Last week the Reserve Bank of Australia surprised financial markets by raising its main interest rate to 3.25% from 3%, becoming the first G20 nation to do so as the global economy looks like it's beginning to recover.

The Australian move raised questions about which country would be next to raise its interest rates, with some analysts pointing to countries with similar resource-rich or export economies, such as New Zealand, Norway, and Canada.

This move also prompted questions from Sunshine Profits Subscribers who wanted to know what would happen to the value of U.S. Dollar, stock market, commodities, and most of all - prices of precious metals if the Fed increased rates overnight.

First of all, if you have been following the news, Federal Reserve Chairman Ben Bernanke sent a fresh signal last week that he is in no rush to reverse course and start boosting interest rates. The Fed, in its high wire act of jump-starting the economic recovery, has reiterated at every policy meeting since it lowered its rate to 0.25 per cent in December, that the key bank lending rate, now at a record low near zero, will probably stay there for an extended period. I personally also have a hard time believing that the rates would be increased in the near future.

But just for argument's sake, let's take a look at what would happen if the Fed did raise its rates.

If that were to happen, I would expect the short term consequences to be that the U.S. dollar would gain sharply, the stock market would decline sharply and commodities would also decline, with the decline being milder in case of gold.

The long-term reaction would be that the decline of the US dollar would be delayed, but not prevented. Interest rates are not the only thing that matters when the value of currency is concerned. In this case it's the ever-growing twin deficit that is the key issue.

A similar thing can be said about commodities, only the other way around. Credit contraction caused by the increase in interest rates would limit speculation, as a lot of speculative trades are done on margin - another form of debt. But in the end, the fundamentals, such as the massive economic development of the Asian nations, would cause commodities prices to increase over time.

The largest impact of interest rates hike would be on the general stock market, as interest rates are an important fundamental factor for most businesses. The economy is still much leveraged, as relatively cheap credit during the Greenspan era allowed companies to use much more capital than can be considered "safe". Using excessive amount of capital seemed like a good idea, as year after year money was cheap and the perception of risk associated with high interest rates seemed very low. The same goes for consumer spending and for the savings rate.

Several months after the not-so-recent increases of the interest rates in the U.S. (before 2007) we have seen the massive plunge in the general stock market, which can be attributed to a large extent to these increases. Companies' profits (and thus the stock prices) depend, to a large extent, on the cost of debt, as much of these companies' assets and operations are funded using debt.

Still, as of now, I view an increase in the interest rates very unlikely, precisely because of the devastating effect it would have on the stock market. I believe the 2007-2009 plunge that stocks are still recovering from scared the monetary authorities to the extent that they will now think twice (or more likely ten times) before they consider any increases in the interest rates. Even if it did take place soon, I would expect rates to be lowered again very soon after that.

There is one more thing that I would like to cover this week before moving on to the technical side of the market, and that is the situation in the junior sector. Gold stabilizes above the $1,000 level, silver is catching up, and so do big senior gold/silver producers, but the junior gold/silver producers/explorers seem to be left behind. Does it mean that the junior stock market is definitely dead or that one needs to wait for its comeback? I believe the latter is the case and that the extreme volatility of the junior mining stocks will once again become an advantage.

Before providing you with reasoning, please take a look at the following assumptions:

- Juniors are less likely to be held by institutional investors than individuals (mutual funds, for instance, often are allowed only to invest in big, senior companies),Generally, individual investors tend to depend more on emotions than financial institutions do.

Based on the above statements one might infer that the stock prices of these small junior companies would be highly dependent on the emotional status of the individual precious metals investors. This finding has very important implications.

Juniors are more volatile (!) than big, senior companies. Emotions cause big upswings to become even bigger, when people get euphoric and buy already overvalued stocks. On the other hand when stocks fall, juniors tend to fall harder as investors panic and dump even already undervalued companies. Therefore, bigger swings are to be expected in this sector.

Since we had just witnessed a massive plunge in virtually every asset class, the predominant emotion was fear. Taking into account influence the emotions have on the junior sector it is not that strange that they sold off heavily. Yes, the extent of the undervaluation is remarkable, but I expect this situation to improve greatly. Gold is trading above $1,000 and is getting ready (I'm not talking about short term here) to soar much higher. The prevailing emotion will be greed, not fear. This means that the emotional factor will now work in favor of the junior sector.

Keeping in mind the points raised above let's focus on what is often repeated when the structure of a bull market is discussed - "most individual investors are likely to enter the market at the late stage of a particular upleg". If most greedy (!) buyers are yet to enter the market and this is what drives the juniors, then we are currently in the very favorable juncture in this sector.

Therefore, if you were wondering whether to cut your junior positions or to increase it, I believe the answer depends on your risk preferences. If you are risk averse, I would enter the market right away (especially with our SP Junior Indicator that is about to flash a buy signal) - the risk is to be left behind while PMs move higher.

However, if you can bear some risk the best option here might be to wait for the likely pullback back to the $1,000 level / for the first part of the downswing in the general stock market, and monitor juniors' price action during the downswing. If they hold up strongly, it will be an "all aboard, we're going much higher!" signal.

Either way, if you already own juniors and are disappointed with their performance, please note that you know about the PM junior sector much before the other 99% of market participants, which will enter the market much higher (with gold over $1,500 or so) the biggest gains are yet to be made.

As far as juniors are concerned, I've already written it in the Key Principles section, but let me emphasize once again that I believe diversification among many juniors is very important. If you own just one stock it may provide you with astonishing gains (like Aquiline Resources, Inc. - AQI.TO which is up 90% since I featured it in our Top Juniors tables two weeks ago), but the emotions involved in owning just one stock, and company-specific risk make the long-term success of your portfolio unlikely in this case. Taking the realistic approach, it is better to own many valuable stocks, which are very likely to provide you with gains in the following months and years, instead of betting on any single company.

Speaking of structuring your portfolio, it is generally a good idea to rebalance your portfolio on a regular basis (monthly or at least quarterly if your perspective is long term). So, if you purchased a stock and then you see that it is not in our list (say, for two months in a row), then it may be profitable to sell this company and purchase one from our top companies. The same goes for the senior gold/silver companies. In this case I suggest using our leverage calculators to create ranking according to your preferred investment time frame.

Moving on to the technical side of the market, let's begin with charts (courtesy of http://stockcharts.com) featuring gold in several key currencies along with the previously featured non-USD version.

Gold

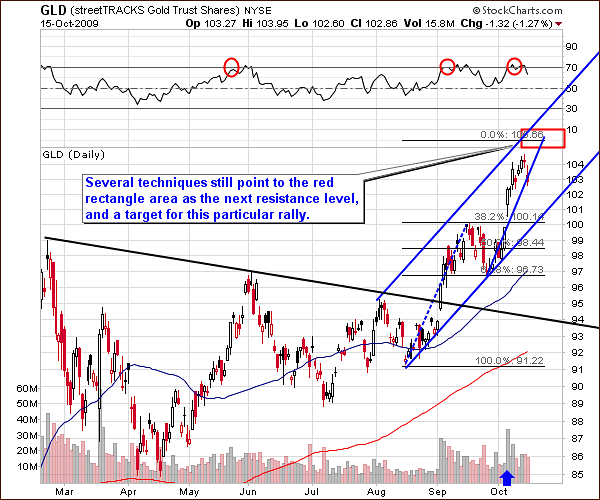

Taking the popular, but still rather reliable, RSI into account, we may be at the local top or (more likely taking the previously mentioned targets into account) a few days before it. Please note that in mid-September the value of this indicator hovered around the 70 level for a few weeks before the top emerged.

The other indicator included in the above chart - the Stochastic indicator is one of the useful tools for timing bottoms in gold (its reliability for estimating local tops has been limited in the past), but since we are not near one, I will not analyze it deeply today.

Moving on to the non-USD (gold:UDN ratio) chart of gold we see that metal’s value is not yet above it’s previous highs. UDN is the symbol for PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of dollar's currency exchange rates with world's most important currencies, the gold: UDN ratio means the value of gold priced in "other currencies".

Gold didn't break past its previous high in the recent months, but that is not the same high that one looks at when viewing the price of gold in the U.S. Dollar. The March 2008 high that was the top that gold broke above in USD, but taking other currencies into account - it has already broken this level in January. Consequently, the non-USD gold chart differs from its USD counterpart but is just as bullish. After all, price broke higher almost a year earlier and has verified that breakout a few times over several months, which means that it is now set to rise higher, most likely above its 2009 high.

The Relative Strength Index is at the overbought level in the long-term perspective, but this does not concern me. The reason is that it is not the first time that it reaches the 70 level after a multi-month consolidation - please take a look at September 2007 and the way RSI shaped at that time - I've marked it with a black ellipse. It's been overbought for about a month before a temporary (!) top emerged. Therefore, taking the historical context into account, the normally bearish implications of the RSI at 70 don't really apply here.

Two above charts are very similar and it is not without a reason. Since the biggest component of the USD Index is the USD/EUR exchange rate, the USD Index trades in a similar fashion to the USD/EUR exchange rate. Consequently UDN fund trades in the opposite direction to this currency rate, which causes the gold: UDN (non-USD gold) to trade in a very similar way to gold priced in Euros.

Since that is the case, the points made while commenting on the previous chart apply also to this chart. In short - it's bullish for gold.

The second biggest component of the USD Index is dollar's exchange rate with yen, so let's take a look at price of gold in this currency.

The value of gold in yen doesn't have as clearly defined trend as it was the case on the previous charts, but it doesn't mean that the implications of this chart are bearish. In fact, while we don't see a rising trend channel, we do see another bullish pattern. The cup-and-handle pattern, whose handle has been forming since late February 2009 has the same bullish implications as the analogous pattern had on silver market - I wrote about it in April, when silver was at $12. Keeping in mind the "the longer the base, the stronger the move" rule, one might infer that the rally following breakout of the current handle will take the price of gold in yen much higher, probably above the previous highs.

The three declining resistance lines have been broken, thus increasing the odds of further gains. As far as the RSI's overbought signal is concerned, the situation is once again similar to the one in September 2007 - the normally bearish implications don't seem to apply to this ratio.

The third biggest component of the USD Index is the pound.

The above chart confirms the assumptions made earlier - gold is rising in all currencies, but the shape of the bull market is different from the non-USD point of view. The first (61.8%) Fibonacci retracement level has been verified as support this summer and gold broke out of the declining trend line in late August. It's been rising since that time, but that does not necessarily mean that a drop is looming - as you may see on the above chart, the previous rallies were not really volatile, so this is what I expect also this time.

Moving on to the Canadian Dollar, we see another beautiful rising trend channel.

From the long-term point of view, the price of gold in CAD is rising as well. Although it has not been the case during the last few months, the trend is clearly up. I've used even longer time frame above than was the case in the previous chart to show you that the beginning of year 2006 marked an important milestone on the precious metals market. From that point gold has been rising in all currencies, not only in the U.S. Dollar. By the way, this is one of the reasons that we use data from the 2006-today time frame in several of our tools.

One more currency that I would like to feature this week is the Australian Dollar.

The situation in gold priced in AUD is similar to the one in gold priced in GBP - the trend is clearly up, however in case of the Australian Dollar, the price of gold has even more upside potential, as it is still far from the upper border of the trend channel.

The current consolidation is stable, even to the point that it seems that the price of gold in AUD has been going nowhere in the past several months, but putting things into perspective sheds light of encouragement. The analysis of the previous consolidations and subsequent rallies reveals that once gold in AUD finally moves, the move can be really rapid, thus more than making up for the previous apathy. For details please consider the action that took place a year ago, when gold soared very quickly.

Summing up, gold's performance in AUD has been disappointing in the previous months, but investors, who patiently keep their long-term holdings intact, are like to reap big gains in the future. Taking into account the amount of time that gold has been consolidating it seems that we will not have to wait long.

Speaking of metals in the non-USD perspective, let's turn to silver and check if the long-term bullish picture is also present on in the white metal

Silver

The chart of silver is not that bullish, as it is the case with gold, because there is no visible rising trend channel - the situation is somewhat similar to the one on the gold in yen chart. Silver broke past the three declining resistance levels and is now testing the breakout above a less significant resistance. Since the importance of this level is relatively small, even if silver moves once again below it, I would not be concerned about the long-term implications. In other words, unless silver:UDN ratio breaks below the 0.56 level (the thick declining support line) - and I don't expect that to happen - the chart still remains bullish.

The late-February - today consolidation may be seen as flag pattern, which means that the rally following the breakout is likely to take the ratio much higher - taking into account the size of the October-2008 - February-2009 move preceding the consolidation. In this case the target would be above 0.75 - above the 2008 high. Naturally, I expect this to mean higher silver prices in USD as well.

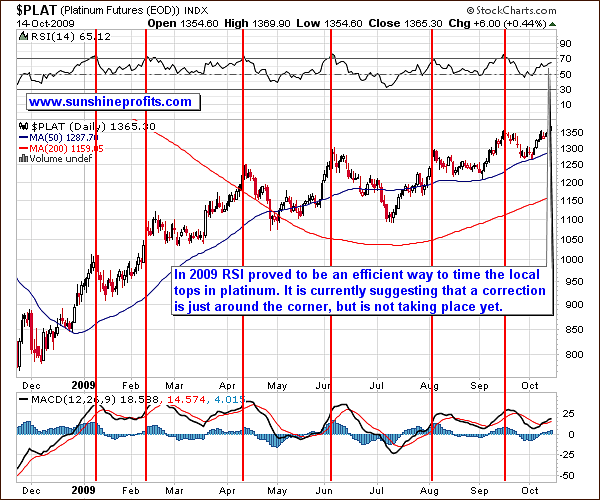

Last week I analyzed the platinum market as a tool in predicting tops in the whole sector and since I received positive feedback after that I will proceed with a follow-up on that topic.

Platinum

As I mentioned in the previous update, the platinum market has been topping along with signals from the RSI indicator, and the reliability of this particular tool has been remarkable on this particular market. Although metals moved slightly lower this week after a few days of rising prices the RSI is not suggesting a top just yet. The risk of a temporary downturn is high here but the precise signal was not yet given.

The same can be said based on the short-term gold chart.

Please note that during the final part of the early-September rally gold moved back and forth a couple of times before finally forming a local top. It seems that this may be the case also here. The Relative Strength Index has moved lower from the overbought territory, which some investors use as a sell signal, but this has been the case also in the early-September, yet price moved a little higher before correcting. I would not be surprised to see RSI move once again above the 70 level, just as it was the case in mid-September, when the local top was put.

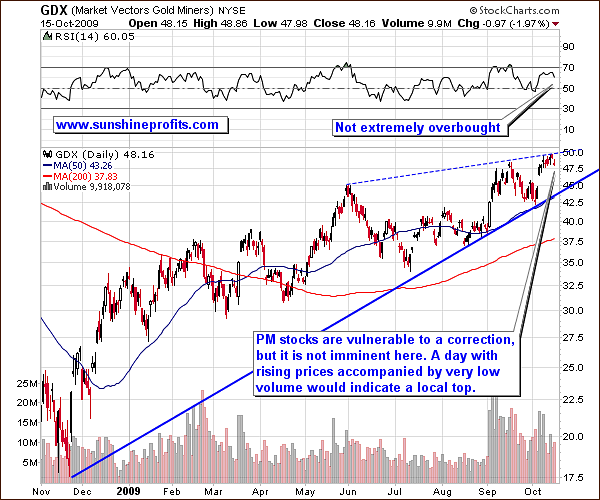

Precious Metals Stocks

The very recent price action in the mining stocks has been less profound than it was the case with gold itself, but after a correction in the price of gold (during which $1,000 holds) I expect PM stocks to regain their strength.

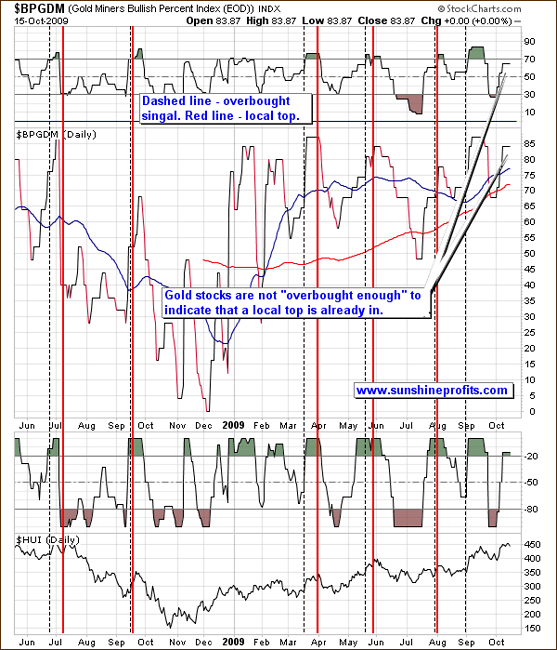

As far as the short-term is concerned, the GDX ETF (proxy for precious metals stocks) touched its resistance line and dropped slightly. Still, the RSI is not overbought yet, and the volume is not extremely low, so the rally may take us above the dashed resistance line before taking a breather. This is confirmed also by the analysis of the Gold Miners Bullish Percent Index.

As you may see on the above chart, the highest odds that a local top is in are generated by high values of the index along with overbought levels in RSI and William's %R indicators. Moreover, once RSI moves above the 70 level it is just a "watch out" signal, it is not yet a confirmation of a top. The top usually takes place several days/weeks after the initial signal is flashed (see vertical dashed and red lines on the chart above for details). Either way, according to the above analysis, we are not at the "sell now" point yet.

Of course, this does not mean that a local top can't form here, as speculation on timing (especially in the short term) is a game of probabilities - it is impossible to tell what is going to take place with 100% certainty; we can only estimate what is likely (!).

As always, it is best to analyze precious metals sector also through other markets, especially those, who can be considered as key drivers of PMs. Let's begin with the general stock market.

The General Stock Market

From the long-term point of view, the values of the main stock indices are once again at the critical point - at the 50% Fibonacci retracement level. Price has retraced half of the giant 2007-2009 plunge and the emotional battle is now between those, who believe that this rally has much more way to go given the sizable momentum, and the bears, who point to declining volume, overbought RSI, and weak fundamentals of the economy.

My take is that although fundamentals of the economy remain weak, the price of stocks may move higher, due to the psychological factors. Short-term chart will provide us with more details.

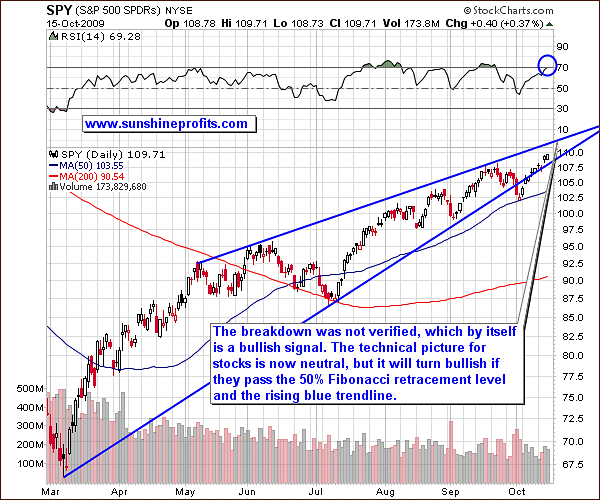

The short-term chart reveals that the previously bearish chart turned neutral once again, as the prices moved quickly higher just after they closed below their long-term support level about 2 weeks ago.

I wrote about the breakdown at the beginning of this month, however I emphasized that the sizable downswing is likely only if the main stock indices don't move sharply higher after the breakdown. I summarized that this is not confirmed by the three-day rule, so I am not suggesting opening short positions in the popular stocks just yet.

The non-confirmation of a breakdown is a bullish sign by itself, but given the 50% Fibonacci retracement level at which the SPY ETF is currently trading and the fact that the upper border of the trend channel is relatively close to yesterday's close, the situation is mixed.

I definitely don't like it, when charts don't favor one outcome over the other, but this time it seems to be appropriate to take the "let's wait and see" approach as far as the general stock market is concerned. Generally, this means that currently the main stock indices are not the key issue in determining the direction, in which PMs will go next. This leaves us with the U.S. Dollar as the key short-term driver of the prices of precious metals and corresponding equities.

USD Index

The USD Index moved below its support level created by the September 2008 low, as I suggested previously. The 3-day confirmation rule meaning that we would need to see USD Index close below the September 2008 low also today applies here, but I believe that this will take place, and thus that the breakdown will be verified. After that it would not surprise me to see the index to enter a small trading range in the area marked on the chart with red ellipse.

The value of the USD Index is still trading near the upper border of the trend channel thus making the following plunge more likely to be a substantial one. However, from the short-term point of view, USD is just above a support level, and the RSI is getting close to the 30 level, which market a local bottom in the past. Therefore, several days/weeks of consolidation are likely before a significant move down. The latter is still the most probable outcome in the medium-term from my point of view.

Summary

The precious metals market bull market is healthy, virtually regardless of the currency that one decides to price gold/silver. Naturally, the chart will look differently from the one including gold/silver priced in U.S. Dollars, but if you take the long term into account, it is clear that since 2006 gold has been rising not only in USD (which also marked the beginning of the second stage of the bull market in PMs).

The performance of the junior sector has been far from amazing if one compares it to other sectors on the precious metals market. However, taking the specifics of this market into account and the facts that gold has now decisively broken into $1,000 thus causing many new investors to enter the market and that the best part of the bull market (for juniors) is still ahead of us, makes me consider PM juniors as one of the best places to invest it. Still, their performance during the coming consolidation in PMs should provide us with additional details.

The situation on the general stock market is mixed, while the USD Index is verifying its recent breakdown. Should the value of the dollar move trade sideways, it is likely that PMs would move higher and then correct their recent gains. For now, it is probable (!) that the local top in metals / corresponding indices is not yet in, but we are close to it.

This completes this week's Premium Update.

Thank you for using the Premium Service. Have a great weekend and a profitable week!

Sincerely,

Przemyslaw Radomski