Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

PLEASE NOTE:

Dear Subscribers,

As the Author will be traveling this week, upcoming Gold & Silver Trading Alerts will not include regular technical analysis. Instead, they will focus on the fundamental aspects. The next regular technical analysis will be published on Monday, August 29. PR will inform you about significant changes (which are unlikely).

Stay tuned!

With the S&P 500 rallying by 1.41% on Aug. 25, the late-afternoon surge was likely a short-covering rally in advance of Powell’s Jackson Hole speech. In the process, gold rose by 0.56%, silver by 1.13%, the GDX ETF by 0.85% and the GDXJ ETF by 0.65%. Conversely, the USD Index declined by 0.17% and the U.S. 10-Year real yield also retreated.

Therefore, while volatility should be amplified today, the PMs’ medium-term technical and fundamental outlooks are profoundly bearish. As a result, Powell’s words should have little impact on their prices in the months ahead.

Gold and the Central Bank Effect

With the Qatar Central Bank increasing its gold purchases in the second quarter, Krishan Gopaul, Senior European and Middle East Analyst at the World Gold Council, tweeted on Aug. 23:

“The Central Bank of Qatar added 14.8t of #gold to its official reserves in July 2022 - appears to be the largest monthly increase on record (back to 1967), although early data is patchy. Gold reserves now stand at 72.3t, the highest on record.”

Thus, you may be curious about how central bank activity influences gold. Well, the reality is that central banks are steady purchasers of the yellow metal, and all things considered, their activity has an immaterial impact on the gold price.

For example, the World Gold Council released its Gold Demand Trends Q2 2022 report on Jul. 28. An excerpt read:

“The LBMA Gold price PM averaged US$1,871/oz in Q2, 3% above the Q2’21 average. However, this comparison conceals the 6% decline in the price during the most recent quarter, pressured by rising interest rates and the rocketing value of the U.S. dollar.”

However:

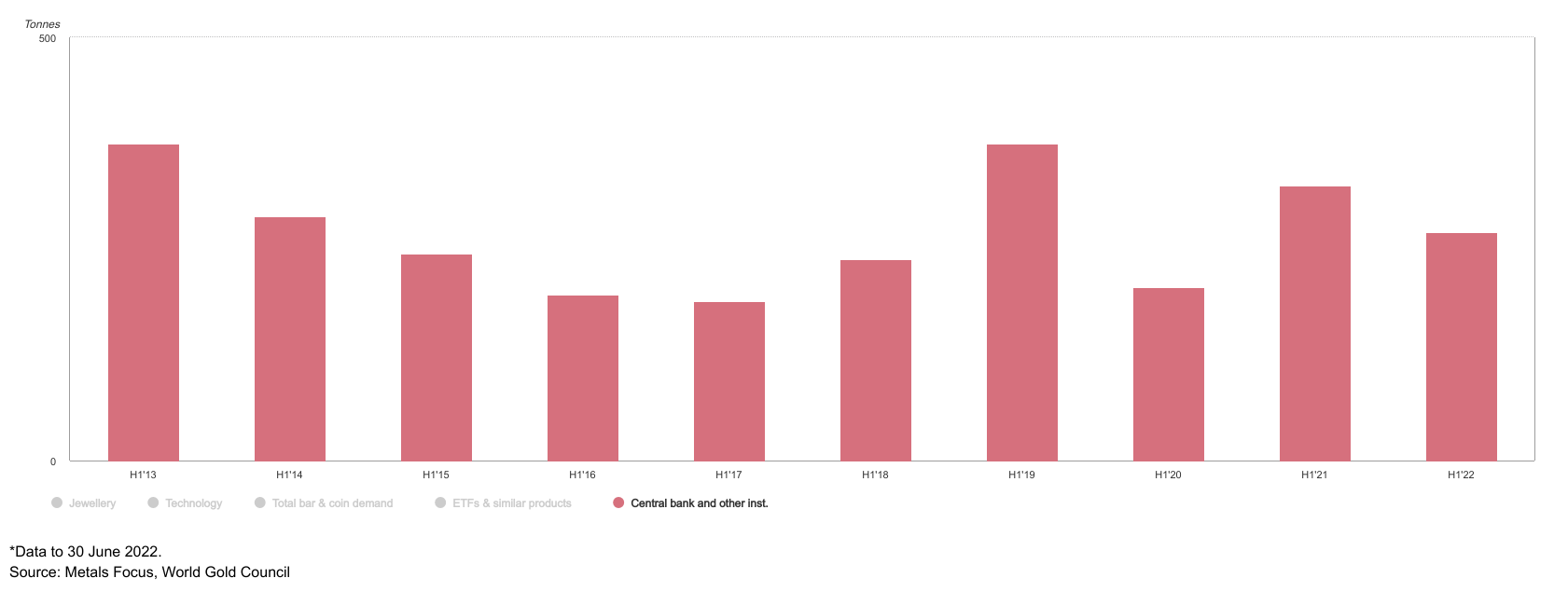

“Central banks continued to buy gold. Global official gold reserves grew by 180t in Q2, taking H1 net purchases to 270t.”

Please see below:

To explain, the red bars above track the gold purchases of central banks and “other institutions.” If you analyze the symmetry, you can see that net flows tend to stay in a relative range of 200 to 300 tons per six-month period.

Furthermore, while H1 2022 purchases were less than H1 2021 and exceeded H1 2020, the data shows that central banks aren’t the best market timers.

Please see below:

To explain, the candlesticks above track the gold futures price, while the vertical gray lines represent the six-month (H1) periods in 2020, 202,1 and 2022. If you analyze the left side of the chart, you can see that the gold futures price ended the six-month period higher, even though central bank purchases were near the low end of the historical range (204.50 tons on the first chart above).

Likewise, central banks purchased 325.25 tons of gold in H1 2021, only to watch the gold futures price end the six-month period lower than where it started. Moreover, central bank purchases fell to 269.62 tons in H1 2022, and the gold futures price was roughly flat throughout the period.

All in all, headlines about central bank gold purchases often garner a lot of excitement from the permabulls. However, their activity doesn’t provide much insight into where gold is headed, let alone where the GDXJ ETF is headed.

In contrast, the technicals, the USD Index, and real interest rates are much better predictors of gold’s short-and-medium-term movement. In addition, with the junior miners influenced by the behavior of the general stock market, the S&P 500 is another critical metric.

Powell’s Prayer

With Fed Chairman Jerome Powell set to speak at the annual Jackson Hole summit today, investors went from front-running a hawkish hammer to front-running a dovish pivot. However, while investors’ manic mood swings have become the norm in an era of easy money, Powell’s words can’t shape the medium-term fundamentals.

Furthermore, with gold, silver, and mining stocks underperforming the S&P 500 on Aug. 25, the PMs have been relatively weak. Therefore, while Powell could ignite a pump or a dump today, his deputies’ messaging on Aug. 25 signals more hawkish surprises to come.

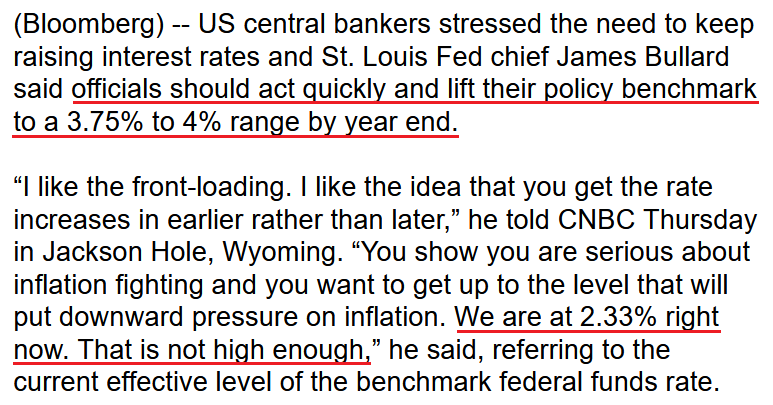

For example, St. Louis Fed President James Bullard said that if the Fed doesn’t front-load interest rate hikes, “a baseline would be that probably inflation would be more persistent than what many on Wall Street expect and that’s going to be higher for longer. That’s a risk that’s underpriced in the markets today.”

As a result, he stressed that the Fed needs to raise the U.S. federal funds rate (FFR) quickly to show it's “serious about inflation fighting.”

Please see below:

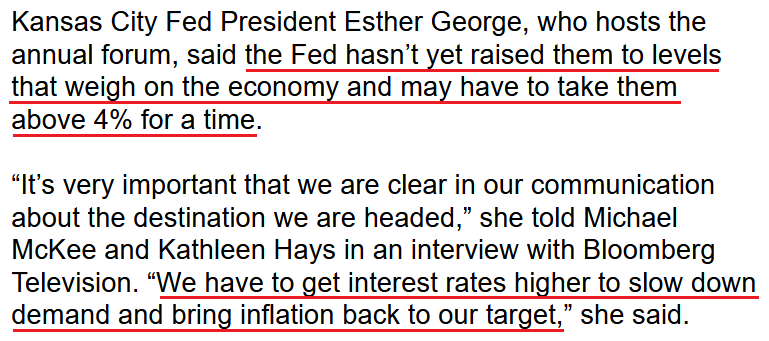

Likewise, Kansas City Fed President Esther George said on Aug. 25 that the central bank has “more work to do” with regards to interest rate hikes, and that “we are trying to get back to 2% inflation as quickly as we can, without doing damage to the economy.”

"So July looked like there was some easing in those price pressures, but certainly not enough that you would say, we're in the right direction," George said. "So I think we have more data to see. And I think we have more work to do, to begin to see that trend move down."

Thus, while George is on the more dovish side of the spectrum, she noted that the FFR may have to exceed 4% before it’s all said and done. For context, we expect inflation to be more problematic than the consensus realizes, and for the FFR to hit 4.5%+ in 2023.

Please see below:

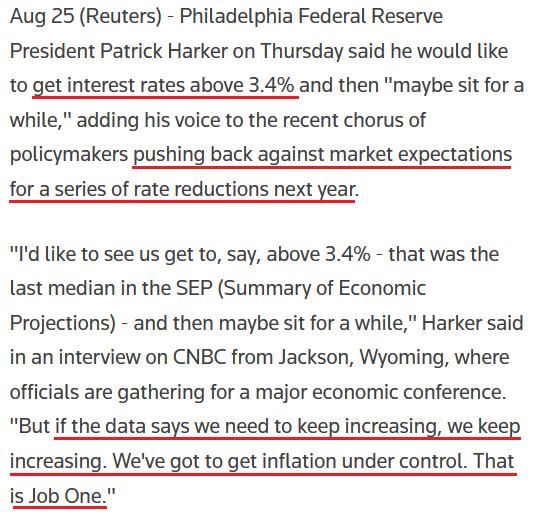

Continuing the theme, Philadelphia Fed President Patrick Harker said on Aug. 25: “We don’t need to rush way up and then rush way down. We need to go up and sit for a while and let things play out,” adding that when rates are above 3.4%, they will begin to slow the economy.

As a result, while his FFR prediction is less hawkish than Bullard and George, he reiterated that curbing inflation is “Job One.”

Please see below:

Joining the fray, Atlanta Fed President Raphael Bostic said on Aug. 25 that he’s split between a 50 or 75 basis point rate hike in September. “At this point, I’d toss a coin between the two,” he said. “We all, as policymakers, understand that inflation is a big problem and is a challenge that we’re going to do all that we can to handle.”

Thus, while it’s quite coincidental that Powell sent out his minions the day before his Jackson Hole speech, I noted during our post-FOMC recap on Dec. 16, 2021 that Powell uses his deputies as messengers. I wrote:

As one of the most important quotes of the press conference, he admitted:

“My colleagues were out talking about a faster taper, and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

And while Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

Therefore, if Powell is up to his old tricks, the hawkish rhetoric from Bullard, George, Harker, and to a lesser extent, Bostic on Aug. 25 may have been a subtle hint at his Jackson Hole speech. Only time will tell.

However, what’s not up for debate is the deteriorating fundamental outlook that confronts financial assets. With unanchored inflation mixed with deteriorating growth, investors have way too much faith in the Fed’s ability to solve the economic conundrum. So while the consensus assumes that a recession is unlikely, the reality is that avoiding a recession under these circumstances has never occurred since 1954.

To that point, Greg Jensen, Co-Chief Investment Officer at Bridgewater Associates – the world’s largest hedge fund – warned on Aug. 25 that “inflation will be more stubborn” despite “the market pricing a decline in inflation to occur in a relatively stable economy.”

Furthermore, he added that long-only investors have nowhere to hide “to totally avoid this,” as the inflationary realities signal material downside for risk assets. Thus, while he’s one of the few that share our fundamental view, a realization is profoundly bearish for gold, silver, mining stocks and the S&P 500.

The Bottom Line

While Powell's rhetoric today remains a coin flip, his deputies' hints on Aug. 25 foreshadow more hawkish policy in the autumn and winter months. Moreover, with investors' inflation and rate hike expectations below the Fed's forecast and the Fed's projection below ours and Jensen's forecast, there is plenty of room for more hawkish re-pricing.

As a result, while Powell may spark a short-term rally today, please remember that we've been here many times. For example, several Powell press conferences over the last ~18 months have ended with a weaker USD Index, lower real yields, and a higher GDXJ ETF. Yet, the former forged ahead to make new highs, while the latter sank to new lows. As such, the important point is that the Fed's inflation fight supports a stronger USD Index and higher real yields, and that the environment is bearish for the PMs.

In conclusion, the PMs rallied on Aug. 25, as the S&P 500 ended the day higher. However, the GDXJ ETF underperformed the general stock market, even as the USD Index and the U.S. 10-Year real yield retreated. Therefore, our medium-term expectations are unchanged.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is either over or about to be over, and that the next big move lower is about to start.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

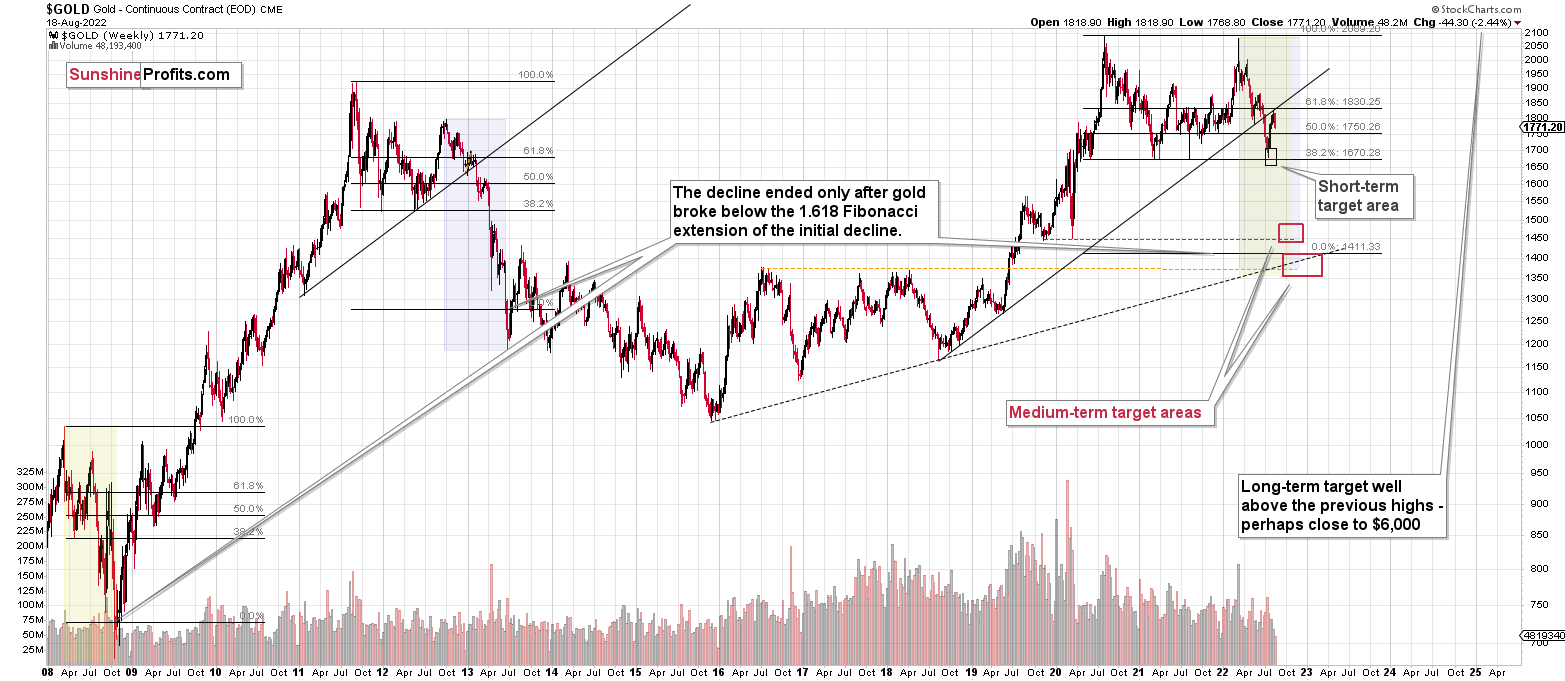

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems that the corrective upswing is over (or close to being over), which means that the powerful medium-term downtrend can now resume.

Two weeks ago, we closed yet another profitable trade in a row. This year’s profits are already enormous, but it seems likely to me that they will grow even more in the following weeks and months. In particular, I expect the profits on the current short positions to be really profound.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $29.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $12.32

SLV profit-take exit price: $11.32

ZSL profit-take exit price: $79.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $19.87

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $49.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief