I like gold and the whole precious metals market which is why I follow it, invest in it and base my professional life around it. Warren Buffet, one of the world's savviest investors, doesn't like gold at all. He doesn't believe in it. In fact, in a speech he gave at Harvard University in 1998 this is what he had to say about gold:

It gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it.

As a trader Warren Buffet is in a class all of his own. There is a reason why he is called the Oracle from Omaha. However, when it comes to gold, perhaps he has missed the point. Gold doesn't generate dividends like the stocks that Buffet favors. However, gold has a role in balancing a portfolio and hedging against the worst of times, like the recent global financial meltdown we have witnessed. For those fortunate to have had it in their portfolio, gold helped preserve wealth that would have otherwise been eroded.

In his last shareholders' meeting Buffet gave some good news about gold, although indirectly. He warned his investors about inflation and predicted that the dollar would be heading down. Both of those are positive indications for gold.

I have consistently told my Subscribers that I believe gold prices are heading higher in the long term. In last week's Premium Update I showed a chart that plotted out the massive increase in the amount of money in the system. The dizzying vertical line at the end of the chart screaming "inflation ahead," illustrates the amount of money that has been recently pumped into the system.

Precious metals tend to appreciate during inflationary periods (under the current financial system) and outperform other assets; therefore, this chart is very bullish for gold and silver. Most likely, even Warren Buffet would agree. More importantly, precious metals are commonly believed to be the ultimate inflation hedge, so once millions begin to realize the implications of the government's printing of so much money, the prices of metals will vault much higher. Maybe even Buffet will change his mind.

Gold

As indicated last week, the situation in the gold market has developed similarly to the scenario at the end of April when I wrote the following:

As you can see, the areas marked with blue rectangles look alike. Generally, it is common to see certain patterns on a particular market repeat themselves in a different scale (the so called fractal nature of markets.) This may be the case here.

The price action that followed has been remarkably in tune with what happened previously in the marked time frame. Please take a look at the chart (charts courtesy of http://stockcharts.com) below.

After publishing last week's essay, we have seen gold go lower, bounce, and move lower again. This is also what happened at the end of April. The implications are positive for gold, because in the past the analogical price action marked the beginning of the new upleg. As always, caution is necessary because there are no sure bets in any market. However, the odds favor higher prices in short- and medium term.

Silver

Silver's performance has been far from stellar disappointing those who included the white metal in their portfolios in hopes of higher rates of return. The good news is that silver tends (general tendency of silver) to underperform gold during the initial phase of a rally, and vastly outperform it during the late stage, more than making up for the initial lagging. In other words, silver's underperformance to gold is nothing to worry about, as we are still in the early part of the rally. On the contrary - we should expect it. Assuming that the major bottom for the precious metals sector is already in place (during the last months of the previous year) and we are still below the previous high (substantially below it, in case of silver), we may infer that the following rally will be accompanied by a massive silver catch up. How can I be so sure that we will eventually rally, and most likely, soon? Because of the favorable fundamentals that determine the market's long-term direction.

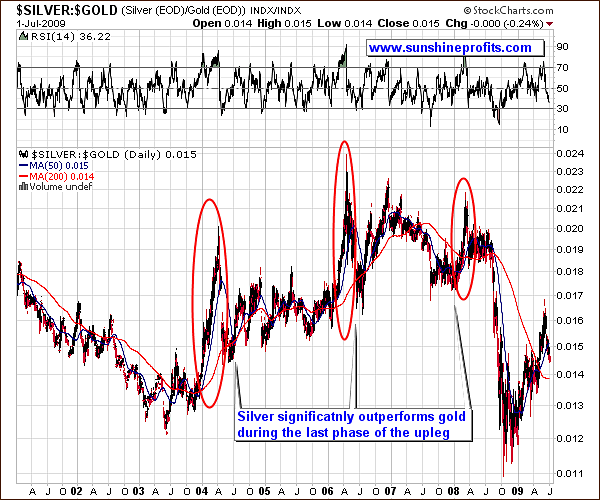

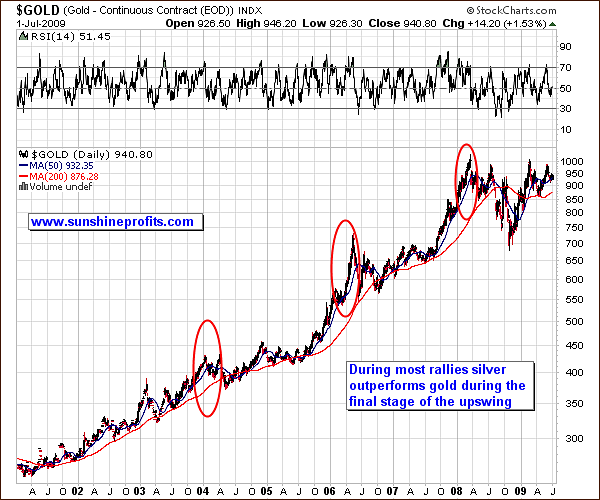

The silver catch up to gold has been visible several times in the past during this bull market. Please compare the following charts for details.

Clearly, in most cases, the final stage of the massive upswing was characterized by an even bigger rally in silver. Since we are not in the final stages of an upleg, but rather at its beginning, silver's underperformance may be viewed as normal and should not overly concern you.

Additionally, please note that these substantial advances topped at the beginning of the year and had begun in the middle of the previous year. Even more interesting is the fact that these massive rallies materialized every two years with great similarity. In the financial markets, as is true for the world in general, history tends to repeat (rhyme) itself. Should this prove to be the case for the next time, it would mean that prices would put a local top at the beginning of 2010, but most of all, it would mean that this is the perfect time to be in this market, as the next powerful rally is just beginning.

However, due to silver's large (and growing) amount of industrial applications, it is correlated with the general stock market to a much greater extent than gold. Don't forget that silver is both a precious metal and an (still) inexpensive industrial commodity. While Warren Buffet is mostly (gold has its own industrial uses too) right that gold is hoarded and "we pay people to stand around guarding it," silver is consumed in industrial applications at a frantic pace to a much greater extent than it is the case in gold. (While all the gold ever mined is basically still around in one form or another, that is not true for silver. It gets consumed. Like gold, silver has a finite supply. There is only so much of it under ground, and we use it up faster than we can mine it, thus consuming existing supplies.)

While correlation coefficients are based on the average values (they tell you what happens in the market on average), the same silver-stocks link is also visible during particularly violent price swings. By that I mean last year's plunge in the general stock market and the corresponding massive drop in the value of silver. Gold declined as well, but silver's fall was much more painful. The point is that if the values of main stock indices move sharply lower, silver may temporarily follow them. If this were to happen, it will most likely be temporary and should not concern long-term investors who hold silver.

Summing up, silver seems to be a great buy today with the medium- and long-term in mind. However, the short-term situation is somewhat unclear, because of the recent developments on the genral stock market.

As far as the latter is concerned, please take a look at the following chart.

General Stock Market

On Thursday, just before the markets closed for the Fourth of July weekend, the Dow Jones Industrial Average posted its biggest drop since April 20 after the U.S. unemployment rate rose to the highest in almost 26 years. This ignited fears that the economic recovery many take longer than expected and gold advanced in Asian trading as investors became risk averse and retreated out of equities and into gold. This is further illustration of the caveat of gold as a hedge.

After bottoming at the beginning of March 2009, the general stock market (here: the SPY ETF) has moved higher without a single significant correction so far. This, along with declining volume, suggests that lower values in the near future are rather likely and that Thursday's decline might have been just a preliminary shot. I have marked the support price levels with black lines - the first one is at the 85 level. It is too early to say how low prices could go from here, but the 85 level (or the area slightly below it) seems to be strong enough to stop the decline, at least temporarily. Please take a look at the short-term chart for more details.

The daily chart reveals an additional, particularly interesting feature - the head-and-shoulders pattern. The volume should be declining during this formation in order to confirm it, and this has been the case. If we get a breakdown below the "neck" level (below 89) on strong volume, the probability will rise significantly of further declines. Should that take place, the target for the decline is 82.5, which is considerably below the previously mentioned 85 level.

Summing up, there are signs that the general stock market may move lower in the short term. Should that be the case, it could affect the prices of precious metals, particularly silver. Still, I believe that this would only be temporary. Naturally, we may see the precious metals rally despite a plunge in the main stock indices - in fact, this is what charts are signaling on an individual basis. The reason why I mention the general stock market here, is to make you aware of the possible dangers, if you are currently speculating in the silver market with a considerable amount of money.

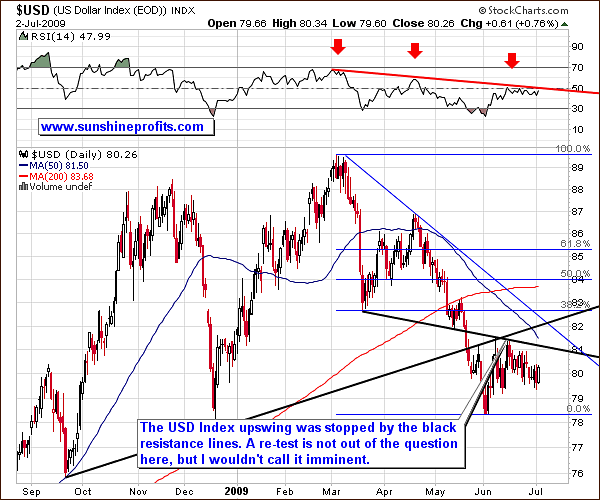

USD Index

There are barely any changes in the dollar market since I wrote about it in June 20th. The USD Index is consolidating after having declined from 87 to approximately 78. From the technical point of view, this makes the following decline (if we get one) more sustainable, which is positive news for precious metals investors as it generally translates into more sustainable upswing in PMs.

Gold Stocks

Gold stocks appear to be consolidating after a quick upswing. Please note that the similarity I mentioned several paragraphs earlier in the part of the essay dedicated to gold is visible also in the corresponding mining shares. The similarity of what happened at the end of April/ beginning of May, is visible not only the price itself, but also in two of the most useful indicators: the Relative Strenght Index (RSI) and the Stochastic Indicator.

The former is currently moving sideways around the 50 level, which was also the case at the end of April, whereas the latter is approximately at the 60 level, which is also similar to what took place in the past. Of course, prices may consolidate further, especially if the general stock market declines in the coming days/weeks, but for now, the technical situation favors higher PM stock prices ahead. I will keep you updated.

Junior Mining Stocks

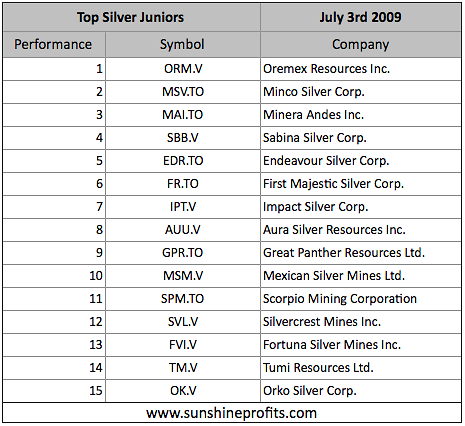

As stated in the Key Principles section, the list of top juniors will be updated approximately every 4 weeks, so this is the Update that should contain the revised version of the list.

The tables below feature our favorite junior stocks at the moment of writing these words. For more information on how you can use these lists please refer to the Key Principles section, especially to the part dedicated to juniors.

The outlook for the precious metals sector remains bullish. We have seen several confirmation signals that the bottom is in, so it seems that this week's price action is a consolidation during an upswing. The situation in the general stock market is now rather bearish, which may put the pressure on the precious metals market. However, for now, the technical picture is favorable for gold and mining stocks. Silver has been disappointing lately, but that is within the historical norms and should not cause worry at this point unless you are short-term oriented. If you are speculating on the silver market and you have open sizable long position, then perhaps limiting it here would be a good idea.

This completes this week's Premium Update.

Thank you for using the Premium Service. Have a great weekend and a profitable week!

Sincerely,

Przemyslaw Radomski