Gold and silver declined once again on Friday, but miners didn't and since this is the only bullish factor that just emerged, we will focus on it in today's message. Before we move to miners' strength (?), we will discuss one more interesting thing - a relatively significant weekly volume in case of the non-USD gold price.

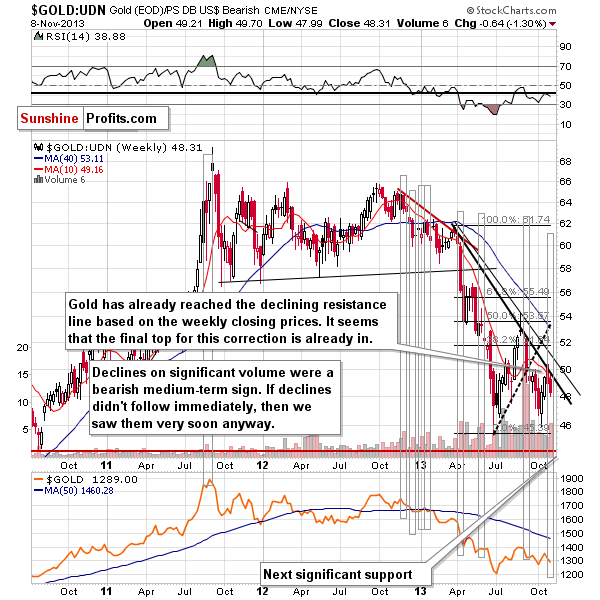

Last week gold:UDN ratio declined on quite big volume, which used to precede significant declines in the past. Of course, a ratio does not have a volume by itself - the above is just a thought short-cut, and what we mean is actually the ratio of volumes - volume for gold divided by volume for the UDN ETF. Anyway, the resulting declines were not seen immediately in all cases, but they were seen shortly in almost all cases. Please take a look below - we marked these cases with grey rectangles:

As mentioned earlier, mining stocks moved higher on Friday, and the performance is even stronger when we compare it to what we saw on the gold market. However, taking a look at the HUI to gold ratio reveals that not much changed. The ratio has already bounced off the declining resistance line in the final part of October and on Friday it didn't even move back to the above-mentioned resistance. Consequently, it doesn't look like anything changed.

Another reason supporting the above is the performance of the stock market. Stocks rallied significantly on Friday. Stocks' correlation with mining stocks has been much higher than the one between stocks and gold (0.65 vs. 0.36 in case of the 30-day correlation coefficients), so it's no wonder that miners got a boost from a relatively big rally in stocks and gold didn't.

At this point you might was if stocks weren't likely to decline based on the True Seasonal patterns. That was and still is the case. Stocks tend to decline around 10th o the month, which means that they are likely to decline very soon. They could have started the decline last week and it wouldn't be surprising either, but it is this week in which we "should" see a start of a more sustainable downswing (2-week decline or so). To be precise, True Seasonals had suggested a sideways trading close to a local top in the past week - which is exactly what we saw.

Besides the above, not much changed on Friday and since the above doesn't change the medium- nor short-term outlook for the precious metals sector, what we wrote in Friday's Premium Update, remains up-to-date.

To summarize:

Trading – PR: Short position in gold, silver and mining stocks.

Long-term investments: A half position in gold, silver, platinum and mining stocks. As far as long-term mining stock selection is concerned, we suggest using our tools before making purchases: the Golden StockPicker and the Silver StockPicker

Stop-loss orders for the above-mentioned speculative short positions:

- Gold: $1,392

- Silver: $23.90

- HUI Index: 268

- GDX ETF: $28.80

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) and we will send additional Market Alerts whenever appropriate.

As a reminder, Market Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA