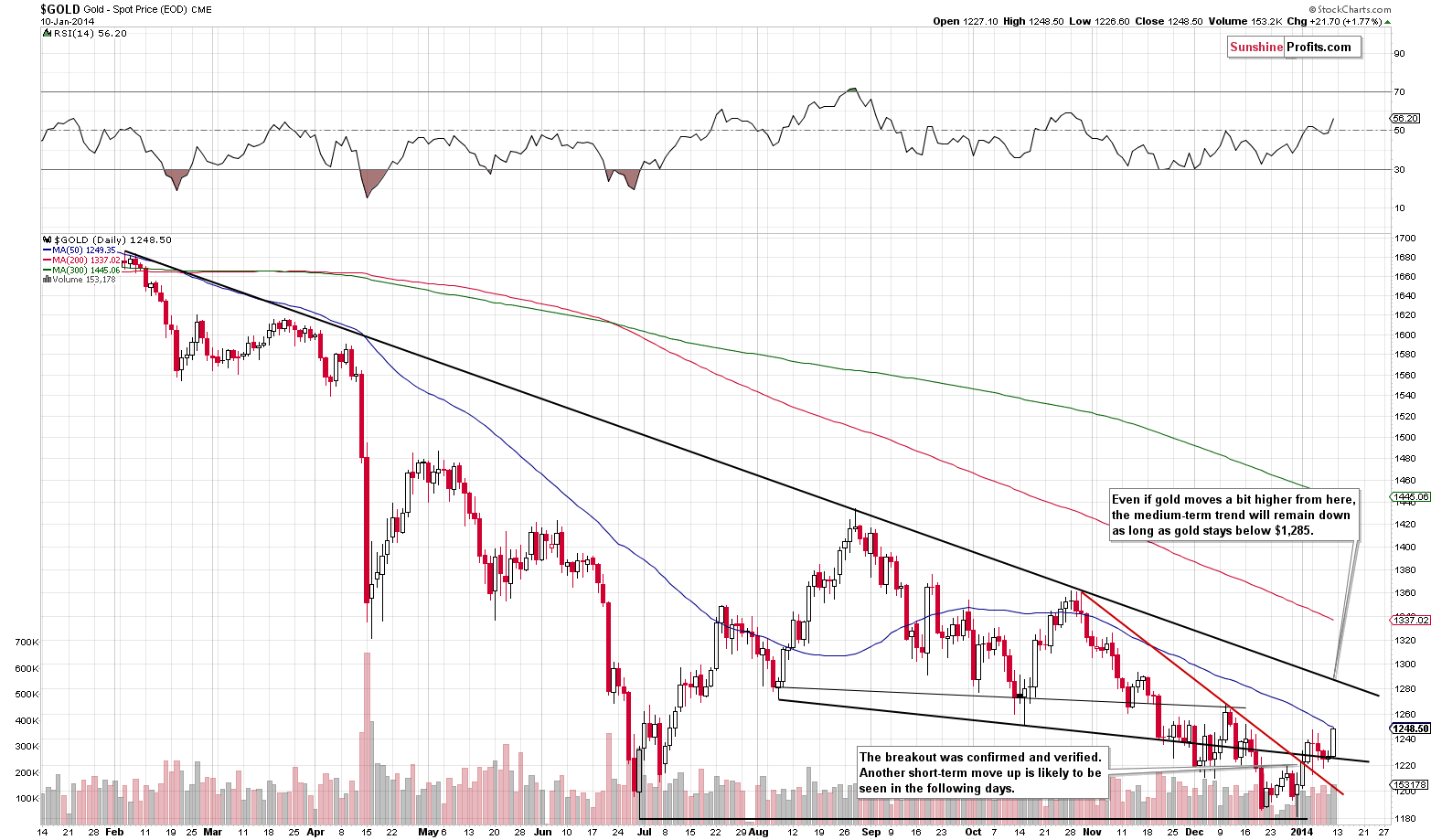

In the last Premium Update, we warned that gold might rally before another big drop, and it has.

Gold is now at the rising long-term resistance line, but given the short-term strength we might (not very likely, though) see a move up to $1,280 - $1,285, where we have the declining resistance line based on the Feb, Aug and Oct 2013 highs.

At this time it's rather unclear if gold moves above the rising long-term resistance line or not. Generally, long-term lines are more important than medium-term ones (and those are more important than short-term ones), but this line was already temporarily invalidated about a month ago. It's clearly possible for this line to be temporary broken and then for gold to move lower once again.

Moreover, $1,285 is where the 38.2% retracement of the entire bull market rally (1999 - 2011) is located.

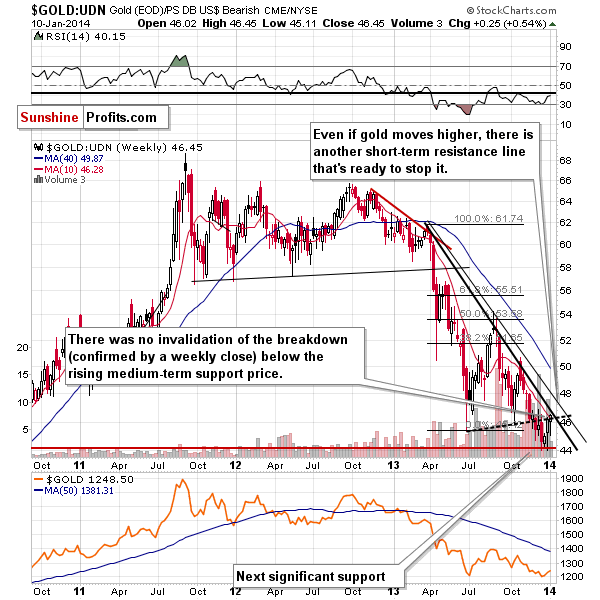

From the non-USD perspective, gold closed the week slightly above the rising support/resistance line, but below both declining resistance lins. As we wrote in Friday's Premium Update, this doesn't change anything and the medium-term outlook remains bearish even though we could see some strength on a short-term basis.

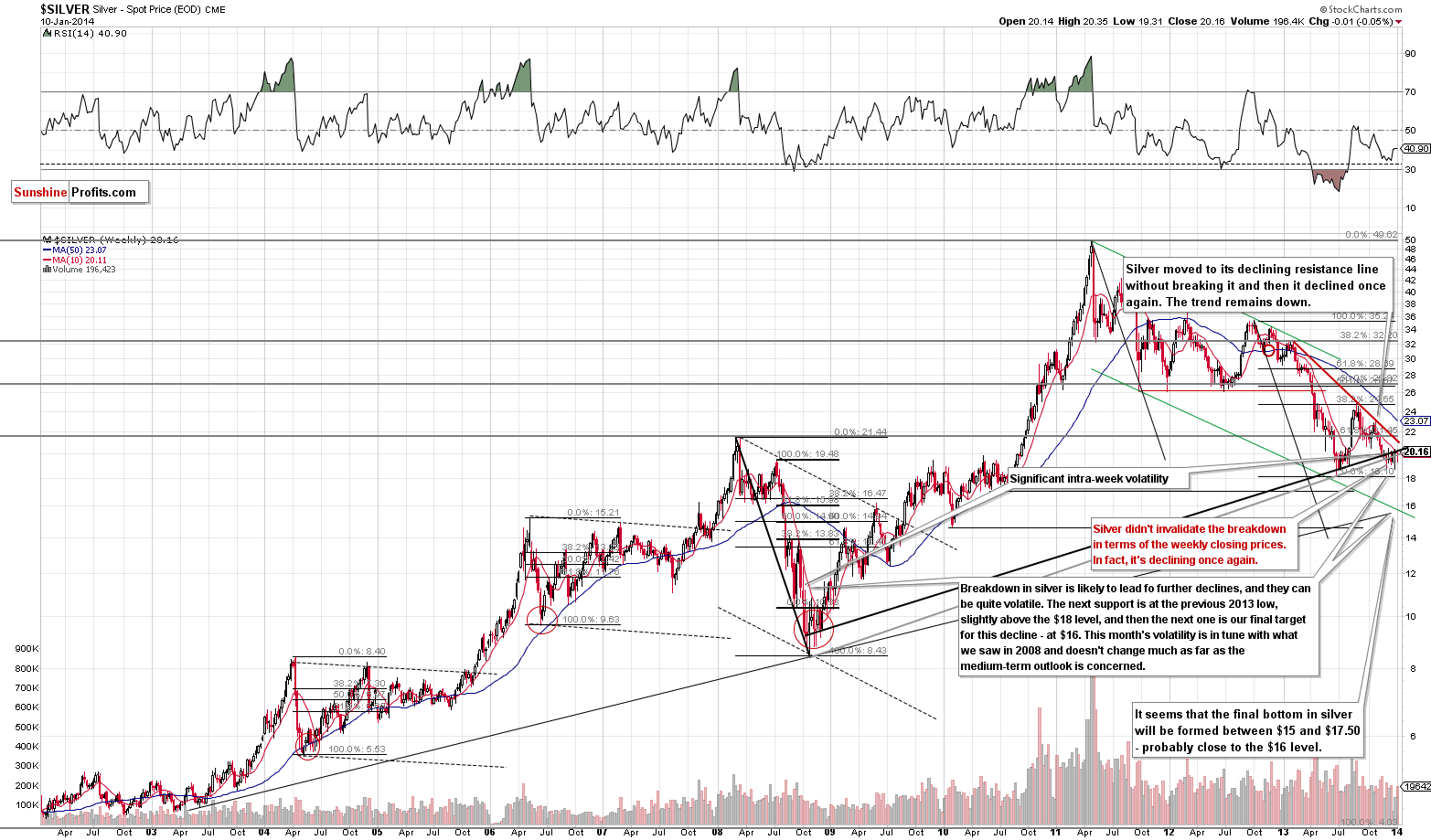

Meanwhile, silver's back and forth movement continues.

There was no invalidation of the preceding breakdown and the move higher was surprising. Back in 2008 silver was moving back and forth in the final part of the decline with great volatility, but since the current (2011-today) decline is not as volatile in general, we can expect the intra-week volatiliy to be lower than in 2008 as well.

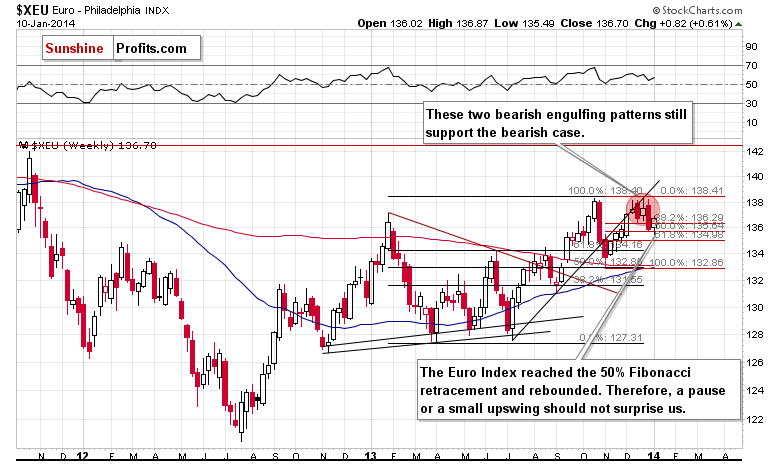

In Friday's Premium Update we commented on the euro's retracement of the half of the preceding rally. A rally was likely to follow - and it has.

This, however, is a correction after a breakdown that was already verified, so we don't expect to see much additional strength.

Consequently, while the medium-term trend in the precious metals market remains down, the short-term situation seems unclear.

To summarize:

- Trading capital: No positions.

- Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) and we will send additional Market Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool). You will find more information by following links in the summary of the latest Premium Update.

As a reminder, Market Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA