Briefly: in our opinion, full speculative long positions (150% of the regular position size) in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. In our view, no positions in gold or silver are currently justified from the risk to reward point of view. We expect to change our position soon (very likely this week). We are moving the profit-take levels higher.

In yesterday's extensive (this week's flagship) Gold & Silver Trading Alert, we explained why the medium-term outlook for the precious metals market remained very bearish, but that is was at the same time bullish in the short term. We made multiple points that confirmed this scenario. Indeed, the precious metals market moved higher yesterday, and it moved sharply higher also today.

Both: gold and silver were so strong that they exceeded our upside targets, while the miners didn't reach them yet. Why would this be the case?

With regard to the metals - gold soared based on Fed's open-ended QE that could last until the end of September. If the Fed can print money to buy almost anything (openly!), then one might want to hold gold as that's what can protect them against hyperinflation. At least that's the current narrative. In reality, we are not threatened by hyperinflation, at least nor right now and it's unlikely that we'll be threatened by it before the end of September. Remember, we are talking about HYPERinflation, not just inflation. Relatively insignificant and stable inflation is not a positive factor for gold - hyperinflation is. We could see stagflation (which would be positive for gold), but until inflation is significant, it might not cause gold to soar.

In other words, the market's reaction is mostly emotional in nature. The focus has simply shifted from the fact that gold is not a useful form of payment during virus outbreaks, or the fact that everything is only beginning in the US.

Yesterday, we wrote about approximately 35,000 Covid-19 cases in the US. It's already about 46,000 at the moment of writing these words. So, what's likely to happen next? The markets will react to the bullish news from the Fed and to the (very likely) 2 trillion stimulus program... Until the death toll becomes a much more important news. That's when the fear will return big time. And since the infections and death-toll are likely to increase dramatically and relatively quickly, the time window for the markets (especially the stock market) to rally is relatively short.

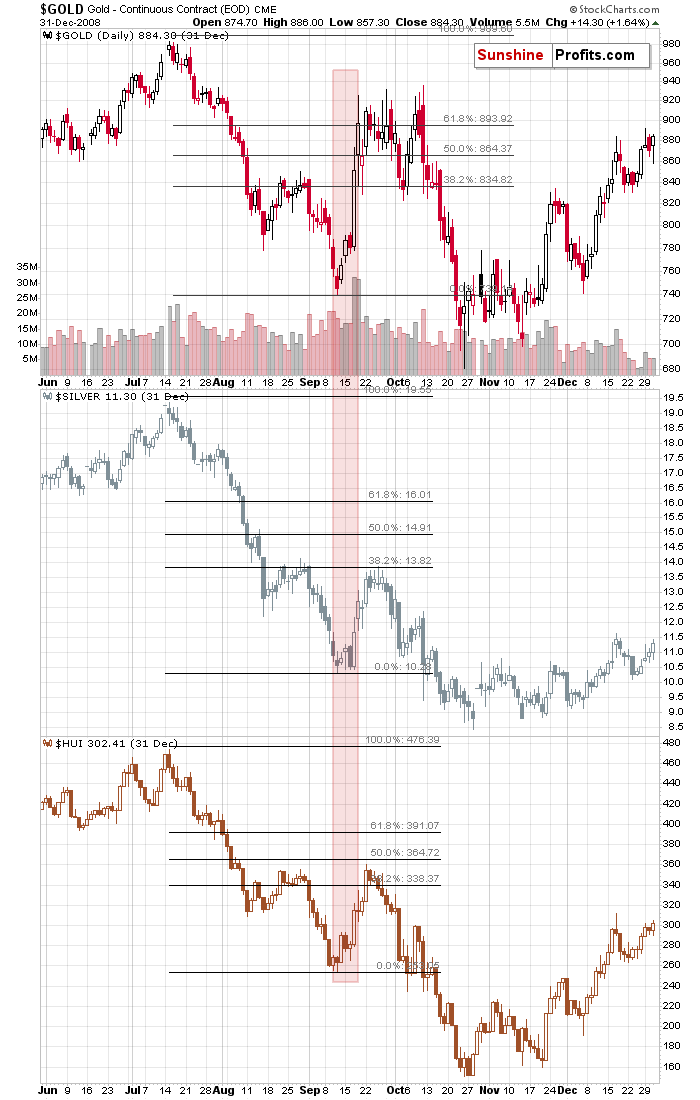

Besides, we've already seen this kind of performance in gold before.

Precious Metals' Lessons from Recent Past

That's how gold is rallying right now.

And that's how gold soared in 2008. It rallied above its 61.8% Fibonacci retracement level and topped relatively close to the levels at which the most volatile part of the decline started.

At this time, we don't have a starting point that's so clear as the 2008 one, so the final resistance is provided by the 2020 high. And it seems to have (almost?) stopped today's pre-market upswing in gold.

Silver corrected about 38.2% of the previous decline, while the HUI Index corrected about half thereof.

Silver is not yet at its 38.2% Fibonacci retracement level, but it's very close to it.

The USD Index declined to 101.55, meaning that its decline is already underway, but quite likely not over yet as the downside target is closer to 100. Perhaps gold will make an attempt to move to or break above the 2020 high once USDX corrects to 100.

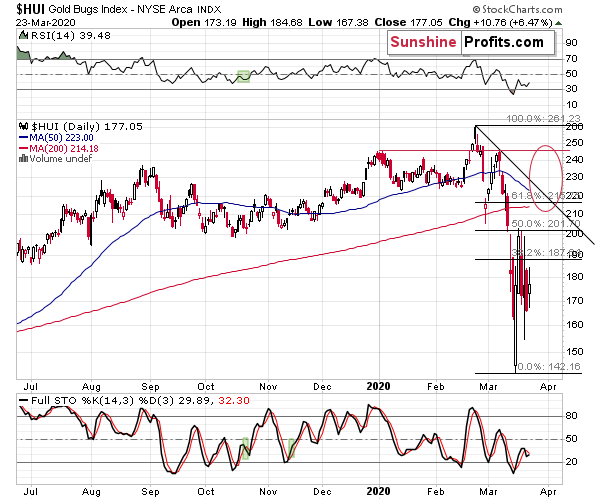

The HUI Index already corrected half of its decline, but it seems that it will rally much more once the stock market soars. The two have been very highly correlated this month, and we expect this to facilitate a big rally in the miners' shortly.

Gold is already up in a big way and the only thing preventing gold miners from soaring was the declining stock market. The stock market is likely to rally not only based on yesterday's Fed bazooka, but also based on the new fiscal stimulus money that are likely to be approved shortly - quite likely today.

In fact, it's already moving higher in today's pre-market trading (S&P 500 futures).

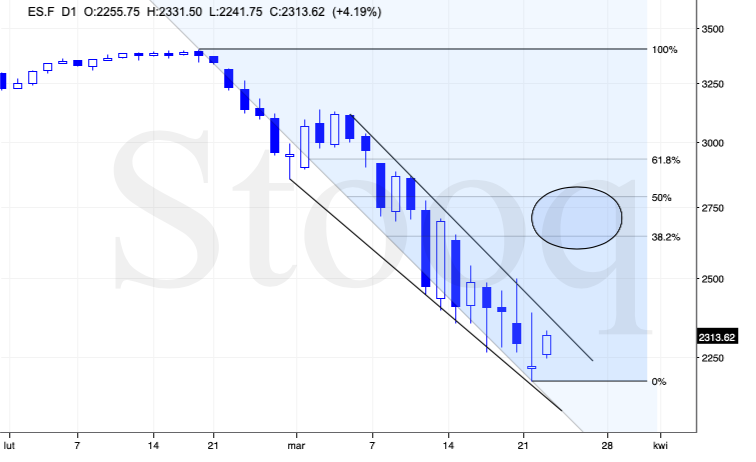

Stock Index Lessons for the Miners

The minimum upside target for stocks is the 38.2% Fibonacci retracement level, which is about 400 index points higher. That will be the easy part of the upswing. During the 2008 slide, stocks didn't correct much more than that, so we might see a bigger upswing this time. Then again, the stimulus is larger this time, so perhaps the quick rally will also be bigger. In our view, it's most justified from the risk to reward perspective to assume that stocks will move to the 38.2% Fibonacci retracement. This level is at about 2650.

Now, what does this imply for the GDX and GDXJ?

It implies big gains.

Probably bigger than we had previously expected, because gold and silver are also rallying above the levels that we marked as our targets (at least initially).

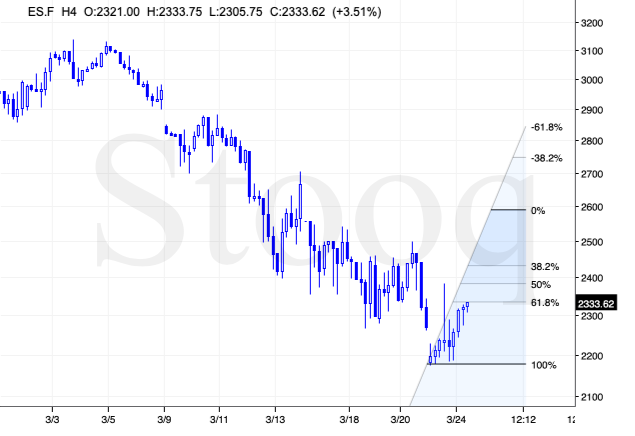

The biggest determinant of mining stock prices in the recent days was the stock market, but the dynamics between miners and stocks changed over time. As stocks are finally rallying today and it seems that this rally will be sustainable (again, over the course of the next several hours - days), it seems to be particularly useful to compare the most recent upswing in stocks (since the bottom to the price that we have available right now) to the prediction regarding the upside target.

In short, it seems that the S&P would be likely to multiply the recent gains by the factor of 2.618 before reaching the target.

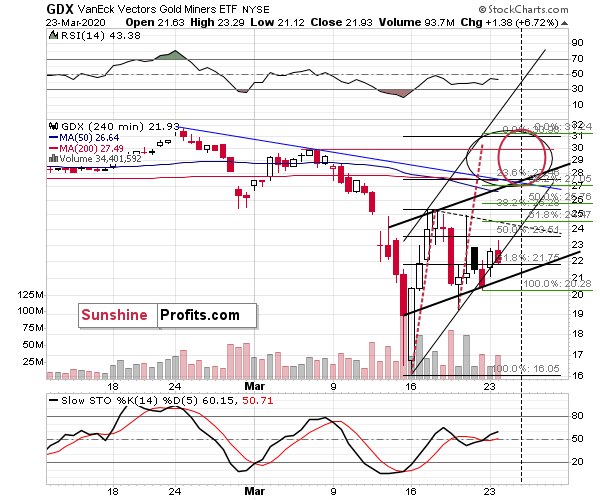

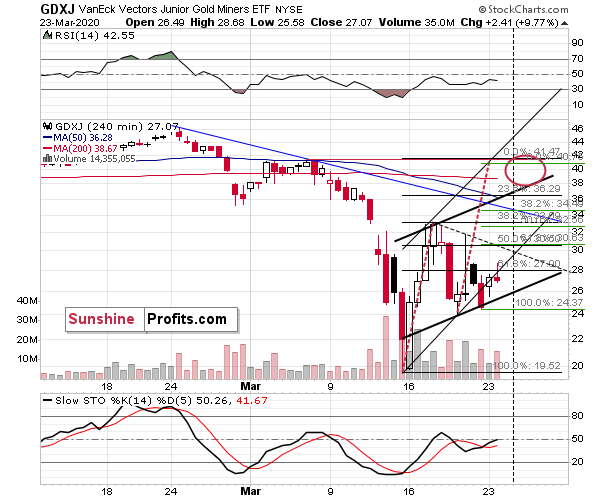

Let's see what would happen if GDX and GDXJ also multiplied their recent gains by 2.618. The important thing is that the above chart is based on the futures prices that include the overnight trading, while the GDX and GDXJ charts include only what's happening during the US session. However, we checked the pre-market prices for GDX and GDXJ at the moment of creating the above chart, so that the sizes of the moves are comparable. GDX was pre-trading at $24.50 and GDXJ was pre-trading at $30.63.

We used green Fibonacci lines to extend the most recent rally (the most recent low - today's pre-market price at which we were making the comparison). This provides us with target prices at (GDXJ) or slightly above (GDX) the March highs. That was not the most likely target price at the beginning of the upswing in the middle of the month, but based on what's happening right now, and how high gold just soared, expecting miners to move back to their March 2020 high before topping just became justified.

Consequently, we are moving our profit-take levels for GDX, GDXJ and the related ETNs higher. The big profits are most likely going to become enormous. And the total 2020 profits so far - they're unbelievable already.

Summary

Summing up, the rally in the corrective upswing in the precious metals market is well underway, and as we warned, it is indeed sharp. It seems that we will see the next local top shortly - perhaps within the next few hours or days. In fact, given gold's powerful upswing above $1,650 and silver's move to $14, we might have already seen it. However, the very short-term rally in the general stock market and in the mining stocks is still likely ahead. With gold over $100 higher than yesterday and soaring stocks, miners practically have to rally profoundly today - likely even more profoundly than we expected them to previously.

Consequently, we are moving our profit-take levels for GDX, GDXJ and the related ETNs higher. The big profits are most likely going to become enormous. And the total 2020 profits so far - unbelievable.

Once the profit-take levels are reached, and you secure your profits, we might shortly decide to open speculative short positions in the precious metals sector. Once again, we will probably focus on the mining stocks, but it doesn't mean that silver or gold would be immune to the following decline. In particular, silver is likely to fall hard in the following weeks. Miners, however, are likely to provide the best risk to reward ratio. We will let you - our subscribers - know via another Alert if / when we think that opening the above-mentioned short position is justified from the risk to reward point of view.

For now, we remain long and are moving the profit-take levels higher. Let's keep in mind that they are "binding" - meaning that if they are reached the position should be closed and profits taken off the table automatically - without an additional confirmation from us.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the declines and temporary rebounds in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time. Please contact us, if you'd like to take advantage of this offer.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (150% of the full position) in mining stocks (but not in gold nor silver) are justified from the risk/reward perspective with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $28.68; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the NUGT ETF: $11.98; stop-loss for the NUGT ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $39.47; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JNUG ETF: $9.48; stop-loss for the JNUG ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager