Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

In yesterday’s analysis, we discussed the breakdown in silver and how the white metal managed to close below the $15.43 level (July 2017 bottom) for two days in a row for the first time since early 2016. The move was not fully verified by the 3-day rule, though. Silver closed exactly at $15.43 yesterday, so the question is if the breakdown was just invalidated and thus should one be expecting a huge rebound.

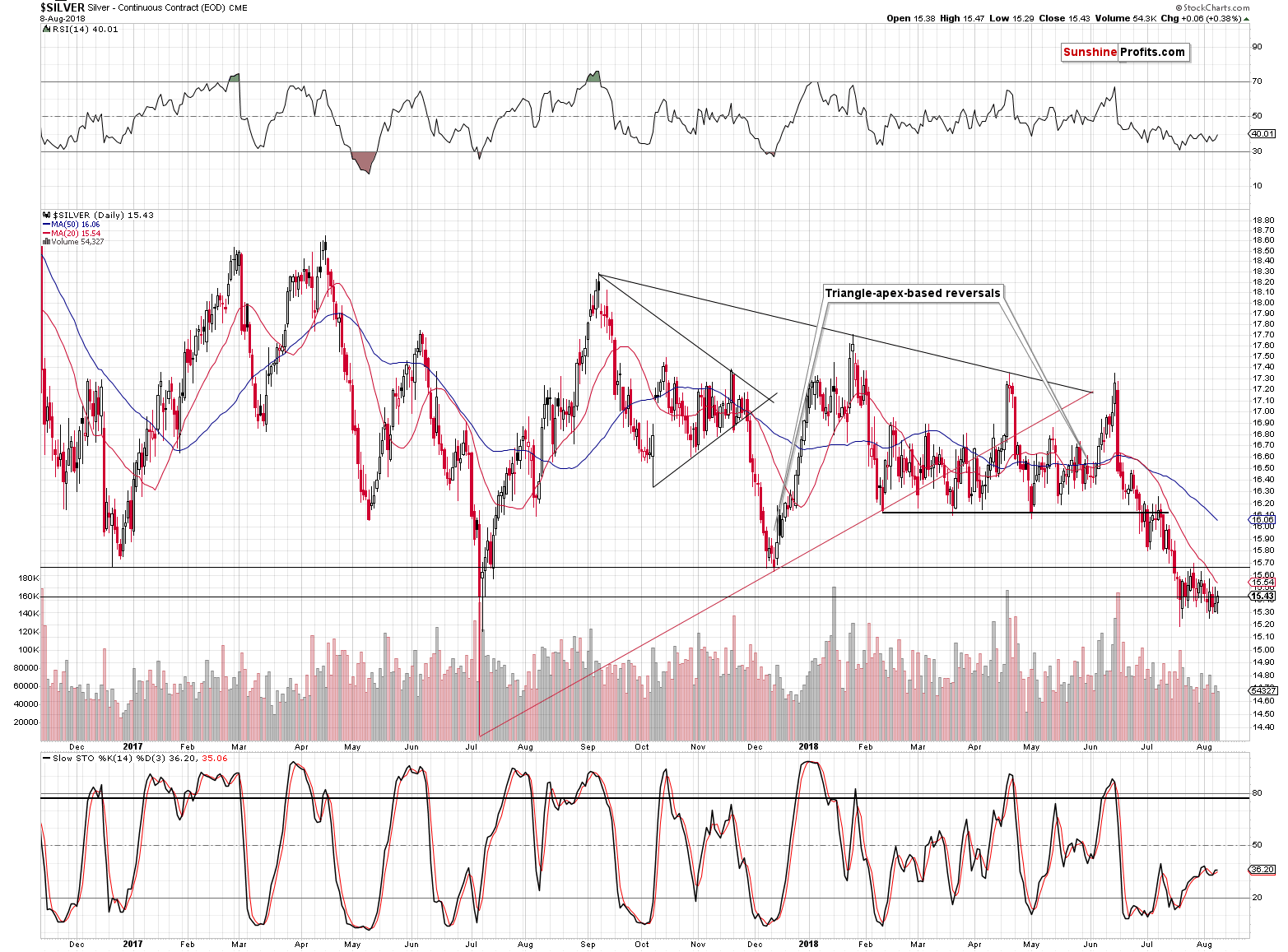

Let’s take a look at the silver chart for more details (charts courtesy of http://stockcharts.com).

As you can see, the white metal closed exactly at the July 2017 low, not even 1 cent above or below it. How should one interpret it? In our view, the implications of yesterday’s session are more bearish than bullish, but overall neutral and it’s best to ignore it. If silver closes below $15.43 today, the breakdown will be confirmed, if it closes above it, it will be invalidated. If the invalidation is significant, it will likely serve as a buy signal.

At the moment of writing these words, silver is down by $0.04, which supports the theory that the breakdown was not invalidated, and thus it was confirmed. Invalidations tend to be followed by rapid reactions. We are definitely missing it in silver. If the white metal wanted to soar from here, it would already be soaring, just like what happened after the sharp turnaround in July 2017. Nothing like that is happening and it seems that the decline has further to go.

Nothing else happened yesterday, so we don’t have much to comment on in today’s analysis, but there is one more thing that we would like to discuss – the analogy to 2013.

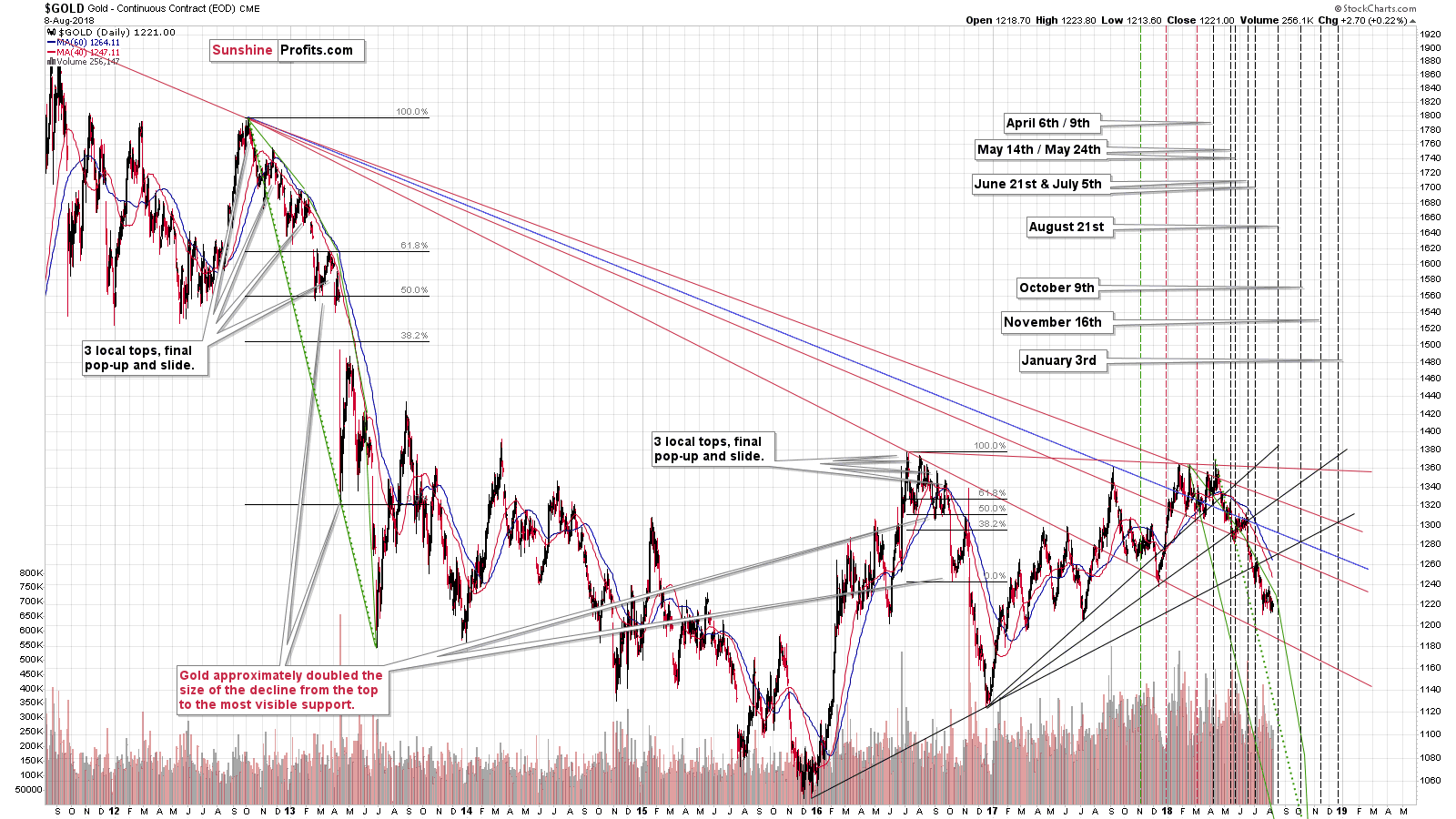

In particular, we’d like to recall the issue of shape similarity. Several months ago we created the green bow-like pattern that is based on how far gold declined during the 2012 – 2013 decline, and the distance between the particular local tops. We then copied it to the current situation, assuming that the February 2018 top is the starting point of the decline.

Now, we know that gold moved even higher (briefly, but still) in April and this top might have been the real starting point of the decline. Therefore, we added a green, dotted line to represent the decline. It’s important not only because of the implications for the final price / time target, but because of the fact that back in 2013, the first interim bottom formed when gold touched this line. This could be an epic trading opportunity and it’s something that influenced our decision to place binding profit-take orders close to the 2015 lows.

However, the reason why we are mentioning all this today is not the above, but the fact that if the analogy is up-to-date, then we are at the moment when the bow (lines based on the local tops) starts to decline at a greater pace. This is what we saw in early April, 2013 – right before the huge slide.

There are many signs pointing to “this is it, brace yourselves” scenario and the above is yet another confirmation thereof. Consequently, we are looking for bullish signs that would invalidate the extremely bearish outlook, but at this time it really seems best to be prepared for the next big slide in the precious metals sector.

Summary

Summing up, the outlook for the precious metals sector is extremely bearish and there are signs that we’re on the verge of seeing another big wave down and that the next local bottom is going to form in about 2 weeks. In other words, it seems that our sizable profits on the short positions are going to become even bigger shortly.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,272; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $46.38

- Silver: profit-take exit price: $12.72; stop-loss: $16.46; initial target price for the DSLV ETN: $46.97; stop-loss for the DSLV ETN $24.07

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $23.64; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $20.87

In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $34.82

- JDST ETF: initial target price: $154.97 stop-loss: $42.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Stocks were virtually flat on Wednesday, as investors took short-term profits off the table following the recent advance. Will the S&P 500 index continue its bull-run above the January record high of 2,872.87? Or is this some short-term topping pattern before a downward reversal?

More Uncertainty as Stocks Got Closer to January Record High

Are there more central banks than the Fed and the ECB? Oh, yes. Last week, the Bank of England raised rates 25 basis points. What does it imply for gold?

BoE Hikes for the Second Time since Lehman

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold stalls as strong dollar weighs

Yamana Gold names new CEO, creates executive chairman role

=====

In other news:

Europe's stocks wilt; U.S. sanctions slam Russia's ruble

Central Banks Push Aside Inflation Doubts as They Eye the Exit

Japan Bond Exodus Fears May Be Overblown, Regional Banks Say

Lira Falls to Fresh Record With No Letup in Turkey-U.S. Tensions

Musk's Tesla buyout plan could test Wall Street's nerves

Oil regains some poise after three percent drop

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts