Briefly: in our opinion, full (150% of the regular size of the position) speculative long positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert. In other words, we are increasing the size of our current long position.

Gold broke below the key support line yesterday, but some may say that this breakdown is rather irrelevant because mining stocks showed strength by moving higher despite this seemingly bearish development. Would they be correct?

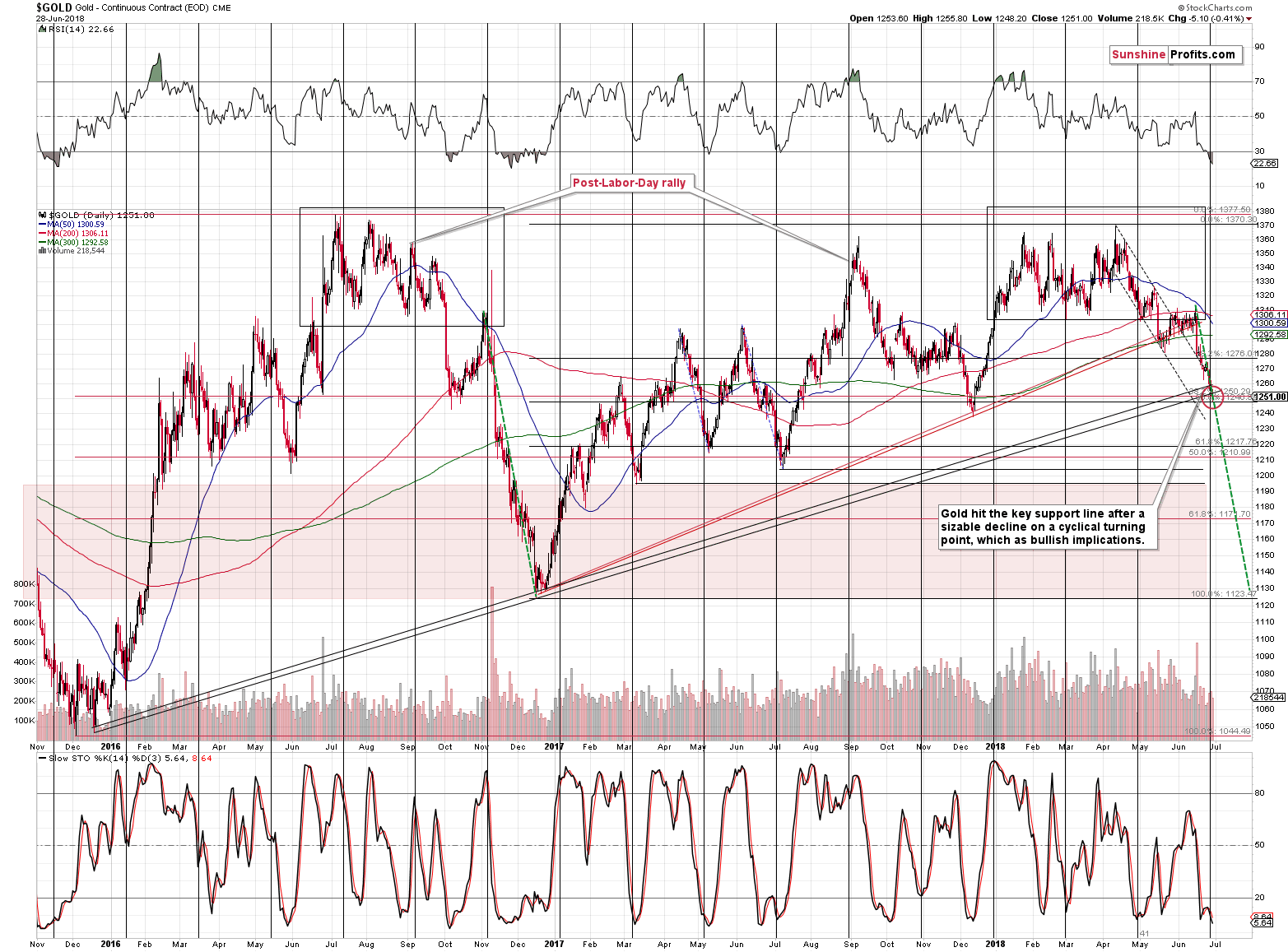

Yes, but not entirely. We wouldn’t call the breakdown irrelevant, but it’s not particularly important yet. And the odds are that it will not become important at all. Mining stocks’ strength is one thing, but one needs to keep in mind that the breakdown in gold is not confirmed. Moreover, gold reached other important support levels and it remains within our target area. Let’s take a closer look at gold’s chart for details (charts courtesy of http://stockcharts.com).

Gold moved lower, but that didn’t change much as it remained inside of the red ellipse, which is our target area. The reason that we featured a target area instead of just saying that gold is likely to bottom right at the rising support line was the proximity of two other important support levels:

- The 38.2% Fibonacci retracement level based on the 2015 – 2016 rally ($1,250)

- The 50% Fibonacci retracement level based on the late 2016 – 2018 rally ($1,246)

Gold moved to $1,248 on an intraday basis and closed at $1,251. This means that gold didn’t really break below the price levels it was likely to reach during this downswing. It moved just a little below the rising support line, but since this breakdown was not confirmed, it’s not that important. In fact, we expect this move to be invalidated shortly.

Speaking of support levels, we noticed that it is quite often the case that the Fibonacci retracements usually work on an intraday basis, while support and resistance levels are more likely to work in terms of closing price terms. The current situation seems to be quite in tune with this observation.

All in all, since gold moved to its support levels very close to its cyclical turning point and the RSI indicator points to a very oversold condition, the implications for the short run are very bullish.

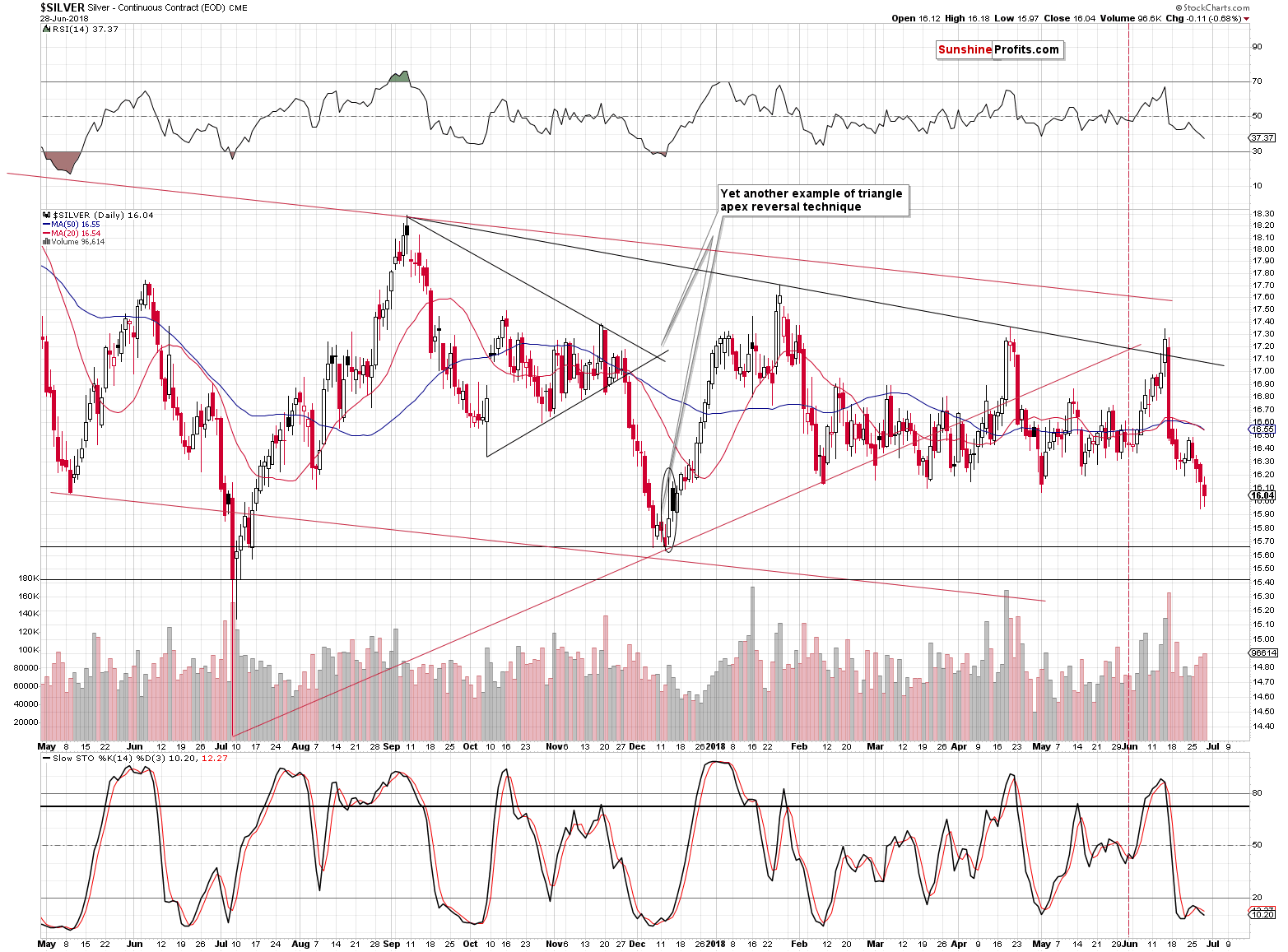

Gold’s sister metal moved a bit lower in terms of the closing prices and it more or less tested the previous lows in intraday terms. Since there was no major breakdown and silver still reversed before the end of the session, it simply emphasizes the implications of the previous analogous session. The implications thereof were bullish and they are also bullish today.

Just because silver didn’t rally immediately after the bottom doesn’t mean that the implications are any less bullish. Please note that something similar took place in the first half of February, earlier this year. Back then, it took silver 3 days to really bottom, but when it did, a sharp rally followed and it was about $0.80 higher in just 4 trading days.

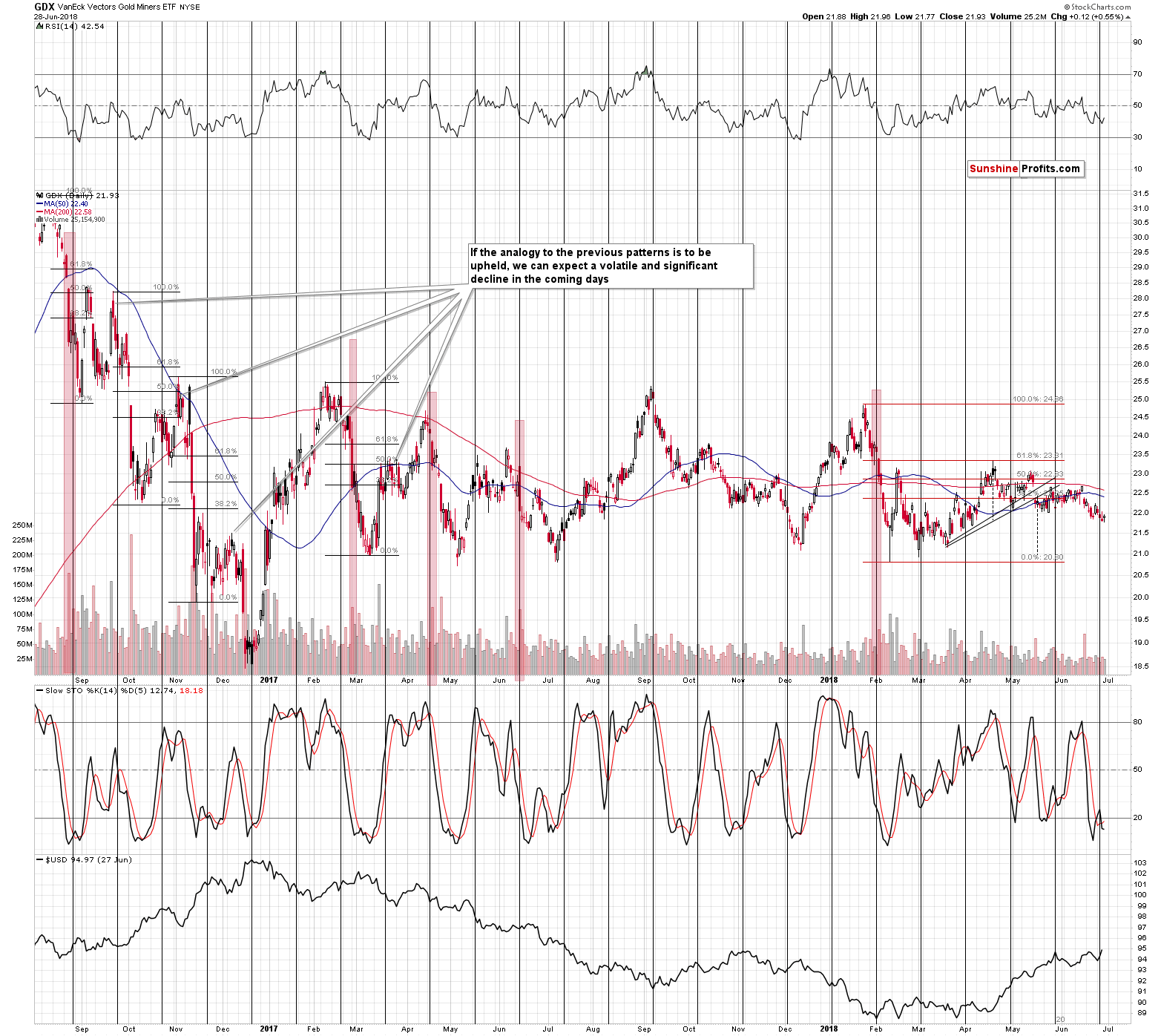

While gold and silver declined a bit, mining stocks managed not only not to decline. They actually closed yesterday’s session higher despite the obvious negative impact from the underlying metals. GDX was up by $0.12, which is nothing to call home about on its own, but when we compare it to the performance of gold and silver, it becomes a strong bullish confirmation.

Summary

Summing up, gold and silver reached our downside targets very close to several reversal dates and it was accompanied by numerous bullish confirmations, which makes the current short-term outlook very bullish. The medium-term outlook remains bearish, but there are so many bullish signs for the short term that we think that a temporary long position is justified anyway. In fact, based on yesterday’s another confirmation of strength in the mining stocks that managed to rally despite a move lower in gold and silver, we decided to increase the size of our speculative trading position to 150% of the regular size of the position and we are moving the stop-loss levels for silver a bit lower.

Also, finance.yahoo.com reports yesterday’s intraday low for silver at $15.97, but kitcosilver.com’s low for yesterday was $15.87, which is 1 cent below our stop-loss level (this level was not reached for the USLV ETN, though), so if your position was automatically closed yesterday, we think that re-opening it today is justified from the risk to reward point of view, as the outlook is even more bullish than it was previously.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full long positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,278; stop-loss: $1,239; initial target price for the UGLD ETN: $10.19; stop-loss for the UGLD ETN $8.97

- Silver: initial target price: $16.54; stop-loss: $15.88; initial target price for the USLV ETN: $9.97; stop-loss for the USLV ETN $8.78

- Mining stocks (price levels for the GDX ETF): initial target price: $22.39; stop-loss: $21.47; initial target price for the NUGT ETF: $25.36; stop-loss for the NUGT ETF $21.84

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $32.97; stop-loss: $31.58

- JNUG ETF: initial target price: $14.38 stop-loss: $12.38

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The global debt is larger than before the Great Recession. As U.S. yields climbed in recent months and dollar has appreciated, we cannot ignore the debt threat any longer. We invite you to read our today’s article about the enormous global pile of debt and find out how strongly the debt crisis threatens us.

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold rebounds on profit-taking, dollar, but seen vulnerable

China central bank revises up end-May gold reserves value to $77.323 bln

=====

In other news:

Fed Test Slaps Wall Street Titans While Unleashing Record Payout

Euro zone inflation rises past ECB target on energy, food costs

Italy Secures Migration Package in Win for Populists From EU

Deutsche Bank Shares Pop Despite Fed Stress Test Fail, But Concerns Remain

Oil steadies as market tightens on lost supply

Bitcoin skids below $6,000, hits lowest level since November

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts