.

Please see below:

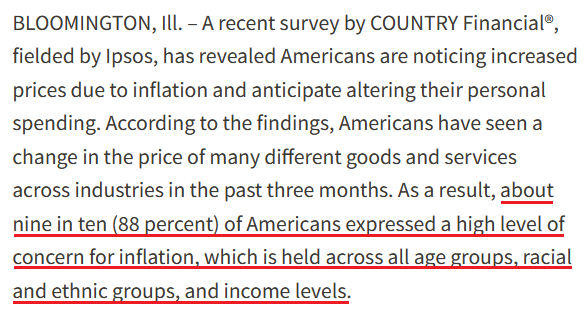

Thus, if the inflationary issues aren’t rectified, demand destruction will likely push the U.S. economy into recession. As evidence, COUNTRY Financial – a U.S. insurer that operates in 19 states – released its Financial Security Index Report on Nov. 11. An excerpt read:

“As inflation rapidly affects everyday life, Americans are being forced to reckon with cutting back spending as the holiday season approaches, and, moreover, postpone costly plans that have been in the making as the nation recovers from the COVID-19 pandemic.”

On top of that:

“Approximately 85 percent of respondents noted hearing topics around inflation over the course of the past three months. Three in five say they have heard a lot about inflation (58%), and about one in four have heard something although they may not be sure what (27%), while 3% are not familiar with inflation.”

As a result:

For context, while this is not a shocking revelation, please remember that politicians pay close attention when consumers’ financial concerns go mainstream. Thus, after reappointing Jerome Powell as the Fed Chair on Nov. 22, it’s no surprise that Biden said the following on Nov. 26:

“I have talked to the Fed about a whole range of things from monetary policy to inflation, and I have confidence that the appointees I’ve made, and I’m going to have three more, are going to reflect that concern.”

The Looming Omicron Threat

Furthermore, while Powell will testify before the Senate Banking Committee on Nov. 30, he should state in his prepared remarks:

“The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation. Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.”

To that point, with more potential disruptions poised to destabilize supply chains further, the dynamic will likely intensify the inflationary pressures. As a result, Biden should put more pressure on the Fed, which, in turn, is fundamentally bullish for the USD Index.

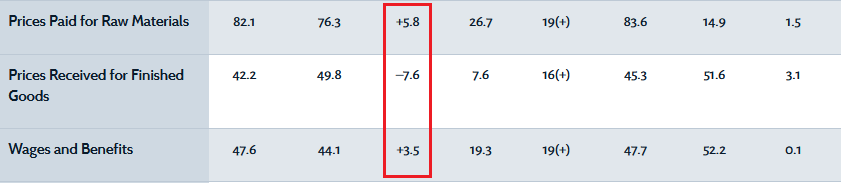

As further evidence, the Dallas Fed released its Texas Manufacturing Outlook Survey on Nov. 29. And while the headline index increased from 18.3 in October to 27.4 in November, the prices paid index hit a new all-time high. The report revealed:

“Prices and wages continued to increase strongly in November. Amid widespread supply-chain disruptions, the raw materials prices index pushed up six points to 82.1, hitting a new series high. The finished goods prices index eased off its high last month, falling eight points to 42.2 but still far exceeding its historical average of 7.6. The wages and benefits index came in near its own series high, edging up from 44.1 to 47.6.”

Please see below:

On top of that, while I’ve been warning for months that surging rents would uplift the Shelter Consumer Price Index (CPI), the latter’s 3.5% year-over-year (YoY) increase in October was a new 2021 high. And with more room to run, recurring hawk talk from the Fed should help solidify the USD Index’s uptrend.

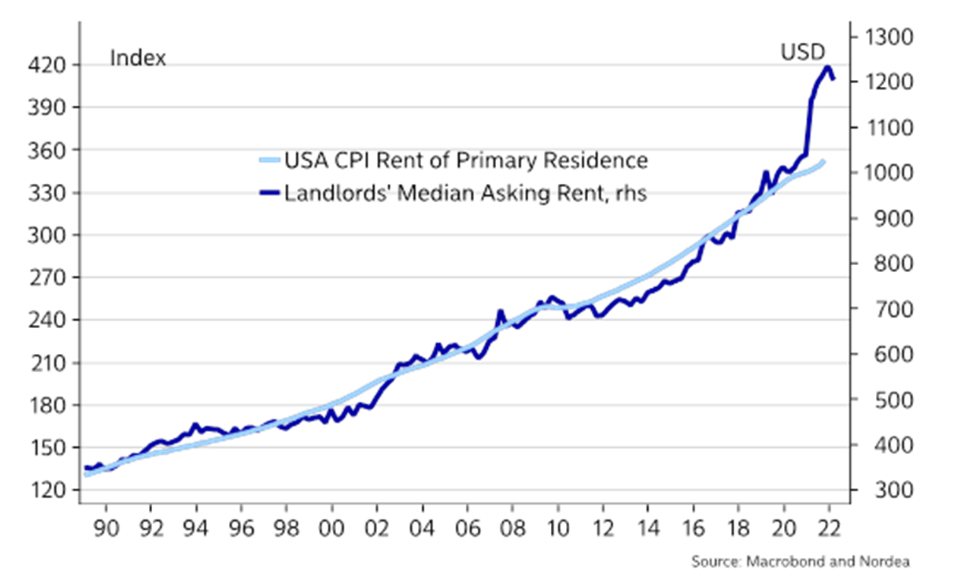

Please see below:

To explain, the dark blue line above tracks the Landlords’ Median Asking Rent Index, while the light blue line above tracks the Rent of Primary Residence CPI Index. If you analyze the material gap on the right side of the chart, you can see that government-reported rents still have plenty of catching up to do. As a result, if the Fed doesn’t act, the negativity confronting the Biden Administration will likely accelerate in 2022.

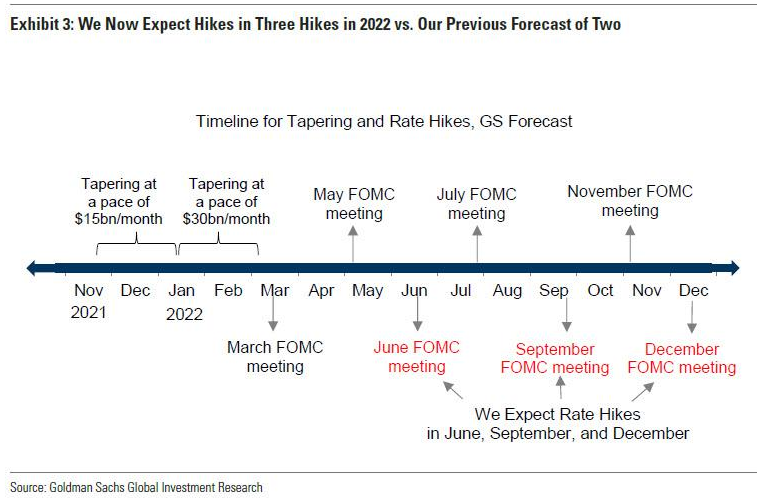

Finally, while the latest coronavirus strain could derail the forecast, Goldman Sachs expects the Fed to shift from hawkish rhetoric to hawkish policy in the coming weeks. To explain, the FOMC’s next monetary policy meeting is on Dec. 14/15. And with Bostic, Clarida and Waller (all voting FOMC members) advocating for a faster taper, Goldman Sachs’ team led by Jan Jatzius, expects the Fed to double the taper pace at its December meeting – from a reduction of $15 billion per month to a reduction of $30 billion per month.

Under the scenario, “the FOMC would announce the final two tapers at its January meeting and implement the final taper in mid-March, several days before the March FOMC meeting.”

On top of that, with inflation now in Biden’s crosshairs, Goldman Sachs expects three rate hikes by the Fed in 2022 – starting in June, then in September, and then in December.

Please see below:

The bottom line? With coronavirus uncertainty abound and the Fed hawked up, the USD Index is poised for further gains over the medium term. With Biden realizing that his presidency may hinge on solving inflation, Powell has essentially been given the green light to calm the pressures. Additionally, with a stronger U.S. dollar and higher U.S. Treasury yields akin to fundamental Kryptonite, Biden’s success will likely come at the PMs’ expense.

In conclusion, the PMs were mixed on Nov. 29, and silver was a noticeable laggard. While I warned on Nov. 16 that the odds of a precious metals’ ‘flash crash’ have risen materially, last week’s sell-off highlighted the PMs’ frail fundamental outlook. As a result, it will likely be a cold winter for gold, silver and mining stocks.

Overview of the Upcoming Part of the Decline

- It seems to me that the current corrective upswing in gold is about to be over soon, and the next short-term move lower is about to begin. Since it appears to be another short-term move more than a continuation of the bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

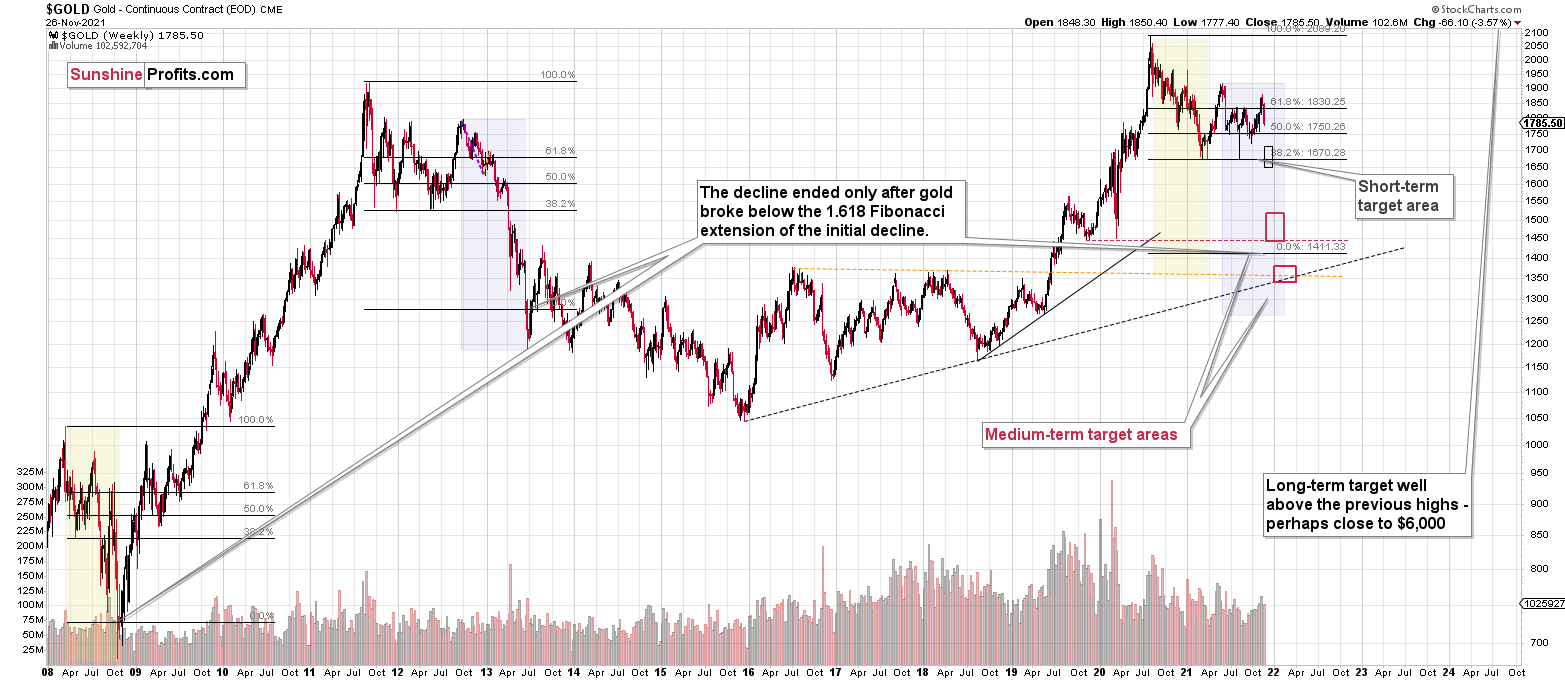

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty. I expect the final bottom to take place near the end of the year, perhaps in mid-December. It is not set in stone that PMs have to bottom at that time. If not then, then early 2022 would become a likely time target.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops. The additional confirmation will come from the tapering schedule, as markets are likely to move on the rumor and reverse on the fact as they tend to do in general.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, gold declined in tune with my long-term-based indications, and the medium-term downtrend appears to have resumed. Based on the analogy to 2013 and other factors, a bigger decline in gold appears to be just around the corner (regardless of what happens in the very near term).

If the new Covid-19 variant makes the vaccine rather useless, we might be in for very wild price moves in most markets. In the case of the precious metals sector, the initial move should be to the downside, but at the same time, it makes the long-term outlook even more bullish.

It seems that we might see a short-term bottom close to the middle of December, and perhaps that’s when gold will move to its previous 2021 lows. However, I don’t think that it would be the final bottom. Conversely, it seems that the final bottom would form lower after a short-term correction (from the above-mentioned December lows).

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief