In short: No changes, no positions (both: short- and long-term).

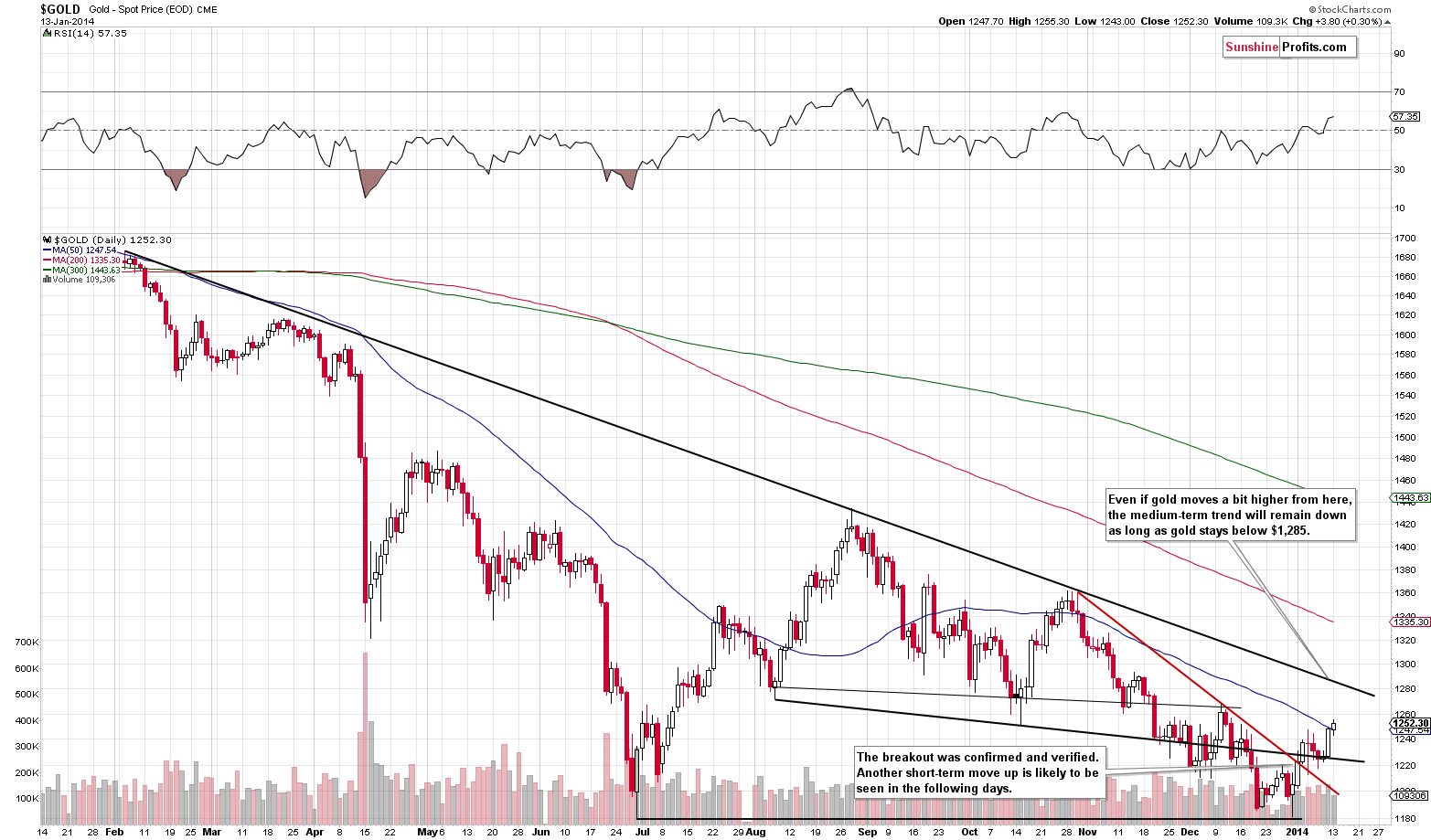

We saw another move higher in gold and the situation basically remains unchanged from yesterday. Please take a look below (charts courtesy of http://stockcharts.com.)

Gold moved above its 50-day moving average – when this happened previously (in October 2013) it stayed there for a few days moving to the declining resistance line, only to decline thereafter. At this time the declining support line is not as close, but it could still be reached – and it‘s a little more likely now that the 50-DMA was taken out.

It’s not likely enough, though, and the possible upswing doesn’t seem significant enough for us to suggest opening long positions. Unless... Anything has changed from a few other important perspectives.

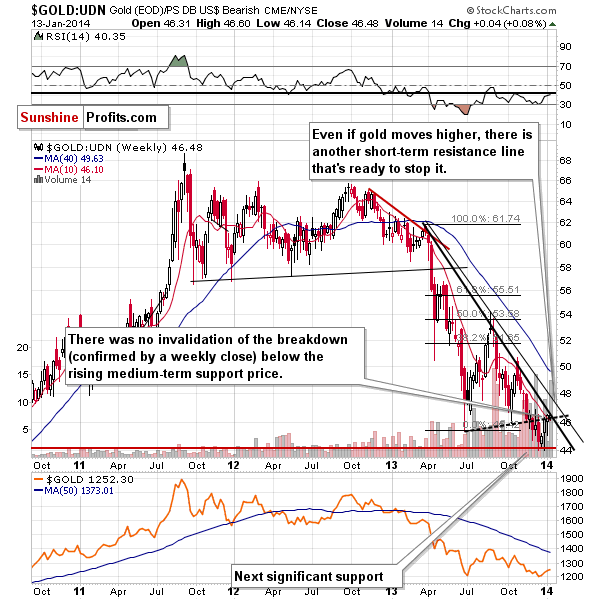

From the non-USD perspective, gold once again closed slightly above the rising support/resistance line, and it’s now at the lower of the declining resistance lines. As we wrote in Friday's Premium Update, this doesn't change anything and the medium-term outlook remains bearish even though we could see some strength on a short-term basis.

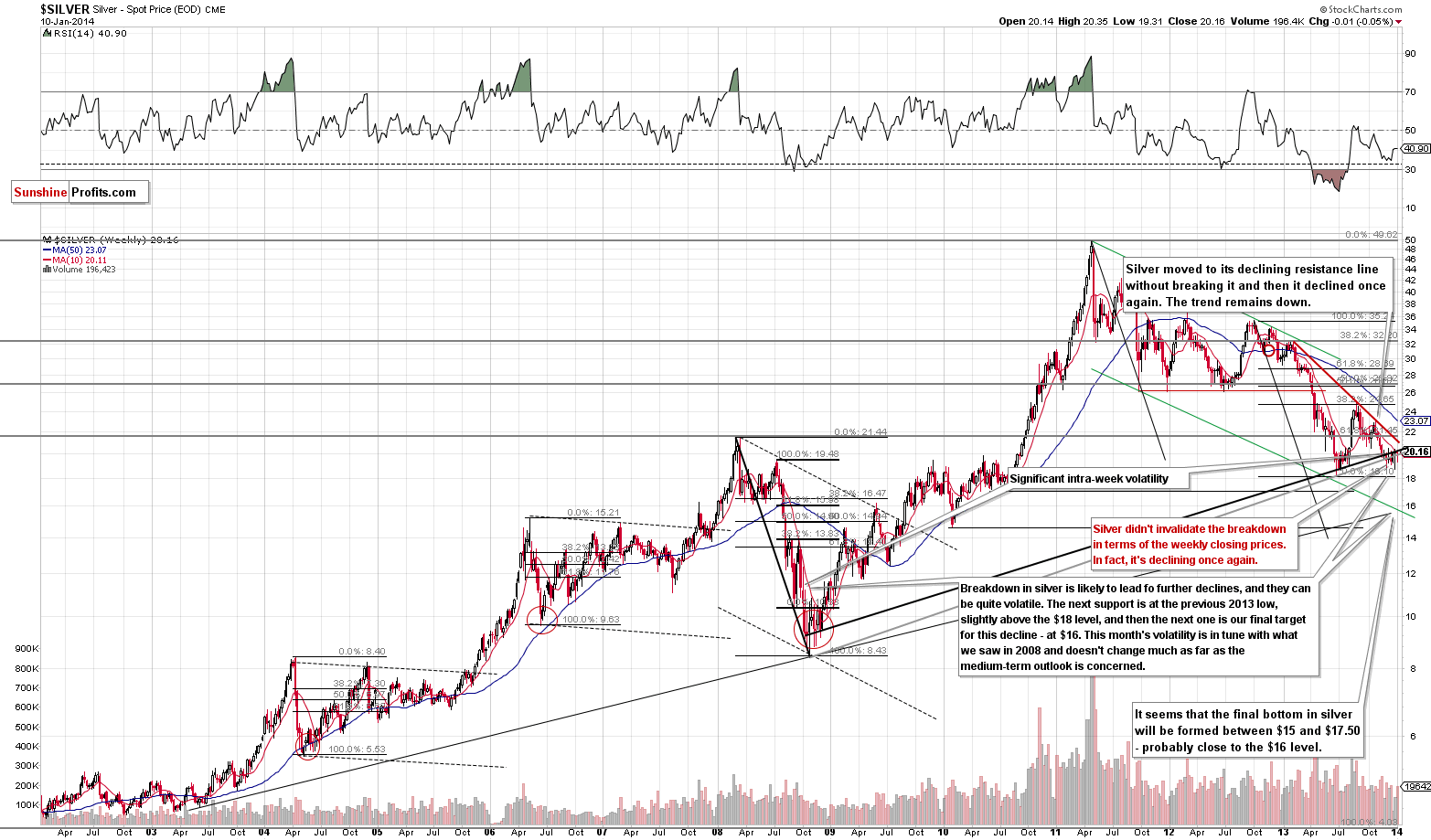

In case of silver, not much changed either.

The white metal moved higher, but didn’t really go above the higher of the rising resistance lines. What we wrote previously remains up-to-date and the same goes for the 2008-today similarity. Back in 2008 silver was moving back and forth in the final part of the decline with great volatility, but since the current (2011-today) decline is not as volatile in general, we can expect the intra-week volatility to be lower than in 2008 as well.

Consequently, if we see a small move higher from here, it will be quite in tune with what happened in the past.

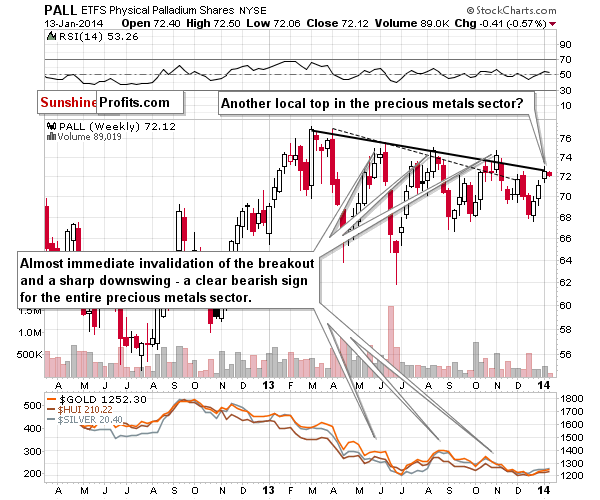

Meanwhile, the palladium market still suggests that we’re at a local top, or at least very close to one.

Naturally, that’s just one part of the market, and we need to take multiple factors into account before making any investment or trading decision; we can’t base it on palladium alone.

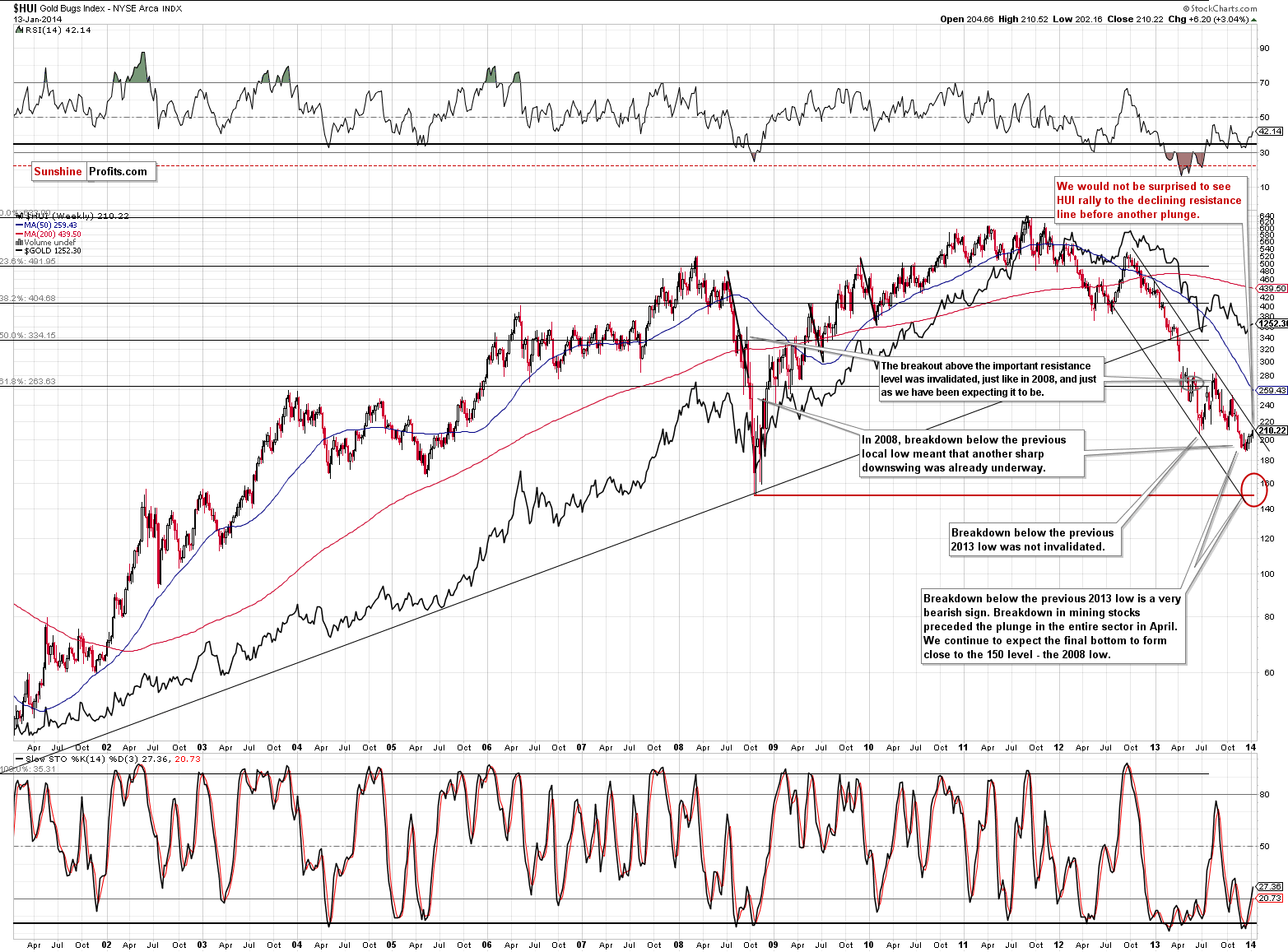

Finally, the HUI Index (gold stocks) moved quite significantly higher yesterday.

As you may recall, we recently wrote that the HUI Index could move up to 215 and remain in a downtrend. It seems that this (or slightly lower) is where gold stocks are moving. With just a little strength, this level will be reached.

Interestingly, gold stocks rallied on Monday despite the decline in the stock market. This is a bullish sign for the short term, but taking into account the proximity of the declining resistance line, it might even be a very short-term sign. In other words, while we can expect gold stocks to move higher, we don’t expect them to move much higher. We don’t think that we will see a significant move above 215 – if one is seen at all.

Taking all of the above into account, we get the same result we got yesterday. The situation is rather unclear for the short term but remains bearish for the medium term. Our best guess is that we will see some short-term strength that will take metals and miners just a little higher. Once we see bearish confirmations (in addition to the one coming from the palladium market), we will consider opening speculative short positions, but we are not there just yet.

To summarize:

- Trading capital: No positions.

- Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) and we will send additional Market Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool). You will find more information by following links in the summary of the latest Premium Update.

As a reminder, Market Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

We have an important administrative announcement.

As you have noticed, Market Alerts that we have been sending this week are a bit different from what we used to send previously - they now include updated charts on each day.

In our recent survey, 10 times more subscribers selected the option that mentioned daily alerts + additional alerts whenever the situation requires it, than the option with 1 weekly update + additional alerts whenever the situation requires it.

This got us thinking that perhaps we are not providing our service in the way that is most suitable for you. Naturally, this led us to thinking how we could improve it. If daily alerts are so much more important than weekly updates, then perhaps we should move our focus to them. We thought that instead of 1 weekly update with charts (most of them don't change from one week to the next, for instance the long-term USD Index chart), we would be sending you alerts with charts on each trading day. In this case, we would be providing charts on which something actually happened and we would have something new to say (or we would stress particularly useful parts of previous alerts).

Having charts in front of you when we describe various resistance / support levels and when we discuss potential sizes of given price moves should help to make it clear what we mean and to decide more easily if a given price move is something that you might be interested in trading on. Until this week, you received charts from us on a weekly basis and now you would get them on each trading day. In this way, the daily alerts would be a smaller version of our current Premium Update. It seems to us that 5 small alerts would be much more useful than 1 big one published once a week. However, the decision is up to you. We have already started providing analysis in the "new form", but we can go back to the previous one if you find it less suited to your needs than the previous setup.

We plan to continue sending bigger Market Alerts that include charts... Unless, of course, you tell us that you think the previous system (with charts once a week in Premium Updates) was better. Naturally, we work for you, and we want to provide our analysis in the most convenient form, but we want to be sure we are going in the right direction. If you think that the previous way of providing the analysis was better, please let us know.

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA