Briefly: In our opinion, full (150% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

There is a part of the precious metals market that was already overbought, but based on the last few days, its overbought status moved to the extreme. It’s now more overbought than in a decade. What is it? It’s… Gold.

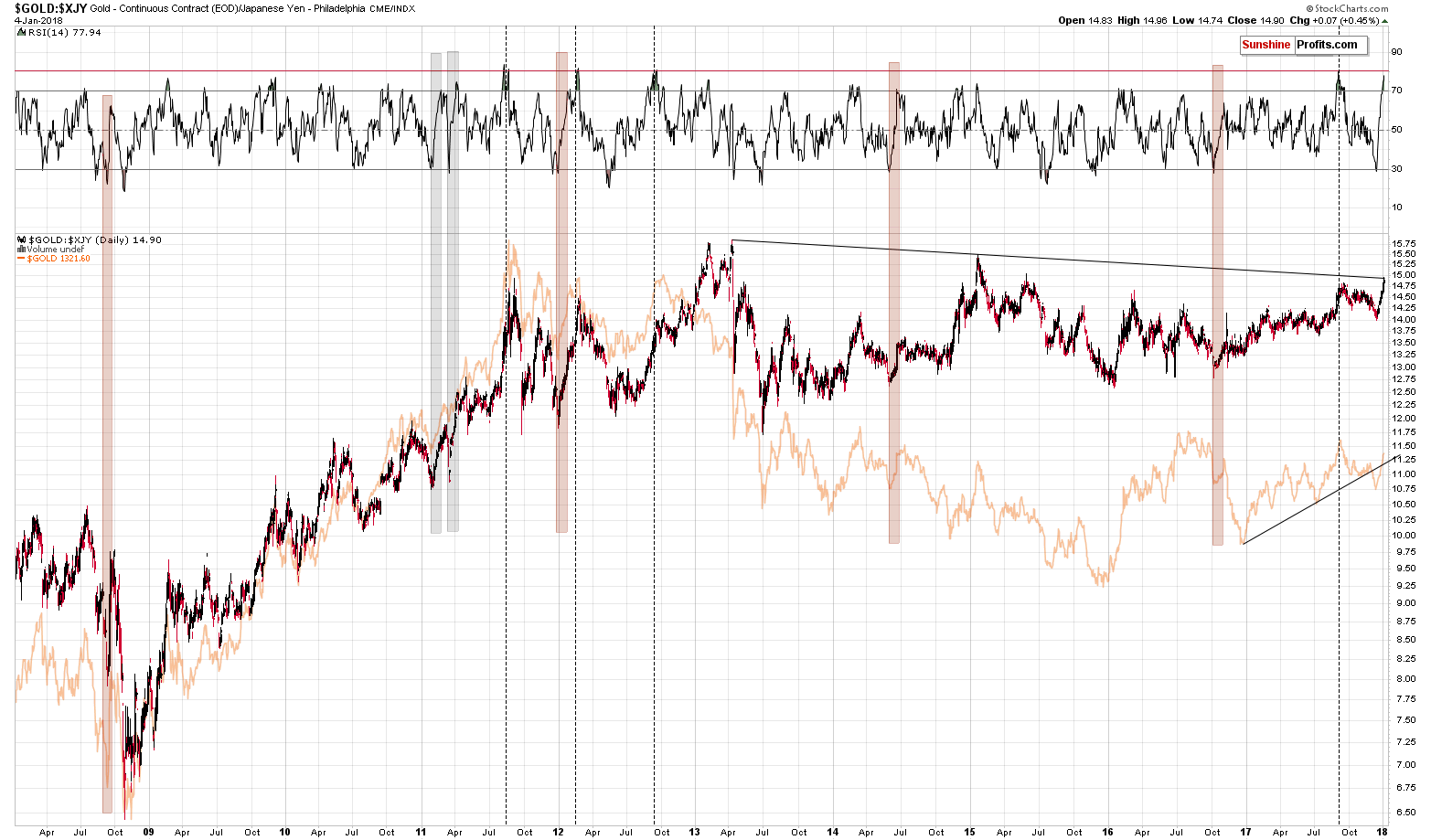

In terms of the Japanese yen. Let’s jump right into the chart featuring the situation (chart courtesy of http://stockcharts.com).

We previously commented on the above chart in the following way:

Gold price in the Japanese yen is after the sharpest upswing of the past decade. In the recent alerts, we commented on the above chart in the following way:

What we discuss below is what’s generally below the investment surface. It’s the things that people usually don’t write about because they are not aware of these relationships or that they don’t care enough to analyze them thoroughly. We do.

(…)

The next thing that’s rarely monitored is gold’s price in terms of the Japanese yen. Even if it is monitored, then the dynamics of the RSI indicator plotted on it are never or almost never discussed.

Gold very often moves in tune with the Japanese yen. We even received a few messages in the past years saying that analyzing gold is pointless as all it does is track the yen. On a side note, the above chart shows that between 2009 and the 2011 top, gold was much more than that.

Whenever gold doesn’t move in tune with the USD/JPY rate, the price of gold in terms of the Japanese yen changes. It recently changed significantly and the question is: “What can we infer from this kind of movement?”

Indicators are useful in many cases, including for making comparisons between price moves. Without them it would be more difficult to discuss similarities. In the current case, the RSI is after a sudden increase from below 30 to almost 70. There were only several such cases in the past decade. Two cases were seen after a multi-year rally while gold was rising within a relatively steep uptrend. We marked those cases with grey rectangles – they are not very similar to what happened recently. Gold has been trading sideways for a few years an it’s after a breakdown below the medium-term support line.

Consequently, the areas marked with red rectangles are much more similar as they were accompanied by similar developments. In these cases, gold was just finishing its corrective upswings. Sounds familiar? Exactly, that’s exactly what all the other charts are indicating.

The thing that we would like to emphasize today is that the maximum level that the RSI indicator achieved during its sudden rallies was just a bit above the 70 level and based on yesterday’s price action, the RSI moved to 74.25. Naturally, the current case can be the odd one and the RSI could rally further. All is possible in the market, but is it likely? No. What’s likely is that the RSI will stop shortly and the same thing is likely for gold priced in the Japanese yen, which makes the same likely for gold priced in the USD.

Based on the size of the upswing in the RSI, the current upswing in gold appears very emotional and unsustainable.

The above serves as a perfect confirmation of the scenario in which gold tops in the first days of 2018.

The extreme situation just got even more extreme, as gold moved higher while the yen declined. This caused gold in terms of the yen to rally sharply and thus the RSI increased as well.

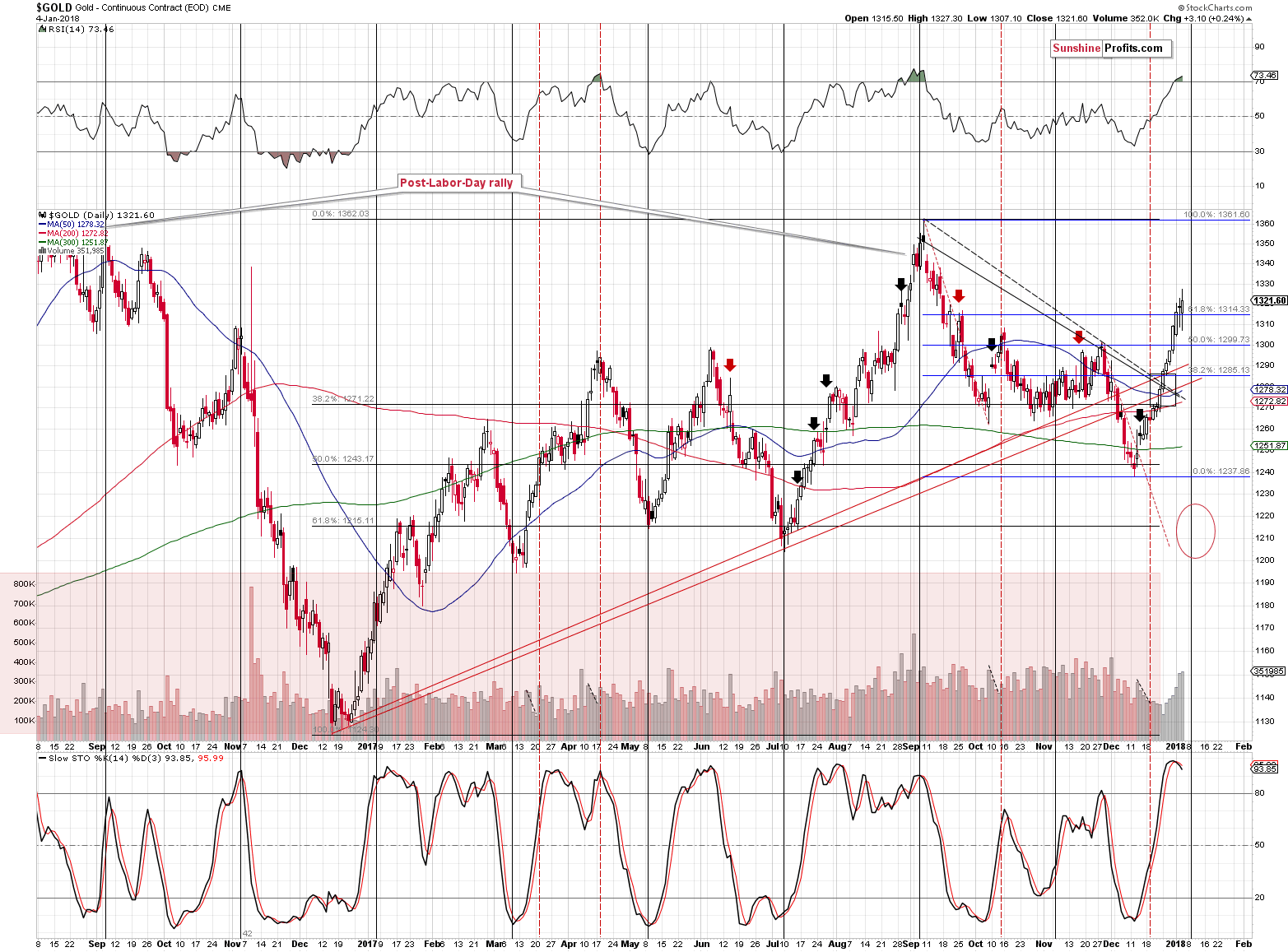

At this time, we have two new developments to report. One is related to the RSI indicator and one is seen in the price of gold itself.

Let’s start with the latter. Gold moved to the key, long-term resistance line based on the 2013 and 2015 tops. Both tops were significant from both the yen and USD perspective and both were followed by significant declines in the price of gold. Consequently, the resistance line based on them is definitely important.

Now, if the line was reached after a major consolidation close to it, and the situation was not overbought, a breakout could be in cards. However, exactly the opposite is the case and a breakout is not likely at all. A reversal is.

Why is exactly the opposite the case and why is gold most overbought since more than a decade?

The above quote already describes the sharpness of the RSI’s increase. The thing that we would like to add today is the emphasis on the level that the RSI reached – it’s almost at 80. There were only a few cases, when the RSI was this high and we marked them with vertical, dashed lines. There were 4 such cases. We saw one in 2017 (right before the top) and we saw the previous 3 cases in 2011 – 2012 period, when gold was topping and before the biggest decline of the decade.

In 2011, the RSI at similar levels was seen before the top, but relatively close to it in terms of time. In all other cases, the above meant that the top was in or very close to being in. Since the current situation is not similar to the pre-2011 top, it seems that the analogies to the other 3 cases are more important. The implications are very bearish.

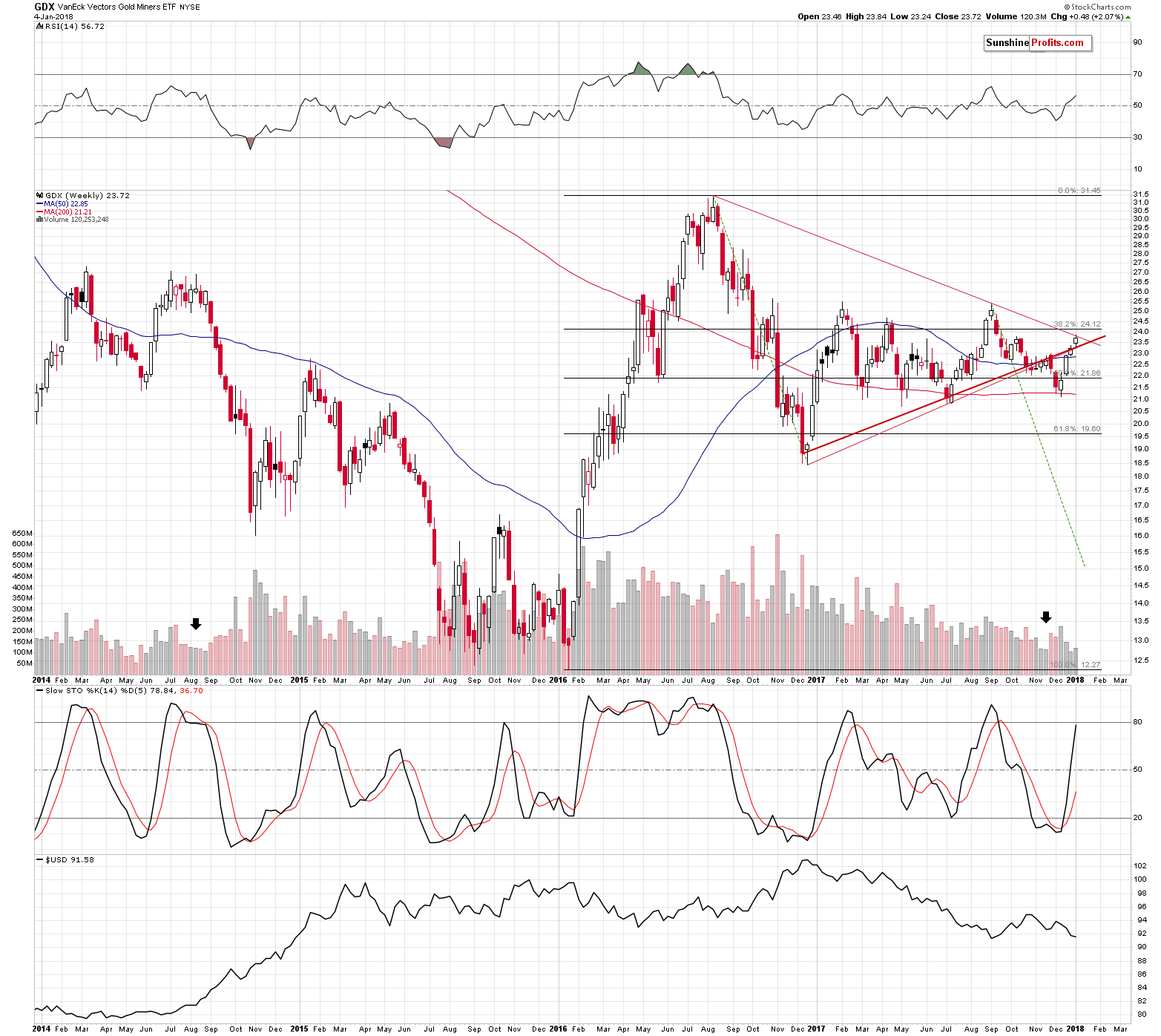

Moving to our regular USD perspective, the situation didn’t change much in the case of the mining stocks.

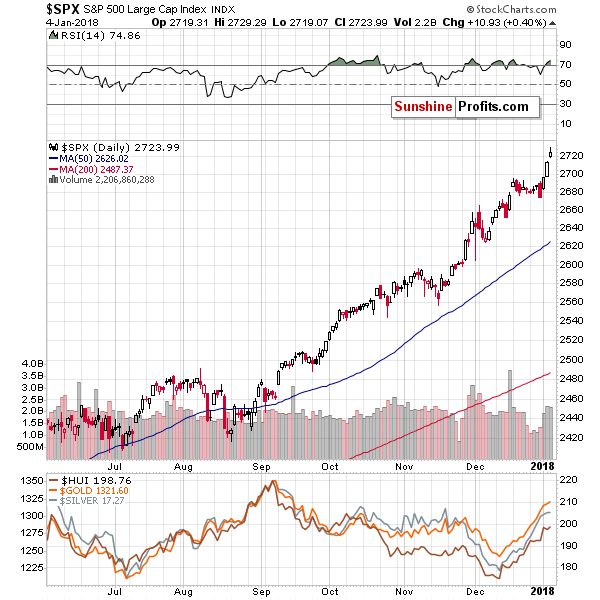

This is the case, even though the general stock market rallied once again.

And even though gold move higher yesterday.

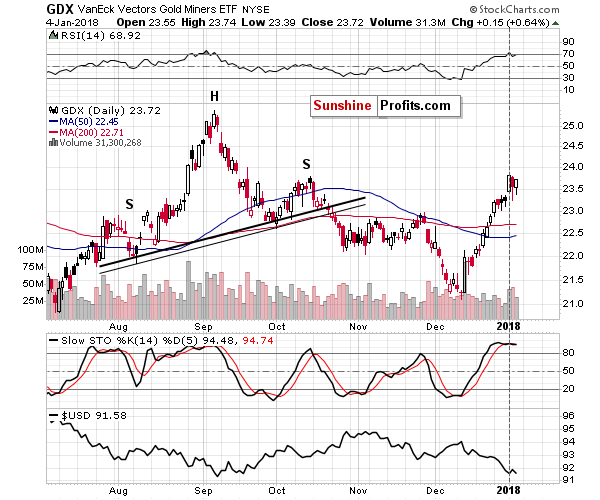

Miners (GDX) didn’t manage to close at new highs and the volume that accompanied the upswing was relatively low. It was not low enough to be a sell signal on its own, but it was low enough to indicate that mining stocks are not willing to follow gold higher. Furthermore, the mining stocks’ performance was weak enough to confirm that Tuesday’s “strong” performance was indeed the result of a tax-optimizing technique and not real strength of the PM sector.

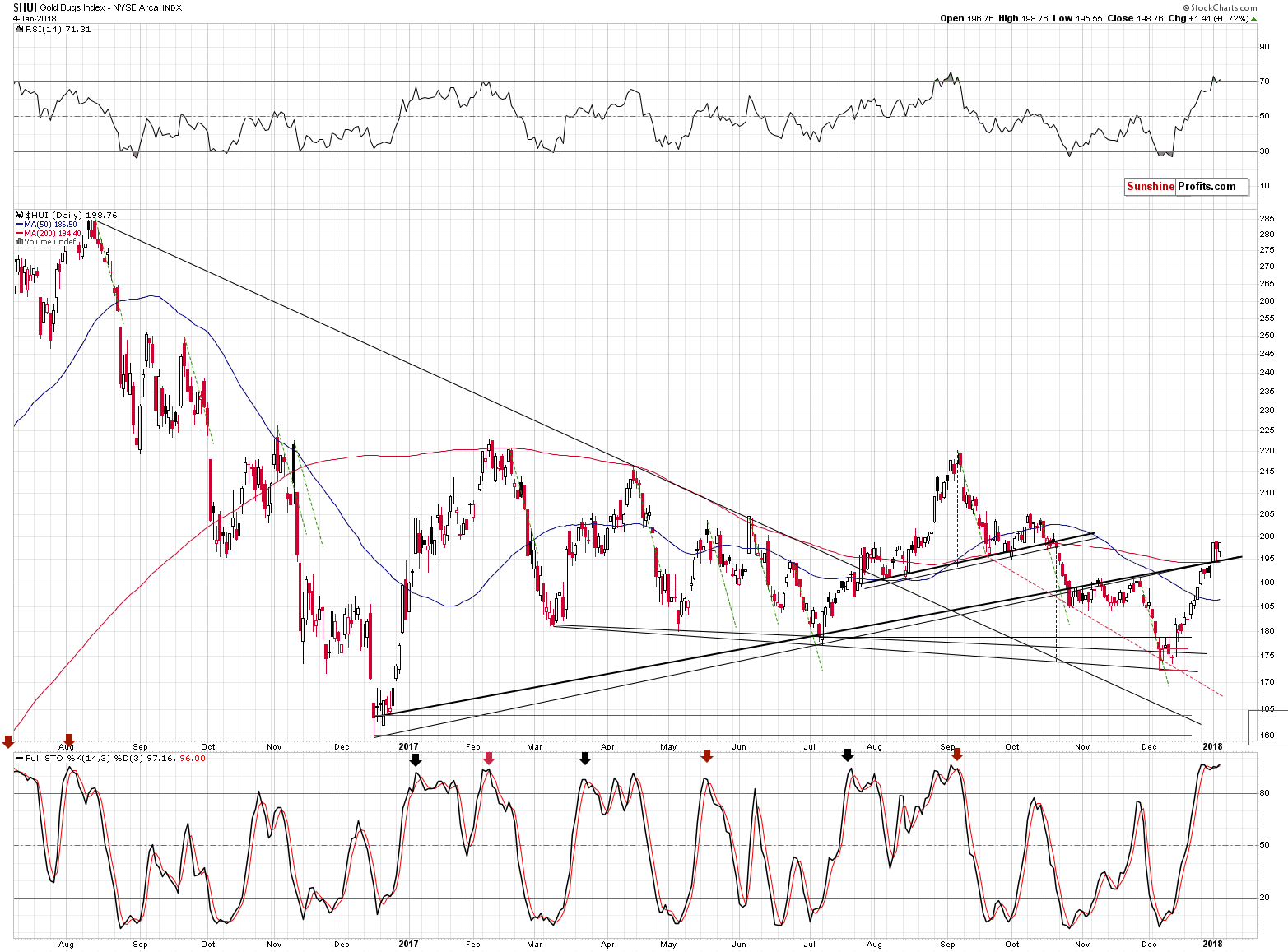

In light of the above and the signal from gold priced in the Japanese yen, can we really trust the confirmation of the breakout in the HUI?

Not really. Especially that the situation in the RSI is very similar to its performance during the early September top.

Add to that the fact that the declining resistance line was not breached. From the weekly perspective, the current situation looks like another short-term top in the making – not a major breakout.

Gold futures closed higher yesterday, but except for Tuesday’s rally, this week’s price movement appears to be a back-and-forth action – not a real really.

At the moment of writing these words, gold is almost exactly where it was two days ago and just a few dollars above where it was yesterday. If gold is really rallying, then why is it still in the same price range?

The RSI and Stochastic indicators both continue to point to lower prices in the following days and weeks.

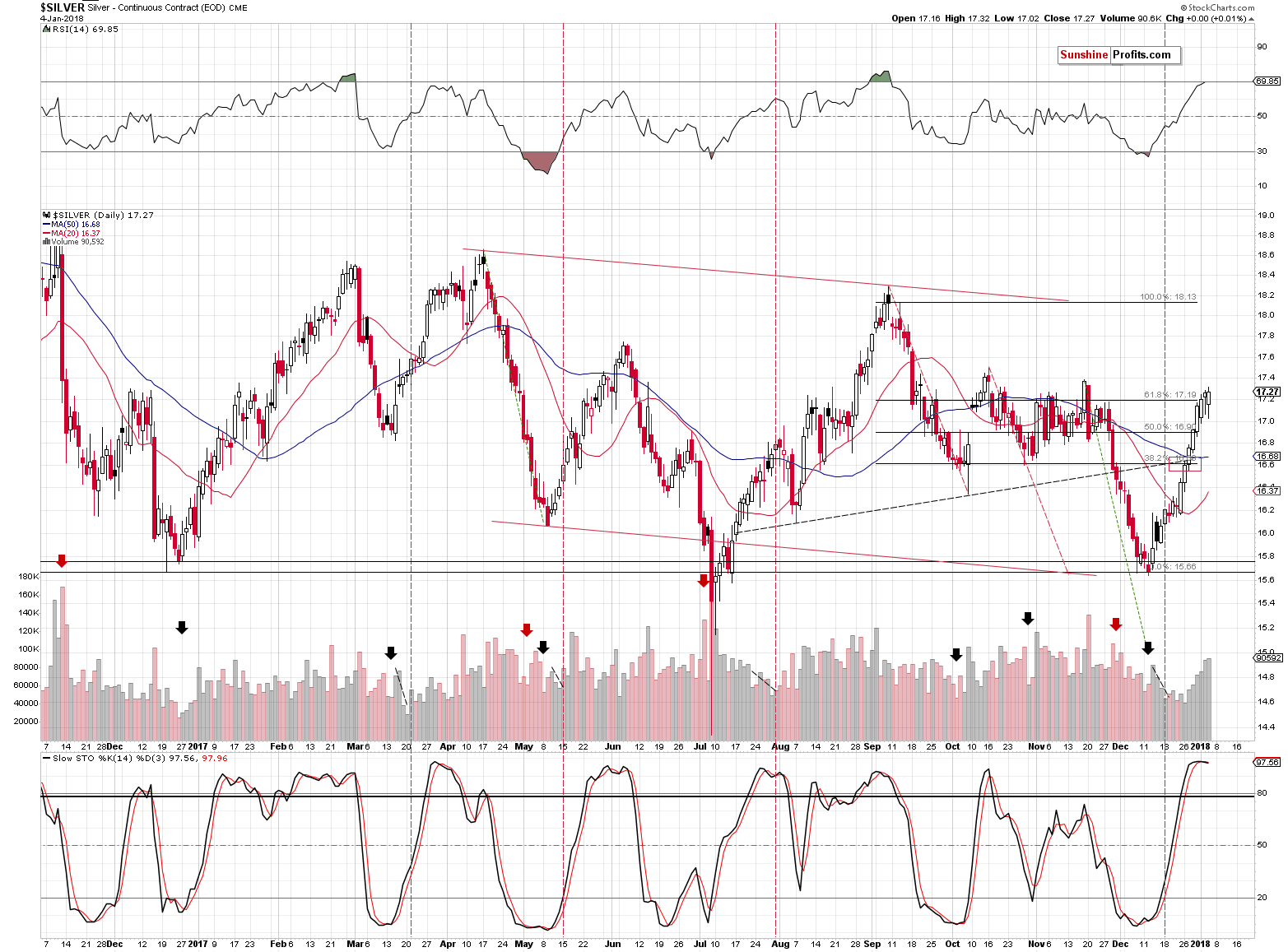

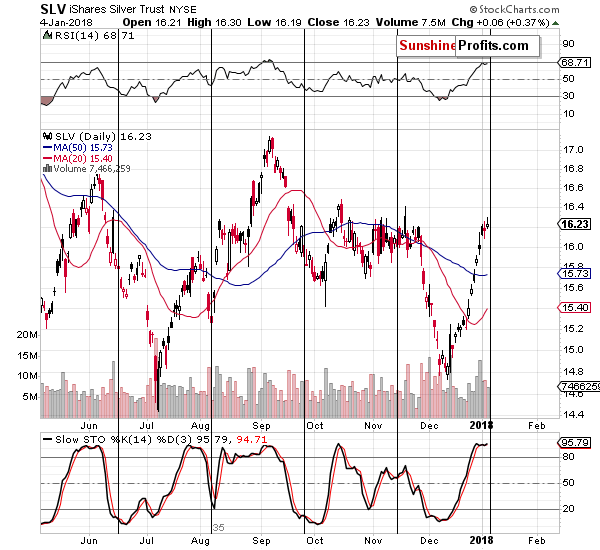

The lack of action is also visible in the case of silver. It’s moving a bit higher in terms of daily closing prices and the differences on the silver futures chart are really minor. However, looking at the intraday action shows that nothing really changed over the past two days. The bearish implications of the position of the indicators (the RSI and Stochastic) remain in place.

While the price doesn’t change much, the move in time is steady and in light of the turning point’s proximity, the implications are bearish as well. It’s crystal clear that the move preceding it is up and thus the turning point means that silver is likely to decline.

Summing up, the medium-term outlook for the precious metals market remains bearish as confirmed by multiple factors, and based on the most recent short-term factors, it seems that the corrective upswing in gold, silver and mining stocks is either over or close to being over. Tuesday’s strength in mining stocks is most likely not real strength, but rather a tax-optimization technique. Consequently, it should not be trusted, also because the breakout in the HUI Index is not confirmed and several other resistance levels are in play. It seems that the downswing will start shortly.

Moreover, we are moving the stop-loss level for gold higher.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,218; stop-loss: $1,343; initial target price for the DGLD ETN: $53.98; stop-loss for the DGLD ETN $40.28

- Silver: initial target price: $14.63; stop-loss: $17.62; initial target price for the DSLV ETN: $33.88; stop-loss for the DSLV ETN $21.78

- Mining stocks (price levels for the GDX ETF): initial target price: $19.22; stop-loss: $26.14; initial target price for the DUST ETF: $39.88; stop-loss for the DUST ETF $19.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $27.82; stop-loss: $38.22

- JDST ETF: initial target price: $94.88 stop-loss: $37.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

How can we summarize the last year in the gold market from the perspective of its fundamentals? We invite you to read our today’s article and learn more about the biggest drivers of the gold price in 2017. This analysis should help investors better understand the gold market, and draw investment conclusions for the new year.

S&P 500 index gained 0.4% on Thursday, as it continued its short-term uptrend following Wednesday's breakout above recent consolidation. Will uptrend accelerate after today's monthly jobs data release? Or is the broad stock market market going to retrace some of its record-setting rally?

S&P 500 Grinds Higher, But Correction Looms

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold dips from 3-1/2 month high ahead of U.S. payrolls data

Higher prices dent gold demand in Asia

Gold Imports Said to Rebound Amid Signs India's Tax Woes Fading

Sleepy Gold Market Is Woken Up by Flurry of Trades

WGC: World Official Gold Holdings

Palladium poised to break another record just days into New Year

=====

In other news:

U.S. job growth slows in December; wages increase

Dollar cuts gains versus yen, slips versus euro after U.S. jobs report

U.S. dollar troubles not over yet, but 2018 to be a better year

North Korea agrees to talks after U.S.-South Korea military drills are postponed

Euro-Area Inflation Slows, Undermining Calls for ECB to Curb QE

Global Debt Hits Record $233 Trillion

The cryptocurrencies disrupting international finance could stabilize African economies

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts