Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In yesterday's analysis, we wrote the following on silver:

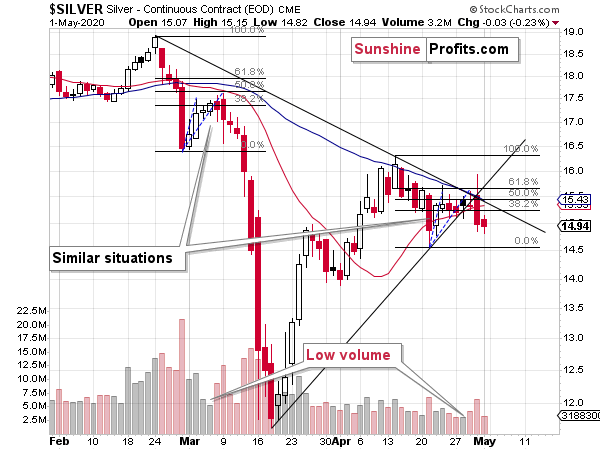

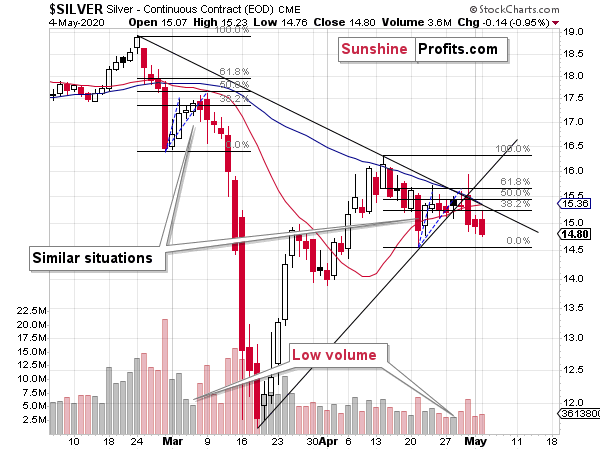

Speaking of similarities to the first half of March, silver is providing us with an excellent confirmation.

On Thursday, the white metal reversed and declined profoundly on relatively big volume - just like it had done on March 9th. In the following two trading days, it had moved lower, but just slightly so. This time, there was - so far - just one trading day after the big daily decline, and during this day, silver declined rather insignificantly - just like it did in early March. If the analogy is near-perfect, we'll see some back and forth trading also today without a bigger change (a lower close is likely, though). And then...

In March, silver then plunged, and it took the white metals just three more days to slide below $12 from about $17.

As the starting point for silver for now is approximately $15, could it slide to about $10 in just 3 trading days? While we don't want to say that it's inevitable, we do want to stress that the outlook is very bearish, and that a major decline is likely just ahead, even if silver doesn't slide again as fast.

... It seems quite possible, though.

That's exactly what we saw yesterday - some back and forth trading without a bigger change, and with a lower close.

The analogy to early March might not be clear in other markets, but it is clear in case of silver. The white metal is behaving practically identically as it did back then.

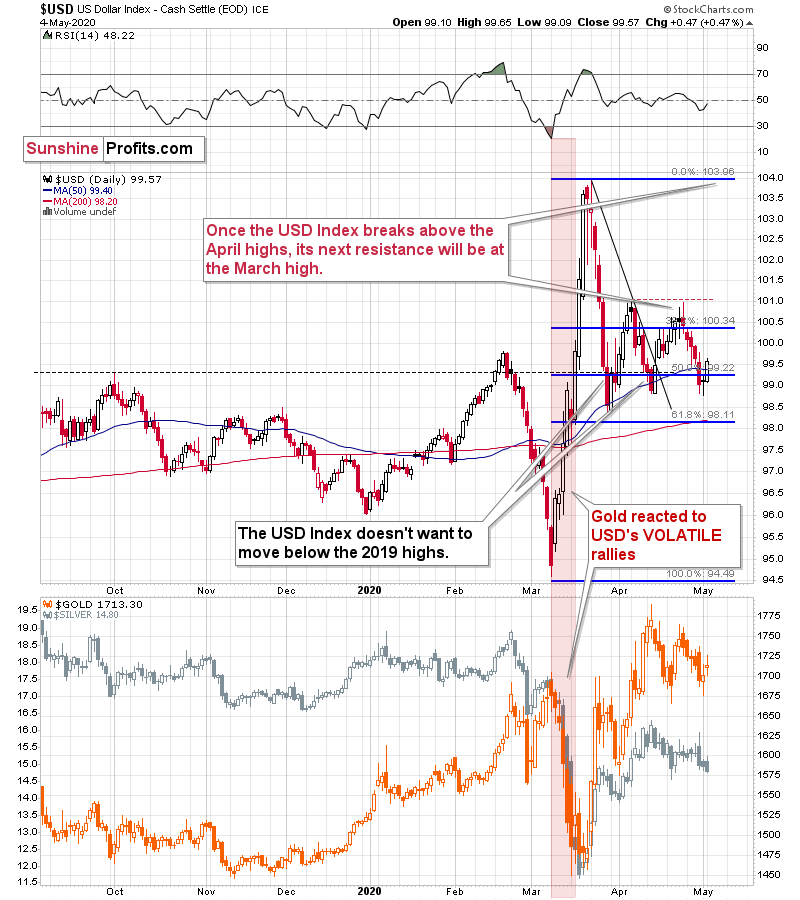

The analogy is not as clear in other markets as they seem to be repeating the early-March situation in a slightly different way. While parts of the intermarket dynamics remain intact, the difference in time at which they occur makes the picture rather unclear, at least at first sight.

The USDX Cues

The USD Index moved higher (invalidating the breakdown below the 50-day moving average), but not particularly sharply so it's little wonder that gold didn't plunge. But is it surprising that it moved higher at all? Once again, not really.

The price moves appear to be taking place at a slower pace right now, but they are similar, nonetheless. Back in March, gold declined with the USD Index for just one day, and this time they both declined for a several days. This time, gold corrected for two days, so by comparison, perhaps it corrected similarly significantly during the session? If so, then the analogy would remain present... And that was exactly what happened.

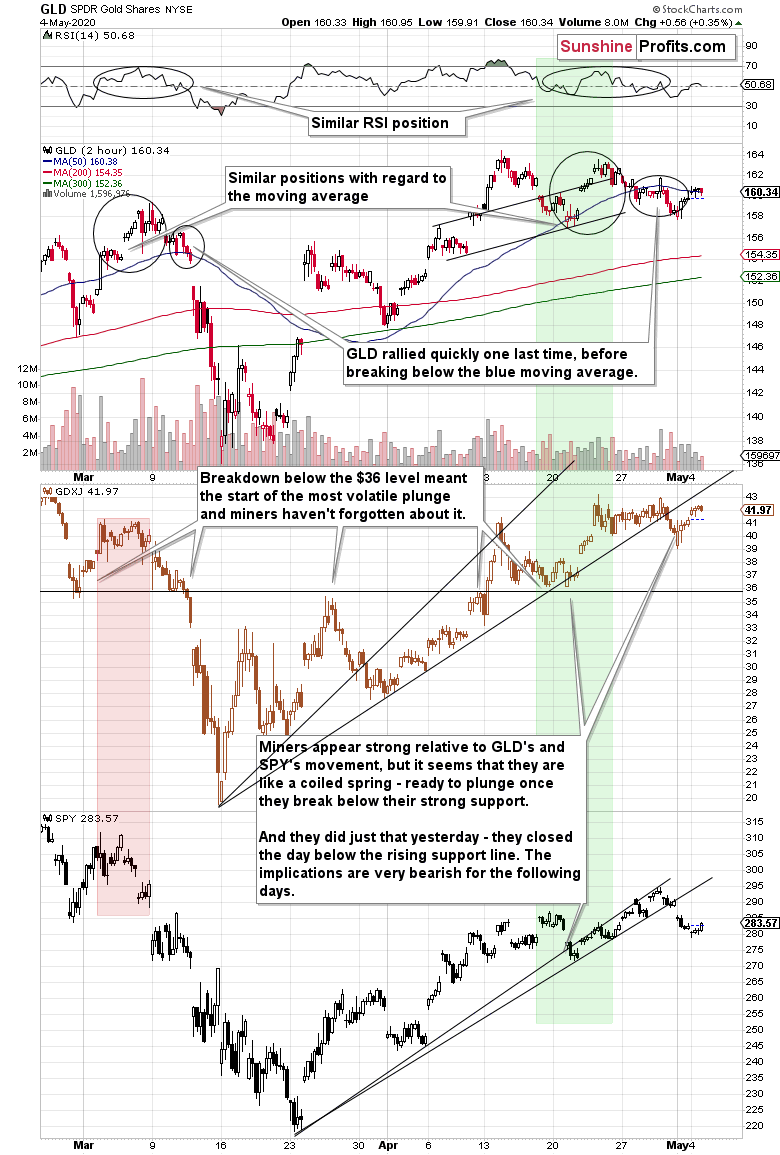

Looking at the above 2-hour gold chart, we see that gold's recent price movement resembles what the yellow metal did on March 11th and 12th. We connected the analogous highs and lows with black lines, and we used red, green, and black dotted lines to show you which levels were broken and which ones were not.

The March 11th and 12th consolidation took place around the level of the most recent low - marked with red dotted line. It started when gold moved below one of the recent lows (the higher one - marked with green dotted line), but not below the final of the recent lows (the lowest one - marked with black dotted line).

Back in March, this was the final pause before the big drop, so the implications of the above similarity are bearish.

Ok, so why the heck are miners so strong right now?

Again, the difference is in timing of various factors. Let's keep in mind that miners are not being traded for as many hours per day as gold futures are, even if we take the pre-market trading and after hours trading into account. Consequently, miners generally react to only a part of what's going on - they catch up to the overnight action sooner or later, but this could be enough to trick one into thinking that miners are moving strongly or weakly relative to gold, while in reality they are not. Comparing miners to the GLD ETF, which is trading during the same hours is useful in this case.

This chart currently shows two things that explain why miners are not lower yet.

- The GLD ETF closed yesterday very similarly to where it had closed in the final days of April, so it's not surprising that mining stocks did the same thing. Once gold futures plunge, GLD is likely to plunge as well, just like it did in March, which means that this factor is very likely only temporary.

- The stock market has only begun its slide and it's been doing more or less what it had done on March 6th. Namely, it declined early in the day, and then it moved back up before the end of the session. What did miners do on that day (middle part of the chart)? They also moved back up before the end of the day, but they magnified the upswing, since gold was topping then, not declining.

Given all these intricacies, it turns out that miners' performance was relatively normal after all. As gold turns lower, miners should head in that direction as well, and once both: gold and stocks plunge, they are likely to catch up with vengeance, just like they did between March 11th and March 13th.

From the Readers' Mailbag

Q: There is a GDX and GDXJ in the London stock market are they the same as the one in US? Will they behave similarly to the ones quoted on your alerts?

A: In short, yes, they are likely to behave similarly (declining and rallying at more or less at the same times). They are based on the same basket of mining stocks, but since they will be trading at different hours, their individual price moves will be slightly different. Moreover, the LSE shares will likely have more price gaps in them, as they will be quickly catching up with what GDX and GDXJ did on the US stock exchange on the previous day.

Q: After seeing Friday's disappointing action, is it still your opinion that miners are going to slide? It seems that the SPX to miners and Gold to miners link reacted in reverse Friday. Miners rose. What happened here? The USD did decline , however before the USD started to decline, Gold was down and SPX was down and yet miners took off and our shorts went down. What caused this action?

A: We wouldn't call Friday's action really disappointing - the analogy that we outlined remains intact, but not 100% exactly as we saw it initially. Since it's practically impossible to detect analogies with 100% accuracy right from the beginning, these adjustments are rather normal, not necessarily disappointing. We generally already replied to this question within the regular part of the analysis - the different moments of the analogy, plus hours at which different parts of the PM market trade, might make the very short-term price moves rather perplexing. Also, it's usually not possible to tell what caused an individual price move within the day. The only 100% true answer would be that more capital was on one side of the trade than on the other, but that is not informative at all. Sometimes, it's possible to get a good estimate of what might have caused a given move (say, a huge move in one market, or an epic real-world event), but this wasn't the case on Friday.

Q: in one of your recent e mails you mentioned a "must read" article. Sounded like it was more of an economic theme. Where can I find it? what was the title?

A: It's difficult to say, as we link to quite a few things and many of them are important. We'll provide a few links that come to our mind right now that could be what you're looking for:

- Explanation how confirmation bias works (important in: trading, estimating real news' impact, and in regular conversations)

- Explanation how myopic loss aversion works (important for trading - the default mind settings to avoid losses might work against you as mind doesn't "feel" the amount of the loss and will prefer one huge loss over a few tiny ones - your portfolio would much prefer the latter)

- Epic quarantine breach in Bangladesh - on a side note, there's almost constant growth in new daily cases (new daily increase record was just noted)

- Article discussing how grave the Covid-19 situation (and in general) is in Ecuador

- Gold in Time of Plague - the April Gold Market Overview discusses why the current situation is so bullish for gold from the fundamental point of view, and why gold is likely to soar in the following months (we still think that a big slide will take place before gold takes off, though). The fundamental discussion continues in the May edition entitled: Gold Performance During the Great Lockdown

However, if we had to name one must-read article, it would be the report to which we are linking from each and every Gold & Silver Trading Alert (the "portfolio" links in the description of trading positions) - the precious metals portfolio structure report. In particular, we encourage everyone to read the "position sizes" section that's in the second half of the report, as we have just updated it. Every now and then, we get questions regarding interpreting the 50%, 100%, or 250% position sizes of the regular trading position - what is the regular trading position and what it depends on? The above report discusses that, and it provides three examples in the "predefined portfolios" section.

Q: A recent article by a market analyst suggested that the Treasury was stepping in to hold down any sharp rises in the $. Do you think this is likely and, if so, would it alter your trajectory for the gold price?

A: This might be the case, but please note that other monetary authorities want their currencies to be trading lower as well, so ECB, BOJ, BOE, SNB, and other banks could take counter measures. They say that currency rates don't float, but that they sink at different rates. The above would represent exactly that - The Powers That Be racing against each other, who's going to devalue their currency faster. Ultimately, that's very positive for the price of gold, but... In the short run, we doubt that when the panic sets in, the authorities will be able to really prevent the price moves. History tells us that a group of speculators might even be stronger than a central bank. And a move triggered by an entire market of extremely scared people is unlikely to be capped by the Treasury. Again, this is all very bullish for gold in the long run, but in the short run, we think that gold will react just like it did in March - with a decline.

Summary

Summing up, the outlook for the precious metals market remains very bearish for the next few weeks. The general stock market seems to have already topped, which means that the bearish pressure on the mining stocks and silver is now likely to be much bigger than it was in April. Gold declined along with the USD Index last week, which has very bearish implications for the precious metals sector, because gold is likely to truly plunge once the USD Index finally rallies in a meaningful way. And it is likely to rally in a meaningful way, not only for purely technical reasons, but also thanks to plunging stock markets, and demand coming from the BRIC (and other) countries.

The above is particularly likely given multiple signs pointing to self-similarity between the current situation and what we saw in early March.

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-3 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (it's initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager